Managerial Accounting

15th Edition

ISBN: 9781337912020

Author: Carl Warren, Ph.d. Cma William B. Tayler

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Question

2

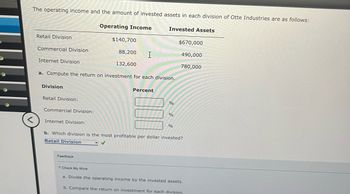

Transcribed Image Text:The operating income and the amount of invested assets in each division of Otte Industries are as follows:

Operating Income

Invested Assets

Retail Division

Commercial Division

Internet Division

$140,700

$670,000

88,200

I

490,000

132,600

780,000

a. Compute the return on investment for each division.

Division

Retail Division:

Commercial Division:

Percent

%

%

%

< Internet Division:

b. Which division is the most profitable per dollar invested?

Retail Division

Feedback

Check My Work

a. Divide the operating income by the invested assets.

b. Compare the return on investment for each division.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- The operating income and the amount of invested assets in each division of Conley Industries are as follows: a. Compute the return on investment for each division. b. Which division is the most profitable per dollar invested? Based on the data in Exercise 10 assume that management has established a 15% minimum acceptable return for invested assets. a. Determine the residual income for each division. b. Which division has the most residual income?arrow_forwardThe operating income and the amount of invested assets in each division of Conley Industries are as follows: Operating Income Invested Assets Retail Division $184,800 $840,000 Commercial Division 142,500 570,000 Internet Division 197,600 760,000 a. Compute the return on investment for each division. (Round to the nearest whole percentage.) Division Percent Retail Division % Commercial Division % Internet Division % b. Which division is the most profitable per dollar invested?arrow_forwardThe operating income and the amount of invested assets in each division of Conley Industries are as follows: Retail Division Commercial Division Internet Division Operating Income $97,200 91,200 79,300 Invested Assets $540,000 570,000 610,000 a. Compute the return on investment for each division. (Round to the nearest whole percentage.) Division Retail Division Commercial Division Internet Division Percent % % % b. Which division is the most profitable per dollar invested? Retail Divisionarrow_forward

- The income from operations and the amount of invested assets in each division of Beck Industries are as follows: Income from Operations Invested Assets Retail Division $130,200 $620,000 Commercial Division 141,600 590,000 Internet Division 98,800 380,000 a. Compute the return on investment for each division. (Round to the nearest whole number.) Division Percent Retail Division % Commercial Division % Internet Division % b. Which division is the most profitable per dollar invested?arrow_forwardPrblmarrow_forwardThe sales, income from operations, and invested assets for each division of Jackson Corporation are as follows: Sales Income from Operations Invested Assets Division E $4,000,000 $550,000 $2,400,000 Division F 4,800,000 760,000 2,500,000 Division G 7,000,000 860,000 2,800,000 (a) Using the expanded expression, determine the profit margin, investment turnover, and rate of return on investment for each division. Round answers to one decimal place. (b) Which Division is the most profitable per dollar invested? (a) (b)arrow_forward

- The income from operations and the amount of invested assets in each division of Shiner Industries are as follows: Income from Invested Assets Retail Division Commercial Division Internet Division Operations $132,000 $600,000 115,000 460,000 90,000 500,000 a. Compute the return on investment for each division. Round to the nearest whole number. Division Retail Division Percent % 90 Commercial Division Internet Division % % b. Which division is the most profitable per dollar invested?arrow_forwardThe sales, operating income, and invested assets for each division of Garner Company are as follows: Operating Invested Sales Income Assets Division E $3,000,000 $470,000 $2,500,000 Division F 3,600,000 430,000 2,400,000 Division G 6,000,000 560.000 3,000,000 a. Using the expanded expression, determine the profit margin, investment turnover, and rate of return on investment for each division. Round to one decimal place. Division E Division F Division G Profit margin X % X % X % Investment turnover Rate of return on investment X % X % X % b. Which division is the most profitable as per dollar invested? Division Earrow_forwardThe sales, income from operations, and invested assets for each division of Jackson Corporation are as follows: Sales Income from Operations Invested Assets Division E $4,100,000 $550,000 $2,400,000 Division F 4,700,000 760,000 2,500,000 Division G 7,200,000 860,000 2,800,000 (a) Using the Dupont ROI expanded expression, determine the profit margin, investment turnover, and rate of return on investment for each division. You must provide 3 answers for each division! Round all answers to two decimal places. (b) Which Division is the most profitable per dollar invested? (a) (b)arrow_forward

- Return on investment The operating income and the amount of invested assets in each division of Conley Industries are as follows: Operating Income Invested Assets Retail Division $111,600 $620,000 Commercial Division 67,500 450,000 Internet Division 74,800 340,000 a. Compute the return on investment for each division. (Round to the nearest whole percentage.) Division Percent Retail Division ? Commercial Division ? Internet Division ?arrow_forwardReturn on Investment The operating income and the amount of invested assets in each division of Otte Industries are as follows: Operating Income Invested Assets Retail Division $176,400 $840,000 Commercial Division 134,400 560,000 Internet Division 167,500 670,000 a. Compute the return on investment for each division. Division Percent Retail Division: % Commercial Division: % Internet Division: % b. Which division is the most profitable per dollar invested?arrow_forwardThe income from operations and the amount of invested assets in each division of Shiner Industries are as follows: Income fromOperations InvestedAssets Retail Division $9,350,000 $55,000,000 Commercial Division 10,640,000 38,000,000 Internet Division 2,240,000 16,000,000 a. Compute the return on investment for each division. Division Percent Retail Division fill in the blank 1% Commercial Division fill in the blank 2% Internet Division fill in the blank 3% b. Which division is the most profitable per dollar invested?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,