Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

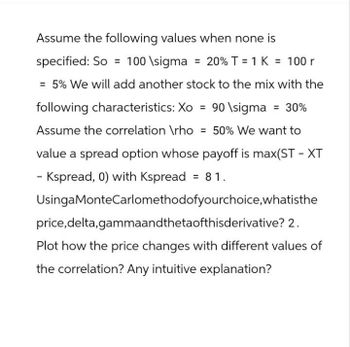

Transcribed Image Text:Assume the following values when none is

specified: So 100 \sigma = 20% T = 1K = 100 r

= 5% We will add another stock to the mix with the

following characteristics: Xo = 90 \sigma = 30%

Assume the correlation \rho = 50% We want to

value a spread option whose payoff is max(ST-XT

- Kspread, 0) with Kspread = 81.

UsingaMonte Carlomethodofyourchoice, whatisthe

price,delta,gammaandthetaofthisderivative? 2.

Plot how the price changes with different values of

the correlation? Any intuitive explanation?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- APT An analyst has modeled the stock of Crisp Trucking using a two-factor APT model. The risk-free rate is 6%, the expected return on the first factor (r1) is 12%, and the expected return on the second factor (r2) is 8%. If bi1 = 0.7 and bi2 = 0.9, what is Crisp’s required return?arrow_forwardConsider a single-index model economy. The index portfolio M has E(RM ) = 6%, σM = 18%.An individual asset i has an estimate of βi = 1.1 and σ2ei = 0.0225 using the single index modelRi = αi + βiRM + ei. The forecast of asset i’s return is E(ri) = 12%. rf = 4%. a) According to asset i’s return forecast, calculate αi. (b) Calculate the optimal weight of combining asset i and the index portfolio M . (c) Calculate the Sharpe ratio of the index portfolio M and the portfolio optimally combiningasset i and the index portfolio M .arrow_forwardSuppose you are given the following inputs for the Fama-Frech-3-Factor model. Required Return for Stock i: bi=0.8, kRF=8%, the market risk premium is 6%, ci=-0.6, the expected value for the size factor is 5%, di=-0.4, and the expected value for the book-to-market factor is 4%. Task: Estimate the required rate of return of this asset using the Capital asset pricing model and compare it with the Fama-French-3-factor model.arrow_forward

- Let S = $100, K = $95, \sigma = 30%, r = 8%, T = 1, and \delta = 0. For simplicity, let u = 1.3, d = 0.8 and n = 2 (that is, 2 periods). When constructing the binomial tree for the European call option, what is A (Stock Share Purchased in the replicating portfolio) at the first node (Time 0)? Question 11 options: 0.1789 0.3886 1.0000 0.2550 0.6912arrow_forward2. Derive the single - period binomial model for a put option. Include a single - period example where: u = 1.10, d = 0.95, Rf = 0.05, SO = $100, X = $100. 3. Assume ABC stock's price follows a binomial process, is trading at SO = $100, has u 1.10, d = 0.95, and probability of its price increasing in one period is 0.5 (q = 0.5). a. Show with a binomial tree ABC's possible stock prices, logarithmic returns, and probabilities after one period and two periods. . b. What are the stock's expected logarithmic return and variance for 2 periods and 3 periods? c. Define the properties of a binomial distribution.arrow_forwardSuppose we estimate SBUX to have β=0.80 when the market premium is 9% and the risk free rate is 3%. However, if SBUX is currently priced to return 9%, then according to the CAPM model SBUX stock is currently _______________ . A) overvalued B) undervalued C) priced just right!arrow_forward

- If put A has T = 0.5, X = 50, sigma = 0.2, and a price of 10, and put B has T = 0.5, X = 50, sigma = 0.2, and a price of 12, which put is written on a stock with a lower price (and why)?arrow_forward1. Consider a one period binomial model. Suppose So = 1 att = To; and Su = 2 and Sd = ½ at time T₁. If we assume the risk free rate R is 1.2, compute the current value of a European put with strike K = 1. Please round your answer to 2 decimals. Enter answer here 2. Compute the number of units of stock we need to short in order to replicate the option in the previous question. Please round your answer to 2 decimals. Enter answer here 3. Use Black-Scholes Formula to calculate the call price of a European call option with: So = 20, K = 20, r = 5%, c = 0,0 = 40%, T = 5; (round to two decimal digits).arrow_forwardPlease solve c part and get a thumbs uparrow_forward

- Given the following information, predict the put option's new price after the stock's volatility changes. Initial put option price = $6 Initial volatility = 25% Vega = 13 New volatility = 18% (required precision 0.01 +/- 0.01) Greeks Reference Guide: Delta = ∂π/∂S Theta = ∂π/∂t Gamma = (∂2π)/(∂S2) Vega = ∂π/∂σ Rho = ∂π/∂rarrow_forwardSuppose the risk free rate (rfr) = 5%, average %3D market return (rm) = 10%, and the required or expected rate of return E(r) = 12% for %3D TNG stock. (a) Calculate the Beta for TNG. (b) If TNG's Beta = 2.0, what would be TNG's new required or expected rate of return (r)?arrow_forwardAssume that using the Security Market Line(SML) the required rate of return(RA)on stock A is found to be halfof the required return (RB) on stock B. The risk-free rate (Rf) is one-fourthof the required return on A. Return on market portfolio is denoted by RM. Find the ratioof betaof A(A) tobeta of B(B). Thank you for your help.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning