Concept explainers

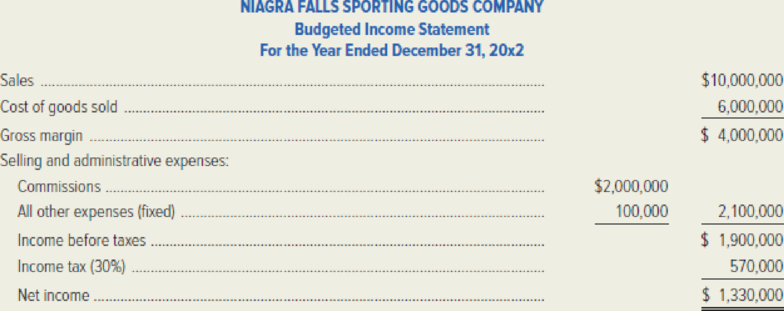

Niagra Falls Sporting Goods Company, a wholesale supply company, engages independent sales agents to market the company’s products throughout New York and Ontario. These agents currently receive a commission of 20 percent of sales, but they are demanding an increase to 25 percent of sales made during the year ending December 31, 20x2. The controller already prepared the 20x2 budget before learning of the agents’ demand for an increase in commissions. The budgeted 20x2 income statement is shown below. Assume that cost of goods sold is 100 percent variable cost.

The company’s sales manager, Joey Dulwich, is considering the possibility of employing full-time sales personnel. Three individuals would be required, at an estimated annual salary of $30,000 each, plus commissions of 5 percent of sales. In addition, a sales manager would be employed at a fixed annual salary of $160,000. All other fixed costs, as well as the variable cost percentages, would remain the same as the estimates in the 20x2

Required:

- 1. Compute Niagra Falls Sporting Goods’ estimated break-even point in sales dollars for the year ending December 31, 20x2, based on the budgeted income statement prepared by the controller.

- 2. Compute the estimated break-even point in sales dollars for the year ending December 31, 20x2, if the company employs its own sales personnel.

- 3. Compute the estimated volume in sales dollars that would be required for the year ending December 31, 20x2, to yield the same net income as projected in the budgeted income statement, if management continues to use the independent sales agents and agrees to their demand for a 25 percent sales commission.

- 4. Compute the estimated volume in sales dollars that would generate an identical net income for the year ending December 31, 20x2, regardless of whether Niagra Falls Sporting Goods Company employs its own sales personnel or continues to use the independent sales agents and pays them a 25 percent commission.

Want to see the full answer?

Check out a sample textbook solution

Chapter 7 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

- Norton Company, a manufacturer of infant furniture and carriages, is in the initial stages of preparing the annual budget for the coming year. Scott Ford has recently joined Nortons accounting staff and is interested in learning as much as possible about the companys budgeting process. During a recent lunch with Marge Atkins, sales manager, and Pete Granger, production manager, Ford initiated the following conversation. FORD: Since Im new around here and am going to be involved with the preparation of the annual budget, Id be interested in learning how the two of you estimate sales and production numbers. ATKINS: We start out very methodically by looking at recent history, discussing what we know about current accounts, potential customers, and the general state of consumer spending. Then, we add that usual dose of intuition to come up with the best forecast we can. GRANGER: I usually take the sales projections as the basis for my projections. Of course, we have to make an estimate of what this years closing inventories will be, which is sometimes difficult. FORD: Why does that present a problem? There must have been an estimate of closing inventories in the budget for the current year. GRANGER: Those numbers arent always reliable since Marge makes some adjustments to the sales numbers before passing them on to me. FORD: What kind of adjustments? ATKINS: Well, we dont want to fall short of the sales projections so we generally give ourselves a little breathing room by lowering the initial sales projection anywhere from 5 to 10 percent. GRANGER: So, you can see why this years budget is not a very reliable starting point. We always have to adjust the projected production rates as the year progresses, and of course, this changes the ending inventory estimates. By the way, we make similar adjustments to expenses by adding at least 10 percent to the estimates; I think everyone around here does the same thing. Required: 1. Marge Atkins and Pete Granger have described the use of budgetary slack. a. Explain why Atkins and Granger behave in this manner, and describe the benefits they expect to realize from the use of budgetary slack. b. Explain how the use of budgetary slack can adversely affect Atkins and Granger. 2. As a management accountant, Scott Ford believes that the behavior described by Marge Atkins and Pete Granger may be unethical and that he may have an obligation not to support this behavior. By citing the specific standards of competence, confidentiality, integrity, and/or credibility from the Statement of Ethical Professional Practice (in Chapter 1), explain why the use of budgetary slack may be unethical. (CMA adapted)arrow_forwardShalimar Company manufactures and sells industrial products. For next year, Shalimar has budgeted the follow sales: In Shalimars experience, 10 percent of sales are paid in cash. Of the sales on account, 65 percent are collected in the quarter of sale, 25 percent are collected in the quarter following the sale, and 7 percent are collected in the second quarter after the sale. The remaining 3 percent are never collected. Total sales for the third quarter of the current year are 4,900,000 and for the fourth quarter of the current year are 6,850,000. Required: 1. Calculate cash sales and credit sales expected in the last two quarters of the current year, and in each quarter of next year. 2. Construct a cash receipts budget for Shalimar Company for each quarter of the next year, showing the cash sales and the cash collections from credit sales. 3. What if the recession led Shalimars top management to assume that in the next year 10 percent of credit sales would never be collected? The expected payment percentages in the quarter of sale and the quarter after sale are assumed to be the same. How would that affect cash received in each quarter? Construct a revised cash budget using the new assumption.arrow_forwardNozama.com Inc. sells consumer electronics over the Internet. For the next period, the budgeted cost of the sales order processing activity is 250,000 and 50,000 sales orders are estimated to be processed. a. Determine the activity rate of the sales order processing activity. b. Determine the amount of sales order processing cost associated with 30,000 sales orders.arrow_forward

- The Sea Wharf Restaurant would like to determine the best way to allocate a monthly advertising budget of 1,000 between newspaper advertising and radio advertising. Management decided that at least 25% of the budget must be spent on each type of media and that the amount of money spent on local newspaper advertising must be at least twice the amount spent on radio advertising. A marketing consultant developed an index that measures audience exposure per dollar of advertising on a scale from 0 to 100, with higher values implying greater audience exposure. If the value of the index for local newspaper advertising is 50 and the value of the index for spot radio advertising is 80, how should the restaurant allocate its advertising budget to maximize the value of total audience exposure? a. Formulate a linear programming model that can be used to determine how the restaurant should allocate its advertising budget in order to maximize the value of total audience exposure. b. Develop a spreadsheet model and solve the problem using Excel Solver.arrow_forwardExquisite Bedding Ltd. The company uses a rolling budgetary control system and is in the process of preparing the budget for the four months’ period from September to December 2020. During a preliminary review, you established that the company intends to sell each bed produced for $219 to Ultimate Care Ltd. in addition to individual customers on the same credit terms. Exquisite Bedding Ltd secured a cash loan of $120,000 (from Barclays Bank) that was secured on the land and buildings at an interest rate of 7 ½ % and this is due to be received in November 2020. Also, machinery costing $112,000 will be received in November and paid for in December 2020. You have been provided with the following budgeted balance sheet information for Exquisite Bedding Ltd as at September 1, 2020 well as estimates and other operating data (PLEASE SEE BALANCE SHEET ATTACHED AS PHOTO) Other information: Stock valuation was done using FIFO method and the closing stock of raw materials is for 100 units and…arrow_forwardExquisite Bedding Ltd. The company uses a rolling budgetary control system and is in the process of preparing the budget for the four months’ period from September to December 2020. During a preliminary review, you established that the company intends to sell each bed produced for $219 to Ultimate Care Ltd. in addition to individual customers on the same credit terms. Exquisite Bedding Ltd secured a cash loan of $120,000 (from Barclays Bank) that was secured on the land and buildings at an interest rate of 7 ½ % and this is due to be received in November 2020. Also, machinery costing $112,000 will be received in November and paid for in December 2020. You have been provided with the following budgeted balance sheet information for Exquisite Bedding Ltd as at September 1, 2020 well as estimates and other operating data (PLEASE SEE BALANCE SHEET ATTACHED AS PHOTO) Other information: Stock valuation was done using FIFO method and the closing stock of raw materials is for 100 units and…arrow_forward

- Exquisite Bedding Ltd. The company uses a rolling budgetary control system and is in the process of preparing the budget for the four months’ period from September to December 2020. During a preliminary review, you established that the company intends to sell each bed produced for $219 to Ultimate Care Ltd. in addition to individual customers on the same credit terms. Exquisite Bedding Ltd secured a cash loan of $120,000 (from Barclays Bank) that was secured on the land and buildings at an interest rate of 7 ½ % and this is due to be received in November 2020. Also, machinery costing $112,000 will be received in November and paid for in December 2020. You have been provided with the following budgeted balance sheet information for Exquisite Bedding Ltd as at September 1, 2020 well as estimates and other operating data (PLEASE SEE BALANCE SHEET ATTACHED AS PHOTO) Other information: Stock valuation was done using FIFO method and the closing stock of raw materials is for 100 units and…arrow_forwardShaak Corporation uses customers served as its measure of activity. The company bases its budgets on the following information: Revenue should be $4.20 per customer served. Wages and salaries should be $21,800 per month plus $1.00 per customer served. Supplies should be $0.70 per customer served. Insurance should be $5,700 per month, Miscellaneous expenses should be $3,900 per month plus $0.30 per customer served. The company reported the following actual results for October: Customers served Revenue Wages and salaries Supplies Insurance Miscellaneous expense Required: 22,500 $ 137,300 $ 40,600 $ 16,300 $ 5,580 $ 7,480 Prepare a report showing the company's revenue and spending variances for October. Label each variance as favorable (F) or unfavorable (U). Note: Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values. Shaak Corporation Revenue and Spending Variances…arrow_forwardGarden Depot is a retailer that is preparing its budget for the upcoming fiscal year. Managementhas prepared the following summary of its budgeted cash flows: (picture) The company’s beginning cash balance for the upcoming fiscal year will be $20,000. The company requires a minimum cash balance of $10,000 and may borrow any amount needed from a local bank at a quarterly interest rate of 3%. The company may borrow any amount at the beginning of any quarter and may repay its loans, or any part of its loans, at the end of any quarter. Interest payments are due on any principal at the time it is repaid. For simplicity, assume that interest is not compounded. Required: Prepare the company’s cash budget for the upcoming fiscal yeararrow_forward

- Shaak Corporation uses customers served as its measure of activity. The company bases its budgets on the following information: Revenue should be $6.30 per customer served. Wages and salaries should be $22,300 per month plus $0.90 per customer served. Supplies should be $0.80 per customer served. Insurance should be $5,950 per month. Miscellaneous expenses should be $4,400 per month plus $0.20 per customer served. The company reported the following actual results for October: Customers served Revenue. Wages and salaries Supplies Insurance Miscellaneous expense Required: Prepare a report showing the company's revenue and spending variances for October. Label each variance as favorable (F) or unfavorable (U). Note: Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values. Customers served Revenue Expenses: Wages and salaries Supplies Insurance 22,750 $ 177,300 $ 40,725 $…arrow_forwardPittman Company is a small but growing manufacturer of telecommunications equipment. The company has no sales force of its own; rather, it relies completely on independent sales agents to market its products. These agents are paid a sales commission of 19% for all items sold.Barbara Cheney, Pittman�s controller, has just prepared the company�s budgeted income statement for next year. The statement follows:Pittman CompanyBudgeted Income StatementFor the Year Ended December 31Sales $ 19,900,000Manufacturing expenses:Variable $ 7,850,000Fixed overhead 2,860,000 10,710,000Gross margin 9,190,000Selling and administrative expenses:Commissions to agents 3,781,000Fixed marketing expenses 250,000*Fixed administrative expenses 2,450,000 6,481,000Net operating income $ 2,709,000Fixed interest expenses 670,000Income before income taxes 2,039,000Income taxes (20%) 407,800Net income 1,631,200*Primarily depreciation on storage facilities.As Barbara handed the statement to…arrow_forwardArtemis, Inc. has developed a specialized wholesale business selling archery equipment to sporting goods stores. The Artemis cost accountants are going through their quarterly budgeting process and have determined that • Sales (in dollars) are expected to be $260,000 for January, $270,000 for February, and $250,000 for March • The company expects to collect cash from credit sales according to this pattern: 60% in the month of sale and 40% in the month following the sale. Cost of goods sold is expected to be approximately 60% of sales. Artemis would like to have inventory at the end of each month equal to 40% of the cost of goods sold budgeted for the following month. When Artemis purchases archery equipment for its suppliers, they generally make payment in the month following the purchase. . . • At January 1, the beginning balance in the accounts receivable account is $61,000. At January 1, the beginning balance in the accounts payable account is $248,000. . Required: a. Prepare a…arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning