Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

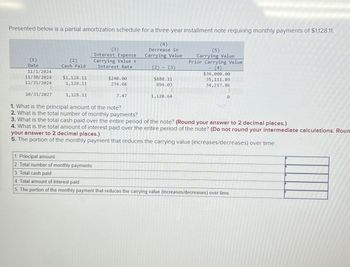

Transcribed Image Text:Presented below is a partial amortization schedule for a three-year installment note requiring monthly payments of $1,128.11.

(1)

Date

(2)

Cash Paid

11/1/2024

11/30/2024

$1,128.11

12/31/2024

1,128.11

10/31/2027

1,128.11

(3)

Interest Expense

Carrying Value x

Interest Rate

$240.00

234.08

(4)

Decrease in

Carrying Value

(2) (3)

$888.11

894.03

7.47

1,120.64

(5)

Carrying Value

Prior Carrying Value

(4)

$36,000.00

35,111.89

34,217.86

0

1. What is the principal amount of the note?

2. What is the total number of monthly payments?

3. What is the total cash paid over the entire period of the note? (Round your answer to 2 decimal places.)

4. What is the total amount of interest paid over the entire period of the note? (Do not round your intermediate calculations. Roun

your answer to 2 decimal places.)

5. The portion of the monthly payment that reduces the carrying value (increases/decreases) over time.

1. Principal amount

2. Total number of monthly payments

3. Total cash paid

4. Total amount of interest paid

5. The portion of the monthly payment that reduces the carrying value (increases/decreases) over time.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Presented below is a partial amortization schedule for a three-year Installment note requiring monthly payments of $1,974.19. () Interest Expense (4) Decrease in Carrying Value (1) Date (2) Cash Paid Carrying Value (S) Carrying Value Prior Carrying Value Interest Rate (2)-83) (4) 11/1/2024 11/30/2024 $1,974.19 12/31/2024 1,974.19 $420.00 409.64 $1,554.19 1,564,55 $63,000.00 61,445.81 59,881.26 10/31/2027 1,974.19 13.07 1,961.12 1. What is the principal amount of the note? 2. What is the total number of monthly payments? 3. What is the total cash paid over the entire period of the note? (Round your answer to 2 decimal places.) 4. What is the total amount of interest paid over the entire period of the note? (Do not round your intermediate calculations. Round your answer to 2 decimal places.) 5. The portion of the monthly payment that reduces the carrying value (increases/decreases) over time. 1. Principal amount 2. Total number of monthly payments 3. Total cash paid 4 Total amount of…arrow_forwardCalculate the principal and interest portions of the specified payment for this ordinary annuty, and give the balance remaining after that payment For full marks your answer should be rounded to the nearest cont Payment Principal Interest Balance Payment Frequency Term Number to Find Interest Payment Loan Principal Paid Paid After Payment 4. 0.00 0.00 0.00 $45,000.00 3.50 % compounded quarterly $3,250.97 Semi-annual 8 yearsarrow_forwardThe following is an amortization schedule for a loan of $5000 to be repaid over two years at 7% compounded semiannually (depicted below in the table). Find the value of A, B, C, and D.arrow_forward

- Given the annual interest rate and a line of an amortization schedule for that loan, complete the next line of the schedule. Assume that payments are made monthly. Annual Interest Paid on Interest Rate Payment Paid Principal Balance 11.6% $425.57 $64.23 $361.34 $6,280.78 Fill out the amortization schedule below. Annual Interest Paid on Payment Balance Interest Rate Paid Principal 11.6% $425.57 $64.23 $361.34 $6,280.78 (Round to the nearest cent as needed.)arrow_forwardFrom the partial/incomplete amortization table below. what is the perlodic tgot payment for the 1st period? Interest Раyment Periodie Repayment Outstanding Principal 7,000,000.00 Periodic Period Payment 0. 100,000 00 100,000 00 100,000 00 60,000 00 O P160,000 00 O PI30.000.00 P40,000 00 P60.000 00 0123arrow_forwardGiven the annual interest rate and a line of an amortization schedule for that loan, complete the next line of the schedule. Assume that payments are made monthly. Annual Interest Rate Payment Interest Paid Paid on Principal Balance 5.4% $289.80 $21.30 $268.50 $4,464.20 Fill out the amortization schedule below. Annual Interest Rate Payment Interest Paid Paid on Principal Balance 5.4% $289.80 $21.30 $268.50 $4,464.20 $______ $_______ $_______ $_____ (Round to nearest cent as needed)arrow_forward

- Assuming a 360-day year, when a $11,200, 90-day, 5% interest-bearing note payable matures, the total payment will be Oa. $560 Ob. $140 Oc. $11,760 Od. $11,340 0 0 0 0arrow_forwardGiven the annual interest rate and a line of an amortization schedule for that loan, complete the next line of the schedule. Assume that payments are made monthly. Paid on Interest Paid Annual Interest Rate Payment $175.92 Balance Principal $159.58 6.9% $16.34 $2,681.75 Fill out the amortization schedule below. Annual Interest Rate Paid on Principal $159.58 Interest Payment Balance Paid 6.9% $175.92 $16.34 $2,681.75 (Round to the nearest cent as needed.)arrow_forwardUse chart and round to nearest centarrow_forward

- Assuming a 360-day year, when a $12,750, 90-day, 11% interest-bearing note payable matures, total payment will amount to: Select the correct answer. $1,403 $14,153 $13,101 $351arrow_forwardAssuming a 360-day year, when a $11,392, 90-day, 10% interest-bearing note payable matures, total payment will be a. $11,677 Ob. $12,531 Oc. $1,139 Od. $285 That's Built PlueAarrow_forwardThe debt is amortized by equal payments made at the end of each payment interval. Compute (a) the size of the periodic payments; (b) the outstanding principal at the time indicated: (c) the interest paid by the payment following the time indicated; and (d) the principal repaid by the payment following the time indicated for finding the outstanding principal. Debt Principal $15,000 Repayment Period 5 years Payment Interval 6 months Interest Rate 6% Conversion Period semi-annually (b) The outstanding principal after the 8th payment is $ (Round the final answer to the nearest cent as needed. Outstanding Principal After: 8th payment (a) The size of the periodic payment is $ (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.) Round all intermediate values to six decimal places as needed.) (c) The interest paid by the 9th payment is $ (Round the final answer to the nearest cent as needed. Round all intermediate values to six…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT