Fundamentals Of Financial Accounting

6th Edition

ISBN: 9781259864230

Author: PHILLIPS, Fred, Libby, Robert, Patricia A.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 8, Problem 5CP

Analyzing Allowance for Doubtful Accounts, Receivables Turnover Ratio, and Days to Collect

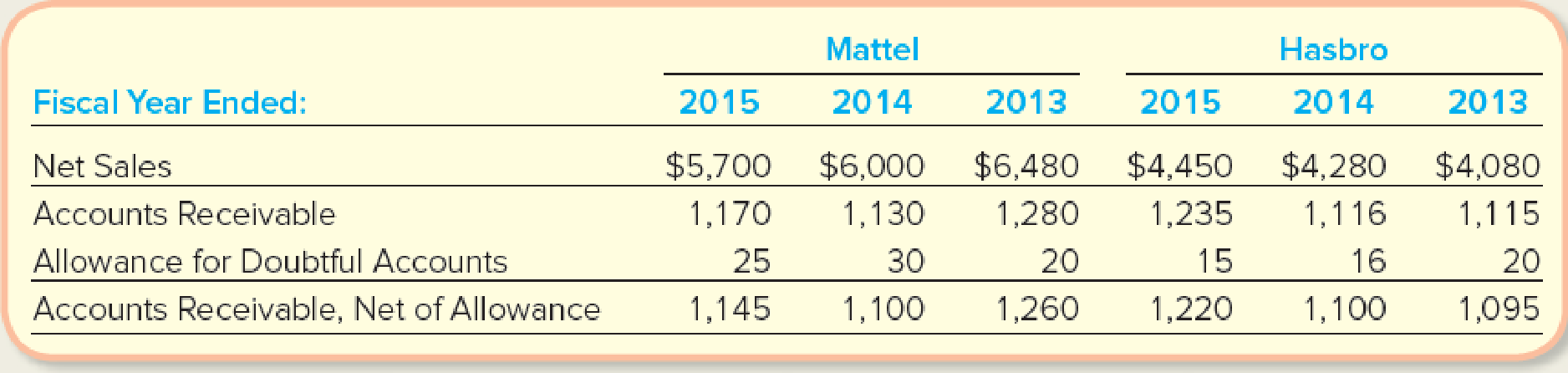

Mattel, Inc., and Hasbro are two of the largest and most successful toymakers in the world, in terms of the products they sell and their receivables management practices. To evaluate their ability to collect on credit sales, consider the following information reported in their annual reports (amounts in millions).

Required:

- 1. Calculate the receivables turnover ratios and days to collect for Mattel and Hasbro for 2015 and 2014. (Round your final answers to one decimal place.)

TIP: In your calculations, use average

Accounts Receivable , Net of Allowance. - 2. Which of the companies was quicker to convert its receivables into cash in 2015? in 2014?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Fizzy Sodas and Hayes Companies are two of the largest and most successful beverage companies in the world in terms of the

products that they sell and their receivables management practices. To evaluate their ability to collect on credit sales, consider the

following rounded amounts reported in their annual reports (amounts in millions).

Fiscal Year Ended:

Net Sales

Accounts Receivable

Allowance for Doubtful Accounts

Accounts Receivable, Net of Allowance

Req 1

Complete this question by entering your answers in the tabs below.

Req 2A

Required:

1. Calculate the receivables turnover ratios and days to collect for Fizzy Sodas and Hayes Companies for 2018 and 2017.

2-a. Which of the companies was quicker to convert its receivables into cash in 2018?

2-b. Which of the companies was quicker to convert its receivables into cash in 2017?

Req 2B

Receivables Turnover Ratio

Days to collect

2018

2018

$ 40,630

4,410

620

3,790

Fizzy Sodas

Fizzy Sodas

2017

$ 45,120

4,710

610

4,100

Hayes

Companies…

i need the answer quickly

ed

Softee Sodas and Patterson Beverage Company are two of the largest and most successful beverage companies in the world in terms

of the products that they sell and their receivables management practices. To evaluate their ability to collect on credit sales, consider

the following rounded amounts reported in their annual reports (amounts in millions).

Fiscal Year Ended:

Net Sales

Accounts Receivable

Allowance for Doubtful Accounts

Accounts Receivable, Net of Allowance

2018

$ 35,660

4,130

550

3,580

Softee Sodas

2017

$ 39,520

4,390

540

3,850

Patterson Beverage Company

2016

$ 44,440

4,580

530

4,050

2018

$ 71,440

7,680

100

7,580

2017

$ 72,120

7,590

130

2016

$ 66,660

7,250

140

7,460

7,110

Required:

1. Calculate the receivables turnover ratios and days to collect for Softee Sodas and Patterson Beverage Company for 2018 and 2017.

2-a. Which of the companies was quicker to convert its receivables into cash in 2018?

2-b. Which of the companies was quicker to convert its receivables into cash…

Chapter 8 Solutions

Fundamentals Of Financial Accounting

Ch. 8 - What are the advantages and disadvantages of...Ch. 8 - Prob. 2QCh. 8 - Which basic accounting principles does the...Ch. 8 - Using the allowance method, is Bad Debt Expense...Ch. 8 - What is the effect of the write-off of...Ch. 8 - How does the use of calculated estimates differ...Ch. 8 - A local phone company had a customer who rang up...Ch. 8 - What is the primary difference between accounts...Ch. 8 - What are the three components of the interest...Ch. 8 - As of May 1, 2016, Krispy Kreme Doughnuts had...

Ch. 8 - Does an increase in the receivables turnover ratio...Ch. 8 - What two approaches can managers take to speed up...Ch. 8 - When customers experience economic difficulties,...Ch. 8 - (Supplement 8A) Describe how (and when) the direct...Ch. 8 - (Supplement 8A) Refer to question 7. What amounts...Ch. 8 - 1. When a company using the allowance method...Ch. 8 - 2. When using the allowance method, as Bad Debt...Ch. 8 - 3. For many years, Carefree Company has estimated...Ch. 8 - 4. Which of the following best describes the...Ch. 8 - 5. If the Allowance for Doubtful Accounts opened...Ch. 8 - 6. When an account receivable is recovered a....Ch. 8 - Prob. 7MCCh. 8 - 8. If the receivables turnover ratio decreased...Ch. 8 - Prob. 9MCCh. 8 - Prob. 10MCCh. 8 - Prob. 1MECh. 8 - Evaluating the Decision to Extend Credit Last...Ch. 8 - Reporting Accounts Receivable and Recording...Ch. 8 - Recording Recoveries Using the Allowance Method...Ch. 8 - Recording Write-Offs and Bad Debt Expense Using...Ch. 8 - Determining Financial Statement Effects of...Ch. 8 - Estimating Bad Debts Using the Percentage of...Ch. 8 - Estimating Bad Debts Using the Aging Method Assume...Ch. 8 - Recording Bad Debt Estimates Using the Two...Ch. 8 - Prob. 10MECh. 8 - Prob. 11MECh. 8 - Recording Note Receivable Transactions RecRoom...Ch. 8 - Prob. 13MECh. 8 - Determining the Effects of Credit Policy Changes...Ch. 8 - Prob. 15MECh. 8 - (Supplement 8A) Recording Write-Offs and Reporting...Ch. 8 - Recording Bad Debt Expense Estimates and...Ch. 8 - Determining Financial Statement Effects of Bad...Ch. 8 - Prob. 3ECh. 8 - Recording Write-Offs and Recoveries Prior to...Ch. 8 - Prob. 5ECh. 8 - Computing Bad Debt Expense Using Aging of Accounts...Ch. 8 - Computing Bad Debt Expense Using Aging of Accounts...Ch. 8 - Recording and Reporting Allowance for Doubtful...Ch. 8 - Recording and Determining the Effects of Write-Off...Ch. 8 - Recording Note Receivable Transactions, Including...Ch. 8 - Recording Note Receivable Transactions, Including...Ch. 8 - Recording Note Receivable Transactions, Including...Ch. 8 - Using Financial Statement Disclosures to Infer...Ch. 8 - Using Financial Statement Disclosures to Infer Bad...Ch. 8 - Prob. 15ECh. 8 - Analyzing and Interpreting Receivables Turnover...Ch. 8 - (Supplement 8A) Recording Write-Offs and Reporting...Ch. 8 - Recording Accounts Receivable Transactions Using...Ch. 8 - Interpreting Disclosure of Allowance for Doubtful...Ch. 8 - Recording Notes Receivable Transactions Jung ...Ch. 8 - Accounting for Accounts and Notes Receivable...Ch. 8 - Analyzing Allowance for Doubtful Accounts,...Ch. 8 - Recording Accounts Receivable Transactions Using...Ch. 8 - Interpreting Disclosure of Allowance for Doubtful...Ch. 8 - Recording Notes Receivable Transactions CS...Ch. 8 - Accounting for Accounts and Notes Receivable...Ch. 8 - Analyzing Allowance for Doubtful Accounts,...Ch. 8 - Recording Accounts Receivable Transactions Using...Ch. 8 - Prob. 2PBCh. 8 - Prob. 3PBCh. 8 - Accounting for Accounts and Notes Receivable...Ch. 8 - Analyzing Allowance for Doubtful Accounts,...Ch. 8 - Recording and Reporting Credit Sales and Bad Debts...Ch. 8 - Prob. 2COPCh. 8 - Recording Daily and Adjusting Entries Using FIFO...Ch. 8 - Prob. 1SDCCh. 8 - Prob. 2SDCCh. 8 - Ethical Decision Making: A Real-Life Example You...Ch. 8 - Critical Thinking: Analyzing the Impact of Credit...Ch. 8 - Using an Aging Schedule to Estimate Bad Debts and...Ch. 8 - Accounting for Receivables and Uncollectible...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Coca-Cola and PepsiCo are two of the largest and most successful beverage companies in the world in terms of the products that they sell and their receivables management practices. To evaluate their ability to collect on credit sales, consider the following rounded amounts reported in their annual reports (amounts in millions). Fiscal Year Ended: Net Sales Accounts Receivable Allowance for Doubtful Accounts Accounts Receivable, Net of Allowance Req 1 Req 2A Required: 1. Calculate the receivables turnover ratios and days to collect for Coca-Cola and PepsiCo for 2018 and 2017. 2-a. Which of the companies was quicker to convert its receivables into cash in 2018? 2-b. Which of the companies was quicker to convert its receivables into cash in 2017? Complete this question by entering your answers in the tabs below. Receivables Turnover Ratio Days to collect Req 2B X Answer is complete but not entirely correct. Coca-Cola 2018 $ 31,860 3,890 490 3,400 2018 8.7 x 41.6 PepsiCo Coca-Cola 2017 9.0…arrow_forwardes Fizzy Sodas and Hayes Companies are two of the largest and most successful beverage companies in the world in terms of the products that they sell and their receivables management practices. To evaluate their ability to collect on credit sales, consider the following rounded amounts reported in their annual reports (amounts in millions). Fiscal Year Ended: Net Sales Accounts Receivable Allowance for Doubtful Accounts Accounts Receivable, Net of Allowance 2018 $ 40,630 4,410 620 3,790 Fizzy Sodas 2017 $ 45,120 4,710 610 4,100 2016 $ 47,640 4,930 600 4,330 2018 $ 82,416 8,240 100 8,140 Hayes Companies 2017 $82,945 8,150 130 8,020 Required: 1. Calculate the receivables turnover ratios and days to collect for Fizzy Sodas and Hayes Companies for 2018 and 2017. 2-a. Which of the companies was quicker to convert its receivables into cash in 2018? 2-b. Which of the companies was quicker to convert its receivables into cash in 2017? 2016 $ 71,470 7,770 140 7,630arrow_forwarda) Calculate Kopitiam Sdn Bud’s accounts receivable turnover ratio for Year 2 and Year 3. b) Calculate the number of days the average balance of receivables is outstanding before being converted into cash (turnover in days) for Year 2 and Year 3 c) What problem do you see with the company’s credit policy if the terms are net 30 days? Explain your answer.arrow_forward

- Please fill all requirementsarrow_forwardPlease answer fast without plagiarism detectorarrow_forwardThe following select financial statement information from Vortex Computing. Compute the accounts receivable turnover ratios and the number of days sales in receivables ratios for 2018 and 2019 (round answers to two decimal places). What do the outcomes tell a potential investor about Vortex Computing if industry average for accounts receivable turnover ratio is 4 times and days sales in receivables ratio is 85 days?arrow_forward

- Millennial Manufacturing has net credit sales for 2018 in the amount of $1,433,630, beginning accounts receivable balance of $585,900, and an ending accounts receivable balance of $621,450. Compute the accounts receivable turnover ratio and the number of days sales in receivables ratio for 2018 (round answers to two decimal places). What do the outcomes tell a potential investor about Millennial Manufacturing if industry average is 2.6 times and number of days sales ratio is 180 days?arrow_forwardReview the select information for Liquor Plaza and Beer Buddies (industry competitors) and complete the following. A. Compute the accounts receivable turnover ratios for each company for 2018 and 2019. B. Compute the number of days sales in receivables ratios for each company for 2018 and 2019. C. Determine which company is the better investment and why. Round answers to two decimal places.arrow_forwardAccounts receivable analysis Xavier Stores Company and Lestrade Stores Inc. are large retail department stores. Both companies offer credit to their customers through their own credit card operations. Information from the financial statements for both companies for two recent years is as follows (in millions): A. Determine the (1) accounts receivable turnover and (2) the number of days sales in receivables for both companies. Round to one decimal place. B. Compare the two companies with regard to their credit card policies.arrow_forward

- Review the select information for Bean Superstore and Legumes Plus (industry competitors), and then complete the following. A. Compute the accounts receivable turnover ratios for each company for 2018 and 2019. B. Compute the number of days sales in receivables ratios for each company for 2018 and 2019. C. Determine which company is the better investment and why. Round answers to two decimal places.arrow_forwardPlease don't give image formatarrow_forwardA company regularly sells its receivables to a factor who assesses a 2% service charge on the amount of receivables purchased. Which of the following statements is true for the seller of the receivables? The credit to Accounts Receivable is less than the debit to Cash when the accounts are sold. Selling expenses will increase each time accounts are sold. The other expense section of the income statement will increase each time accounts are sold. The loss section of the income statement will increase each time receivables are sold.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License