What is the Time Value of Money?

Time value of money affects all aspects of business in every industry the reason why we have the time value of money is due to interest because the interest the value of a dollar amount is different depending on the point in time that is paid or received for example dollar received today is more valuable than a dollar received in five years or anytime in the future for that matter. This is because the dollar today can earn interest over the next five years but therefore be worth more than the dollar and the future that is being compared to. In this time value of money, we will go over simple interest, compound interest, future value, annuities, present value, compounding interest future value of annuities present value of annuities and perpetuities.

So, What is Simple Interest?

It can be thought of as rent to borrow the money you can either receive interest or rent when you lend out money or you can pay interest or rent when you borrow money simple interest is when the interest received or paid is based solely on the amount of money that was initially invested. So, if you invested and earned simple interest at an annual rate of 10% for five years then your investment would earn $10.00 each year for the next five years totaling $50 in interest.

The formula to solve the future value is the initial investment time's one plus the interest rate times a number of periods that the investor will be helpful.

Future Value=Initial Investment× 1+Interest Rate×Number of Periods

Therefore, if we invest $100 in an account for five years the earns 10% simple interest per year then we would have $150 in five years.

$100× 1+ 0.10×5 =$150

The bank balance in five years would consist of our initial $100 investment and $50 in interest earned over the five years. Our formula is plus the interest rate of years that is 5 periods.

What is Compound Interest?

Compound interest is much different than simple interest. Compound interest is the kind of interest you would like to receive in investment but not the kind of interest that you want to pay. Because the interest rate is based on the balance of the investment when is calculated not just the initial investment. What this means is that interest is being earned on both the investment and interest is being earned on the previous periods' interest. This may be easier to understand with an example.

Let's say you invested $100 for five years at a compound interest rate of 10% at the end of this first year your vestment would be worth $110 because it earned 10% interest on $100. At the end of the second year, your investment is worth $121. This means that it earned $11.00 in the interest the second year which is different from the $10 in interest earned in the first year. Why? because in second-year, your earn 10% interest on the initial investment and 10% interest on the $10 interest earned in the first year. The easiest way to understand the compounding interest concept is to understand the interest is being earned on the initial investment and the interest earned in previous periods. The best way to calculate what investment or any compound interest will be worth at some point in the future is to use the future value formula.

The calculation will look something like this:

FV=PV× 1+I n

So, for our investment, we would calculate the future value of $100 earning 10% interest over a 5-year period.

Investment of $100 will be worth $161.05 in five years this means that it earned $61.05 in interest or interest than if it earned simple interest. Now you can see why compound interest is the kind of interest that you want to receive but not the kind of interest do you want to pay.

$100× 1+0.1 5 =$161.05

So, What is Future Value?

Future value is what a dollar today will be worth in the future this is because of interest that the dollar can earn over time therefore making it more valuable in the future. If someone offered to give you $100 today or $100 in the future would obviously take the $100 today. Why? Even if you didn't need the $100 today and you knew that you would need it in the future you could simply invest it and earn interest over that year than a year from now. When you did need the money, you could cash out and have one of the dollars plus any interest that it earned so if you earn 10% interest your $100 today would be worth $110 one year in the future. This means in theory that the future value of money is always was worth more. Again, the future value formula is future value equals present value times one plus the interest rate to the nth power.

Calculation will be like this:

FV=PV× 1+I n

Suppose you invested $1000 in an investment that was expected to earn 10% annual interest for the next 10 years what would the future value of your investment be worth in 10 years? Let's plug our figures into the future value formula to find out.

$1000× 1+0.1 10 =$2593.74

Due $1000×1 +0 .1 to the 10th power giving us a future value of $2593.74 mean that $1000 today, the future value of $1000 is $2593.74.

Annuities

An annuity is a series of payments that are either paid to or paid from annuities can be cash flows paid such as monthly rent payments, car payments. It can be the money received as a semi-annual coupon payment from a bond just remember for a series of cash flows to be considered an annuity cash flows need to be equal.

An annuity due is one of the payments is made at the beginning of the payment. For example, we are usually required to pay on the 1st of every month.

An ordinary annuity is a payment that is paid or received at the end of the period, an example of an ordinary annuity would be a coupon payment made from bonds usually bonds will make semi-annual coupon payments at the end of every six months.

What is the Present Value?

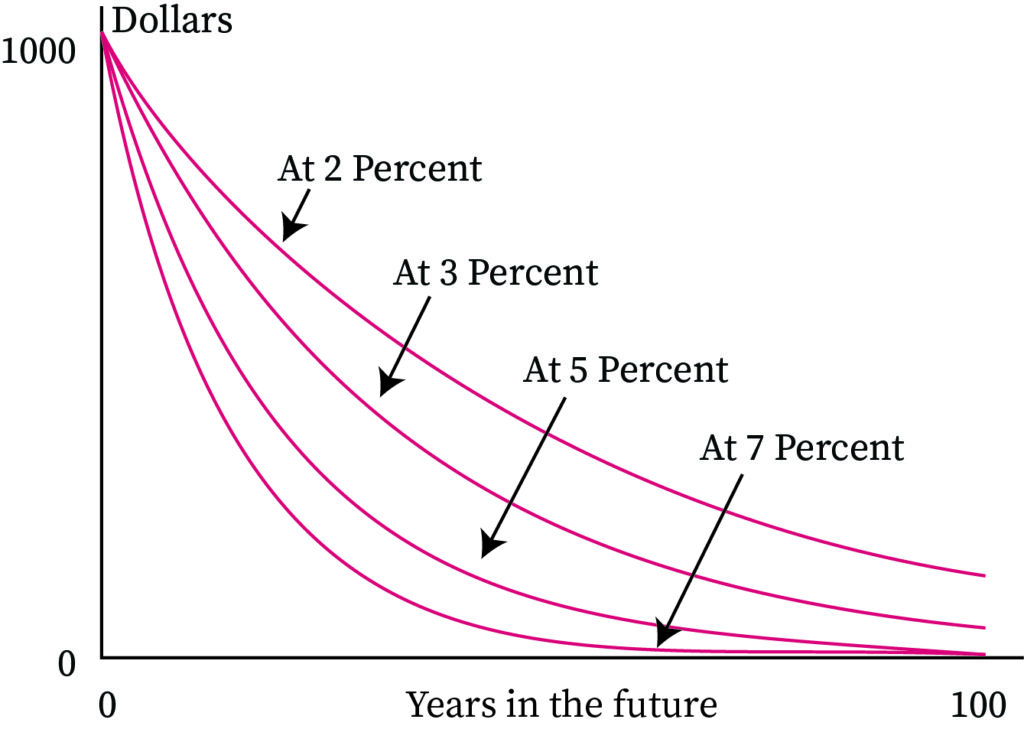

Present value is today's value of money from some point in the future For example, $100 received a year from today is worth less than $100 received today this is because of interest earned over time.

For example, if we invested $90.91 in a fund that is in 10% interest that is $90.91 would be worth about $100 one year in the future this means that according to an available 10% interest rate the present value of $100 in the year from today is worth $90.91 today.

The present value formula for a lump sum of money and the future is shown here.

PV=FV÷ 1+i n

The interest rate is also considered as the discount rate because it helps to discount the future sum of money by the interest rate. Suppose you expected to receive $100 in one year and there were currently several investments offering 10% interest what would the present value of your investment be just plug in the proper figures to the present value formula and you will see that the present value comes out to $90.00 and 91 cents.

$100÷ 1+0.10 1 =$90.91

Calculate the Present Value of a Series of Cash flows?

Let's assume you have an ordinary annuity that pays you $100 at the end of each year for the next three years. It is coming from an investment that is earning 5% interest, what is the present value of your annuity. The way you would solve the present value of this annuity is by solving the present value of each payment or cash flow individually you would do this by using the present value formula for each cash flow that recurs in the future.

Context and Applications

This topic is significant in the professional exams for both undergraduate and graduate courses, especially for

- B.A Economics

- M.A Economics

Want more help with your finance homework?

*Response times may vary by subject and question complexity. Median response time is 34 minutes for paid subscribers and may be longer for promotional offers.

Time Value of Money Homework Questions from Fellow Students

Browse our recently answered Time Value of Money homework questions.