PRIN.OF CORPORATE FINANCE

13th Edition

ISBN: 9781260013900

Author: BREALEY

Publisher: RENT MCG

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 8, Problem 6PS

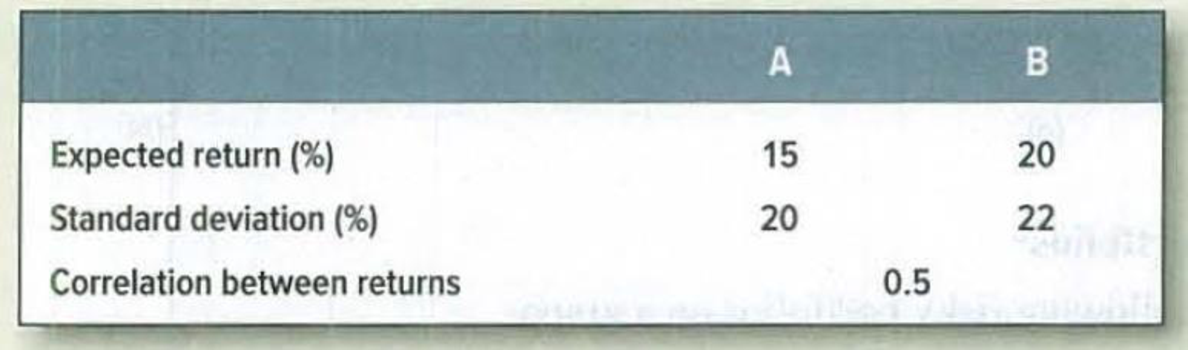

Portfolio risk and return* Ebenezer Scrooge has invested 60% of his money in share A and the remainder in share B. He assesses their prospects as follows:

- a. What are the expected return and standard deviation of returns on his portfolio?

- b. How would your answer change if the correlation coefficient were 0 or –.5?

- c. Is Mr. Scrooge’s portfolio better or worse than one invested entirely in share A, or is it not possible to say?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Ebenezer Scrooge has invested 50% of his money in share A and the remainder in share B. He assesses their prospects as follows:

A

B

Expected return (%)

15

21

Standard deviation (%)

22

24

Correlation between returns

0.6

a. What are the expected return and standard deviation of returns on his portfolio? (Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.)

b. How would your answer change if the correlation coefficient were 0 or –0.60? (Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.)

(a) (i) Calculate the expected returns and standard deviations of Stock Alpha and Stock Beta.

(a) (ii) Assuming that Jerry Tan is a risk-adverse investor, recommend which stock he should select for long term investment.

(b) Suppose that Jerry Tan has surplus funds to invest in both stocks, Alpha and Beta. He has decided to form a portfolio with investment in both stocks. The correlation coefficient between the expected return of both stocks is 0.8 and the weightage of investment is 40% for Stock Alpha and 60% for Stock Beta.

Required:(i) Compute the expected return, Standard Deviation and Variance of the portfolio.

(c) Explain the specific risk and market risk in details, which affecting a company or a group of companies that represent a sector of the stock market.

(d) Give THREE (3) reasons why airlines and machine tool manufacturers have substantial macro and market risks.

Assuming you are an investor with GHS100 available. If you invest GHS60 and GHS40 in Allos Inc. and Orangus Inc. respectively, what will be your portfolio returns?

4.Calculate the Standard deviation of the portfolio.

Chapter 8 Solutions

PRIN.OF CORPORATE FINANCE

Ch. 8 - Efficient portfolios For each of the following...Ch. 8 - Efficient portfolios Figure 8.11 purports to show...Ch. 8 - Portfolio risk and return Look back at the...Ch. 8 - Portfolio risk and return Mark Harrywitz proposes...Ch. 8 - Portfolio risk and return Ebenezer Scrooge has...Ch. 8 - Portfolio risk and return Here are returns and...Ch. 8 - Portfolio risk and return Percival Hygiene has IO...Ch. 8 - Sharpe ratio Use the long-term data on security...Ch. 8 - Portfolio beta Refer to Table 7.5. a. What is the...Ch. 8 - CAPM True or false? Explain or qualify as...

Ch. 8 - CAPM True or false? a. The CAPM implies that if...Ch. 8 - CAPM Suppose that the Treasury bill rate is 6%...Ch. 8 - CAPM The Treasury bill rate is 4%, and the...Ch. 8 - Cost of capital Epsilon Corp. is evaluating an...Ch. 8 - APT Consider a three-factor APT model. The factors...Ch. 8 - Prob. 18PSCh. 8 - APT Consider the following simplified APT model:...Ch. 8 - Prob. 20PSCh. 8 - Three-factor modelThe following table shows the...Ch. 8 - Efficient portfolios Look again at the set of the...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Ebenezer Scrooge has invested 55% of his money in share A and the remainder in share B. He assesses their prospects as follows: A B Expected return (%) 15 19 Standard deviation (%) 22 24 Correlation between returns 0.4 a. What are the expected return and standard deviation of returns on his portfolio? (Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.) b. How would your answer change if the correlation coefficient were 0 or –0.40? (Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.) c. Is Mr. Scrooge’s portfolio better or worse than one invested entirely in share A, or is it not possible to say? multiple choice Better Worse Not possible to sayarrow_forwardYour client, Bo Regard, holds a complete portfolio that consists of a portfolio of risky assets (P) and T-Bills. The information below refers to these assets. What is the expected return of the complete portfolio? Group of answer choices a. 10.32% b. 5.28% c. 9.62% d. 8.44% e. 7.58%arrow_forwardSuppose you are an average risk-averse investor who can purchase only one of the following stocks. Which should you purchased? Explain your reasoning. Investment Expected Return, r Standard Deviation, (r Stock M 6.0% 4.0% Stock N 18.0 12.0 Stock O 12.0 7.0arrow_forward

- (Portfolio VaR) Suppose there are two investments A and B. Either investment A or B has a 4.5% chance of a loss of $15 million, a 2% chance of a loss of $2 million, and a 93.5% change of a profit of $2 million. The outcomes of these two investments are independent of each other.arrow_forwardIf an investor that owns a portfolio with 3 stocks increases their portfolio to 30 stocks, which of the following is MOST LIKELY to happen? Select one: a. risk will increase b. risk would decrease c. Systematic risk would increase d. return would increasearrow_forwardA. Mubita is contemplating on investing in Stocks A and B with the following probability distributions of possible future returns: Probability (Pi ). 0.1, 0.2, 0.4, 0.2, 0.1 Stock A (%) 15, 0, 5, 10, 25 Stock B (%) 20, 10, 20, 30,50 Calculate the expected rate of return for each stock. Assuming the Capital Asset Pricing Model (CAPM) holds and stock B’s beta is greater than stock A’s beta by 0.27, what is the excess return on the market portfolio?arrow_forward

- An investor wants to determine the safest way to structure a portfolio from several investments, whose annual returns under different scenarios are as follows: Returns Scenario A B. D Probability 1. 0.11 -0.09 0.10 0.07 0.10 -0.11 0.12 0.14 0.06 0.10 3 0.09 0.15 0.11 0.08 0.10 4 0.25 0.18 0.33 0.07 0.30 0.18 0.16 0.1 0.06 0.40 9. Suppose the investor ignores the scenarios have different probabilities. If he has determined his risk aversion value is 0.75, what percentage of his portfolio should be invested in A? percent 2.arrow_forwardWhat is the beta of a portfolio made up of two risky assets and a risk-free asset? You invest 35% in asset A with a beta of 1.2 and 35% in asset B with a beta of 1.1. Select one: O a. 0.66 O b.1.29 O C. 0.81 O d.1.14 O e. 1.03arrow_forwardThe risky portfolio expected return and standard deviation is 14% and 20%, respectively. The risk free rate is 5%. The risk aversion coefficient A is 2.5 and 4 for Mary and Kim, respectively. Answer the following questions: A. Who is more risk averse? B. What is the capital allocation y to the risky portfolio for each investor? C. Suppose investors have the following utility function: U = E(R) - ¹2 Ao² Calculate the Utility level for each investor's optimal complete portfolio.arrow_forward

- An investor is considering two possible investment alternatives, Portfolio A and Portfolio B. The expected returns for each are shown in the table below under two different market conditions, along with the investors prediction for the probability of each market condition. The investor's prediction for the probability of each market condition. The investor's utility function can be represented as U(w) - square root (w). If the investor maximises their expected utility, which alternative would they choose? Portfolio A Portfolio B Bull Market Bear Market Portfolio A 16% Portfolio B 4% Probability 0.75 3% 2% 0.25arrow_forwardCarl plans to add one of two alternative stocks to his portfolio. Stock A has a correlation of 0.70 with his portfolio and Stock B has a correlation of 0.10. Both stocks have the same standard deviation of returns. Based on this information, relative to Stock A, Stock B will result in: a. less total risk and more active risk for the portfolio b. less total risk and less active risk for the portfolio С. more total risk and less active risk for the portfolio d. more total risk and more active risk for the portfolioarrow_forwardEbenezer Scrooge has invested 65% of his money in share A and the remainder in share B. He assesses their prospects as follows: A B Expected return (%) 16 21 Standard deviation (%) 23 27 Correlation between returns 0.5 What are the expected return and standard deviation of returns on his portfolio? Note: Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places. How would your answer change if the correlation coefficient were 0 or −0.50? Note: Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places. Is Mr. Scrooge’s portfolio better or worse than one invested entirely in share A, or is it not possible to say?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Chapter 8 Risk and Return; Author: Michael Nugent;https://www.youtube.com/watch?v=7n0ciQ54VAI;License: Standard Youtube License