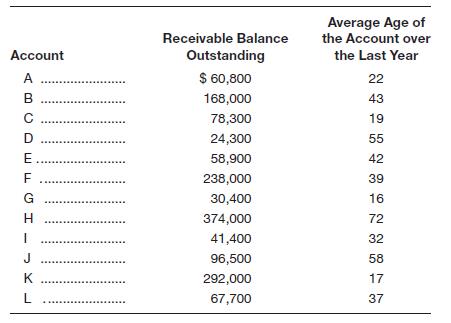

Charming Paper Company sells to the 12 accounts listed here:

Capital Financial Corporation will lend 90 percent against account balances that have averaged 30 days or less; 80 percent for account balances between 31 and 40 days; and 70 percent for account balances between 41 and 45 days. Customers that take over 45 days to pay their bills are not considered acceptable accounts for a loan. The current prime rate is 15.5 percent, and Capital charges 4.5 percent over prime to Charming as its annual loan rate.

a. Determine the maximum loan for which Charming Paper Company could qualify.

b. Determine how much one month’s interest expense would be on the loan balance determined in part a.

Want to see the full answer?

Check out a sample textbook solution

Chapter 8 Solutions

Loose Leaf for Foundations of Financial Management Format: Loose-leaf

- Summit Record Company is negotiating with two banks for a $122,000 loan. Fidelity Bank requires a compensating balance of 20 percent, discounts the loan, and wants to be paid back in four quarterly payments. Southwest Bank requires a compensating balance of 10 percent, does not discount the loan, but wants to be paid back in 12 monthly installments. The stated rate for both banks is 9 percent. Compensating balances will be subtracted from the $122,000 in determining the available funds in part a. a-1. Calculate the effective interest rate for Fidelity Bank and Southwest Bank. (Do not round intermediate calculations. Input your answers as a percent rounded to 2 decimal places.) Fidelity Bank Southwest Bank a-2. Which loan should Summit accept? Southwest Bank O Fidelity Bank Effective Rate of Interest b. Recompute the effective cost of interest, assuming that Summit ordinarily maintains $24,400 at each bank in deposits that will serve as compensating balances. (Do not round intermediate…arrow_forwardCumberland Furniture wishes to establish a prearranged borrowing agreement with its local commercial bank. The bank’s terms for a line of credit are 3.30% over the prime rate, and each year the borrowing must be reduced to zero for a 30-day period. For an equivalentrevolving credit agreement, the rate is 2.80% over prime with a commitment feeof 0.50% on the average unused balance. With both loans, the required compensating balance is equal to 20% of the amount borrowed. The prime rate is currently 8%. Both agreements have $4 million borrowing limits. The firm expects on average to borrow $2 million during the year no matter which loan agreement it decides to use. What is the effective annual rate under the line of credit? b. What is the effective annual rate under the revolving credit agreement? (Hint: Compute the ratio of the dollars that the firm will pay in interest and commitment fees to the dollars that the firm will effectively have used of.) If the firm does expect to borrow…arrow_forwardYasha Co. sells 400,000 of accounts receivable to a factor and receiving 75%of the value of the factored account less 10% commission. Yasha already establish a doubtful allowance for this receivable at 5% and sales discount of 2%. How much should Yasha received upon the remittance of the factor's holdback, assuming a customer was given a credit of 15,000 for the sales return?arrow_forward

- Slingshot Machine Tool Co. owes $40,000 to one of its suppliers. The supplier has offered a trade discount of 2/10 net 30. Slingshot can borrow the funds from either of two banks: First City Bank will loan the funds for 20 days at a cost of $400; Upstart Bank offers a discounted loan for 20 days at a cost of $320. -What is the cost of failing to take the discount? -What is the effective interest rate on each of the loans? -Should Slingshot take the cash discount?-Which bank loan should Slingshot use?arrow_forwardFoods Galore has a line of credit of $325,000 with an interest rate of 1.85 percent per quarter. The credit line also requires that 2.5 percent of the unused portion of the credit line be deposited in a non-interest-bearing account as a compensating balance. Food Galore's short-term investments are earning .48 percent per quarter. What is the effective annual interest rate on this arrangement if the line of credit goes unused all year? Assume any funds borrowed or invested use compound interest.arrow_forwardJhar Industries has borrowed $125,000 under a line-of-credit agreement. While the company normally maintains a checking account balance of $15,000 in the lending bank, this credit line requires a 20% compensating balance. The stated interest rate on the borrowed funds is 10%. Show Solutions and Explanation. A. What is the effective annual rate of interest on the line of credit? (Format: 11.11%)arrow_forward

- Your company has arranged a revolving credit agreement for up to $82 million at an interest rate of 1.51 percent per quarter. The agreement also requires your company to maintain a compensating balance of 4 percent of the unused portion of the credit line, to be deposited in a non-interest bearing account. Your company's short-term investment account at the same bank pays an interest rate of .65 per quarter. What is the effective annual interest rate if your company does not use the revolving credit arrangement during the year? Multiple Choice O O O O 3.30% 6.18% 3.85% 2.89% 2.63%arrow_forwardJason Industries has a line of credit at Bank Lucas that requires it to pay 11% interest on its borrowing and to maintain a compensating balance equal to 15% of the amount borrowed. The firm has borrowed $800,000 during the year under the agreement. Show Solutions and Explanation. Calculate the effective annual rate on the firm’s borrowing in each of the following circumstances: A. The firm normally maintains no deposit balances at Bank Lucas (Format: 11.11%) B. The firm normally maintains $70,000 in deposit balances at Bank Lucas. (Format: 11.11%) C. The firm normally maintains $150,000 in deposit balances at Bank Lucas. (Format: 11%)arrow_forwardHBC Inc. buys on terms of 2/10, net 30 days. It does not take discounts, and it typically pays 30 days after the invoice date. Net purchases amount to P1,750,000 per year. On average, how much “free” trade credit does HBC receive during the year? (Assume a 365-day year.)arrow_forward

- Jackson Industries has borrowed $125,000 under a line-of-credit agreement. While the company normally maintains a checking account balance of $15,000 in the lending bank, this credit line requires a 20% compensating balance. The stated interest rate on the borrowed funds is 10%. 1.What is the effective annual rate of interest on the line of credit? Format: 11.11%arrow_forwardBlack Panther Inc. buys on terms of 2/15, net 60 days. It does not take discounts, and it typically pays on time, 60 days after the invoice date. Net purchases amount to P450,000 per year. On average, how much “free” trade credit does the firm receive during the year? (Assume a 365-day year, and note that purchases are net of discounts.)arrow_forwardWrexham Corp. (WC) purchases computer parts from its suppliers 1/15, net 30. However, to take advantage of the discount WC needs to get a bank loan. The bank charges 8% interest (APR) and a one percent origination fee for the loan (assume the loan is for 1 year and is renewed yearly). What is the effective annual cost of not taking the trade discount? What is the effective cost of the bank loan? Should WC take out the bank loan to take advantage of the trade credit?arrow_forward

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT