ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

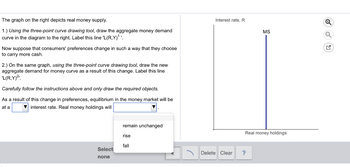

Transcribed Image Text:The graph on the right depicts real money supply.

1.) Using the three-point curve drawing tool, draw the aggregate money demand

curve in the diagram to the right. Label this line 'L(R,Y)¹¹.

Now suppose that consumers' preferences change in such a way that they choose

to carry more cash.

2.) On the same graph, using the three-point curve drawing tool, draw the new

aggregate demand for money curve as a result of this change. Label this line

'L(R,Y)²¹.

Carefully follow the instructions above and only draw the required objects.

As a result of this change in preferences, equilibrium in the money market will be

at a

interest rate. Real money holdings will

Select

none

remain unchanged

rise

fall

T

Interest rate, R

Delete Clear

MS

Real money holdings

?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- The quantity equation, also known as the equation of exchange, shows that the product of the money supply (M) and the velocity of money (V) is equal to the product of the price level (P) and real GDP (Q): Mx V = PxQ. Observe that when the left-hand side of the quantity equation, Mx V, changes by a given percentage, the right-hand side, P x Q, must change by the same percentage: Percentage Change in (Mx V) = = You can use the rule that the percentage change in the product of two variables is approximately equal to the sum of the percentage changes in each of the variables (as long as the percentage changes are fairly small) to further analyze changes in the variables of the quantity equation. In the following equation, let "%A" stand for "percentage change in": %AM+%AV = = Percentage Change in (PxQ) %AP+%AQ For example, if you know that the money supply grows at a rate of 8% per year, velocity grows at a rate of 1% per year, and real GDP grows at a rate of 5% per year, you can use this…arrow_forwardThe price level and the market for bank reserves The following graph shows the market for bank reserves in a hypothetical economy. Suppose the price level decreases from 110 to 70. Shift the appropriate curve on the following graph to show the impact of a decrease in the overall price level. Note: Select and drag one or both of the curves to the desired position. Curves will snap into position, so if you try to move a curve and it snaps back to its original position, just drags it a little farther. Analyze the effects of this change in the price level, then fill in the following table with these results. Effect Quantity of bank reserves supplied _________ (increase/ decreases/remains the same ) Quantity of real GDP demanded ___________ (increases/decreases/remain the same ) NOTE- THIS QUESTION IS A ONE QUESTION BUT IT IS DIVIDED INTO SUBPARTS . PLEASE ANSWER ALL QUESTUIONS WITH EXPLANATION.arrow_forward5. Changes in the money supply The following graph represents the money market in a hypothetical economy. As in the United States, this economy has a central bank called the Fed, but unlike in the United States, the economy is closed (that is, the economy does not interact with other economies in the world). The money market is currently in equilibrium at an interest rate of 6% and a quantity of money equal to $0.4 trillion, as indicated by the grey star. INTEREST RATE (Percent) 8.0 7.5 7.0 6.5 6.0 5.5 5.0 4.5 4.0 0 Money Demand + 0.1 Money Supply 0.2 0.3 0.4 0.5 MONEY (Trillions of dollars) 0.6 0.7 0.8 New MS Curve New Equilibrium ?arrow_forward

- how to calculate the equilibrium price.....arrow_forwardChanges in the money supply The following graph represents the money market for some hypothetical economy. This economy is similar to the United States in the sense that it ha a central bank called the Fed, but a major difference is that this economy is closed (and therefore does not have any interaction with other world economies). The money market is currently in equilibrium at an interest rate of 4% and a quantity of money equal to $0.4 trillion, designated on the graph by the grey star symbol. INTEREST RATE (Percent) 6.0 5.5 5.0 45 4.0 35 3.0 25 20 0 Money Demand 0.1 Money Supply 0.2 03 0.4 0.5 0.6 0.7 MONEY (Trillions of dollars) 08 4 New MS Curve New Equilibrium Ⓒ image 1 Suppose the Fed announces that it is lowering its target interest rate by 75 basis points, or 0.75 percentage points. To do this, the Fed will use open- market operations to the money by the public. Use the green line (triangle symbol) on the previous graph to illustrate the effects of this policy by placing the…arrow_forward6. Targeting the money supply or interest rates The following graph shows an increase in the demand for money from 2020 (MD2020 to 2021 ( MD202) caused by an increase in aggregate output. The initial equilibrium interest rate in 2020 was Suppose the Federal Reserve (the Fed) chooses not to alter the money supply between 2020 and 2021. On the following graph, use the grey point (star symbol) to indicate the equilibrium interest rate and quantity of money that would result from this lack of intervention. NOMINAL INTEREST RATE (Percent) 6.50 Money Supply 6.25 6.00 5.75 5.50 5.25 5.00 4.75 4.50 0.9 1.0 1.1 1.2 1.3 14 1.5 QUANTITY OF MONEY (Trillions of dollars) MD 2021 MD 2020 No Intervention New MS Curve + With Intervention Suppose the Fed wants to keep 2021 interest rates at their 2020 level. On the previous graph, place the green line (triangle symbols) to indicate the new money supply curve if the Fed follows this policy. Then use the black point (plus symbol) to indicate the…arrow_forward

- Which of the following is NOT implied by the Quantity Theory of Money (QTM)? a With constant money supply and output an increase of velocity creates an increase in price level. b If velocity is stable an increase in the money supply is accompanied by a proportional increase in nominal GDP. c With constant money supply and velocity an increase in output creates a proportional increase in price level. d If velocity is stable an increase in the money supply is accompanied by a proportional increase of price level when real output stays the same.arrow_forwardu10. Using the demand and supply schedule for money shown below, do the following: a)Graph the demand for and the supply of money curves. b)Determine the equilibrium interest rate. c)Suppose the RBA decreases the money supply by $5 billion. Show the effect in your graph and describe the money market adjustment process that is likely to follow. What is the new equilibrium rate of interest? Interest rate (%) Demand for money (billions of dollars) Supply of money (billions of dollars) 4 10 30 3 20 30 2 30 30 1 40 30arrow_forwardview picturearrow_forward

- do fast.arrow_forwardThe desired reserve ratio is 1 percent of deposits, and the currency drain ratio is 2 percent of deposits. The central bank makes an open market purchase of $4 million of securities. Calculate the change in the quantity of money. How much of the new money is currency and how much is bank deposits? >>> Answer to 2 decimal places. ..... The quantity of money changes by 5 million.arrow_forwardAm.101.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education