Connect Access Card For Fundamentals Of Cost Accounting

6th Edition

ISBN: 9781260708738

Author: William N. Lanen Professor, Shannon Anderson Associate Professor, Michael W Maher

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 8, Problem 46E

Operation Costing: Ethical Issues

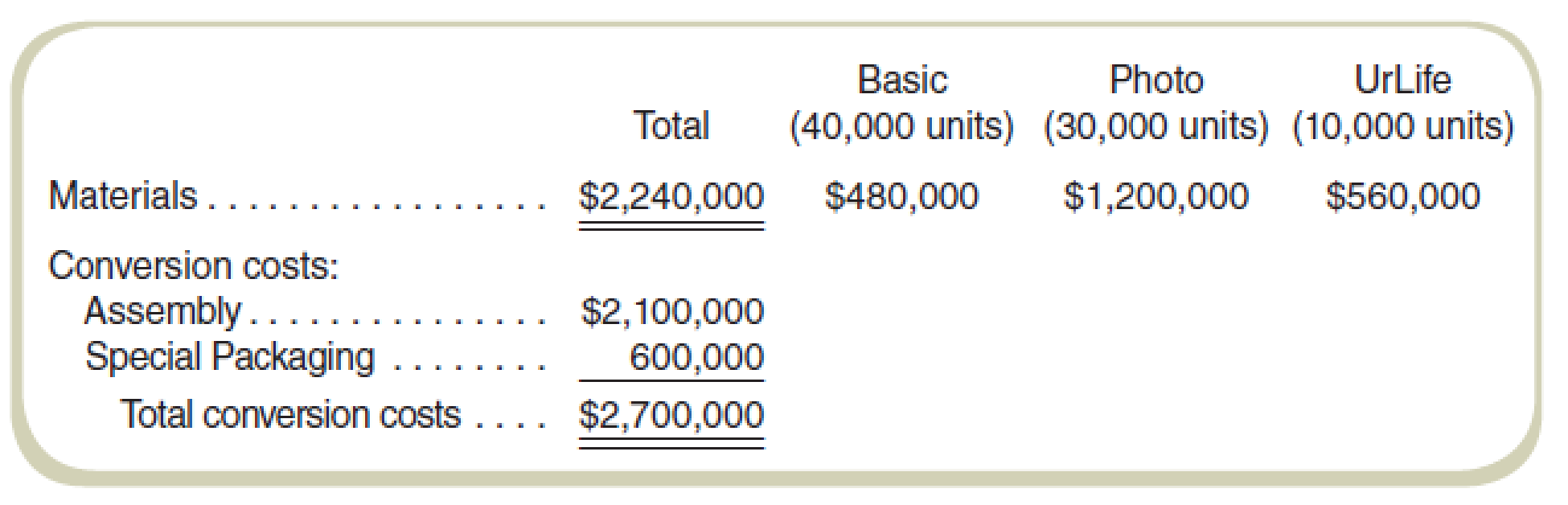

Brokia Electronics manufactures three cell phone models, which differ only in the components included: Basic, Photo, and UrLife. Production takes place in two departments, Assembly and Special Packaging. The Basic and Photo models are complete after Assembly. The UrLife model goes from Assembly to Special Packaging and is completed there. Data for July are shown in the following table. Conversion costs are allocated based on the number of units produced. There are no work-in-process inventories.

Required

- a. What is the cost per unit transferred to finished goods inventory for each of the three phones in July?

- b. The UrLife model is sold only to the government on a cost-plus basis. The marketing vice president suggests that conversion costs in Assembly could be allocated on the basis of material costs so he can offer a lower price for the Basic model.

- (1) What cost would be reported for the three models if the marketing vice president’s suggestion is adopted?

- (2) Would this be ethical?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Ole Company manufactures two products, Product A and Product B. Currently, machine hours are used to allocate the overhead costs to the two products. Ole Company is considering adopting an activity-based costing system. If so, overhead costs will be traced to the following activities: Activities Machining Quality Control Material Moves Activity cost pools $300,000 $200,000 $400,000 Cost Drivers Machine Hours Number of inspections Number of moves Product A 30,000 400 2,000 Product B 20,000 600 6,000 (a) Calculate the total overhead cost assigned to Product A under the current system. (b) Calculate the total overhead cost for Product A if the company implements activity-based costing system. (c) Briefly explain which costing method gives a more accurate picture of the costs. (d) Suppose you are the management accountant in a university. List any three (3)activities commonly carried out in universities and identify an appropriate cost driver for each activity.

Brokia Electronics manufactures three cell phone models, which differ only in the components included: Basic, Photo, and UrLife. Production takes place in two departments, Assembly and Special Packaging. The Basic and Photo models are complete after Assembly. The UrLife model goes from Assembly to Special Packaging and is completed there. Data for July are shown in the following table. Conversion costs are allocated based on the number of units produced. There are no work-in-process inventories.

Total

total

Basic(40,000 units)

Photo(20,000 units)

UrLife(10,000 units)

Materials

$

2,380,000

$

494,000

$

1,214,000

$

672,000

Conversion costs:

Assembly

$

2,284,800

Special Packaging

614,000

Total conversion costs

$

2,898,800

Required:

a. What is the cost per unit transferred to finished goods inventory for each of the three…

Old Victrola, Inc., produces top-quality stereos and uses process costing. The manufacture of stereos is such that direct materials, labor, and overhead are all added evenly throughout the production process. Due to the smooth production process, only one cost category—manufacturing costs—is used for equivalent unit calculations. Old Victrola had the following cost and production information available for the months of March and April.

March

April

Direct materials costs

$

978,460

$

1,168,310

Direct labor costs

2,562,260

3,041,940

Manufacturing overhead applied

3,438,640

3,571,030

Total manufacturing costs

$

6,979,360

$

7,781,280

Units in beginning work in process

7,900

4,500

Units transferred to finished goods

19,800

23,700

Units in ending work in process

4,500

6,400

Beginning work in process was 30 percent complete in March and 60 percent complete in April. Ending work in process was…

Chapter 8 Solutions

Connect Access Card For Fundamentals Of Cost Accounting

Ch. 8 - What are the characteristics of industries most...Ch. 8 - A manufacturing company has records of its...Ch. 8 - If costs increase from one period to another, will...Ch. 8 - What are the five steps to follow when computing...Ch. 8 - What is the distinction between equivalent units...Ch. 8 - Which method, weighted-average or FIFO, better...Ch. 8 - It has been said that a prior departments costs...Ch. 8 - The more important individual unit costs are for...Ch. 8 - Assume that the number of units transferred out of...Ch. 8 - The management of a liquid cleaning product...

Ch. 8 - We have discussed two methods for process costing,...Ch. 8 - A friend owns and operates a consulting firm that...Ch. 8 - The controller of a local firm that uses a...Ch. 8 - Throughout the chapter, we treated conversion...Ch. 8 - Consider a manufacturing firm with multiple...Ch. 8 - Prob. 16CADQCh. 8 - Would process costing work well for a service...Ch. 8 - Compute Equivalent Units: Weighted-Average Method...Ch. 8 - Compute Equivalent Units: FIFO Method Refer to the...Ch. 8 - Compute Equivalent Units: Weighted-Average Method...Ch. 8 - Compute Equivalent Units: FIFO Method Refer to the...Ch. 8 - Compute Equivalent Units Magic Company adds...Ch. 8 - Equivalent Units: Weighted-Average Process Costing...Ch. 8 - Prob. 24ECh. 8 - Prob. 25ECh. 8 - Compute Equivalent Units: Ethical Issues Aaron...Ch. 8 - Equivalent Units and Cost of Production By...Ch. 8 - Compute Costs per Equivalent Unit:...Ch. 8 - Compute the cost per equivalent unit for materials...Ch. 8 - Compute Equivalent Units: FIFO Method Materials...Ch. 8 - Compute Equivalent Units and Cost per Equivalent...Ch. 8 - Cost Per Equivalent Unit: Weighted-Average Method...Ch. 8 - Compute Costs per Equivalent Unit:...Ch. 8 - Refer to the data in Exercise 8–33. Compute the...Ch. 8 - Using the data in Exercise 8-33, compute the cost...Ch. 8 - Refer to the data in Exercises 8-33 and 8-35....Ch. 8 - Compute Costs per Equivalent Unit:...Ch. 8 - Refer to the data in Exercise 8-37. Compute the...Ch. 8 - Refer to the data in Exercise 8-37. Compute the...Ch. 8 - Prob. 40ECh. 8 - Prepare a Production Cost Report: FIFO Method...Ch. 8 - Prob. 42ECh. 8 - Prepare a Production Cost Report: Weighted-Average...Ch. 8 - Prob. 44ECh. 8 - Cost of Production: Weighted-Average and FIFO...Ch. 8 - Operation Costing: Ethical Issues Brokia...Ch. 8 - Prob. 47ECh. 8 - Prob. 48ECh. 8 - Prob. 49ECh. 8 - Suppose the marketing manager’s suggestion is...Ch. 8 - Prob. 51PCh. 8 - Prob. 52PCh. 8 - Prob. 53PCh. 8 - Prob. 54PCh. 8 - Prepare a production cost report for June for the...Ch. 8 - Prob. 56PCh. 8 - Prob. 57PCh. 8 - Prob. 58PCh. 8 - Prob. 59PCh. 8 - Prob. 60PCh. 8 - Prob. 61PCh. 8 - Prob. 62PCh. 8 - Prob. 63PCh. 8 - Prob. 64PCh. 8 - Prob. 65PCh. 8 - Prob. 66PCh. 8 - Prob. 67PCh. 8 - Process Costing and Ethics: Increasing Production...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Bumblebee Mobiles manufactures a line of cell phones. The management has identified the following overhead costs and related cost drivers for the coming year. The following were incurred in manufacturing two of their cell phones, Bubble and Burst, during the first quarter. REQUIREMENT Review the worksheet called ABC that follows these requirements. You have been asked to determine the cost of each product using an activity-based cost system. Note that the problem information is already entered into the Data Section of the ABC worksheet.arrow_forwardVermont Instruments manufactures two models of calculators. The fiancé model is the Fin-X and the scientific model is the Sc-X. Both models are assembled in the same plant and require the same assembling operations. The difference between the models is in the cost of the parts. The following data are available for June: Fin-X Sci-X Total Number of units 12,000 40,000 52,000 Parts cost per unit $25 $23 Other costs: Direct labor $53,000 Indirect materials 18,000 Overhead…arrow_forwardUse the following information for questions 2-4. Compute It uses activity-based costing. Two of Compute It’s production activities are Kitting (assembling the raw materials needed for each computer in one kit) and boxing the completed products for shipment to customers. Assume that Compute It spends $960,000 per month on kitting and $32,000 per month on boxing. Compute It allocates the following: • Kitting costs based on the number of parts used in the computer • Boxing costs based on the cubic feet of space the computer requires Suppose Compute It estimates it will use 400,000 parts per month and ship products with a total volume of 6,400 cubic feet per month. Assume that each desktop computer requires 125 parts and has a volume of 2 cubic feet. Compute It contracts with its suppliers to pre-kit certain component parts before delivering them to Compute It. Assume this saves $210,000 of the kitting cost and reduces the total number of parts by 100,000 (because Compute It considers each…arrow_forward

- Chipville Inc. is a fast-growing manufacturer of computer chips. Direct materials are added at the start of the production process. Conversion costs are added evenly during the process. Some units of this product are spoiled as a result of defects not detectable before inspection of finished goods. Spoiled units are disposed of at zero net disposal value. Chipville uses the weighted-average method of process costing. Summary data for September are: (Click the icon to view the data.) Required 1. For each cost category, compute equivalent units. Show physical units in the first column of your schedule. 2. Summarize total costs to account for, calculate cost per equivalent unit for each cost category, and assign total costs to units completed and transferred out (including normal spoilage), to abnormal spoilage, and to units in ending work in process. Materials Costs incurred to date Divide by: Equivalent units of work done to date Cost per equivalent unit for work done to date Finally,…arrow_forwardOld Victoria Inc produces top-quality stereos and uses process costing. The manufacture of stereos is such that direct materials, labor and overhead are all added evenly throughout the production process. Due to the smooth production process, only one cost category - manufactured costs - is used for equivalent unit calcualtions. Old Victoria had the following cost and production information available for the months of March and April. March April Direct materials cost $978,460 $1,168,310 Direct Labor costs 2,562,260 3,041,940 Manufacturing overhead applied 3,438,640 3,571,030 Total Manufacturing costs $6,979,360 $7,781,280 Units in beginning work in progress 7,000 4,800 Units transferred to finished goods 18,500 23,000 Units in ending work in process 4,800 6,400 Beginning work in process was 30% complete in March and 60% complete in April. Ending work in process was 60% complete in March and 35% complete in April. a. For each of the 2 months, calculate the…arrow_forwardOld Victrola, Inc., produces top-quality stereos and uses process costing. The manufacture of stereos is such that direct materials, labor, and overhead are all added evenly throughout the production process. Due to the smooth production process, only one cost category-manufacturing costs-is used for equivalent unit calculations. Old Victrola had the following cost and production information available for the months of March and April. Direct materials costs Direct labor costs Manufacturing overhead applied Total manufacturing costs Units in beginning work in process Units transferred to finished goods Units in ending work in process Req A Beginning work in process was 30 percent complete in March and 60 percent complete in April. Ending work in process was 60 percent complete in March and 35 percent complete in April. Req B1 March April a. For each of the two months, calculate the equivalent units of production. b-1. For each of the two months, calculate the manufacturing cost per…arrow_forward

- Use the following information for questions 2-4. Compute It uses activity-based costing. Two of Compute It’s production activities are kitting(assembling the raw materials needed for each computer in one kit) and boxing the completed products for shipment to customers. Assume that Compute It spends $960,000 per month on kitting and $32,000 per month on boxing. Compute It allocates the following: • Kitting costs based on the number of parts used in the computer • Boxing costs based on the cubic feet of space the computer requires Suppose Compute It estimates it will use 400,000 parts per month and ship products with a total volume of 6,400 cubic feet per month. Assume that each desktop computer requires 125 parts and has a volume of 2 cubic feet.Compute It contracts with its suppliers to pre-kit certain component parts before delivering them to Compute It. Assume this saves $210,000 of the kitting cost and reduces the total number of parts by 100,000 (because Compute It considers each…arrow_forwardChippity Inc. is a fast-growing manufacturer of computer chips. Direct materials are added at the start of the production process. Conversion costs are added evenly during the process. Some units of this product are spoiled as a result of defects not detectable before inspection of finished goods. Spoiled units are disposed of at zero net disposal value. Chippity uses the weighted-average method of process costing. Summary data for September are: (Click the icon to view the data.) Required 1. For each cost category, compute equivalent units. Show physical units in the first column of your schedule. 2. Summarize total costs to account for, calculate cost per equivalent unit for each cost category, and assign total costs to units completed and transferred out (including normal spoilage), to abnormal spoilage, and to units in ending work in process. Requirement 1. For each cost category, calculate equivalent units. Show physical units in the first column of your schedule. Enter the…arrow_forwardAngle Max Industries produces a product which goes through two operations, Assembly and Finishing, before it is ready to be shipped. Next year's expected costs and activities are shown below. Direct labor hours Machine hours Overhead costs Multiple Choice Assume that the Assembly Department allocates overhead using a plantwide overhead rate based on machine hours. How much total overhead will be assigned to a product that requires 2 direct labor hour and 3.30 machine hours in the Assembly Department, and 4.50 direct labor hours and 0.4 machine hours in the Finishing Department? O$17.60. Assembly 180,000 DLH 380,000 MH $380,000 $20.40. Finishing 148,000 DLH 91, 200 MH $562, 400arrow_forward

- Rooney Manufacturing produces two keyboards, one for laptop computers and the other for desktop computers. The production process is automated, and the company has found activity-based costing useful in assigning overhead costs to its products. The company has identified five major activities involved in producing the keyboards. Activity Materials receiving & handling Production setup Assembly Quality inspection Packing and shipping Activity measures for the two kinds of keyboards follow: Laptops Desktops Required Labor Cost $ 1,190 1,080 Laptop keyboards Desktop keyboards Allocation Base Cost of material Number of setups Number of parts Inspection time Number of orders Material Number of Number of Cost $6,000 7,000 Cost Per Unit Setups 26 13 Parts 46 25 Allocation Rate 1% of material cost $ 109.00 per setup $ 5.00 per part $ 1.30 per minute $10.00 per order Inspection Time 7,200 minutes 5,100 minutes Number of Orders 61 a. Compute the cost per unit of laptop and desktop keyboards,…arrow_forwardIKIT company produces and sells recliner chairs. IKIT uses an absorption product costing system, which means that both variable and fixed overhead are included in the product cost. Cost estimates for a recliner chair and expected production volume for next year are as follows: Per Unit Total Direct materials $40Direct labour $20Variable manufacturing overhead $14Variable selling and administrative expenses $15Fixed selling and administrative expenses $380,000Fixed manufacturing overhead $460,000Expected volume of production (units): 42,000The company’s owners expect to earn a rate of return (ROI) of 30% on their invested assets of $2,500,000. a)a. IKIT currently uses the cost-plus pricing method. Compute the mark-up percentage and target selling price that will allow IKIT to earn its desired ROI of 30% for next year. b) Based on a recent marketing research, the senior management has an optimistic sales expectation of 50,000 units and predicts to earn a higher ROI of 35%. Compute new…arrow_forwardEagle Co. manufactures bentwood chairs and tables. Wood for both products is steam-bent in the same process, but different types of wood are used for each product. Thus, materials cost is identified separately to each product. One production cycle uses 20 board feet. Labor cost is identified to the process as a whole, as is overhead cost. Data for the month of July follow: Chairs Tables Direct material cost per board foot $3.60 $4.20 Number of parts formed per production cycle (20 board feet) 10 8 Actual operating hours in July 120 380 Parts produced during July 4,000 9,000 Budgeted annual conversion cost: Labor $150,000 Utilities 125,000 Depreciation 65,000 Other overhead 50,000 Total $390,000 Budgeted annual operating hours for steam-bending 5,200 In your computations, round cost per unit amounts to two decimal places. If required, round final answers to the nearest dollar. a.…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY