Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

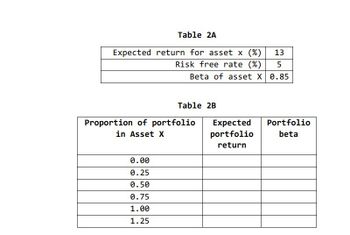

Consider the information given in the Table 2A and complete Table 2B. From the completed Table 2B, use the information to graphically present the Security Market Line (SML). Compute the slope of this

line.

Hints:

i) When 100% money is invested in asset X (portfolio weight = 1), the beta of the portfolio is 0.85

ii) Since the risk-free asset is, well, risk-free, its beta will be zero

Transcribed Image Text:Table 2A

Expected return for asset x (%)

Risk free rate (%)

13

5

Beta of asset X 0.85

Table 2B

Expected

portfolio

Portfolio

beta

return

Proportion of portfolio

in Asset X

0.00

0.25

0.50

0.75

1.00

1.25

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Which asset in the following table has the most market risk (also known as systematic or non-diversifiable risk)? (Ch. 8) Asset Return Beta Standard Deviation Asset A 9% 0.95 20% Asset B 13% 1.10 35% Asset C 10% 1.00 40% Group of answer choices Asset A Asset C Asset B and Asset C Asset Barrow_forwardWhich asset in the following table has the most market risk (also known as systematic or non- diversifiable risk)? Asset A B Asset B Asset A Return Both Assets A and C Asset C (10% 12% 14% Beta 0.74 1.00 1.25 Standard Deviation 20% 40% 30%arrow_forwardwhat are the axcess rates?arrow_forward

- What is the expected return of a portfolio of two risky assets if the expected return E(Ri), standard deviation (SDi), covariance (COVij), and asset weight (Wi) are as shown below? Asset (A) E(R₂) = 25% SDA = 18% WA = 0.75 COVA, B = -0.0009 Select one: A. 13.65% B. 20 U ODN 20.0% C. 18.64% D. 22.5% Asset (B) E(R₂) = 15% SDB = 11% WB = 0.25arrow_forwardQu. 5 please help and show all steps with formulas usedarrow_forward2. Assuming the following: Average Return (Risky Portfolio) 3.86% Standard Dev (Risky Portfolio) 10.56% Average Risk Free Rate 2.18% Return on Risk Free Asset Avg 4.15% Using the formula: E(rc)=rf + y* (E(rp) - rf) Solve for: 1. % of Risky Assets (y): 2. % of Risk Free Assets (1-y): Note: You wish to generate a 7% return for your complete portfolio E(rc)arrow_forward

- Berdasarkan informasi tersebut a. Expected return Asset A b. Standard Deviation Asset A dan Asset B c. Portfolio AB Expected Return. d. Coefficient Correlation AB e. Portofolio AB Standard Deviation Please explain by Microsoft excelarrow_forwardWhat is the standard deviation of asset M?arrow_forwardWhat is the standard deviation of the portfolio that invests equally in all three assets M, N, and O?arrow_forward

- For each 1% change in the market portfolio's excess return, the investment's excess return is expected to change by due to risks that it has in common with the market. ..... А. 1% В. beta C. alpha D. 0%arrow_forwardQuestion 2 You must choose between two investments, X and Y . The profitability index (PI), net present value (NPV) and internal rate of return (IRR) of the two investments are as follows: Criteria Investment X Investment Y NPV R44 000 −R22 000 PI 1,945 0,071 IRR 16,00% 8,04% Which investment(s) should you choose, taking all the above criteria into consideration, if the cost of capital is equal to 12% per year? [1] X [2] Y [3] Both X and Y [4] Neither X nor Y [5] Too little information to make a decision 17 DSC1630arrow_forwardQUESTION 2 Exhibit 6.2 USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S) Asset (A) Asset (B) E(RA) = 25% E(RB) = 15% (σA) = 18% (σB) = 11% WA = 0.75 WB = 0.25 COVA,B = −0.0009 Refer to Exhibit 6.2. What is the expected return of a portfolio of two risky assets if the expected return E(Ri), standard deviation ( σ i ), covariance (COVi,j), and asset weight (Wi) are as shown above? a. 18.64% b. 22.5% c. 11% d. 13.65% e. 20.0%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education