FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

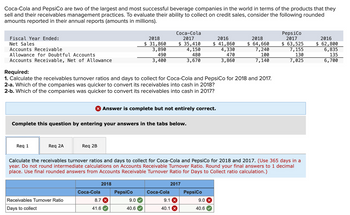

Transcribed Image Text:Coca-Cola and PepsiCo are two of the largest and most successful beverage companies in the world in terms of the products that they

sell and their receivables management practices. To evaluate their ability to collect on credit sales, consider the following rounded

amounts reported in their annual reports (amounts in millions).

Fiscal Year Ended:

Net Sales

Accounts Receivable

Allowance for Doubtful Accounts

Accounts Receivable, Net of Allowance

Req 1

Req 2A

Required:

1. Calculate the receivables turnover ratios and days to collect for Coca-Cola and PepsiCo for 2018 and 2017.

2-a. Which of the companies was quicker to convert its receivables into cash in 2018?

2-b. Which of the companies was quicker to convert its receivables into cash in 2017?

Complete this question by entering your answers in the tabs below.

Receivables Turnover Ratio

Days to collect

Req 2B

X Answer is complete but not entirely correct.

Coca-Cola

2018

$ 31,860

3,890

490

3,400

2018

8.7 x

41.6

PepsiCo

Coca-Cola

2017

9.0

40.6

$ 35,410

4,150

480

3,670

Calculate the receivables turnover ratios and days to collect for Coca-Cola and PepsiCo for 2018 and 2017. (Use 365 days in a

year. Do not round intermediate calculations on Accounts Receivable Turnover Ratio. Round your final answers to 1 decimal

place. Use final rounded answers from Accounts Receivable Turnover Ratio for Days to Collect ratio calculation.)

Coca-Cola

9.1 x

40.1 X

2017

2016

$ 41,860

4,330

470

3,860

PepsiCo

9.0 X

2018

$ 64,660

7,240

100

7,140

40.6

PepsiCo

2017

$ 63,525

7,155

130

7,025

2016

$ 62,800

6,835

135

6,700

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- Karanarrow_forwardSoftee Sodas and Patterson Beverage Company are two of the largest and most successful beverage companies in the world in terms of the products that they sell and their receivables management practices. To evaluate their ability to collect on credit sales, consider the following rounded amounts reported in their annual reports (amounts in millions). Softee Sodas Patterson Beverage Company Fiscal Year Ended: 2018 2017 2016 2018 2017 2016 Net Sales $ 42,160 $ 46,840 $ 48,600 $ 85,696 $ 86,240 $ 72,900 Accounts Receivable 4,490 4,810 5,030 8,400 8,310 7,930 Allowance for Doubtful Accounts 640 630 620 100 130 140 Accounts Receivable, Net of Allowance 3,850 4,180 4,410 8,300 8,180 7,790 Required: 1. Calculate the receivables turnover ratios and days to collect for Softee Sodas and Patterson Beverage Company for 2018 and 2017. 2-a. Which of the companies was quicker to convert its receivables into cash in 2018? 2-b. Which of the companies was quicker to convert its receivables into cash in…arrow_forwardPlease help mearrow_forward

- Question: In 2015, Warehouse 13 had net credit sales of $750,000. On January 1, 2015, Allowance for Doubtful Accounts had a credit balance of $16,000. During 2015, $29,000 of uncollectible accounts receivable were written off. Past experience indicates that the allowance should be 10% of the balance in receivables (percentage of receivable basis). If the accounts receivable balance at December 31 was $150,000, what is the required adjustment to the Allowance for Doubtful Accounts at December 31, 2015? a) $29,000 b) $31,000 c) $150,000 d) $28,000arrow_forwardWant Answerarrow_forwardes Fizzy Sodas and Hayes Companies are two of the largest and most successful beverage companies in the world in terms of the products that they sell and their receivables management practices. To evaluate their ability to collect on credit sales, consider the following rounded amounts reported in their annual reports (amounts in millions). Fiscal Year Ended: Net Sales Accounts Receivable Allowance for Doubtful Accounts Accounts Receivable, Net of Allowance 2018 $ 40,630 4,410 620 3,790 Fizzy Sodas 2017 $ 45,120 4,710 610 4,100 2016 $ 47,640 4,930 600 4,330 2018 $ 82,416 8,240 100 8,140 Hayes Companies 2017 $82,945 8,150 130 8,020 Required: 1. Calculate the receivables turnover ratios and days to collect for Fizzy Sodas and Hayes Companies for 2018 and 2017. 2-a. Which of the companies was quicker to convert its receivables into cash in 2018? 2-b. Which of the companies was quicker to convert its receivables into cash in 2017? 2016 $ 71,470 7,770 140 7,630arrow_forward

- Harlan Company uses the Allowance method for accounting for receivables. They had the following information as of December 31, 2022: Net Credit Sales, year 2022 6,867,750 Accounts Receivable, December 31, 2021 655,000 Accounts Receivable, December 31, 2022 745,000 Allowance for Doubtful Accounts, December 31, 2022 4,350 Credit Harlan Company estimates that 2% of the Accounts Receivable will become uncollectible. What are some things that a company can do to improve the collection of its Accounts Receivable? On January 7, 2023 it was determined that Bundy Company’s account in the amount of $3,800 will be uncollectible. Prepare the entry to write off the Bundy Company account. What is the Cash Realizable Value of the receivables after the write-off of the Bundy Company account?arrow_forwardProvide both Answerarrow_forwardMr. Husker's Tuxedos Corp. ended the year 2021 with an average collection period of 35 days. The firm's credit sales for 2021 were $56.4 million. What is the year-end 2021 balance in accounts receivable for Mr. Husker's Tuxedos? (Enter your answer in dollars not in millions.) Accounts receivablearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education