Financial Accounting

15th Edition

ISBN: 9781337272124

Author: Carl Warren, James M. Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter MJ, Problem 2IFRS

IFRS Activity 2

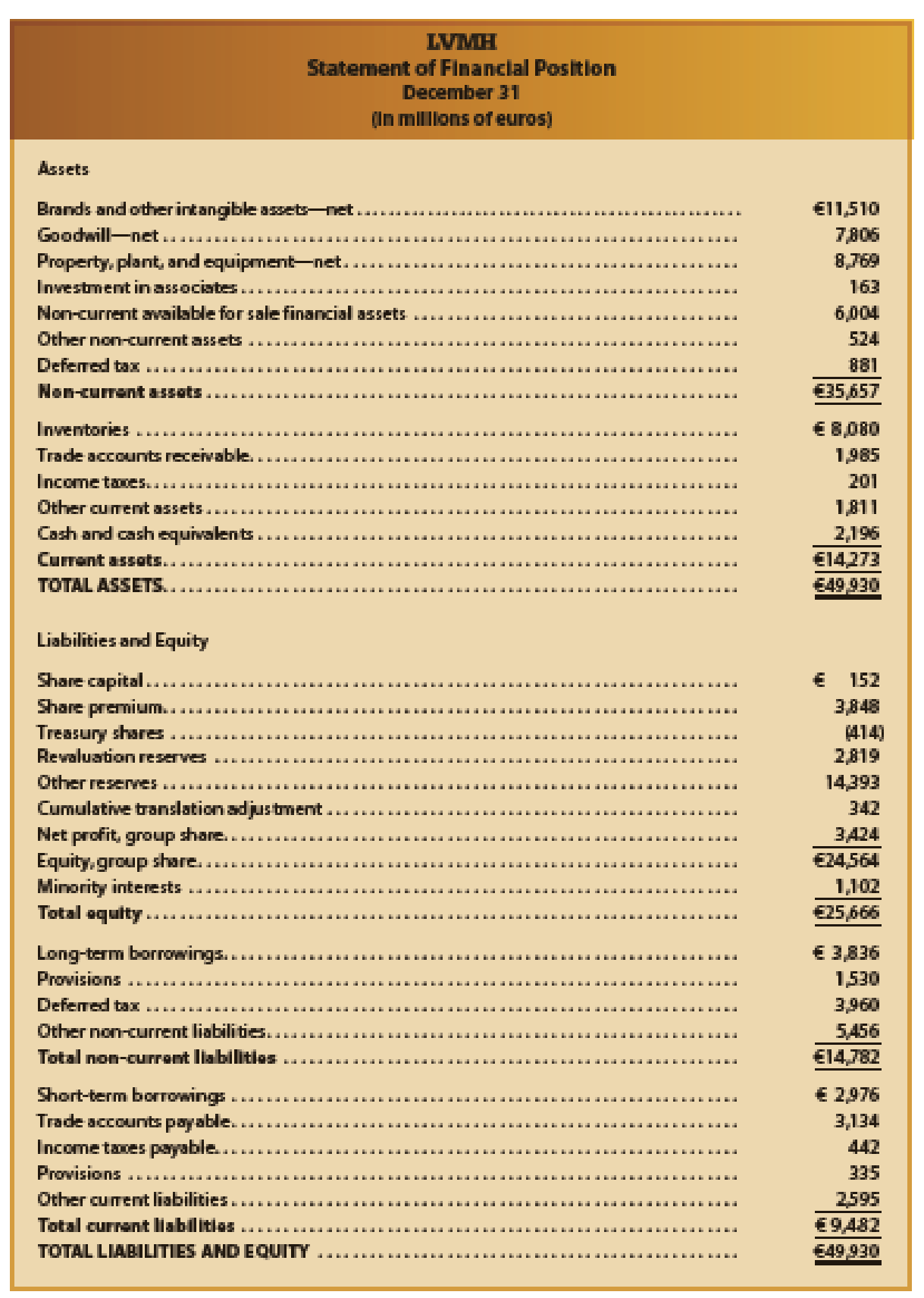

The following is a recent consolidated

- a. Identify presentation differences between the balance sheet of LVMH and a balance sheet prepared under U.S. GAAP. Use the Mornin’ Joe balance sheet (Exhibit 2) as an example of a U.S. GAAP balance sheet. (Ignore minority interests and cumulative translation adjustment.)

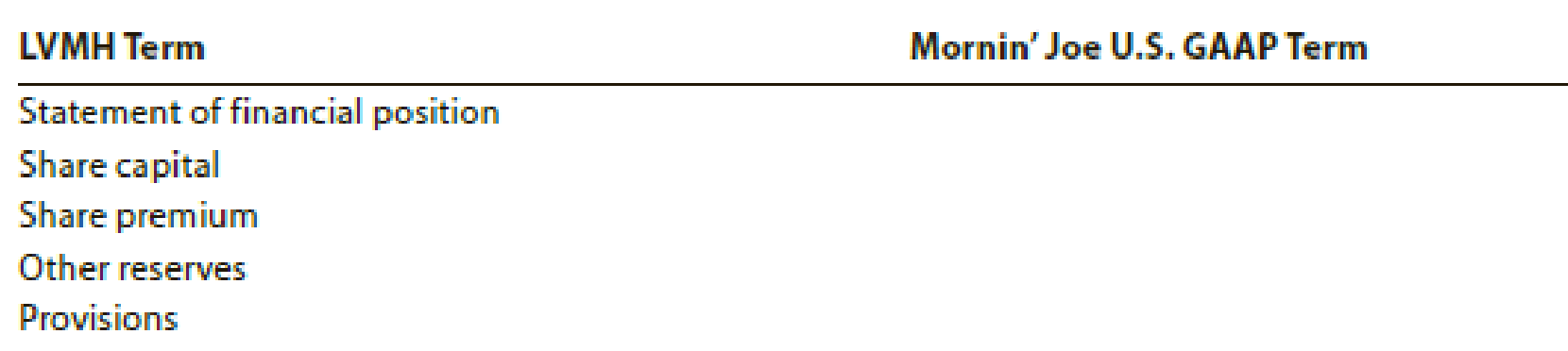

- b. Compare the terms used in this balance sheet with the terms used by Mornin’ Joe (Exhibit 2), using the table that follows:

- c. What does the “Revaluation reserves” in the Equity section of the balance sheet represent?

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Quick answer of this accounting questions

Can you please give me correct answer the accounting question?

Purchases for February will ??

Chapter MJ Solutions

Financial Accounting

Ch. MJ - Prob. 1DQCh. MJ - What is the difference between classifying an...Ch. MJ - If a functional expense classification is used for...Ch. MJ - Prob. 4DQCh. MJ - What are two main differences in inventory...Ch. MJ - Prob. 6DQCh. MJ - Prob. 7DQCh. MJ - Prob. 8DQCh. MJ - Prob. 9DQCh. MJ - IFRS Activity 1

Unilever Group is a global company...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Get correct answer accounting questionsarrow_forwardNeed answer the accounting question please answerarrow_forwardThe 2019 annual report for Anglo-American PLC, the world's leading global mining company, shows that the firm had $41.065 billion in non-current assets and $11.670 billion in current assets. It reported $13.120 billion in current liabilities and $9.442 billion in non-current liabilities. How much was the equity of Anglo-American PLC worth? Tutor, please provide step by step correct solution to this financial accounting problem.arrow_forward

- Don't use ai given answer accounting questionsarrow_forwardNot use ai solution given correct answer general Accounting questionarrow_forwardAsh Merchandising Company expects to purchase $86,000 of materials in July and $118,000 of materials in August. Three-quarters of all purchases are paid for in the month of purchase, and the other one-fourth are paid for in the month following the month of purchase. How much will August's cash disbursements for materials purchases be? I need Solutionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Business Diversification; Author: GreggU;https://www.youtube.com/watch?v=50-d__Pn_Ac;License: Standard Youtube License