Concept explainers

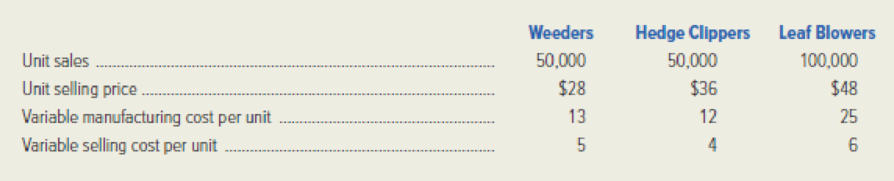

Cincinnati Tool Company (CTC) manufactures a line of electric garden tools that are sold in general hardware stores. The company’s controller, Will Fulton, has just received the sales

For 20x2, CTC’s fixed manufacturing overhead is budgeted at $2,000,000, and the company’s fixed selling and administrative expenses are forecasted to be $600,000. CTC has a tax rate of 40 percent.

Required:

- 1. Determine CTC’s budgeted net income for 20x2.

- 2. Assuming the sales mix remains as budgeted, determine how many units of each product CTC must sell in order to break even in 20x2.

- 3. After preparing the original estimates, management determined that its variable

manufacturing cost of leaf blowers would increase by 20 percent, and the variable selling cost of hedge clippers could be expected to increase by $1.00 per unit. However, management has decided not to change the selling price of either product. In addition, management has learned that its leaf blower has been perceived as the best value on the market, and it can expect to sell three times as many leaf blowers as each of its other products. Under these circumstances, determine how many units of each product CTC would have to sell in order to break even in 20x2.

Want to see the full answer?

Check out a sample textbook solution

Chapter 7 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

- The managers of Lessing Toy & Hobby (LTH) have decided to keep the stores in the Northern Division open, in spite of the dwindling demand in the area. They want to forecast what the income will be in the coming year, using the income statement as the base. The cost analyst at LTH estimates sales in the coming year will only be 85 percent of the current year sales. Cost of goods sold is estimated to be 90 percent of the current year. The managers have decided to increase advertising next year by 10 percent above the current year, but will cut administrative salaries in the Northern Division by 30 percent. They also expect to lower rent and occupancy costs by 15 percent. Allocated corporate overhead, based on information from the CFO, is expected to be $1.2 million. Required: Prepare an income statement for Year 2 for the Northern Division based on the estimates provided by the cost analyst and other managers at LTH. Note: Enter your answers in thousands e.g., 10,000,000 should be…arrow_forwardNico Parts, Inc., produces electronic products with short life cycles (of less than two years). Development has to be rapid, and the profitability of the products is tied strongly to the ability to find designs that will keep production and logistics costs low. Recently, management has also decided that post-purchase costs are important in design decisions. Last month, a proposal for a new product was presented to management. The total market was projected at 200,000 units (for the two-year period). The proposed selling price was 130 per unit. At this price, market share was expected to be 25 percent. The manufacturing and logistics costs were estimated to be 120 per unit. Upon reviewing the projected figures, Brian Metcalf, president of Nico, called in his chief design engineer, Mark Williams, and his marketing manager, Cathy McCourt. The following conversation was recorded: BRIAN: Mark, as you know, we agreed that a profit of 15 per unit is needed for this new product. Also, as I look at the projected market share, 25 percent isnt acceptable. Total profits need to be increased. Cathy, what suggestions do you have? CATHY: Simple. Decrease the selling price to 125 and we expand our market share to 35 percent. To increase total profits, however, we need some cost reductions as well. BRIAN: Youre right. However, keep in mind that I do not want to earn a profit that is less than 15 per unit. MARK: Does that 15 per unit factor in preproduction costs? You know we have already spent 100,000 on developing this product. To lower costs will require more expenditure on development. BRIAN: Good point. No, the projected cost of 120 does not include the 100,000 we have already spent. I do want a design that will provide a 15-per-unit profit, including consideration of preproduction costs. CATHY: I might mention that post-purchase costs are important as well. The current design will impose about 10 per unit for using, maintaining, and disposing our product. Thats about the same as our competitors. If we can reduce that cost to about 5 per unit by designing a better product, we could probably capture about 50 percent of the market. I have just completed a marketing survey at Marks request and have found out that the current design has two features not valued by potential customers. These two features have a projected cost of 6 per unit. However, the price consumers are willing to pay for the product is the same with or without the features. Required: 1. Calculate the target cost associated with the initial 25 percent market share. Does the initial design meet this target? Now calculate the total life-cycle profit that the current (initial) design offers (including preproduction costs). 2. Assume that the two features that are apparently not valued by consumers will be eliminated. Also assume that the selling price is lowered to 125. a. Calculate the target cost for the 125 price and 35 percent market share. b. How much more cost reduction is needed? c. What are the total life-cycle profits now projected for the new product? d. Describe the three general approaches that Nico can take to reduce the projected cost to this new target. Of the three approaches, which is likely to produce the most reduction? 3. Suppose that the Engineering Department has two new designs: Design A and Design B. Both designs eliminate the two nonvalued features. Both designs also reduce production and logistics costs by an additional 8 per unit. Design A, however, leaves post-purchase costs at 10 per unit, while Design B reduces post-purchase costs to 4 per unit. Developing and testing Design A costs an additional 150,000, while Design B costs an additional 300,000. Assuming a price of 125, calculate the total life-cycle profits under each design. Which would you choose? Explain. What if the design you chose cost an additional 500,000 instead of 150,000 or 300,000? Would this have changed your decision? 4. Refer to Requirement 3. For every extra dollar spent on preproduction activities, how much benefit was generated? What does this say about the importance of knowing the linkages between preproduction activities and later activities?arrow_forwardBienestar, Inc., has two plants that manufacture a line of wheelchairs. One is located in Kansas City, and the other in Tulsa. Each plant is set up as a profit center. During the past year, both plants sold their tilt wheelchair model for 1,620. Sales volume averages 20,000 units per year in each plant. Recently, the Kansas City plant reduced the price of the tilt model to 1,440. Discussion with the Kansas City manager revealed that the price reduction was possible because the plant had reduced its manufacturing and selling costs by reducing what was called non-value-added costs. The Kansas City manufacturing and selling costs for the tilt model were 1,260 per unit. The Kansas City manager offered to loan the Tulsa plant his cost accounting manager to help it achieve similar results. The Tulsa plant manager readily agreed, knowing that his plant must keep pacenot only with the Kansas City plant but also with competitors. A local competitor had also reduced its price on a similar model, and Tulsas marketing manager had indicated that the price must be matched or sales would drop dramatically. In fact, the marketing manager suggested that if the price were dropped to 1,404 by the end of the year, the plant could expand its share of the market by 20 percent. The plant manager agreed but insisted that the current profit per unit must be maintained. He also wants to know if the plant can at least match the 1,260 per-unit cost of the Kansas City plant and if the plant can achieve the cost reduction using the approach of the Kansas City plant. The plant controller and the Kansas City cost accounting manager have assembled the following data for the most recent year. The actual cost of inputs, their value-added (ideal) quantity levels, and the actual quantity levels are provided (for production of 20,000 units). Assume there is no difference between actual prices of activity units and standard prices. Required: 1. Calculate the target cost for expanding the Tulsa plants market share by 20 percent, assuming that the per-unit profitability is maintained as requested by the plant manager. 2. Calculate the non-value-added cost per unit. Assuming that non-value-added costs can be reduced to zero, can the Tulsa plant match the Kansas City per-unit cost? Can the target cost for expanding market share be achieved? What actions would you take if you were the plant manager? 3. Describe the role that benchmarking played in the effort of the Tulsa plant to protect and improve its competitive position.arrow_forward

- Littlefield Partners produce a part sold to agricultural equipment suppliers. For the last year (Year 1), the price, costs, and volume of the part were as follows: Unit price Unit variable cost Annual fixed cost Sales volume Managers at Littlefield believe that next year (Year 2), conditions in the industry will result in lower prices, both for the part they sell and the materials they purchase. Their best estimates at this time are that the selling price will decline by 10 percent while the unit variable cost will decline by 5 percent, taking into account the changes in both materials and labor. They believe that fixed costs will remain the same. $ 60 $ 40 Required: a. What was the break-even volume in number of units last year (Year 1)? b. Assume that the managers estimates are correct for Year 2. How many units would have to be sold in Year 2 to earn the same operating profits as earned in Year 1? Required A Required B $ 3,320,000 c. Assume that the managers' estimates on price and…arrow_forwardBlue Skies Inc. is a retail gardening company that is piloting a new strategic initiative aimed at increasing gross profit. Currently, the company’s gross profit is 25% of sales, and its target gross profit percentage is 30%. The company’s current monthly sales revenue is $600,000.The new initiative being piloted is to produce goods in-house instead of buying them from wholesale suppliers. Its in-house production process has two procedures. The makeup of the costsof production for Procedure 1 is 40% direct labor, 45% direct materials, and 15% overhead. The makeup of the costs of production for Procedure 2 is 60% direct labor, 30% direct materials, and 10% overhead. Assume that Procedure 1 costs twice as much as Procedure 2.Instructions1. Determine what the cost of labor, materials, and overhead for both Procedures 1 and 2 wouldneed to be for the company to meet its target gross profit.2. The company’s actual labor cost is $114,000 for Procedure 1. Determine the actual cost of…arrow_forwardThe Monroe Forging Company sells a corrugated steel product to the Standard Manufacturing Company and is in competition on such sales with other suppliers of the Standard Manufacturing Co. The vice president of sales of Monroe Forging Co. believes that by reducing the price of the product, a 40% increase in the volume of units sold to the Standard Manufacturing Co. could be secured. As the manager of the cost and analysis department, you have been asked to analyze the proposal of the vice president and submit your recommendations as to whether it is financially beneficial to the Monroe Forging Co. You are specifically requested to determine the following: (a) Net profit or loss based on the pricing proposal. (b) Unit sales volume under the proposed price that is required to make the same $40,000 profit that is now earned at the current price and unit sales volume. Use the following data in your analysis:arrow_forward

- Quality Chairs Incorporated (QC) manufactures chairs for industrial use. Laura Winters, the Vice President for Marketing at QC, concluded from market analysis that sales were dwindling for QC's standard three-foot chair due to aggressive pricing by competitors. QC's chairs sold for $580 whereas the competition's comparable chair was selling for $525. Winters determined that a price drop to $525 would be necessary to regain market share and reach a targeted annual sales level of 10,000 chairs. Cost data based on sales of 10,000 chairs: Budgeted Quantity Actual Quantity Actual Cost Direct materials (board feet) 90,100 81,300 $ 1,280,000 Direct labor (hours) 73,800 76,300 905,000 Machine hours (hours) 12,800 12,600 280,000 Finishing and packing (hours) 8,100 7,900 155,000 The current cost per unit is: Multiple Choice $262.00. $312.00. $412.00. $462.00. $487.00.arrow_forwardCalabria Healthcare supplies prescription drugs to pharmacies. As the management accountant,you are required to analyze the financial statements for this quarter. You already have analyzedthe company’s two divisions, Name Brand and Generic, and your supervisor wants an analysis ofthe comparable profitability of the SBUs. The contribution margins are $500,000 and $200,000,respectively; the controllable fixed costs are $200,000 and $50,000; and the noncontrollable fixedcosts are $50,000 and $100,000. Assume there are no nontraceable fixed costs.What are the total contributions by profit center (CPC) for the Name Brand and Genericdivisions, respectively?a. Name Brand: $300,000; Generic: $150,000b. Name Brand: $250,000; Generic: $50,000c. Name Brand: $200,000; Generic: $50,000d. Name Brand: $500,000; Generic: 200,000arrow_forwardQuality Chairs Incorporated (QC) manufactures chairs for industrial use. Laura Winters, the Vice President for Marketing at QC, concluded from market analysis that sales were dwindling for QC's standard three-foot chair due to aggressive pricing by competitors. QC's chairs sold for $550 whereas the competition's comparable chair was selling for $495. Winters determined that a price drop to $495 would be necessary to regain market share and reach a targeted annual sales level of 10,000 chairs.Cost data based on sales of 10,000 chairs: Budgeted Quantity Actual Quantity Actual Cost Direct materials (board feet) 88,000 79,500 $ 1,250,000 Direct labor (hours) 71,350 73,775 875,000 Machine hours (hours) 11,400 11,250 250,000 Finishing and packing (hours) 6,500 6,400 125,000 The current profit per unit is: Multiple Choice $250. $300. $400. $450. $475.arrow_forward

- Nico Parts, Inc., produces electronic products with short life cycles (of less than two years). Development has to be rapid, and the profitability of the products is tied strongly to the ability to find designs that will keep production and logistics costs low. Recently, management has also decided that post-purchase costs are important in design decisions. Last month, a proposal for a new product was presented to management. The total market was projected at 220,000 units (for the two-year period). The proposed selling price was $145 per unit. At this price, market share was expected to be 25 percent. The manufacturing and logistics costs were estimated to be $136 per unit. Upon reviewing the projected figures, Brian Metcalf, president of Nico, called in his chief design engineer, Mark Williams, and his marketing manager, Cathy McCourt. The following conversation was recorded: BRIAN: Mark, as you know, we agreed that a profit of $13 per unit is needed for this new product. Also, as I…arrow_forwardNico Parts, Inc., produces electronic products with short life cycles (of less than two years). Development has to be rapid, and the profitability of the products is tied strongly to the ability to find designs that will keep production and logistics costs low. Recently, management has also decided that post-purchase costs are important in design decisions. Last month, a proposal for a new product was presented to management. The total market was projected at 220,000 units (for the two-year period). The proposed selling price was $128 per unit. At this price, market share was expected to be 25 percent. The manufacturing and logistics costs were estimated to be $119 per unit. Upon reviewing the projected figures, Brian Metcalf, president of Nico, called in his chief design engineer, Mark Williams, and his marketing manager, Cathy McCourt. The following conversation was recorded: BRIAN: Mark, as you know, we agreed that a profit of $14 per unit is needed for this new product. Also, as I…arrow_forwardThe Chromosome Manufacturing Company produces two products, X and Y. The company president, Gene Mutation, is concerned about the fierce competition in the market for product X. He notes that competitors are selling X for a price well below Chromosome's price of P12.70. At the same time, he notes that competitors are pricing product Y almost twice as high as Chromosome's price of P12.50. Mr. Mutation has obtained the following data for a recent time period: PRODUCT X PRODUCT Y Number of Units 11,000 3,000 Direct Materials Cost Per Unit 3.23 3.09 Direct Labor Cost Per Unit 2.22 2.10 Direct Labor Hours 10,000 2,500 Machine Hours 2,100 2,800 Inspection Hours 80 100 Purchase Orders 10 10 Mr. Mutation has learned that overhead costs are assigned to products on the basis of direct labor hours. The overhead costs for his time period consisted of the following items: Overhead Cost Item Amount Inspecting Costs…arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning