Concept explainers

Cash budgets under two alternatives (Learning Objectives 2 & 3)

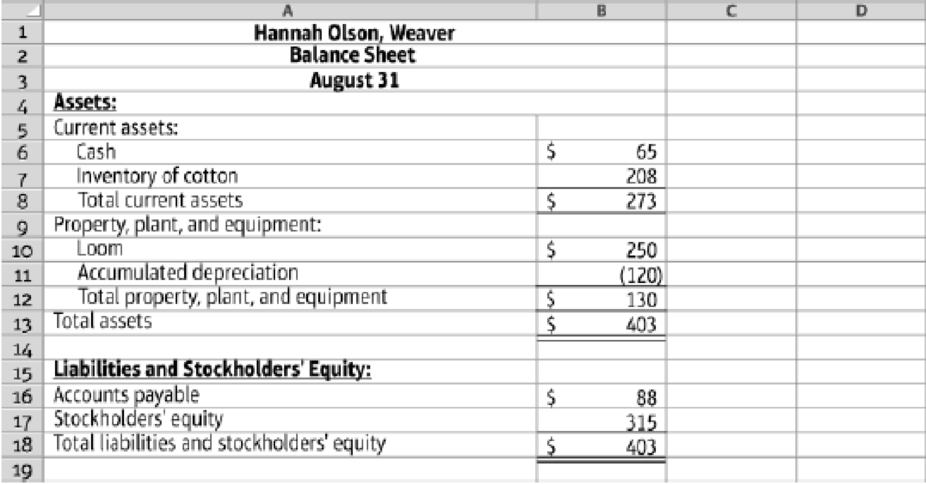

Each autumn, as a hobby, Hannah Olson weaves cotton placemats to sell at a local craft shop. The mats sell for $30 per set of four mats. The shop charges a 20% commission and remits the net proceeds to Olson at the end of December. Olson has woven and sold 26 sets in each of the last two years. She has enough cotton in inventory to make another 26 sets. She paid $8 per set for the cotton. Olson uses a four-harness loom that she purchased for cash exactly two years ago. It is depreciated at the rate of $5 per month. The accounts payable relate to the cotton inventory and are payable by September 30.

Olson is considering buying an eight-harness loom so that she can weave more intricate patterns in linen. The new loom costs $1,000; it would be depreciated at $20 per month. Her bank has agreed to lend her $1,000 at 18% interest, with $200 principal plus accrued interest payable each December 31. Olson believes she can weave 16 linen placemat sets in time for the Christmas rush if she does not weave any cotton mats. She predicts that each linen set will sell for $65. Linen costs $20 per set. Olson’s supplier will sell her linen on credit, payable December 31.

Olson plans to keep her old loom whether or not she buys the new loom. The

9.4-59 Full Alternative Text

Requirements

- 1. Prepare a combined

cash budget for the four months ending December 31, for two alternatives: weaving the placemats in cotton using the existing loom and weaving the placemats in linen using the new loom. For each alternative, prepare abudgeted income statement for the four months ending December 31 and a budgeted balance sheet at December 31. - 2. On the basis of financial considerations only, what should Olson do? Give your reason.

- 3. What nonfinancial factors might Olson consider in her decision?

Want to see the full answer?

Check out a sample textbook solution

Chapter 9 Solutions

Managerial Accounting (5th Edition)

- As a fund-raiser, the pep band at Melrose University sells T-shirts fans can wear when attendingthe school’s 12 home basketball games. As the band’s business manager, you must choose amongseveral options for ordering and selling the T-shirts.1. Place a single order in October large enough to last the entire season. The band must pay forthe shirts in full when the order is placed. A 5 percent quantity discount applies to this option.2. Place a series of small orders, as needed, throughout the season. Again, payment in full is duewhen the order is submitted. No discount applies to this option.3. Have band members sell shirts directly to members of the student body. Cash is collectedimmediately as sales are made.4. Sell all of the T-shirts through the university bookstore. The bookstore would receive a6 percent commission on total sales and would remit to the band its share of the proceeds ina lump-sum payment at the end of the season.a. Describe which combination of options would give…arrow_forwardMegan Berry, a freshman horticulture major at the University of Minnesota, has some financial questions for the next three years of school and beyond. Round your answers for the following questions to the nearest dollar. If Megan's tuition, fees, and expenditures for books this year total $24,000, what will they be during her senior year (three years from now), assuming costs rise 7 percent annually? (Hint: Use Appendix A-1 or the Garman/Forgue companion website.) Round Future Value of a Single Amount in intermediate calculations to four decimal places. $ Megan is applying for a scholarship currently valued at $3,000 at the end of first year. If she is awarded it at the end of next year, how much is the scholarship worth in today's dollars, assuming inflation of 2 percent? (Hint: Use Appendix A-2 or the Garman/Forgue companion website.) Round Present Value of a Single Amount in intermediate calculations to four decimal places. $arrow_forwardAmy Martin is a student who plans to attend approximately four professional events a year at her college. Each event necessitates a financial outlay of $100 to $200 for a new suit and accessories. After incurring a major hit to her savings for the first event, Amy developed a different approach. She buys the suit on credit the week before the event, wears it to the event, and returns it the next week to the store for a full refund on her charge card. 1. Comment on the ethics exhibited by Amy and the possible consequences of her actions. 2. How does the merchandising company account for the suits that Amy returns?arrow_forward

- Megan Berry, a freshman horticulture major at the University of Minnesota, has some financial questions for the next three years of school and beyond. Round your answers for the following questions to the nearest dollar. If Megan's tuition, fees, and expenditures for books this year total $19,000, what will they be during her senior year (three years from now), assuming costs rise 3 percent annually? (Hint: Use Appendix A-1 or the Garman/Forgue companion website.) Round Future Value of a Single Amount in intermediate calculations to four decimal places. $ Megan is applying for a scholarship currently valued at $1,000 at the end of first year. If she is awarded it at the end of next year, how much is the scholarship worth in today's dollars, assuming inflation of 2 percent? (Hint: Use Appendix A-2 or the Garman/Forgue companion website.) Round Present Value of a Single Amount in intermediate calculations to four decimal places. $ Megan is already looking ahead to graduation…arrow_forwardMegan Berry, a freshman horticulture major at the University of Minnesota, has some financial questions for the next three years of school and beyond. Round your answers for the following questions to the nearest dollar. If Megan's tuition, fees, and expenditures for books this year total $15,000, what will they be during her senior year (three years from now), assuming costs rise 5 percent annually? (Hint: Use Appendix A-1 or the Garman/Forgue companion website.) Round Future Value of a Single Amount in intermediate calculations to four decimal places. $ Megan is applying for a scholarship currently valued at $7,000 at the end of first year. If she is awarded it at the end of next year, how much is the scholarship worth in today's dollars, assuming inflation of 2 percent? (Hint: Use Appendix A-2 or the Garman/Forgue companion website.) Round Present Value of a Single Amount in intermediate calculations to four decimal places. $ Megan is already looking ahead to graduation…arrow_forwardNeed help on these multiple choice please asap 1. Girl Scout cookie sales help raise funds for all of the Girl Scout activities in any given year. Troop 68 has 62 girls and their parents contribute $100 per year per girl in membership fees. If a box of cookies sells for $5, costs them $2 per box (the troop buys these cookics from the central office), and they sell 10,000 boxes in total, how much money can Troop 68 budget for all of their activities that year? There are no fixed costs – kids sell these cookies for free, rain or shine. o 23,800 o 36,200 o 6,200 o 76,200 2. Flexible budgets help us understand: o How fixed costs are distributed in an organization o How basic assumptions are lined up in the budget o To what extent changes in the number of clients can affect the overall budget o How capital resources are allocated across the organization 3. Estimating Deprecation. If you pay $829 for an IPhone 12, replace the screen two times for S110.5 cach time, and use it for five full…arrow_forward

- The West Indies School Book Shop sells T Shirts emblazoned with the school’s name and logo. Theshirts cost $2,000 each and management estimates that 900 T Shirts will be sold during each month ofthe year. The annual holding cost for a unit of that inventory is estimated to be 1.5% of the purchaseprice. It costs the Book Shop $500 to place a single order.The maximum sale for the Book Shop for any one week is 300 shirts and minimum sales 150shirts. The supplier takes anywhere from 2 to 4 weeks to deliver the merchandise after the order isplaced.i) Determine the highest number of shirts that should be purchased by the Gift Shop in order tominimize stock administration cost.ii) What is the total stock administration costs?iii)Using the EOQ policy, determine the re-order level, minimum inventory level and maximuminventory level for the T Shirts.arrow_forwardHannah Byers and Kathleen Taylor are considering the possibility of teaching swimming to kids during the summer. A local swim club opens its pool at noon each day, so it is available to rent during the morning. The cost of renting the pool during the10-week period for which Hannah and Kathleen would need it is $1,700. The pool would also charge Hannah and Kathleen an admission, towel service, and life guarding fee of $7 per pupil, and Hannah and Kathleen estimate an additional $5 cost per student to hire several assistants. Hannah and Kathleen plan to charge $75 per student for the 10-week swimming class. a. How many pupils do Hannah and Kathleen need to enroll in their class to break even? b. If Hannah and Kathleen want to make a profit of $5,000 for the summer, how many pupils do they need to enroll? c. Hannah and Kathleen estimate that they might not be able to enroll more than 60 pupils. If they enroll this many pupils, how much would they need to charge per pupil in order to…arrow_forwardMolly Dymond and Kathleen Taylor are considering the possibility of teaching swimming to kids during the summer. A local swim club opens its poolat noon each day, so it is available to rent during the morning. The cost of renting the pool during the 10-week period for which Molly and Kathleenwould need it is $1,700. The pool would also charge Molly and Kathleen an admission, towel service, and life guarding fee of $7 per pupil, andMolly and Kathleen estimate an additional $5 cost per student to hire several assistants. Molly and Kathleen plan to charge $75 per student for the10-week swimming class. How many pupils do Molly and Kathleen need to enroll in their class to break even?arrow_forward

- Amber, owner of Amber’s Flowers and Gifts, produces gift baskets for various special occasions. Each giftbasket includes fruit or assorted small gifts (e.g., a coffee mug, deck of cards, novelty cocoa mixes, scentedsoap) in a basket that is wrapped in colorful cellophane. Amber has estimated the following unit sales of thestandard gift basket for the rest of the year and for January of next year.September 260October 250November 270December 350January 170Amber likes to have 5% of the next month’s sales needs on hand at the end of each month. This requirement was met onAugust 31. Two materials are needed for each fruit basket:Fruit 2 poundsSmall Gifts 4 itemsThe materials inventory policy is to have 5% of the next month’s fruit needs on hand and 30% of the next month’sproduction needs of small gifts. (The relatively low inventory amount for fruit is designed to prevent spoilage.) Materialsinventory on August 31 met this company policy.1. Prepare a production budget for September,…arrow_forwardthe happy toddlers is a preparatory school for children three to five years old. pupils are enrolled for a school-year. parents can pay the full tuition fee of p70000 at the start of the school year (june).there is also an option to pay two installments of p37000 each at the start of every semester (june 1 and november 1). of the 150 students enrolled, 80 are paid in full at the start of the year. the remaining students are on installment payments. one school year runs from june 1-march 31. determine the tuition fee revenue for the period december 31. this is the first year of happy toddlers operations.arrow_forwardCarl is a student at a college. He has a part-time job with take-home pay of $525 every two weeks. He has received a scholarship of $4100 this year. a) Use the data provided to design a monthly budget for Carl. Show your calculations for his income and expenses. Identify each expense as fixed or variable. b) Is Carl earning enough to cover his expenses? If not, suggest how he could balance the budgetarrow_forward