Loose Leaf for Foundations of Financial Management Format: Loose-leaf

17th Edition

ISBN: 9781260464924

Author: BLOCK

Publisher: Mcgraw Hill Publishers

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 8, Problem 11P

McGriff Dog Food Company normally takes 27 days to pay for average daily credit purchases of

a. What is its net credit position? That is, compute its accounts receivable and accounts payable and subtract the latter from the former.

b. If the firm extends its average payment period from 27 days to 37 days (and all else remains the same), what is the firm’s new net credit position? Has it improved its cash flow?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Terry's hardware normally takes 27 days to pay for average daily credit purchases of $9,530. Its average daily sales are $10,680, and it collects accounts in 32 days.

A. What is its net credit position? Compute its account receivable and accounts payable and subtract the latter from the former.

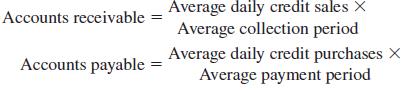

Accounts receivable = Average daily credit sales x Average collection period

Accounts payable = Average daily credit purchases x Average payment period

B. If the firm extends its average payment period from 27 days to 37 days (all else remains the same), what is the firm's new net credit position? Has it improved its cash flow?

McGriff Dog Food Company normally takes 30 days to pay for average daily credit purchases of $9,730. Its average daily sales

are $10,010, and it collects accounts in 32 days.

a. What is its net credit position?

Net credit position

b-1. If the firm extends its average payment period from 30 days to 37 days (and all else remains the same), what is the firm's

new net credit position? (Negative amount should be indicated by a minus sign.)

Net credit position

b-2. Has the firm improved its cash flow?

Yes

No

Route Canal Shipping Company has the following schedule for aging of accounts receivable:

Age of Receivables

April 30, 20X1

(3)

(2)

Age of

Account

0-30

31-60

61-90

91-120

(1)

Month of

Sales

April

March

February

January

Total receivables

Month of Sales

April

March

a. Calculate the percentage of amount due for each month.

February

January

Amounts

$120,540

86,100

103,320

34,440

$344,400

Total receivables

Percent of

Amount Due

%

%

%

do

(4)

Percent of

Amount Due

%

100 %

100%

Chapter 8 Solutions

Loose Leaf for Foundations of Financial Management Format: Loose-leaf

Ch. 8 - Under what circumstances would it be advisable to...Ch. 8 - Discuss the relative use of credit between large...Ch. 8 - Prob. 3DQCh. 8 - Prob. 4DQCh. 8 - Prob. 5DQCh. 8 - Prob. 6DQCh. 8 - Prob. 7DQCh. 8 - Prob. 8DQCh. 8 - Prob. 9DQCh. 8 - Prob. 10DQ

Ch. 8 - Prob. 11DQCh. 8 - Prob. 12DQCh. 8 - Compute the cost of not taking the following cash...Ch. 8 - Regis Clothiers can borrow from its bank at 17...Ch. 8 - Simmons Corp. can borrow from its bank at 17...Ch. 8 - Your bank will lend you $4,000 for 45 days at a...Ch. 8 - Prob. 5PCh. 8 - Prob. 6PCh. 8 - Mary Ott is going to borrow $10,400 for 120 days...Ch. 8 - Prob. 8PCh. 8 - Prob. 9PCh. 8 - Prob. 10PCh. 8 - McGriff Dog Food Company normally takes 27 days to...Ch. 8 - Maxim Air Filters Inc. plans to borrow $300,000...Ch. 8 - Digital Access Inc. needs $400,000 in funds for a...Ch. 8 - Carey Company is borrowing $200,000 for one year...Ch. 8 - Randall Corporation plans to borrow $233,000 for...Ch. 8 - Prob. 16PCh. 8 - Your company plans to borrow $13 million for 12...Ch. 8 - If you borrow $5,300 at $400 interest for one...Ch. 8 - Zerox Copying Company plans to borrow $172,000 ....Ch. 8 - Prob. 20PCh. 8 - Mr. Hugh Warner is a very cautious businessman....Ch. 8 - The Reynolds Corporation buys from its suppliers...Ch. 8 - Prob. 23PCh. 8 - Neveready Flashlights Inc. needs $340,000 to take...Ch. 8 - Harper Engine Company needs $631,000 to take a...Ch. 8 - Summit Record Company is negotiating with two...Ch. 8 - Charming Paper Company sells to the 12 accounts...Ch. 8 - The treasurer for Pittsburgh Iron Works wishes to...Ch. 8 - Prob. 2WECh. 8 - Prob. 3WE

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- McGriff Dog Food Company normally takes 28 days to pay for average daily credit purchases of $9,540. Its average daily sales are $10,710, and it collects accounts in 32 days.a. What is its net credit position? b-1. If the firm extends its average payment period from 28 days to 38 days (and all else remains the same), what is the firm's new net credit position? (Negative amount should be indicated by a minus sign.)arrow_forwardJaxon Markets currently has credit terms of net 30, an average collection period of 29 days, and average receivables of $211,410. The firm estimates that if it offered terms of 2/10, net 30 that 45 percent of its customers would pay on day 10 with the remainder paying on average in 32 days. How much cash could the company free up from its accounts receivables if it switched its credit policy?arrow_forwardABCD Corporation has credit sales of $10,640,000 and receivables of $1,520,000. a. What is the receivables turnover?b. What is the average collection period (days sales outstanding)?c. If the company offers credit terms of 30 days, are its receivables past due?arrow_forward

- Please Solve This Question 1. Medwing Corporation has a DSO of 19 days. The company averages 5,500 in credit sales each day. What is the company’s average accounts receivable?arrow_forwardAssume that ABC Corporation pays for each purchase three (3) weeks after date of purchase. Maintains its inventory at a level equal to 9-day sales and are made on a 30-day charge basis.How long the cash cycle is and how many cash cycles it has in one year? Solution: 2. If ABC Corporation has annual credit sales of Ᵽ990,000 and its average accounts receivable is Ᵽ100,000, how many is its average collection period? Assuming that receivable turnover rate increases by 25%, how much would then be the estimated change in accounts receivable.Solution: 3. The following data are available from the records of ABC Corporation Annual sales Ᵽ 396,000Cost 70%Average inventory 50,000Based on the above information determine the following:a) Number of days sales in average inventoryb) Average inventory assuming that desired inventory turnover rateis 12x in one year. Solution:arrow_forwardDome Metals has credit sales of $342,000 yearly with credit terms of net 45 days, which is also the average collection period. Dome does not offer a discount for early payment, so its customers take the full 45 days to pay. a. What is the average receivables balance? (Use a 360-day year.)b. What is the receivables turnover? (Use a 360-day year.)arrow_forward

- Blackwell Co. has credit sales of $317,428, costs of goods sold of $151,217, and average accounts receivable of $28,744. How long on average does it take the firm's credit customers to pay for their purchases? Multiple Choice 33.05 days 27.99 days 31.37 days 29.95 days 38.23 daysarrow_forwardWhich one of the following statements is correct if a firm has a receivables turnover of 10? It takes the firm an average of 36.5 days to sell its items. The firm has ten times more in accounts receivable than it does in cash. The firm collects its credit sales in an average of 36.5 days. It takes the firm 10 days to collect payment from its customers.arrow_forwardKK Co. normally takes 30 days to pay for its average daily credit purchases of P2,000. Its average daily sales are P3,000, and it collects accounts in 25 days. What is its net credit position? (Note that a negative position implies receivables exceed payables.)A. P1,000 C. P15,000B. (P1,000) D. (P15,000)arrow_forward

- You prefer to extend credit on the assumption that you will be paid in fullwithin 30 days of the sales. Firm X has average inventory of $600,000 with all cash sales (no credit sales) of $6,000,000. If you extend credit to this firm, can you expect to be paid on time?arrow_forwardABCD Corporation has credit sales of $8,460,000 and receivables of $1,260,000. Assume there are 365 days in a year. What is the receivables turnover? Round your answer to two decimal places. What is the average collection period (days sales outstanding)? Round your answer to the nearest whole number. days If the company offers credit terms of 30 days, are its receivables past due? Round your answer to the nearest whole number. Enter zero if the receivables are not past due. , it is days overdue.arrow_forward4. On average it takes Acme Tool Company 80 days to collect on its sales receivables, and its operating cycle is 290 days. a. How long is cash typically tied up in inventories? (Show computations) b. What would be the likely effect to Acme's operating cycle if the company changes its current policy that sales upon credit must be paid within 3 months, instead requiring payment within 2 months? (No calculations needed, just describe the likely effect on Acme's operating cycle.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

The management of receivables Introduction - ACCA Financial Management (FM); Author: OpenTuition;https://www.youtube.com/watch?v=tLmePnbC3ZQ;License: Standard YouTube License, CC-BY