Activity-Based Costing in a Service Environment

Elite Lawn & Plowing (EL&P) is a lawn and snow plowing service with both residential and commercial clients. The owner believes that the commercial sector has more growth opportunities and is considering dropping the residential service.

Twenty employees worked a total of 20,000 hours last year, 13,000 on residential jobs and 7,000 on commercial jobs. Wages were $25 per hour for all work done. Any materials used are included in

Required

- a. If overhead for the year was $205,000, what were the profits of the residential and commercial services using labor-hours as the allocation base?

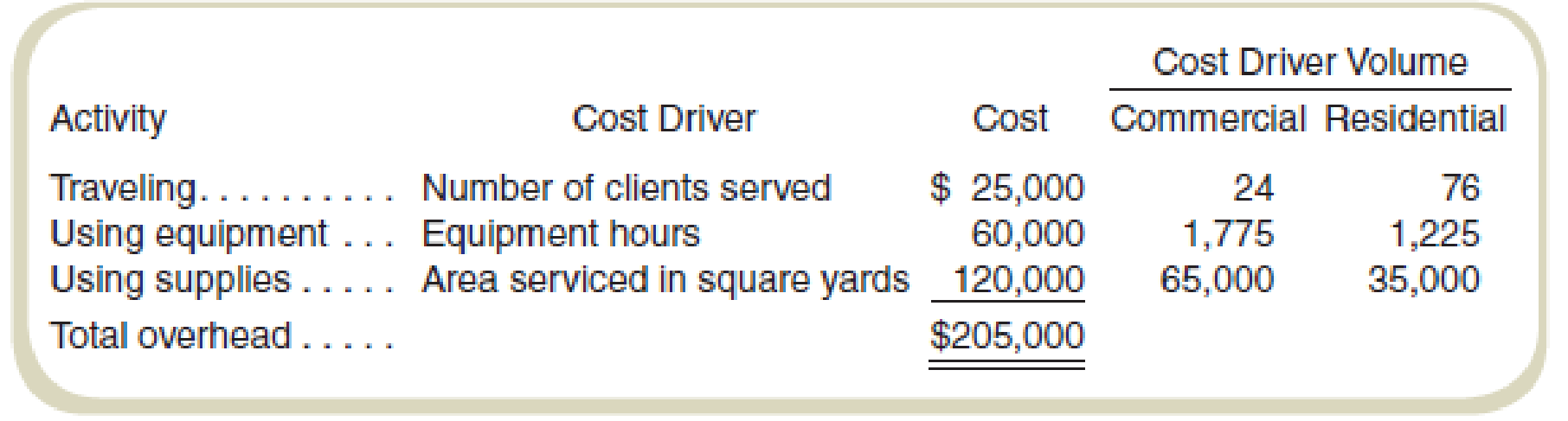

- b. Overhead consists of costs of traveling to the site, using equipment (including vehicle rental), and using supplies, which can be traced as follows:

Recalculate profits for commercial and residential services based on these activity bases.

- c. What recommendations do you have for management regarding the profitability of these two types of services?

Want to see the full answer?

Check out a sample textbook solution

Chapter 9 Solutions

Fundamentals Of Cost Accounting (6th Edition)

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,  Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning