Survey Of Accounting

5th Edition

ISBN: 9781259631122

Author: Edmonds, Thomas P.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 8, Problem 6E

Exercise 8-6 Effect of issuing common stock on the

Newly formed S&J Iron Corporation has 50,000 shares of $10 par common stock authorized. On March 1, 2018, S&J Iron issued 6,000 shares of the stock for $16 per share. On May 2, the company issued an additional 10,000 shares for $18 per share. S&J Iron was not affected by other events during 2018.

Required

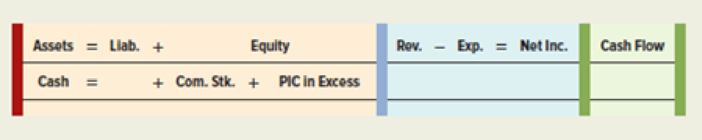

- a. Record the transactions in a horizontal statements model like the following one. In the

Cash Flow column, indicate whether the item is an operating activity (OA), investing activity (IA), or financing activity (FA). Use NA to indicate that an element was not affected by the event.

b. Determine the amount S&J Iron would report for common stock on the December 31, 2018, balance

sheet.

c. Determine the amount S&J Iron would report for paid-in capital in excess of par.

d. What is the total amount of capital contributed by the owners?

e. What amount of total assets would S&J Iron report on the December 31, 2018, balance sheet?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Required information

Problem 8-24 (Algo) Common and preferred stock-issuances and dividends LO 1, 2

[The following information applies to the questions displayed below]

Permabilt Corp. was incorporated on January 1, 2019, and issued the following stock for cash:

• 1100.000 shares of no-par common stock were authorized; 277,000 shares were issued on January 1, 2019, at $31 per

share.

. 447,000 shares of $100 par value, 10.00% cumulative, preferred stock were authorized; 126.000 shares were issued on

January 1, 2019, at $125 per share.

• No dividends were declared or paid during 2019 or 2020. However, on December 22, 2021, the board of directors of

Permabilt Corp, declared dividends of $6,120.000, payable on February 12, 2022, to holders of record as of January 8,

2022.

Problem 8-24 (Algo) Part c

c. Calculate the common stock dividends per share declared during 2021. (Round your answer to 2 decimal places.)

Common stock dividends per share

Movt >

Required information

Problem 8-24 (Algo) Common and preferred stock-issuances and dividends LO 1, 2

[The following information applies to the questions displayed below.]

Permabilt Corp. was incorporated on January 1, 2019, and issued the following stock for cash:

• 1,100,000 shares of no-par common stock were authorized; 342,000 shares were issued on January 1, 2019, at $26 per

share.

• 381,000 shares of $90 par value, 9.10% cumulative, preferred stock were authorized; 132,000 shares were issued on

January 1, 2019, at $128 per share.

• No dividends were declared or paid during 2019 or 2020. However, on December 22, 2021, the board of directors of

Permabilt Corp. declared dividends of $6,260,000, payable on February 12, 2022, to holders of record as of January 8,

2022.

Problem 8-24 (Algo) Part c

c. Calculate the common stock dividends per share declared during 2021. (Round your answer to 2 decimal places.)

Common stock dividends per share

Exercise 19-24 (Algo) New shares; contingently issuable shares [LO19-6,19-12]

During 2024, its first year of operations, Kevin Berry Industries entered into the following transactions relating to shareholders’ equity. The corporation was authorized to issue 100 million common shares, $1 par per share.

January 2

Issued 75 million common shares for cash.

January 2

Entered an agreement with the company president to issue up to 2 million additional shares of common stock in 2025 based on the earnings of Berry in 2025. If net income exceeds $120 million, the president will receive 1 million shares; 2 million shares if net income exceeds $130 million.

March 31

Issued 4 million shares in exchange for plant facilities.

Net income for 2024 was $125 million.

Required:

Compute basic and diluted earnings per share for the year ended December 31, 2024.

Note: Do not round intermediate calculations. Enter your answers in millions (i.e., 10,000,000 should be entered as 10).

Chapter 8 Solutions

Survey Of Accounting

Ch. 8 - Prob. 1QCh. 8 - Prob. 2QCh. 8 - Prob. 3QCh. 8 - Prob. 4QCh. 8 - 5. What is the purpose of the articles of...Ch. 8 - 6. What is the function of the stock certificate?Ch. 8 - Prob. 7QCh. 8 - Prob. 8QCh. 8 - 9. What is a limited liability company? Discuss...Ch. 8 - Prob. 10Q

Ch. 8 - 11. What is the difference between contributed...Ch. 8 - Prob. 12QCh. 8 - Prob. 13QCh. 8 - 14. What is the meaning of each of the following...Ch. 8 - 15. What is the difference between cumulative...Ch. 8 - 16. What is no-par stock? How is it recorded in...Ch. 8 - 17. Assume that Best Co. has issued and...Ch. 8 - 18. If Best Co. issued 10,000 shares of 20 par...Ch. 8 - 19. What is the difference between par value stock...Ch. 8 - 20. Why might a company repurchase its own stock?Ch. 8 - 21. What effect does the purchase of treasury...Ch. 8 - 22. Assume that Day Company repurchased 1,000 of...Ch. 8 - 23. What is the importance of the declaration...Ch. 8 - 24. What is the difference between a stock...Ch. 8 - 25. Why would a company choose to distribute a...Ch. 8 - 26. What is the primary reason that a company...Ch. 8 - 27. If Best Co. had 10,000 shares of 20 par value...Ch. 8 - 28. When a company appropriates retained earnings,...Ch. 8 - Prob. 29QCh. 8 - Prob. 30QCh. 8 - Prob. 31QCh. 8 - 32. What are some reasons that a corporation might...Ch. 8 - Prob. 1ECh. 8 - Exercise 8-2 Effect of accounting events on the...Ch. 8 - Prob. 3ECh. 8 - Prob. 4ECh. 8 - Exercise 8-5 Characteristics of capital stock The...Ch. 8 - Exercise 8-6 Effect of issuing common stock on the...Ch. 8 - Exercise 8-7 Recording and reporting common and...Ch. 8 - Prob. 8ECh. 8 - Prob. 9ECh. 8 - Prob. 10ECh. 8 - Prob. 11ECh. 8 - Prob. 12ECh. 8 - Exercise 8-13 Recording and reporting treasury...Ch. 8 - Prob. 14ECh. 8 - Prob. 15ECh. 8 - Prob. 16ECh. 8 - Prob. 17ECh. 8 - Prob. 18ECh. 8 - Prob. 19PCh. 8 - Problem 8-20 Effect of business structure on...Ch. 8 - Prob. 21PCh. 8 - Prob. 22PCh. 8 - Problem 8-23 Recording and reporting stock...Ch. 8 - Prob. 24PCh. 8 - Prob. 25PCh. 8 - Problem 8-26 Treasury stock transactions and...Ch. 8 - Prob. 27PCh. 8 - Prob. 28PCh. 8 - Prob. 1ATCCh. 8 - ATC 8-3 Research Assignment Analyzing Skecherss...Ch. 8 - Prob. 4ATCCh. 8 - ATC 11-7 Ethical Dilemma Bad news versus very bad...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Issuing Common Stock Carmean Products Inc. sold 32,350 shares of common stock to stockholders at the time of its incorporation. Carmean received S42 per share for the stock. Required: Assume that the stock has a $22 par value per share. Prepare the journal entry to record the sale and issue of the stock. Assume that the stock has a $8 stated value per share. Prepare the journal entry to record the sale and issue of the stock. Assume that the stock has no par value and no stated value. Prepare the journal entry to record the sale and issue of the stock. CONCEPTUAL CONNECTION How do the different par values affect total contributed capital and total stockholders equity?arrow_forwardGroup Assignment 5, Due Date: 29 Sep 2019 Problem 16.8 Share issues and statement of changes in equity Gundagai Ltd was incorporated on 30 June 2016. On 1 July 2016, the company issued a prospectus offering 300 000 ordinary shares at an issue price of $10, payable on the following terms: application $3 on allotment $3 on $2 on first call $2 on second call A summary of the applications and allotments register follows: Number of shares applied for 200 000 Number of shares allotted Amount paid per share on application $ 3 150 000 100 000 100 000 $6 50 000 50 000 $10 on 1 September 2016. All money received in excess of applied to amounts due on allotment and calls. Where appropriate, Shares were allotted to all applicants application was refunds of application money were made. All allotment money was received by 30 September 2016. атоиnts duе оn On 1 November 2016, Gundagai Ltd's directors made a call of 42c per share, payable by 30 November 2016. By 31 December, call money had not been…arrow_forwardExercise 19-24 (Algo) New shares; contingently issuable shares [LO19-6,19-12] During 2024, its first year of operations, Kevin Berry Industries entered into the following transactions relating to shareholders' equity. The corporation was authorized to issue 100 million common shares, $1 par per share. January 2 Issued 55 million common shares for cash. January 2 Entered an agreement with the company president to issue up to 2 million additional shares of common stock in 2025 based on the earnings of Berry in 2025. If net income exceeds $140 million, the president will receive 1 million shares; 2 million shares if net income exceeds $150 million. March 31 Issued 4 million shares in exchange for plant facilities. Net income for 2024 was $148 million. Required: Compute basic and diluted earnings per share for the year ended December 31, 2024. Note: Do not round intermediate calculations. Enter your answers in millions (i.e., 10,000,000 should be entered as 10). Basic Diluted Numerator + +…arrow_forward

- Question Content Area On January 1, Vermont Corporation had 47,300 shares of $11 par value common stock issued and outstanding. All 47,300 shares had been issued in a prior period at $21 per share. On February 1, Vermont purchased 980 shares of treasury stock for $24 per share and later sold the treasury shares for $19 per share on March 1. The journal entry for the purchase of the treasury shares on February 1 would include a a. credit to a gain account for $2,940 b. credit to Treasury Stock for $23,520 c. debit to Treasury Stock for $23,520 d. debit to a loss account for $2,940arrow_forwardQuestion 7 of 14 View Policies Current Attempt in Progress Indigo Corporation had 135.600 shares of stock outstanding on January 1, 2020. On May 1, 2020. Indigo issued 48,000 shares. On July 1, Indigo purchased 10,800 treasury shares, which were reissued on October 1. Compute Indigo's weighted-average number of shares outstanding for 2020. Weighted-average number of shares outstanding eTextbook and Media Save for Later Attempts: 0 of 2 used Submit Answer Using multiple attempts will impact your score. 20% score reduction after attempt 1 IIarrow_forwardSelf-Assessment Task 6.18 Score Items Bacoor Company had 2,500,000 ordinary shares outstanding on January 1, 2021. An additional 500,000 ordinary shares were issued on April 1, 2021 and 250,000 shares on July 1, 2021. On October 1, 2021, the entity issued 5,000 P1,000 face value, 7% convertible bonds. Each bond is convertible into 40 ordinary shares. No bonds were converted into ordinary shares in 2021. What is the number of shares to be used in computing basic earnings per share and diluted earnings per share, respectively? 2,875,000 and 2,925,000 2,875,000 and 3,075,000 3,000,000 and 3,050,000 3,000,000 and 3,200,000arrow_forward

- 1-Spring 2021 Question 16 of 17 -/1 View Policies Current Attempt in Progress The original sale of the $50 par value common shares of Tamarisk Company was recorded as follows: Cash 291,200 Common Stock 260,000 Paid-in Capital in Excess of Par 31,200 Transactions: (a) Bought 420 shares of common stock as treasury shares at $61. (b) Sold 130 shares of treasury stock at $59. (c) Sold 70 treasury shares at $69. Record the treasury stock transactions (given above) under the cost method. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) No. Account Titles and Explanation Debit Credit (a) MacBook Air IIIarrow_forward%24 Metlock Ridge Corporation was organized on January 1, 2018. During its first year, the corporation issued 42,000 shares of $5 par value preferred stock and 490,000 shares of 51parvalue common stock At December 31, the company declared the following cash dividends: 2019 00 2020 (e) VYour answeris correct Show the allocation of dividends to each class of stock, assuming the preferred stock dividend is 6% and not cumulative. Preferred. 2019 eTextbook and Media List of Accounts Attempts: 2 of 3 used (g) Show the allocation of dividends to each class of stock, assuming the preferred stockk dividend is 7BA and cumulative. Preferred Common 2019 2020 eTextbook and Media List of Accountsarrow_forwardQuestion 14 Hamad Town Company had the following balances in the stockholders' equity accounts at Dec. 31, 2020: - Common stock, $10 par, 50,000 shares authorized, 30,000 shares issued and outstanding ....$ 300,000 Paid in Capital in Excess of Par Value, Common Stock Retained Eamings The following transactions occurred during 2021: 1. Feb. 20: Purchased 2,000 of its own shares for $ 18 per share. 2. March 10: Declared a $2 per share cash dividend on the outstanding common stock. 3. April 07: Paid the cash dividends declared early in March 10. 4. May 20: Sold all treasury shares for $19 each. 5. Oct. 1: Declared 10% stock dividends on the outstanding common stock for the record of Nov. 1 and to be distributed on Dec. 10; The market value of stock on Oct. 1 was $14 per share. 6. Dec. 10: Distributed the shares which declared on Oct. 1. 7. Dec. 25: Implemented a 2-for-1 stock split, when the market value of stock was $26 per share. NOTE: If there is no entry, please write: "NO ENTRY"…arrow_forward

- Q1 The following transactions show how the company responded to these questions during the fiscal year that ended on June 30, 2020. 1. The board of directors declared a 2-for-1 stock split. 2. The board of directors obtained authorization to issue 25,000 shares of $100 par value, 6 percent noncumulative preferred stock, callable at $104. 3. The company issued 6,000 shares of common stock for a building appraised at $48,000. 4. It bought back 4,000 shares of its common stock for $32,000. 5. It issued 10,000 shares of preferred stock for $100 per share. 6. It sold 2,500 shares of treasury stock for $17,500. 7. It declared cash dividends of $6 per share on preferred stock and $0.20 per share on common stock. 8. It declared a 10 percent stock dividend on common stock to be distributed after the end of the fiscal year. The market value was $10 per share. 9. It closed net income for the year, $170,000. Opening balances are given below: Contributed capital Common stock, no par value, Só…arrow_forwardProblem 4 On December 29, 2018, Blue Company was registered at the Securities and Exchange Commission with 100,00 authorized shares of P100 par value. The following were Blue's transactions: December 29, 2018 May 14, 2019 August 9, 2019 December 31, 2019 Issued 40,000 shares at P105 per share. Purchased 600 of its ordinary shares at P110 per share. 400 treasury shares were resold at P95 per share. Profit for 2019 is P830,000. Dividends paid P200,000. 34. What is the total outstanding shares? 35. What is the balance of treasury shares? 36. How many shares are entitled to receive dividends? 37. What is the total shareholders' equity? Problem 5 Partners A & B have capital balances of P600,000 and P400,000 and share profits and losses in the ratio of 3:2, respectively, before the admission of C. With the consent of B, A sells one-half of his equity to C, with C paying A the amount of P350,000. 38. What is A's capital balance after the admission of C? 39. What is the total partnership…arrow_forwardew PolicieS Current Attempt in Progress On January 1,2020, Larkspur Corporation had 66,500 shares of $1 par value common stock issued and outstanding. During the year, the following transactions occurred: ar. 1. Issued 21,000 shares of common stock for $535,000. Declared a cash dividend of$2per share to stockholders of record on June 15. July Paid the $2 cash dividend. Dec 1 Purchased 5,900 shares of common stock for the treasury for $23 per share, Dec. 15 Declared a cash dividend on outstanding shares of $2.25 per share to stockholders of record on December 31. Prepare journal entries to record the above transactions. (If no entry is required, select No entry" for the account titles and enter Ofor the amounts. Credit account titles are automatically indented when armount is entered. Do not indent manually List all debit entries before credit entries, Record journal entries in the order presented in the problem) Date Account Titles and Explanation Credit e Textbook and Media List of…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Stockholders Equity: How to Calculate?; Author: Accounting University;https://www.youtube.com/watch?v=2jZk1T5GIlw;License: Standard Youtube License