Survey Of Accounting

5th Edition

ISBN: 9781259631122

Author: Edmonds, Thomas P.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 8, Problem 5E

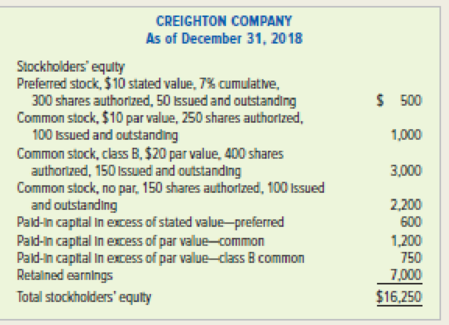

Exercise 8-5 Characteristics of capital stock

The stockholders’ equity section of Creighton Company’s

Required

- a. Assuming the

preferred stock was originally issued for cash, determine the amount of cash that was collected when the stock was issued. - b. Based on the class B common stock alone, determine the amount of the company’s legal capital.

- c. Based on the class B common stock alone, determine the minimum amount of assets that must be retained in the company as protection for creditors.

- d. Determine the number of shares of class B common stock that are available to sell as of December 31, 2018.

- e. Assuming Creighton purchases

treasury stock consisting of 25 shares of its no par common stock on January 1, 2019, determine the amount of the no-par common stock that would be outstanding immediately after the purchase. - f. Based on the stockholders’ equity section shown above, can you determine the market value of the preferred stock? If yes, what is the market value of one share of this stock?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

12 -

What is the process of determining the optimal amount of stock that should be in the enterprise, taking into account production and sales ?

a)

Management of Securities

B)

Cash Assets Management

NS)

Fixed Assets Management

D)

Management of stocks

TO)

Management of Receivables

Problem #1

Effects of Transactions

Indicate the effects of each of the following transactions on Assets, Liabilities, Share

Capital and Retained Earnings. Use + for increase, - for decrease, and 0 for no effect.

Share

Retained

Assets

Liabilities

Сapital

Earnings

1.

Declaration of cash dividends

2.

Payment of cash dividends

3.

Declaration of share dividends

4.

Issuance of share dividends

5.

A share split

6.

Cash purchase of treasury stock

7.

Sale of tre

stock below cost

Problem #2

Effect of Cash Dividend

Indicate whether the following actions would (+) increase, (-) decrease, or (0) not affect

Bernal Inc.'s total assets, liabilities and shareholders' equity:

Shareholders'

Assets

Liabilities

Equity

1.

Declaring a cash dividend

Paying the cash dividend

declared in no. 1

2.

3.

Declaring a share dividend

4,

Issuing share certificates for the

share dividend declared in no. 3

5.

Authorizing and issuing share

certificates in a share split

PROBLEM 7-1

The following information has been taken from the ledger accounts of Yogi Corporation:

Total net income since incorporation

Total cash dividends paid

Carrying value of the company investment is

Yogi company declared as property dividend

Proceeds from sale of donated shares

Total value of stocks dividends distributed

Gain on treasury share transactions

Unamortized premium on bonds payable

Appropriated for contingencies

The current balance of unappropriated retained earnings is:

a.

b.

C.

d.

P2,030,000

P3,200,000

P1,330,000

P1,930,000

P3,200,000

150,000

600,000

150,500

420,000

375,000

413,200

700,000

Chapter 8 Solutions

Survey Of Accounting

Ch. 8 - Prob. 1QCh. 8 - Prob. 2QCh. 8 - Prob. 3QCh. 8 - Prob. 4QCh. 8 - 5. What is the purpose of the articles of...Ch. 8 - 6. What is the function of the stock certificate?Ch. 8 - Prob. 7QCh. 8 - Prob. 8QCh. 8 - 9. What is a limited liability company? Discuss...Ch. 8 - Prob. 10Q

Ch. 8 - 11. What is the difference between contributed...Ch. 8 - Prob. 12QCh. 8 - Prob. 13QCh. 8 - 14. What is the meaning of each of the following...Ch. 8 - 15. What is the difference between cumulative...Ch. 8 - 16. What is no-par stock? How is it recorded in...Ch. 8 - 17. Assume that Best Co. has issued and...Ch. 8 - 18. If Best Co. issued 10,000 shares of 20 par...Ch. 8 - 19. What is the difference between par value stock...Ch. 8 - 20. Why might a company repurchase its own stock?Ch. 8 - 21. What effect does the purchase of treasury...Ch. 8 - 22. Assume that Day Company repurchased 1,000 of...Ch. 8 - 23. What is the importance of the declaration...Ch. 8 - 24. What is the difference between a stock...Ch. 8 - 25. Why would a company choose to distribute a...Ch. 8 - 26. What is the primary reason that a company...Ch. 8 - 27. If Best Co. had 10,000 shares of 20 par value...Ch. 8 - 28. When a company appropriates retained earnings,...Ch. 8 - Prob. 29QCh. 8 - Prob. 30QCh. 8 - Prob. 31QCh. 8 - 32. What are some reasons that a corporation might...Ch. 8 - Prob. 1ECh. 8 - Exercise 8-2 Effect of accounting events on the...Ch. 8 - Prob. 3ECh. 8 - Prob. 4ECh. 8 - Exercise 8-5 Characteristics of capital stock The...Ch. 8 - Exercise 8-6 Effect of issuing common stock on the...Ch. 8 - Exercise 8-7 Recording and reporting common and...Ch. 8 - Prob. 8ECh. 8 - Prob. 9ECh. 8 - Prob. 10ECh. 8 - Prob. 11ECh. 8 - Prob. 12ECh. 8 - Exercise 8-13 Recording and reporting treasury...Ch. 8 - Prob. 14ECh. 8 - Prob. 15ECh. 8 - Prob. 16ECh. 8 - Prob. 17ECh. 8 - Prob. 18ECh. 8 - Prob. 19PCh. 8 - Problem 8-20 Effect of business structure on...Ch. 8 - Prob. 21PCh. 8 - Prob. 22PCh. 8 - Problem 8-23 Recording and reporting stock...Ch. 8 - Prob. 24PCh. 8 - Prob. 25PCh. 8 - Problem 8-26 Treasury stock transactions and...Ch. 8 - Prob. 27PCh. 8 - Prob. 28PCh. 8 - Prob. 1ATCCh. 8 - ATC 8-3 Research Assignment Analyzing Skecherss...Ch. 8 - Prob. 4ATCCh. 8 - ATC 11-7 Ethical Dilemma Bad news versus very bad...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 10. Explain the components of the shareholders' equity section of the statement of financial position (balance sheet) 11. Identify and discuss the two components of contributed capital. 12. Identify the different types of dividends. How much is debited to Retained Earnings upon declaration of each types of dividends? 13. How will you distinguish a small from large share capital (stock) dividend?arrow_forwardting Standards Sec-1 with B Shivakumar for Sem II 2021 C021-3/ Topic 3/ Quiz 2 Redemption of preference shares by a company is classified under investing activities of its cash flow statement Select one: of O True O False stion Next page pagearrow_forwardd. mutual agency for stockholders 20. Stockholders' equity a. is usually equal to cash on hand b. is shown on the income statement c. includes paid-in capital and liabilities d. includes retained earnings and paid-in capita blec bisearrow_forward

- Treasury Stock Refer to the information for Heitman Company above. Required: 1. How will this transaction affect stockholders equity? How will this transaction affect net income?arrow_forwardThe total amount of cash and other assets received by a corporation from the stockholders in exchange for the shares is ________. A. always equal to par value B. referred to as retained earnings C. always below its stated value D. referred to as paid-in capitalarrow_forwardTreasury stock is listed as a(n) __________ on the balance sheet. (a) current liability (b) current asset (c) deduction from stockholders equity (d) addition to stockholders equityarrow_forward

- Treasury Stock A corporation sometimes engages in treasury stock transactions. Required: 1. Define treasury stock. 2. Why would a corporation acquire treasury stock? 3. Briefly explain the cost method of accounting for the requisition and reissuance of treasury stock. Assume the treasury stock is common stock and has a par value. 4. Briefly explain the balance sheet presentation of treasury stock under this method.arrow_forward5. How is the treasury share account presented in the Statement of Financial Position? a. deducted from accumulated profits b. deducted from shareholders’ equity c. part of reserves d. current assetarrow_forwardMatch each of the following terms with the correct definition: a. additional paid-in capitalb. issued and outstandingc. retained earningsd. treasury stocke. authorized share capitalf. par value Correct Definitions:A. The price at which each share is recorded in the company’s booksB. Held by investorsC. Cumulative amount of profits that have been plowed backD. The difference between the amount of cash raised by an equity issue and the par value of the issueE. The maximum number of shares that can be issued without shareholder approvalF. The amount that the company has spent buying back stock that it has not subsequently resoldarrow_forward

- Match each of the following terms with the correct definition: a. additional paid-in capitalb. issued and outstandingc. retained earningsd. treasury stocke. authorized share capitalf. par value Correct Definitions:A. The price at which each share is recorded in the company’s booksB. Held by investorsC. Cumulative amount of profits that have been plowed backD. The difference between the amount of cash raised by an equity issue and the par value of the issueE. The maximum number of shares that can be issued without shareholder approvalF. The amount that the company has spent buying back stock that it has not subsequently resold SELECTED FORMULAS PVIFA = PVIF = requity = rassets + (rassets – rdebt) PV of tax shield = = Tc *DWACC = (1-Tc) * *() + *()arrow_forwardPROBLEM 5 - AUDITING PROBLEMSCompute fot the following:1. Number of ordinary shares issued and outstanding 2. Ordinary share capitalarrow_forwardQuestion 1 Which of the following would NOT be included as equity in a corporate balance sheet? Retained earnings Paid in capital Cash Ordinary sharesarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Stockholders Equity: How to Calculate?; Author: Accounting University;https://www.youtube.com/watch?v=2jZk1T5GIlw;License: Standard Youtube License