PRIN.OF CORPORATE FINANCE

13th Edition

ISBN: 9781260013900

Author: BREALEY

Publisher: RENT MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 8, Problem 21PS

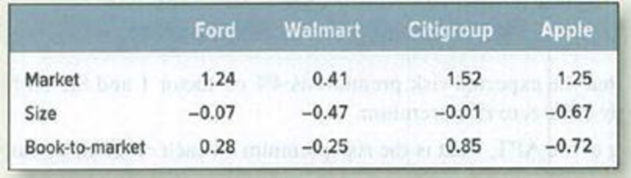

Three-factor model*The following table shows the sensitivity of four stocks to the three Fama–French factors. Estimate the expected return on each stock assuming that the interest rate is 2%, the expected risk premium on the market is 7%, the expected risk premium on the size factor is 3.2%, and the expected risk premium on the book-to-market factor is 4.9%.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

The following table shows the sensitivity of four stocks to the three Fama–French factors. Estimate the expected return on each stock assuming that the interest rate is 2%, the expected risk premium on the market is 7%, the expected risk premium on the size factor is 3.2%, and the expected risk premium on the book-to-market factor is 4.9%.

The following table shows the sensitivity of four stocks to the three Fama-French factors. Assuming that the interest rate is 4%, the

expected risk premium on the market is 7%, the expected risk premium on the size factor is 3,1%, and the expected risk premium on

the book-to-market factor is 4.3%.

Market

Size

Ford

1.38

-0.21

0.72

Ford

Walmart

Citigroup

Apple

Walmart

0.82

Expected return

%

%

%

%

-0.42

-0.33

Citigroup

1.19

-0.46

0.99

Apple

1.39

Book-to-market

Calculate the expected return on each stock.

Note: Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.

-0.59

-0.72

he following table shows the sensitivity of four stocks to the three Fama-French factors. Assuming that the interest rate is 5%, the expected risk premium on the market is 8%, the expected risk premium on the size factor is 3.8%, and the expected risk premium on the book-to-market factor is 3.8%.

Ford

Walmart

Citigroup

Apple

Market

1.43

0.92

1.24

1.44

Size

−0.26

−0.37

−0.51

−0.64

Book-to-market

0.67

−0.28

1.04

−1.02

Calculate the expected return on each stock.

Chapter 8 Solutions

PRIN.OF CORPORATE FINANCE

Ch. 8 - Efficient portfolios For each of the following...Ch. 8 - Efficient portfolios Figure 8.11 purports to show...Ch. 8 - Portfolio risk and return Look back at the...Ch. 8 - Portfolio risk and return Mark Harrywitz proposes...Ch. 8 - Portfolio risk and return Ebenezer Scrooge has...Ch. 8 - Portfolio risk and return Here are returns and...Ch. 8 - Portfolio risk and return Percival Hygiene has IO...Ch. 8 - Sharpe ratio Use the long-term data on security...Ch. 8 - Portfolio beta Refer to Table 7.5. a. What is the...Ch. 8 - CAPM True or false? Explain or qualify as...

Ch. 8 - CAPM True or false? a. The CAPM implies that if...Ch. 8 - CAPM Suppose that the Treasury bill rate is 6%...Ch. 8 - CAPM The Treasury bill rate is 4%, and the...Ch. 8 - Cost of capital Epsilon Corp. is evaluating an...Ch. 8 - APT Consider a three-factor APT model. The factors...Ch. 8 - Prob. 18PSCh. 8 - APT Consider the following simplified APT model:...Ch. 8 - Prob. 20PSCh. 8 - Three-factor modelThe following table shows the...Ch. 8 - Efficient portfolios Look again at the set of the...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Using the CAPM, estimate the appropriate required rate of return for the three stocks listed here, given that the risk-free rate is 4 percent and the expected return for the market is 17 percent. STOCK BETA A 0.63 B 0.95 C 1.48 a. Using the CAPM, the required rate of return for stock A is B.Using the CAPM, the required rate of return for stock b is C.Using the CAPM, the required rate of return for stock C is (Round to two decimal places.)arrow_forwardUsing the CAPM, estimate the appropriate required rate of return for the three stocks listed here, given that the risk-free rate is 6 percent and the expected return for the market is 14 percent. STOCK ВЕТА A 0.62 B 1.09 1.48 a. Using the CAPM, the required rate of return for stock A is %. (Round to two decimal places.) b. Using the CAPM, the required rate of return for stock B is %. (Round to two decimal places.) c. Using the CAPM, the required rate of return for stock C is %. (Round to two decimal placesarrow_forwardThe following table shows the sensitivity of four stocks to the three Fama–French factors. Assume the interest rate is 2%, the expected risk premium on the market is 5%, the expected risk premium on the size factor is 2.9%, and the expected risk premium on the book-to-market factor is 4.7%. Ford Walmart Citigroup Apple Market 1.34 0.74 1.15 1.35 Size −0.17 −0.46 −0.42 −0.57 Book-to-market 0.86 −0.37 0.95 −0.62 Calculate the expected return on each stock. (Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.)arrow_forward

- Consider the following information about two stocks (D and E) and two common risk factors (1 and 2) ba 1.6 2.1 Stock D E ba E(R.) 3.1 14.45% 2.1 13.90% a. Assuming that the risk-free rate is 5.5%, calculate the levels of the factor risk premia that are consistent with the reported values for the factor betas and the expected returns for the two stocks. Round your answers to one decimal place Axt Ax b. You expect that in one year the prices for Stocks D and I will be $51 and $39, respectively. Also, neither stock is expected to pay a dividend over the next year. What should the price of each stock be today to be consistent with the expected return levets listed at the beginning of the problem? Round your answers to the nearest cent. Today's price for Stock D: Today's price for Stock E: S Suppose now that the risk premium for Factor 1 that you calculated in Part a suddenly increases by 0.33% 0e, from x to (-0.35%, where is the value established in Part . What are the new expected returns…arrow_forwardSuppose that three stocks (A, B, and C} and two common risk factors (1 and 2) have the following relationship: E(RA) = (1.1)A1 + (0.8)A2 E(RB) = (0.7)A1 + (0.6)A2 E(RC) = (0.3)A1 + (0.4)A2 a. If A1 = 4 percent and A2 = 2 percent, what are the prices expected next year for each of the stocks? Assume that all three stocks currently sell for $30 and will not pay a dividend in the next year. b. Suppose that you know that next year the prices for Stocks A, B, and C will actually be $31.50, $35.00, and $30.50. Create and demonstrate a riskless, arbitrage investment to take advantage of these mispriced securities. What is the profit from your investment? You may assume that you can use the proceeds from any necessary short sale. Problems 13 and 14 refer to the data contained in Exhibit 7.23, which lists 30 monthly excess returns to two different actively managed stock portfolios (A and B) and three different common risk factors (1, 2, and 3). {Note: You may find it…arrow_forwardThe data on the expected return of 2 stocks (M and C) along with the economic conditions and their probabilities is attached below Questions : Calculate the expected return for asset M and asset C. Calculate the standard deviation for asset M and asset C. c) If asset M is a market portfolio, while the beta (β) for asset C is 1.25 and the risk-free asset is 6%. What is the required rate of return for asset C according to the CAPM method ?. .arrow_forward

- 1. You estimate the Fama-French 3-factor model for the two stocks, A and B, and find the following coefficients. You also estimate risk premiums for each factor. Calculate the cost of equity capital (i.e., expected rate of return) for each company using the 3-factor APT model. The risk-free rate is 4%. Stock Mkt A B Risk premiums 1.1 1.0 5% SMB -1.2 -2.0 HML -1.0 -1.5 3%arrow_forward3. You have gathered average return and standard deviation data for five stocks (A-E). How have these stocks performed on a risk-versus-return basis? Which one has the best risk-to-reward trade-off? Show your calculations for all five stocks. Annual Return Average Standard deviation Company A 13% 35 B 14% 44 C 9% 18 D 11% 25 E 9% 30arrow_forwardConsider the following information about two stocks (D and E) and two common risk factors (factor 1 and factor 2) Stock Risk factor 1 Risk factor 2 Expected return (%) D 1.2 3.4 13.1 2.6 2.6 15.4 a. Assuming that the risk free rate is 5%, determine the risk premium for factors 1 and 2 that are consistent with the expected returns for the two stocks. You expect that in one year the prices of Stock D and E will be $55 and $36 respectively and pay no dividends. What should be the price of each stock today to be consistent with the expected return levels. b. C. Determine how to you identified if Stock D and E are overvalued, fairly valued and undervalued? d. Suppose the risk premium for factor 1 as computed in (a) increases by 0.25 percent, what will be the new expected return for D and E? e. Suppose the risk premium for factor 1 as computed in (a) decreases by 0.25%, what will be the new expected return for D and E? f. Devise how would you develop a Jensen Index using Arbitrage Pricing…arrow_forward

- Consider an investment portfolio that consists of three different stocks, with the amount invested in each asset shownbelow. Assume the risk-free rate is 2.5% and the market risk premium is 6%. Use this information to answer thefollowing questions.Stock Weights BetasChesapeake Energy 25% 0.8Sodastream 50% 1.3Pentair 25% 1.0a) Compute the expected return for each stock using the CAPM and assuming that the stocks are all fairly priced.b) Compute the portfolio beta and the expected return on the portfolio.c) Now assume that the portfolio only includes 50% invested in Pentair and 50% invested in Sodastream (i.e., a twoassetportfolio). The yearly-return standard deviation of Pentair is 48% and the yearly-return standard deviation ofSodastream is 60%. The correlation coefficent between Pentair’s returns and Sodastream’s returns is 0.3 What is theexpected yearly-return standard deviation for this portfolio?arrow_forwardSuppose that you observe the following information in Table 2 for stocks A and B: Table 2 Expected Return (%) 11% Stock Beta A 0.8 B 14% 1.5 The risk-free rate of return is 6% and the expected rate of return on the market index is 12%. Using the Single-Index Model, calculate the alpha of both stocks. Show your calculations. Explain what the alpha of the single-factor model represents and interpret your results.arrow_forwardAssume that the CAPM holds. One stock has an expected return of 8% and a beta of 0.3. Another stock has an expected return of 14% and a beta of 1.5. What is the return-to-risk ratio that CAPM assumes equal across all individual stocks?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Portfolio return, variance, standard deviation; Author: MyFinanceTeacher;https://www.youtube.com/watch?v=RWT0kx36vZE;License: Standard YouTube License, CC-BY