Lower of cost or market

• LO9–1

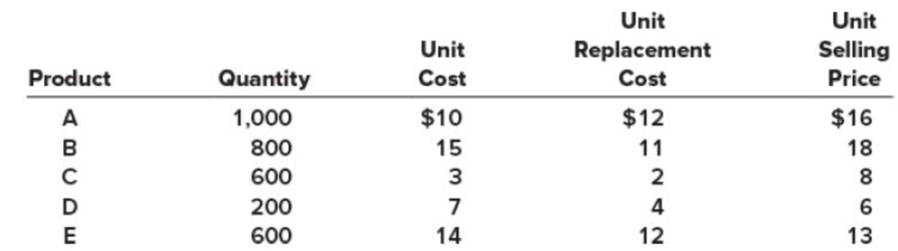

Forester Company has five products in its inventory. Information about the December 31, 2018, inventory follows.

The cost to sell for each product consists of a 15 percent sales commission. The normal profit percentage for each product is 40 percent of the selling price.

Required:

1. Determine the carrying value of inventory at December 31, 2018, assuming the lower of cost or market (LCM) rule is applied to individual products.

2. Determine the carrying value of inventory at December 31, 2018, assuming the LCM rule is applied to the entire inventory. Also, assuming inventory write-downs are usual business practice for Forester, record any necessary year-end

1.

LCM (Lower of Cost or Market) approach: It is an approach that values the inventory at historical cost or lesser than the market replacement cost. The replacement cost refers to the amount that could be realized from the sale of the inventory.

NRV (Net Realizable Value): It refers to an estimated selling price that a company expects to collect in the form of cash from the customers by the sale of inventory. The value is reduced by the expected cost of completion, disposal and transportation. Sales commission and shipping costs also included in the predictable cost.

To Determine: The carrying value of inventory at December 31, 2018 using the lower of cost or market (LCM) for individual products.

Explanation of Solution

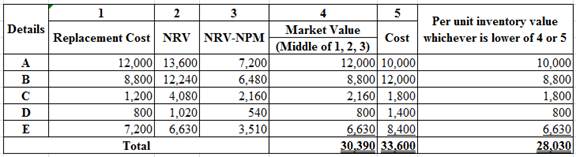

The following table shows the carrying value of inventory at December 31, 2018 using the lower of cost or market (LCM) for individual products.

Figure (1)

Explanation:

- NRV is the difference of selling price and selling costs.

- Market Value is the middle of the replacement cost, NRV (ceiling), and NRV- NPM (floor) for each product.

- NRV is Net Realizable Value and NPM is Net Profit Margin.

- When the replacement cost is:

- Less than the (NRV-NPM), the (NRV-NPM) amount is the market value.

- More than the NRV, the NRV amount is the market value

- Between the NRV and the (NRV-NPM), the replacement cost is the market value.

Selling price of the product is less costs to sell. The value of cost to sell consists of a sales commission equal to 15% of selling price.

Working Notes:

Calculate the amount of NRV for product A.

Calculate the amount of NRV for product B.

Calculate the amount of NRV for product C.

Calculate the amount of NRV for product D.

Calculate the amount of NRV for product E.

Determine the difference of NRV and NPM.

| Product | NRV ($) | Total Cost ($) | NPM (40% of Total cost) |

NRV-NPM |

| A | B | C = B × 40% | A - C | |

| A | 13.60 | 16 | 6.40 | 7.20 |

| B | 15.30 | 18 | 7.20 | 8.10 |

| C | 6.80 | 8 | 3.20 | 3.60 |

| D | 5.10 | 6 | 2.40 | 2.70 |

| E | 11.05 | 13 | 5.20 | 5.85 |

Table (1)

Therefore, the carrying value of inventory at December 31, 2018 using the lower of cost or market (LCM) for individual products is $28,030.

2.

Explanation of Solution

The total aggregate inventory cost and aggregate inventory market value is $33,600 and $30,390 respectively. Therefore, the carrying value of inventory at December 31, 2018, using the LCM rule applied for entire inventory is $30,390. The amount of inventory write-down is $3,210 ($33,600 - $30,390). The write-down value will be adjusted at the year end.

Want to see more full solutions like this?

Chapter 9 Solutions

INTERMEDIATE ACCOUNTING, W/CONNECT

- Exercise 9-6 (Algo) Lower of cost or market [LO9-1] Tatum Company has four products in its inventory. Information about the December 31, 2021, inventory is as follows: Total Total Net Product Total Cost Replacement Cost $118,100 91,000 42,800 30,200 Realizable Value $129,000 96,400 64,200 32,300 $107,300 117,800 53,700 54,000 101 102 103 104 The normal profit is 30% of total cost. Required: 1. Determine the carrying value of inventory at December 31, 2021, assuming the lower of cost or market (LCM) rule is applied to individual products. 2. Assuming that inventory write-downs are common for Tatum Company, record any necessary year-end adjusting entry. X Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Determine the carrying value of inventory at December 31, 2021, assuming the lower of cost or market (LCM) rule is applied to individual products. Inventory Value Replacement NRV NRV - NP Market Product…arrow_forwardDecker Company has five products in its inventory. Information about ending inventory follows. Unit Product Quantity Cost $ A 1,100 30 35 4 11 34 The cost to sell for each product consists of a 10 percent sales commission. BCP с D E 900 800 400 800 1. Determine the carrying value of ending inventory, assuming the lower of cost or net realizable value (LCNRV) rule is applied to individual products. 2. Determine the carrying value of ending inventory, assuming the LCNRV rule is applied to the entire inventory. 3. Assuming inventory write-downs are common for Decker, record any necessary year- end adjusting entry based on the amount calculated in requirement 2. Complete this question by entering your answers in the tabs below. Product Unit Selling Price $36 38 12 10 33 Required 1 Required 2 Required 3 Determine the carrying value of ending inventory, assuming the lower of cost or net realizable value (LCNRV) rule is applied to individual products. Note: Do not round intermediate…arrow_forwardd t nces SLR Corporation has 500 units of each of its two products in its year-end inventory. Per unit data for each of the products are as follows: Cost Replacement cost Selling price Selling costs Normal profit Product 1 $ 53 51 73 Required 1 Determine the carrying value of SLR's inventory assuming that the lower of cost or market (LCM) rule is applied to individual products. What is the before-tax income effect of the LCM adjustment? Complete this question by entering your answers in the tabs below. Product Cost 9 13 Required 2 Product 2 $ 37 29 39 7 11 Determine the carrying value of SLR's inventory assuming that the lower of cost or market (LCM) rule is applied to individual products. Market Per Unit Inventory Value Unit Cost Lower of Cost or Marketarrow_forward

- 21. A company has two pieces of Inventory, A and B. Inventory A cost the company P40 per unit and can now be sold for P60 per unit after incurring P15 in selling expenses per unit. It has a replacement cost of P35 per unit and a normal profit of P4 per unit. Inventory B cost the company P52 per unit and can now be sold for P63 per unit after the incurring P15 in selling expenses per unit and a normal profit of P4 per unit. If the company uses the retail method to value its inventory, how much should be reported on the balance sheet for these items? a. 90 b. 89 c. 86 d. 88 D00 000arrow_forward4 Lynn Corporation has two products in its ending inventory, each accounted for at the lower of cost or market. A profit margin of 30% on selling price is considered normal for each product. Specific data with respect to each product follows: Product Product 2 Historical cost Replacement cost Estimated cost to dispose/complete Estimated selling price $30 27 13 60 $15 35 In pricing its ending inventory using the lower of cost or market, what unit values should Lynn use for products #1 and #2, respectively? a. $15.00 and $29.00 b. $19.50 and $29.00 c. $19.50 and $30.00 d. $18.00 and $27.00arrow_forwardForest Company has tive products in its inventory. Information about ending inventory follows. Product Quantity Cost $ A 900 29 34 22 BC с D E 900 900 900 1,000 Lea Unit Unit Unit Replacement Selling Cost Price 26 33 Required 1 Product (units) A (900) B (900) C/900) $ 31 30 21 The cost to sell for each product consists of a 20 percent sales commission. The normal profit for each product is 40 percent of the selling price. Required 2 Required 3 RC 0131 223 23 1. Determine the carrying value of ending inventory, assuming the lower of cost or market (LCM) rule is applied to individual products. 2. Determine the carrying value of inventory, assuming the LCM rule is applied to the entire inventory. 31 3. Assuming inventory write-downs are common for Forest, record any necessary year- end adjusting entry based on the amount calculated in requirement 2. NRV Complete this question by entering your answers in the tabs below. 57223 $35 Determine the carrying value of ending inventory, assuming…arrow_forward

- Black Corporation uses the LIFO cost flow assumption. Each unit of its inventory has a net realizable value of 300, a normal profit margin of 35, and a current replacement cost of 250. Determine the amount per unit that should be used as the market value to apply the lower of cost or market rule to determine Blacks ending inventory.arrow_forwardExercise 9-19 (Algo) Dollar-value LIFO retail [LO9-5] On January 1, 2024, the Brunswick Hat Company adopted the dollar-value LIFO retail method. The following data are available for 2024: Beginning inventory Net purchases Net markups Net markdowns Net sales Retail price index, 12/31/2024 Required: Calculate the estimated ending inventory and cost of goods sold for 2024 using the information provided. Note: Do not round intermediate calculations. Answer is complete but not entirely correct. Ending inventory at retail Ending inventory at cost Cost of goods sold Cost $ 82,600 119,500 $ $ $ 162,000 86,386 122,113 Retail $ 140,000 247,000 4,000 12,000 217,000 1.08arrow_forwardInventory Write-Down Stiles Corporation uses the LIFO cost flow assumption and is in the process of applying the LCM rule for each of two products in its ending inventory. A profit margin of 30% on the selling price is considered normal for each product. Specific data for each product are as follows: Historical cost Replacement cost Estimated cost of disposal Estimated selling price Product A Product B $80 $96 70 98 32 30 150 120 Required: 1. What is the correct inventory value for each product? Product A Product B $ per unit per unit 2. Next Level With regard to requirement 1, what effect does the imposition of the constraints on market value have on the inventory valuations? For Product A, For Product B,arrow_forward

- 55.XXX Company uses the average cost retail method to estimate its inventory. Data relating to the inventory at December 31, 2020 are: Cost Retail Inventory, January 1 P 2,000,000 P3,000,000 Purchases 10,600,000 14,000,000 Net markups 1,600,000 Net markdowns 600,000 Sales 12,000,000 Estimated normal shoplifting losses 400,000 Estimated normal shrinkage is 5% of sales Trinidad’s cost of goods sold for the year ended December 31, 2019 isarrow_forwardPA4. LO 10.3 Calculate the cost of goods sold dollar value for A74 Company for the sale on March 11, considering the following transactions under three different cost allocation methods and using perpetual inventory updating. Provide calculations for (a) first-in, first-out (FIFO); (b) last-in, first-out (LIFO); and (c) weighted average (AVG). Number of Units Unit Cost Beginning inventory Mar. 1 Purchased Mar. 8 Sold Mar. 11 for $120 per unit 110 140 $87 89 95 Solution А. Number of Units Dollar per Unit Value Cost of goods sold В. Number of Units Dollar per Unit Value Cost of goods sold C. Number of Units Dollar per Unit Value Cost of goods sold PA5. LO 10.3 Use the first-in, first-out (FIFO) cost allocation method, with perpetual inventory updating, to calculate (a) sales revenue, (b) cost of goods sold, and c) gross margin for A75 Company, considering the following transactions. Number Unit Cost of Units Beginning inventory Purchased Mar. 2 Sold Mar, 31 for $75 per unit 105 150 88…arrow_forwardValuing Inventory at Lower-of-Cost-or-Market Gard Inc. has compiled the following information related to its five products. Costs of disposal are estimated to be 10% of selling price, and gross profit is estimated to be 25% of the selling price. Determine the value of inventory applying the lower-of-cost-or-market rule to each individual inventory item. Note: Round each amount to the nearest dollar. #1 #2 #3 #4 #5 Estimated selling price $10 $20 $30 $40 $50 Original cost (LIFO) 60 80 90 100 110 Replacement cost 120 130 140 150 160 Inventory at the lower-of-cost-or-market Answer Answer Answer Answer Answerarrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning