CONCEPTS IN FED.TAX.,2020-W/ACCESS

20th Edition

ISBN: 9780357110362

Author: Murphy

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Question

Need answer the accounting question please answer

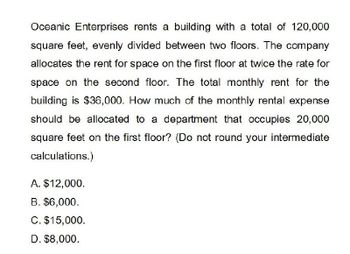

Transcribed Image Text:Oceanic Enterprises rents a building with a total of 120,000

square feet, evenly divided between two floors. The company

allocates the rent for space on the first floor at twice the rate for

space on the second floor. The total monthly rent for the

building is $36,000. How much of the monthly rental expense

should be allocated to a department that occupies 20,000

square feet on the first floor? (Do not round your intermediate

calculations.)

A. $12,000.

B. $6,000.

C. $15,000.

D. $8,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A company purchases a 10,020-square-foot commercial building for $325,000 and spends an additional $50,000 to divide the space into two separate rental units and prepare it for rent. Unit A, which has the desirable location on the corner and contains 3,340 square feet, will be rented for $1.00 per square foot. Unit B contains 6,680 square feet and will be rented for $0.75 per square foot. How much of the joint cost should be assigned to Unit B using the value basis of allocation?arrow_forwardA company purchases a 7,920-square-foot building for $410,000. The building has two separate rental units. Unit A, which has the desirable location on the corner and contains 1,620 square feet, will be rented for $2.00 per square foot. Unit B contains 6,300 square feet and will be rented for $1.20 per square foot. How much of the joint cost should be allocated to Unit A and to Unit B using the value basis of allocation?arrow_forwardMarkson and Sons leases a copy machine with terms that include a fixed fee each month of $500 plus a charge for each copy made. The company uses the high-low method to analyze costs and Markson paid $360 for 5,000 copies and $280 for 3,000 copies,arrow_forward

- Assume that RAS AMBA Hotel has annual fixed costs applicable to its operation of $182,500 for its 60 rooms motel,daily room rent income of $ 150,and variable costs of $ 50 for each room rented.It operates 365 days a year.Required :- 1. Operating income on rooms wii be generated ,if the motel is fully occupied throughout an entire year and if the motel is half full during a year? 2.what is the breakeven point in number of rooms rented assuming that the motel is fully occupied throughout the year.arrow_forwardA 100,000 SF office building has average rents of $30 per SF per year for a full-service gross lease. The Operating Expenses, Taxes and Insurance are $6.00 per SF. Vacancy is 5%. I need the calculations for the PGI, EGI, NOI.arrow_forwardA retail tenant is in 3,575 rentable square feet. Their base rent is $15.95/sf and they pay percentage rent equal to 3.5% of sales over the natural breakpoint. What amount of sales per square foot is the natural breakpoint?arrow_forward

- What is the management fee as a percentage of total revenue for a 275-room hotel located in the northwest, if the property recorded an occupancy percentage of 67.3% and an average room rate of $110.86? the hotel had a room revenue to total revenue ratio of 65.1% and a GOP of 29.3% of total revenue. The management fee contract stipulated that the hotel management company would receive 1% of total revenue and 9% of GOP.arrow_forwardRundle Camps, Inc. leases the land on which it builds camp sites. Rundle is considering opening a new site on land that requires $3,200 of rental payment per month. The variable cost of providing service is expected to be $7 per camper. The following chart shows the number of campers Rundle expects for the first year of operation of the new site: Jan. Feb. 210 290 Mar. Apr. May June July Aug. 270 240 420 540 690 690 Answer is complete but not entirely correct. February August Sept. Oct. 390 420 Required Assuming that Rundle wants to earn $8 per camper, determine the price it should charge for a camp site in February and August. (Do not round Intermediate calculations.) Price S 27 Ⓡ S 20 X Nov. 300 Dec. Total 340 4,800arrow_forwardFranklin Camps, Incorporated leases the land on which it builds camp sites. Franklin is considering opening a new site on land that requires $2,450 of rental payment per month. The variable cost of providing service is expected to be $6 per camper. The following chart shows the number of campers Franklin expects for the first year of operation of the new site: January February March 150 260 210 February August April 210 Price May 330 June 510 Required Assuming that Franklin wants to earn $7 per camper, determine the price it should charge for a camp site in February and August. Note: Do not round intermediate calculations. July August September October November December Total 660 660 360 390 150 310 4,200arrow_forward

- Markson and Sons leases a copy machine with terms that include a fixed fee each month of $313 plus a charge for each copy made. The company uses the high-low method to analyze costs. If Markson paid a variable cost of $0.15, how much would Markson pay if it made 7,814 copies? Round to the nearest penny, two decimals.arrow_forwardfrarrow_forwardPlease given correct option general accountingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College