Quickbooks Online Accounting

3rd Edition

ISBN: 9780357391693

Author: Owen

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

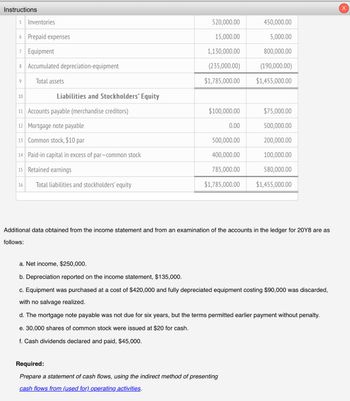

Transcribed Image Text:Instructions

5 Inventories

6 Prepaid expenses

7 Equipment

8 Accumulated depreciation-equipment

520,000.00

450,000.00

15,000.00

5,000.00

1,130,000.00

800,000.00

(235,000.00)

(190,000.00)

9

Total assets

$1,785,000.00

$1,455,000.00

10

Liabilities and Stockholders' Equity

11 Accounts payable (merchandise creditors)

$100,000.00

$75,000.00

12 Mortgage note payable

0.00

500,000.00

13 Common stock, $10 par

500,000.00

200,000.00

14 Paid-in capital in excess of par-common stock

400,000.00

100,000.00

15 Retained earnings

785,000.00

580,000.00

16

Total liabilities and stockholders' equity

$1,785,000.00

$1,455,000.00

Additional data obtained from the income statement and from an examination of the accounts in the ledger for 20Y8 are as

follows:

a. Net income, $250,000.

b. Depreciation reported on the income statement, $135,000.

c. Equipment was purchased at a cost of $420,000 and fully depreciated equipment costing $90,000 was discarded,

with no salvage realized.

d. The mortgage note payable was not due for six years, but the terms permitted earlier payment without penalty.

e. 30,000 shares of common stock were issued at $20 for cash.

f. Cash dividends declared and paid, $45,000.

Required:

Prepare a statement of cash flows, using the indirect method of presenting

cash flows from (used for) operating activities.

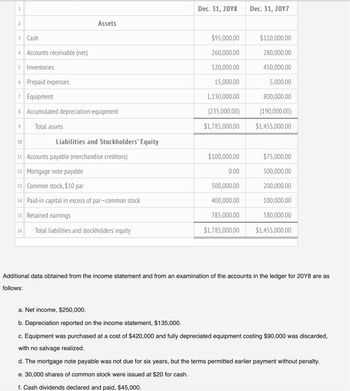

Transcribed Image Text:1

2

Assets

Dec. 31, 20Y8 Dec. 31, 20Y7

3 Cash

4 Accounts receivable (net)

$95,000.00

$110,000.00

260,000.00

280,000.00

5

Inventories

520,000.00

450,000.00

6 Prepaid expenses

7 Equipment

15,000.00

5,000.00

1,130,000.00

800,000.00

8

Accumulated depreciation-equipment

(235,000.00)

(190,000.00)

9

Total assets

$1,785,000.00

$1,455,000.00

10

Liabilities and Stockholders' Equity

11 Accounts payable (merchandise creditors)

$100,000.00

$75,000.00

12 Mortgage note payable

0.00

500,000.00

13 Common stock, $10 par

500,000.00

200,000.00

14 Paid-in capital in excess of par-common stock

400,000.00

100,000.00

15 Retained earnings

785,000.00

580,000.00

16

Total liabilities and stockholders' equity

$1,785,000.00

$1,455,000.00

Additional data obtained from the income statement and from an examination of the accounts in the ledger for 20Y8 are as

follows:

a. Net income, $250,000.

b. Depreciation reported on the income statement, $135,000.

c. Equipment was purchased at a cost of $420,000 and fully depreciated equipment costing $90,000 was discarded,

with no salvage realized.

d. The mortgage note payable was not due for six years, but the terms permitted earlier payment without penalty.

e. 30,000 shares of common stock were issued at $20 for cash.

f. Cash dividends declared and paid, $45,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- 0.OKB/s 1ll 4G+ 2:41 PM ě 80 00:50:21 Remaining The following information pertains to ABC Company for 2021: Accounts receivable, January 1, 2021 P8,000 Accounts receivable, December 31, 2021 9,600 Net cash sales Accounts receivable turnover for 3,200 2021 5 times The company's net sales for 2021 was O P47,200 O P88,000 P51,200 O P48,000 3 of 20arrow_forwardIn reviewing the Accounts Receivable, the Net Cash Realizable Value is __ before a write off of $1500. What is the Net Cash Realizable Value after the write off?a. $16,000b. $1500c. $17300d. $14500arrow_forwardCash \table[[Dr., Cr.]. [,610, 10, 640,], [,980, 605.]. [, 10,880,,], [,6,535,,], [Bal. vv, 12, 730,,]] Service Revenue 12°C Mostly sunny Searcharrow_forward

- Account$ 51,000Accounts payable$33, 700 Land Notes payable49,000Accounts receivable 71, 2000perating expenses 102,000Building86, 500Prepaid insurance3.100Cash3, 200Service revenue172.000Equipment35, 700Unearned revenue 3,000J. Koizumi, capitalJ. Koizumi, drawings99, 0004, 000(c) Determine the amount overKoizumi Kollections has the following alphabetical list of accounts and balances at July 31. 2017:arrow_forwardim.3arrow_forward119il 12.6KB/s 8:48 VOLTE 60% Q2.pdf 1 The following is the Schedule of balances as on 31.3.1988 extracted from the bo Gavaskar, who caries on business under the name and style of Messrs Gavaskar Visuanin Co., at Bombay: Dr. Cr. Amount Amount Particulars Rs Rs 1,400 S Cash in Handr. •Cash at Bank Cn S Sundry Debtors lor, 2,600 86,000 Stock as on 1.4.1987– 62,000 Furniture & Fixtures 21,400 Office Equipment Buildings 16,000 60,000 Motor Car 20,000 Sundry Creditors Loan from Viswanath 43,000 30,000 Reserve for Bad Debts 3,000 Purchases u Purchase Returgs pr 1,40,000 2,600 Sales- Sales Returns 2,30,000 Salaries 4,200 Rent for Godown Pr 11,000 Interest on loan from Viswanath . 5,500 Rates and taxes 2,700 Discount allowed to Debtors 2,100 Discount received from Creditors 2,400 Freight on Purchases Carriage Outwards Drawings Printing & Stationery Electric Charges 1,600 1,200 2,000 12,000 1,800 2,200 Contd.... 1/2arrow_forward

- The following balances apply to this question BANK Mar Balance b/d 20 Mar Total 83 1 000 31 раyments 138 Mar Total 31 receipts Balance c/d 8 021 A A Apr | Balance b/d 8 1 021 Which one of the following amounts represents B? A. R45 118 B. R56 337 OC. R55 128 D. R55 117arrow_forwardFind the present balances in the table below Previous Deposits Balance $42.30 220.72 37.09 849.83 19.84 1 2 3 4 5 $502.00 304.50 806.51 795.14 1,136.22 Withdrawals $80.60 398.63 329.77 900.62 1,108.00 Service Charge $6.75 2.80 2.85 0.00 48.06 Interest $0.00 1.00 1.98 2.19 0.00 Present Balancearrow_forwardMC Qu. 12-154 Southview Company's interest revenue for the... Southview Company's Interest revenue for the period is $14,600 and the beginning and ending Interest recelvable balances are $1,620 and $6,200, respectively, cash recelved for Interest Is: Multiple Cholce $8.400. $10,020. $14,600. $19,100.arrow_forward

- APATHY COMPANY provided the following information: Apathy Company Check No. Withdrawal Deposits 100,000.00 100,000.00 Date Balance 2 18 104 10,000.00 90,000.00 101 5,000.00 85,000.00 60,000.00 50,000.00 110,000.00 10,000.00 120,000.00 20 22 106 25,000.00 27 29 80,000.00 30,000.00 110,000.00 108,000.00 29 103 40,000.00 29 CM 31 Service Charge DM 2,000.00 First Bank 1 Deposit 21 Deposit 27 Deposit 31 Deposit 100,000.00 Dec 4 ck# 101 5,000.00 15,000.00 Dec 6 ck# 102 8 ck# 103 8 ck# 104 50,000.00 10,000.00 40,000.00 80,000.00 10,000.00 10 ck# 105 30,000.00 14 ck# 106 25,000.00 28 ck# 107 50,000.00 The credit made by the bank on December 29 represents the proceeds of a note received from customer which was given to the bank for collection by the entity on December 26. Required: a. Prepare a Bank Reconciliation using adjusted balance method, book to bank method and bank to book method. b. Prepare adjusting entries.arrow_forwardWhat is the accounts payable total on $112,000 with 2/10 net 30arrow_forwardpe Sistema TAL Saved TB MC Qu. 5-177 A company reports the following Informartion... A company reports the following Information for the year. Net credit sales $110,000 12,000 98,000 Average accounts Heceivable Cash collections on credit sales What Is the company's receivables turnover ratio? (Round your answer to 1 decimal place.) Multiple Cholce 01.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning