ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

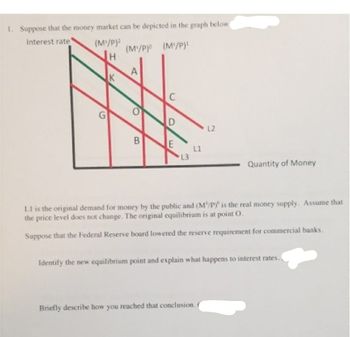

Transcribed Image Text:1. Suppose that the money market can be depicted in the graph below

Interest rate

(M/P)²

(M³/P)⁰ (M³/P)¹

G

K

A

O

B

C

O

E

L3

L1

12

Quantity of Money

LI is the original demand for money by the public and (M/P) is the real money supply. Assume that

the price level does not change. The original equilibrium is at point O.

Suppose that the Federal Reserve board lowered the reserve requirement for commercial banks.

Briefly describe how you reached that conclusion. (

Identify the new equilibrium point and explain what happens to interest rates.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 51) What is the impact on interest rates when the Federal Reserve decreases the money supply by selling bonds to the public? 52) Use demand and supply analysis to explain why an expectation of Fed rate hikes would cause Treasury prices to fall. 5.4 Supply and Demand in the Market for Money: The Liquidity Preference Framework 1) In Keynes's liquidity preference framework, individuals are assumed to hold their wealth intwo forms: A) real assets and financial assets. B) stocks and bonds. C) money and bonds. D) money and gold. 2) In Keynes's liquidity preference framework, A) the demand for bonds must equal the supply of money. B) the demand for money must equal the supply of bonds. C) an excess demand of bonds implies an excess demand for money. D) an excess supply of bonds implies an excess demand for money. 3) In Keynes's liquidity preference framework, if there is excess demand for money, there is…arrow_forwardThe following graph shows the money market in equilibrium at an interest rate of 7.5% and a quantity of money equal to $60 billion. Show the impact of the increase in government purchases on the interest rate by shifting one or both of the curves on the following graph. 15.0 Money Supply Money Demand 0 Money Supply 12.5 10.0 INTEREST RATE 5 5.0 25 0 0 20 Money Demand 40 60 80 100 MONEY (Billions of dollars) 120arrow_forwardThe money market in the United States and the investment demand curve are as shown in the graphs below. Currently, the Federal Reserve has a money supply of $40 billion and the money market is in equilibrium. a. Suppose the Federal Reserve increases the money supply by $20 billion. Use the money market and investment demand graphs to show the effects of the increase in the money supply on interest rates, money demand, and investment. Instructions: In the money market graph, use the tool provided 'MS,1' to draw a new money supply curve. Plot only the endpoints of the line (2 points total). Use the tool provided 'New Equilibrium' to plot a new equilibrium interest rate.arrow_forward

- Show the impact of the increase in government purchases on the interest rate by shifting one or both of the curves on the following graph. INTEREST RATE 12 10 8 2 0 0 20 Money Supply known as the Money Demand 40 60 80 MONEY (Billions of dollars) 100 120 = Money Demand Money Supply ? Suppose that for every increase in the interest rate of one percentage point, the level of investment spending declines by $0.5 billion. Based on the changes made to the money market in the previous scenario, the new interest rate causes the level of investment spending to by Taking the multiplier effect into account, the change in investment spending will cause the quantity of output demanded to by at every price level. The impact of an increase in government purchases on the interest rate and the level of investment spending is effect. Use the purple line (diamond symbol) on the graph at the beginning of this problem to show the aggregate demand curve (AD3) after accounting for the impact of the increase…arrow_forwardINTEREST RATE (Percent) 3 6 Suppose the money market for some hypothetical economy is given by the following graph, which plots the money demand and money supply curves Assume the central bank in this economy (the Fed) fixes the quantity of money supplied. Suppose the price level decreases from 90 to 75. Shift the appropriate curve on the graph to show the impact of a decrease in the overall price level on the market for money. 18 Money Supply 15 12 0 0 10 20 30 Money Demand 40 50 60 MONEY (Billions of dollars) Money Demand Money Supply Ⓡarrow_forwardu10. Using the demand and supply schedule for money shown below, do the following: a)Graph the demand for and the supply of money curves. b)Determine the equilibrium interest rate. c)Suppose the RBA decreases the money supply by $5 billion. Show the effect in your graph and describe the money market adjustment process that is likely to follow. What is the new equilibrium rate of interest? Interest rate (%) Demand for money (billions of dollars) Supply of money (billions of dollars) 4 10 30 3 20 30 2 30 30 1 40 30arrow_forward

- Assume that the following data characterize the hypothetical economy of Trance: money supply = $210 billion; quantity of money demanded for transactions = $160 billion; quantity of money demanded as an asset = $10 billion at 12 percent interest, increasing by $10 billion for each 2-percentage-point fall in the interest rate. %3D Instructions: Enter your answers as whole numbers. a. What is the equilibrium interest rate in Trance? 4% b. At the equilibrium interest rate, what are the quantity of money supplied, the total quantity of money demanded, the amount of money demanded for transactions, and the amount of money demanded as an asset in Trance? Quantity of money supplied = billion. %3D Quantity of money demanded = billion. %3D Amount of money demanded for transactions = billion. MacBook DII DD O00 F8 F9 F10 F11arrow_forward2arrow_forwardQUESTION 3 When a customer takes cash from a drawer in his home and deposits it into his saving account, the composition of the money supply will change immediately and the size of the money supply may eventually change. Illustrate and explain the process by which this action may change the money supply in economy. ***END OF QUESTION PAPER*** States) E Accessibility: Investigatearrow_forward

- 2. What “backs" the money supply in the United States? What determines the value (domestic purchasing power) of money? How does the purchasing power of money relate to the price level? Who in the United States is responsible for maintaining money's purchasing power? There is ( no, some ) concrete backing to the money supply in the United States. Paper money, which has ( some, no ) intrinsic value, has value only because people are willing to accept it in exchange for goods and services, including their labor services as employees. And people are willing to accept paper as money because they know that everyone else is also willing to do so. If the monetary authorities were issuing new banknotes at a rate far in excess of available output, the acceptability of paper money would (increase, diminish ). People would start to worry about whether the banknotes would be worth much after they received them. Checks are part of the money supply and ( are, are not) legal tender, but people accept…arrow_forwardThe following diagram shows the Money Market for a hypothetical economy. Suppose that the economy begins with a Money Supply (Ms) of $300 million, and an equilibrium interest rate of 5.0%. Finally suppose that the required reserve ratio (rr) is 15%. Use the scenario to answer Questions 10 to 13. Interest rates (i) 5.5% 5% 4.5% Ms O increase the money supply $10 million O increase the money supply $100 million O decrease the money supply $300 million O decrease the money supply $200 million O decrease the money supply $100 million $200 $300 $350 Mp Quantity of Money (millions) Suppose that the Central Bank wished to raise the equilibrium interest rate up to 5.5%. In order to achieve this, it would need I toarrow_forwardThe graph on the right depicts real money supply. 1.) Using the three-point curve drawing tool, draw the aggregate money demand curve in the diagram to the right. Label this line 'L(R,Y)¹¹. Now suppose that consumers' preferences change in such a way that they choose to carry more cash. 2.) On the same graph, using the three-point curve drawing tool, draw the new aggregate demand for money curve as a result of this change. Label this line 'L(R,Y)²¹. Carefully follow the instructions above and only draw the required objects. As a result of this change in preferences, equilibrium in the money market will be at a interest rate. Real money holdings will Select none remain unchanged rise fall T Interest rate, R Delete Clear MS Real money holdings ?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education