Connect Access Card For Fundamentals Of Cost Accounting

6th Edition

ISBN: 9781260708738

Author: William N. Lanen Professor, Shannon Anderson Associate Professor, Michael W Maher

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 8, Problem 31E

Compute Equivalent Units and Cost per Equivalent Unit: Weighted-Average Method

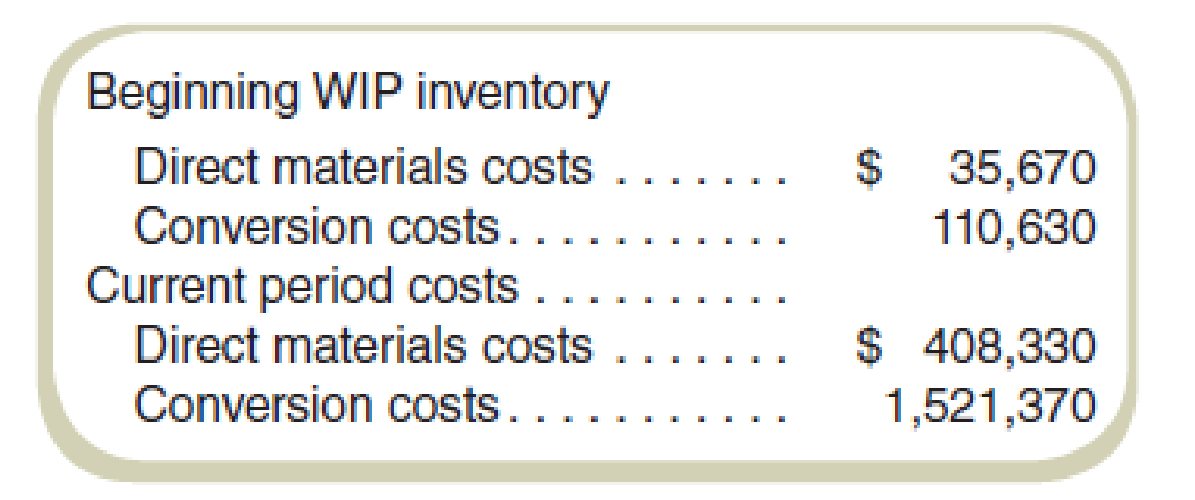

Refer to the data in Exercise 8-28. Cost data for November show the following:

Required

- a. Compute the cost equivalent units for the conversion cost calculation assuming Campo uses the weighted-average method.

- b. Compute the cost per equivalent unit for materials and conversion costs for November.

8-28 Compute Equivalent Units: FIFO Method

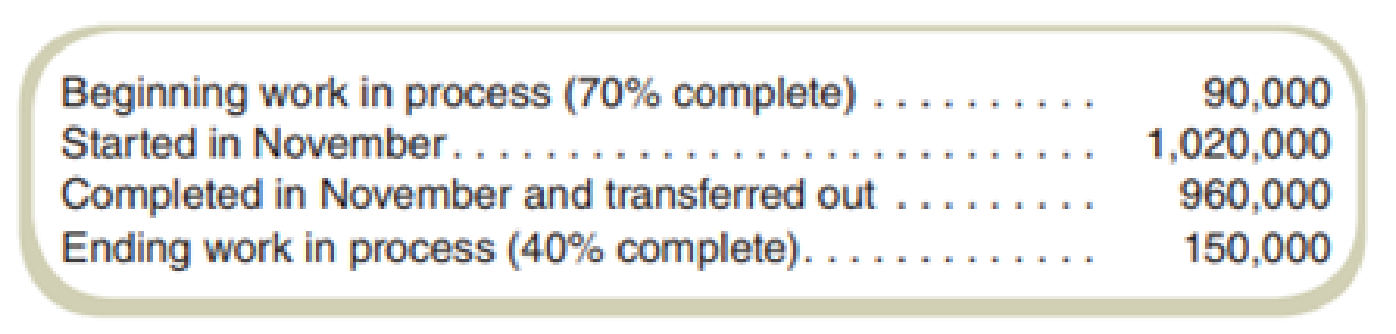

Materials are added at the beginning of the production process at Campo Company. Campo uses a FIFO

Required

Compute the equivalent units for the conversion cost calculation.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Required:

1. Tabulate the conversion costs of each operation, the total units produced,

and the conversion costs per unit for November.

2. Calculate the total costs and the cost per unit of each style of box

produced in November. Be sure to account for all the total costs.

3. Prepare summary journal entries for each operation. For simplicity,

assume that all direct materials are introduced at the beginning of the

cutting operation. Also, assume that all units were transferred to finished

goods when completed and that there was no beginning or ending work

in process. Prepare one summary entry for all conversion costs incurred.

but prepare a separate entry for allocating conversion costs in each

operation.

Radford Products adds materials at the beginning of the process in Department A. The following information on physical units for

Department A for the month of January is available.

Units started in January

Units completed in January

Work in process, January 1 (25% complete with respect to conversion)

Work in process, January 31 (40% complete with respect to conversion)

Required:

a. Compute the equivalent units for materials costs and for conversion costs using the weighted-average method.

b. Compute the equivalent units for materials costs and for conversion costs using the FIFO method.

> Answer is complete but not entirely correct.

Equivalent Units

a. Using the weighted-average method

b. Using the FIFO method

Materials

96,250 X

96,250 X

Conversion

Costs

477,400 X

107,800

900,000

924,000

101,000

77,000

Radford Products adds materials at the beginning of the process in Department A. The following information on physical units for

Department A for the month of January is available.

Units started in January

Units completed in January

Work in process, January 1 (25% complete with respect to conversion)

Work in process, January 31 (40%- complete with respect to conversion)

Required:

a. Compute the equivalent units for materials costs and for conversion costs using the weighted average method.

b. Compute the equivalent units for materials costs and for conversion costs using the FIFO method.

Answer is not complete.

a Using the weighted average method

b. Using the FIFO method

Equivalent Units

Materials

1,008,500

905,000

929,000

103,500

79,500

Conversion

Costs

900,800

Chapter 8 Solutions

Connect Access Card For Fundamentals Of Cost Accounting

Ch. 8 - What are the characteristics of industries most...Ch. 8 - A manufacturing company has records of its...Ch. 8 - If costs increase from one period to another, will...Ch. 8 - What are the five steps to follow when computing...Ch. 8 - What is the distinction between equivalent units...Ch. 8 - Which method, weighted-average or FIFO, better...Ch. 8 - It has been said that a prior departments costs...Ch. 8 - The more important individual unit costs are for...Ch. 8 - Assume that the number of units transferred out of...Ch. 8 - The management of a liquid cleaning product...

Ch. 8 - We have discussed two methods for process costing,...Ch. 8 - A friend owns and operates a consulting firm that...Ch. 8 - The controller of a local firm that uses a...Ch. 8 - Throughout the chapter, we treated conversion...Ch. 8 - Consider a manufacturing firm with multiple...Ch. 8 - Prob. 16CADQCh. 8 - Would process costing work well for a service...Ch. 8 - Compute Equivalent Units: Weighted-Average Method...Ch. 8 - Compute Equivalent Units: FIFO Method Refer to the...Ch. 8 - Compute Equivalent Units: Weighted-Average Method...Ch. 8 - Compute Equivalent Units: FIFO Method Refer to the...Ch. 8 - Compute Equivalent Units Magic Company adds...Ch. 8 - Equivalent Units: Weighted-Average Process Costing...Ch. 8 - Prob. 24ECh. 8 - Prob. 25ECh. 8 - Compute Equivalent Units: Ethical Issues Aaron...Ch. 8 - Equivalent Units and Cost of Production By...Ch. 8 - Compute Costs per Equivalent Unit:...Ch. 8 - Compute the cost per equivalent unit for materials...Ch. 8 - Compute Equivalent Units: FIFO Method Materials...Ch. 8 - Compute Equivalent Units and Cost per Equivalent...Ch. 8 - Cost Per Equivalent Unit: Weighted-Average Method...Ch. 8 - Compute Costs per Equivalent Unit:...Ch. 8 - Refer to the data in Exercise 8–33. Compute the...Ch. 8 - Using the data in Exercise 8-33, compute the cost...Ch. 8 - Refer to the data in Exercises 8-33 and 8-35....Ch. 8 - Compute Costs per Equivalent Unit:...Ch. 8 - Refer to the data in Exercise 8-37. Compute the...Ch. 8 - Refer to the data in Exercise 8-37. Compute the...Ch. 8 - Prob. 40ECh. 8 - Prepare a Production Cost Report: FIFO Method...Ch. 8 - Prob. 42ECh. 8 - Prepare a Production Cost Report: Weighted-Average...Ch. 8 - Prob. 44ECh. 8 - Cost of Production: Weighted-Average and FIFO...Ch. 8 - Operation Costing: Ethical Issues Brokia...Ch. 8 - Prob. 47ECh. 8 - Prob. 48ECh. 8 - Prob. 49ECh. 8 - Suppose the marketing manager’s suggestion is...Ch. 8 - Prob. 51PCh. 8 - Prob. 52PCh. 8 - Prob. 53PCh. 8 - Prob. 54PCh. 8 - Prepare a production cost report for June for the...Ch. 8 - Prob. 56PCh. 8 - Prob. 57PCh. 8 - Prob. 58PCh. 8 - Prob. 59PCh. 8 - Prob. 60PCh. 8 - Prob. 61PCh. 8 - Prob. 62PCh. 8 - Prob. 63PCh. 8 - Prob. 64PCh. 8 - Prob. 65PCh. 8 - Prob. 66PCh. 8 - Prob. 67PCh. 8 - Process Costing and Ethics: Increasing Production...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Using the same data found in Exercise 6.22, assume the company uses the FIFO method. Required: Prepare a schedule of equivalent units, and compute the unit cost for the month of December. Fordman Company has a product that passes through two processes: Grinding and Polishing. During December, the Grinding Department transferred 20,000 units to the Polishing Department. The cost of the units transferred into the second department was 40,000. Direct materials are added uniformly in the second process. Units are measured the same way in both departments. The second department (Polishing) had the following physical flow schedule for December: Costs in beginning work in process for the Polishing Department were direct materials, 5,000; conversion costs, 6,000; and transferred in, 8,000. Costs added during the month: direct materials, 32,000; conversion costs, 50,000; and transferred in, 40,000.arrow_forwardHeap Company manufactures a product that passes through two processes: Fabrication and Assembly. The following information was obtained for the Fabrication Department for September: a. All materials are added at the beginning of the process. b. Beginning work in process had 80,000 units, 30 percent complete with respect to conversion costs. c. Ending work in process had 17,000 units, 25 percent complete with respect to conversion costs. d. Started in process, 95,000 units. Required: 1. Prepare a physical flow schedule. 2. Compute equivalent units using the weighted average method. 3. Compute equivalent units using the FIFO method.arrow_forwardTransferred-In Cost Goldings finishing department had the following data for July: Required: 1. Calculate unit costs for the following categories: transferred-in, materials, and conversion. 2. Calculate total unit cost.arrow_forward

- Patterson Company produces wafers for integrated circuits. Data for the most recent year are provided: aCalculated using number of dies as the single unit-level driver. bCalculated by multiplying the consumption ratio of each product by the cost of each activity. Required: 1. Using the five most expensive activities, calculate the overhead cost assigned to each product. Assume that the costs of the other activities are assigned in proportion to the cost of the five activities. 2. Calculate the error relative to the fully specified ABC product cost and comment on the outcome. 3. What if activities 1, 2, 5, and 8 each had a cost of 650,000 and the remaining activities had a cost of 50,000? Calculate the cost assigned to Wafer A by a fully specified ABC system and then by an approximately relevant ABC approach. Comment on the implications for the approximately relevant approach.arrow_forwardAero Aluminum Inc. uses a process cost system. The records for May show the following information: Required: Prepare a cost of production summary for each department. (Hint: When preparing the Converting production summary, refer to the Rolling production summary for the costs transferred in during the month.)arrow_forwardThe Converting Department of Tender Soft Tissue Company uses the weighted average method and had 1,900 units in work in process that were 60% complete at the beginning of the period. During the period, 15,800 units were completed and transferred to the Packing Department. There were 1,200 units in process that were 30% complete at the end of the period. a. Determine the number of whole units to be accounted for and to be assigned costs for the period. b. Determine the number of equivalent units of production for the period. Assume that direct materials are placed in process during production.arrow_forward

- The increases to Work in ProcessRoasting Department for Highlands Coffee Company for May as well as information concerning production are as follows: Prepare a cost of production report for May, using the weighted average method. Assume that direct materials are placed in process during production.arrow_forwarda. Based upon the data in Exercise 17-7, determine the following for December: 1. Direct materials cost per equivalent unit 2. Conversion cost per equivalent unit 3. Cost of the beginning work in process completed during December 4. Cost of units started and completed during December 5. Cost of the ending work in process b. Assuming that the direct materials cost is the same for November and December, did the conversion cost per equivalent unit increase, decrease, or remain the same in December?arrow_forwardSeacrest Company uses a process-costing system. The company manufactures a product that is processed in two departments: A and B. As work is completed, it is transferred out. All inputs are added uniformly in Department A. The following summarizes the production activity and costs for November: Required: 1. Using the weighted average method, prepare the following for Department A: (a) a physical flow schedule, (b) an equivalent unit calculation, (c) calculation of unit costs (Note: Round to four decimal places.), (d) cost of EWIP and cost of goods transferred out, and (e) a cost reconciliation. 2. CONCEPTUAL CONNECTION Prepare journal entries that show the flow of manufacturing costs for Department A. Use a conversion cost control account for conversion costs. Many firms are now combining direct labor and overhead costs into one category. They are not tracking direct labor separately. Offer some reasons for this practice.arrow_forward

- The standard cost summary for the most popular product of Phenom Products Co. is shown as follows, together with production and cost data for the period. One gallon each of liquid lead and varnish are added at the start of processing. The balance of the materials is added when the process is two-thirds complete. Labor and overhead are added evenly throughout the process. There were no units in process at the beginning of the month. Required: Calculate equivalent production for materials, labor, and overhead. (Be sure to refer to the standard cost summary to help determine the percentage of materials in ending work in process.) Calculate materials and labor variances and indicate whether they are favorable or unfavorable, using the diagram format shown in Figure 8-4. Determine the cost of materials and labor in the work in process account at the end of the month.arrow_forwardJackson Products produces a barbeque sauce using three departments: Cooking, Mixing, and Bottling. In the Cooking Department, all materials are added at the beginning of the process. Output is measured in ounces. The production data for July are as follows: With respect to conversion costs. Required: 1. Prepare a physical flow schedule for July. 2. Prepare an equivalent units schedule for July using the weighted average method. 3. What if you were asked to calculate the FIFO units beginning with the weighted average equivalent units? Calculate the weighted average equivalent units by subtracting out the prior-period output found in BWIP.arrow_forwardHolmes Products, Inc., produces plastic cases used for video cameras. The product passes through three departments. For April, the following equivalent units schedule was prepared for the first department: Costs assigned to beginning work in process: direct materials, 90,000; conversion costs, 33,750. Manufacturing costs incurred during April: direct materials, 75,000; conversion costs, 220,000. Holmes uses the weighted average method. Required: 1. Compute the unit cost for April. 2. Determine the cost of ending work in process and the cost of goods transferred out.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY