Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

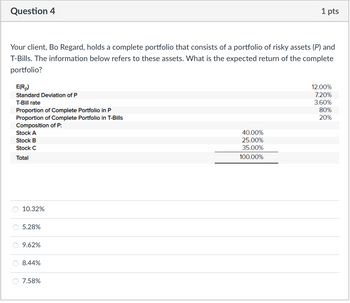

Your client, Bo Regard, holds a complete portfolio that consists of a portfolio of risky assets (P) and T-Bills. The information below refers to these assets. What is the expected return of the complete portfolio?

Group of answer choices

a. 10.32%

b. 5.28%

c. 9.62%

d. 8.44%

e. 7.58%

Transcribed Image Text:### Portfolio Composition and Performance Data

- **Expected Return of Portfolio (E(Rₚ))**: 12.00%

- **Standard Deviation of Portfolio (P)**: 7.20%

- **T-Bill Rate**: 3.60%

#### Allocation within the Complete Portfolio:

- **Proportion in Portfolio P**: 80%

- **Proportion in T-Bills**: 20%

#### Composition of Portfolio P:

- **Stock A**: 40.00%

- **Stock B**: 25.00%

- **Stock C**: 35.00%

- **Total Composition**: 100.00%

This data provides an overview of a hypothetical investment portfolio, detailing expected returns, risk (as measured by standard deviation), and the distribution of investments between stocks and T-Bills for risk management and potential growth. The detailed composition within the stocks section illustrates diversification strategies to balance risk and reward.

Transcribed Image Text:**Question 4**

**Points: 1**

Your client, Bo Regard, holds a complete portfolio that consists of a portfolio of risky assets (P) and T-Bills. The information below refers to these assets. What is the expected return of the complete portfolio?

- **E(Rₚ):** 12.00%

- **Standard Deviation of P:** 7.20%

- **T-Bill rate:** 3.60%

- **Proportion of Complete Portfolio in P:** 80%

- **Proportion of Complete Portfolio in T-Bills:** 20%

**Composition of P:**

- **Stock A:** 40.00%

- **Stock B:** 25.00%

- **Stock C:** 35.00%

- **Total:** 100.00%

**Multiple Choice Options:**

- 10.32%

- 5.28%

- 9.62%

- 8.44%

- 7.58%

This question involves calculating the expected return of a complete portfolio made up of risky assets and T-Bills, based on the given proportions and rates.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Baghibenarrow_forwardImagine a feasible set of portfolios with two risky assets with a correlation of -1. What name did Harry Markowitz give to the portfolios on the upper arm of the sideways 'v'? The feasible set The portfolio possibility line. The optimum set The efficient set Previous Page Next Pagearrow_forwardBaghibenarrow_forward

- An investor has a portfolio of two assets A and B. The details are shown in the below table. Portfolio Details Asset Expectedreturn Standarddeviation Covariance (A, B) Expected Portfolio Return A 0.06 0.5 0.12 0.1 B 0.08 0.8 Which one of the following statements is NOT correct? a. The portfolio weight in asset A is -100%. b. The correlation of asset A and B’s returns is 0.3. c. The investor can benefit from a fall in the price of asset A. d. The variance of the portfolio is 2.33. e. The order of short selling is borrowing, buying, selling, and returning.arrow_forwardi need the answer quicklyarrow_forwardDraw the profit diagram of the portfolio just drawn (and clearly state any assumptions you make). The profit is equal to the difference between the payoff of the portfolio at expiry (maturity) date and the cost of the portfolio. Is the cost of the portfolio positive?arrow_forward

- 9.1 q1- How would you describe the relationship between risk and return for large portfolios of investments? Select one: a. There is no clear relationship. b. The relationship is precisely a positive linear relationship. c. The relationship approximates a positive linear relationship. d. The relationship approximates a negative linear relationship.arrow_forward(c)) Discuss the following graphic, which shows the relationship between expected return and portfolio weights. The portfolio is comprised of a debt security D and an equity security E. What would the portfolio strategy be when Wp = 2 and ba WE = -1? 38 (33) -0.5 Expected Return 13% 8% Debt Fund 0 (ebenso) esenicut adol leu@ ledol (loorba (ognerloxel) Ismet tametnl Equity Fund 1.0 0 OC) becida nieu to 2.0 w (stocks) AB -1.0 68 XO.YOUTS RO w (bonds)=1-w (stocks) 15 V10 anollesup Figure 7.3 Portfolio expected return as a function of investment proportions la 21101TOarrow_forward9.2- Use the diagrams to answer the question q1- This question relates to Diagrams 1 - 4 from the 9.2 diagrams, each of which shows a set of portfolios plotted on a set of risk/return axes. Which diagram shows (in red) the set of feasible portfolios? Select one: a. Diagram 1 b. Diagram 2 c. Diagram 3 d. Diagram 4arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education