Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

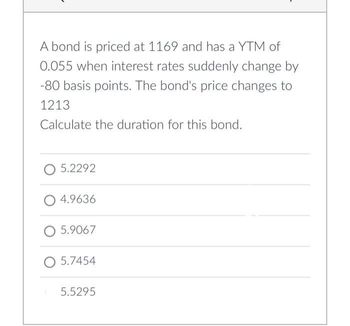

Transcribed Image Text:A bond is priced at 1169 and has a YTM of

0.055 when interest rates suddenly change by

-80 basis points. The bond's price changes to

1213

Calculate the duration for this bond.

5.2292

4.9636

O 5.9067

O 5.7454

5.5295

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Suppose that a short-term government bond has a face value of $100. If the price of that bond is $95. What is the insterest rate of that bond? 5.3% 9.0% 10.0% 1.0%arrow_forwardK Assume that a bond will make payments every six months as shown on the following timeline (using six-month periods): 0 2 5 Period $19.53 a. What is the maturity of the bond (in years)? b. What is the coupon rate (as a percentage)? c. What is the face value? Cash Flows View an example Get more help. ★ a. What is the maturity of the bond (in years)? The maturity is years. (Round to the nearest integer.) A 6 1 MacBook Pro & 7 $19.53 * 8 9 C 59 $19.53 60 $19.53+$1,000 Clear all BUB 0 {arrow_forwardA bond has a duration of 7.677 and the current yield-to-maturity is 4.81%. If the current bond's price is $1,085.48 what is predicted to be the bond's new price if interest rates suddenly jump upwards by 0.66%? State your answer as a dollar amount with two decimal places.arrow_forward

- A bond currently has a price of $890. The yield on the bond is 6%. If the yield increases 25 basis points, the price of the bond will go down to $870. The duration of this bond is ____ years. Group of answer choices A. 9.56 B. 9.02 C. 7.46 D. 8.08arrow_forwardOnly Part Aarrow_forwardWhat is the reat risk free rate on these financial accounting question?arrow_forward

- 5. A bond is currently selling at $1,034.5. This bond has a yield-to-maturity (market interest rate) of 6.36% and a duration of 8. If the market interest rate decreases by 40 basis points, calculate the new price of the bond. 11arrow_forwardConsider a one-year discount bond that has a present value of P1,500. If the rate of discount is 4 percent, the future value of the bond (the amount the bond pays in one year) is * P1,560.00 P1,540.00 P1,440.00 O P1,442.31arrow_forwardBond X is a premum bond making semiannual payments. The bond has a coupon rate of 7 percent, a YTM of 5 percent, and 19 years to maturity Bond Y is a discount bond making semiannual payments. This bond has a coupon rate of 5 percent a YTM of 7 percent. and also has 19 years to maturity. Both bonds have a par vaiue of $1,000 a. What is the price of each bond today? b. interest rates remain unchanged, what do you expect the price of these bonds to be 1 year from now? In 10 years? In 14 years? in 18 years? In 19 years? Note: For all requirements, do not round intermediate calculations and round your answers to 2 decimal places, *g. 32.16. a. Price today b. Price in 1 year Price in 10 years Price in 14 yas Price in 18 years Price in 19 years Bond X Bond Yarrow_forward

- A Treasury bond that settles on August 10, 2022, matures on November 5, 2029. The coupon rate is 6.8 percent and the 11811 32 quoted price is What is the bond's yield to maturity? Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places. Yield to maturity A Treasury bond that settles on August 10, 2022, matures on November 5, 2029. The coupon rate is 6.8 percent and the quoted price is 118 11/32. What is the bond's yield to maturity? Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places. Yield to maturityarrow_forwardA bond with 11 years to maturity has an annual interest payment of $50. If the bond sells for its par value, what are the bond's current yield and yield to maturity? Round your answers to two decimal places. CY: .....% YTM: ..... %arrow_forwardA one-year bond currently pays 6% interest. It's expected that it will pay 11.0% next year and 10% the following year. The two-year term premium is 0.4% while the three-year term premium is 0.7%. What is the interest rate on a three-year bond according to the liquidity premium theory? Select one: a. 10.1% b. 9.70A O c.9.0% O d. 9.40%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education