Basics Of Engineering Economy

2nd Edition

ISBN: 9780073376356

Author: Leland Blank, Anthony Tarquin

Publisher: MCGRAW-HILL HIGHER EDUCATION

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 6, Problem 40P

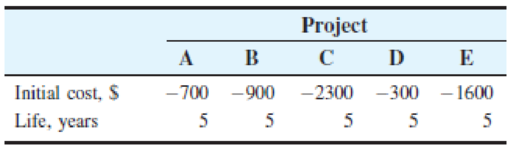

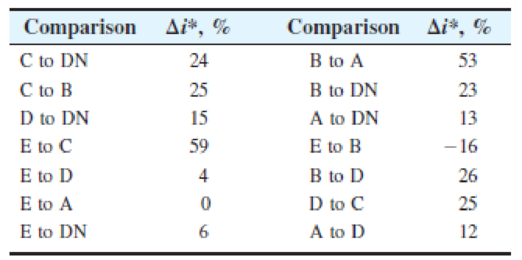

Five revenue projects are under consideration by General Dynamics for improving material flow through an assembly line. The initial cost (in $1000 units) and life of each project are estimated. Income estimates are not known at this point.

An engineer determined the incremental ROR (Δi*) values. From these results, determine which project, if any, should be undertaken, provided the company’s MARR is (a) 13.5% per year, and (b) 16% per year. If other calculations must be made in order to make a decision, state which ones are necessary.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Based on the incremental return shown and the

company's MARR of 16% per year, the alternative

that should be selected is _____

The project initial costs are such that A < C < B.

Comparison Rate of Return, %

(A-DN)

(B-DN)

(C-DN)

(B-A)

(C-A)

(B-C)

Alternative C

Do nothing

Alternative B

Alternative A

Cannot be determined.

17

25

19

14

18

12

Alternative R has a first cost of $73,000, annual M&O costs of $52,000, and a $20,000 salvage value after 5 years. Alternative S has a

first cost of $175,000 and a $43,000 salvage value after 5 years, but its annual M&O costs are not known. Determine the M&O costs

for alternative S that would yield a required incremental rate of return of 29%.

The M&O cost for alternative S is $

The capitalized cost of $ 10,000 , every 5 years forever, starting now at an interest rate of 10% per year?

( thanks in advance)

Chapter 6 Solutions

Basics Of Engineering Economy

Ch. 6 - Prob. 1PCh. 6 - Prob. 2PCh. 6 - Prob. 3PCh. 6 - Prob. 4PCh. 6 - Prob. 5PCh. 6 - Prob. 6PCh. 6 - Prob. 7PCh. 6 - Prob. 8PCh. 6 - A University of Massachusetts study found that...Ch. 6 - Prob. 10P

Ch. 6 - The Closing the Gaps initiative by the Texas...Ch. 6 - Prob. 12PCh. 6 - Prob. 13PCh. 6 - Prob. 14PCh. 6 - Prob. 15PCh. 6 - Prob. 16PCh. 6 - Prob. 17PCh. 6 - Prob. 18PCh. 6 - Prob. 19PCh. 6 - Prob. 20PCh. 6 - Prob. 21PCh. 6 - Prob. 22PCh. 6 - Prob. 23PCh. 6 - Prob. 24PCh. 6 - Prob. 25PCh. 6 - A company that manufactures rigid shaft couplings...Ch. 6 - For each of the following scenarios, state whether...Ch. 6 - Prob. 28PCh. 6 - Prob. 29PCh. 6 - Prob. 30PCh. 6 - Prob. 31PCh. 6 - Prob. 32PCh. 6 - Prob. 33PCh. 6 - Prob. 34PCh. 6 - Prob. 35PCh. 6 - The four alternatives described below are being...Ch. 6 - Prob. 37PCh. 6 - Prob. 38PCh. 6 - Ashley Foods, Inc. has determined that only one of...Ch. 6 - Five revenue projects are under consideration by...Ch. 6 - Four different machines are under consideration...Ch. 6 - Prob. 42PCh. 6 - Prob. 43PCh. 6 - Prob. 44PCh. 6 - Prob. 45PCh. 6 - Prob. 46PCh. 6 - Prob. 47PCh. 6 - Prob. 48PCh. 6 - Prob. 49PCh. 6 - Prob. 50PCh. 6 - Prob. 51PCh. 6 - Prob. 52PCh. 6 - Prob. 53PCh. 6 - Prob. 54PCh. 6 - Prob. 55PCh. 6 - Prob. 56PCh. 6 - Prob. 57PCh. 6 - Prob. 58PCh. 6 - Prob. 59PCh. 6 - Prob. 60APQCh. 6 - Prob. 61APQCh. 6 - Prob. 62APQCh. 6 - Prob. 63APQCh. 6 - Prob. 64APQCh. 6 - Prob. 65APQCh. 6 - Prob. 66APQCh. 6 - Prob. 67APQCh. 6 - Prob. 68APQCh. 6 - Prob. 69APQCh. 6 - Prob. 70APQ

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- The PW-based relation for the incremental cash flow series to find 4/"between the lower first-cost alternative X and alternative Y has been developed. 0=-22,000+ 9000(P/A,4,10)+(-4000(P/F,A*,10)) Determine the highest MARR value for which Y is preferred over X. Any MARR value greater than % favors Y.arrow_forwardThe PW-based relation for the incremental cash flow series to find A/* between the lower first-cost alternative X and alternative Y has been developed. 0= -38,000 + 9000 (P/A,Ai *,10) + (-5000(P/F,Ai*,10)) Determine the highest MARR value for which Y is preferred over X. Any MARR value less than % favors Y.arrow_forwardAlternative R has a first cost of $100,000, annual M&O costs of $50,000, and a $20,000 salvage value after 5 years. Alternative S has a first cost of $175,000 and a $40,000 salvage value after 5 years, but its annual M&O costs are not known. Determine the M&O costs for alternative S that would yield a required incremental rate of return of 20%. Solve (a) by hand, and (b) using the Goal Seek tool or RATE function on a spreadsheet.arrow_forward

- Four mutually exclusive alternatives are being evaluated, and their costs and revenues are itemized in the Table. If the MARR 15%per year and the analysis period is 12 years, use the PW method to determine PW1, PW2, PW3, PW4, and which one of those four is the best alternative ?arrow_forwardCharlie’s Truck Repair and Service has a new contract that requires him to purchase and maintain new equipment for work on 18-wheeler trucks and heavy road equipment. Two separate vendors have made quotes and estimates for Charlie. Use the estimates and a 6% per year return requirement to find the better economic option. One problem is that Charlie does not currently know if the contract will last for 5, 8, or 10 years. He needs a recommendation for all three time periods. Vendor Ferguson Halgrove First cost P, $ −203,000 −396,000 M&O, $ per year −90,000 −82,000 Salvage value, SV 10% of P 10% of P Maximum life, years 5 10arrow_forwardA large textile company is trying to decide which sludge dewatering process it should use ahead of its sludge drying operation. The costs associated with centrifuge and belt press systems are shown. Compare them on the basis of their annual worths using an interest rate of 10% per year. System Centrifuge Belt Press First cost, $ −235,000 −150,000 AOC, $/year −48,000 −41,000 Overhaul in year 2, $ -- −26,000 Salvage value, $ 40,000 10,000 Life, years 6 4 The annual worth of the centrifuge system is $− , and the annual worth of the belt press system is $− . The system selected on the basis of the annual worth analysis is the (Click to select) belt press centrifuge system.arrow_forward

- A chemical processing corporation is considering three methods to dispose of a non- hazardous chemical sludge: land application. Fluidized-bed incineration, and private disposal contract. The estimates for each method are shown. a) Determine which has the least cost on the basis of a present worth comparison at 10% per year for the following scenarios (You may assume a planning horizon of 6 years. The estimates are as shown the table b) If land application and incineration costs are as shown in the table, but the annual cost of the contract award cost increase br 20% everv time the contract is renewed (every 2 years) Use factors or formulasarrow_forwardA chemical processing corporation is considering three methods to dispose of a nonhazardous chemical sludge: land application, fluidized-bed incineration, and private disposal contract. The estimates for each method are shown. Determine which has the least cost on the basis of a present worth comparison at 10% per year for the following scenarios (You may assume a planning horizon of 6 years.): (a) The estimates are as shown in the table above. b) If land application and incineration costs are as shown in the table, but the annual cost of the contract award cost increase by 20% every time the contract is renewed (every 2 years).arrow_forwardA member of congress wants to know the capitalized cost of maintaining a proposal national park. The annual maintenance cost is expected to be P 2 250 000. At an interest rate of 6% per year, the capitalized cost of the maintenance would be closest to:arrow_forward

- Two roadway designs are under consideration for access to a permanent suspension bridge. Design 1A will cost $3 million to build and $100,000 per year to maintain. Design 1B will cost $3.5 million to build and $40,000 per year to maintain. Both designs are assumed to be permanent. Use an AWbased rate of return equation to determine (a) the breakeven ROR, and (b) which design is preferred at a MARR of 10% per year.arrow_forwardIf you have the capitalized cost of a certain alternative that has a 5-year life, you can get its annual worth by: (a) multiplying the CC by i (b) multiplying the CC by (A / F, i,5) (c) multiplying the CC by (P / A, i,5) (d) multiplying the CC by (A / P, i,5) (e) Any of the above darrow_forwardA product generates an income of P7300per month and an operating expense of P3000 per month. The initial cost of this product is P15000. The payback period for this investment if MARR is 10% per month is close to: *arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education

Break Even Analysis (BEP); Author: Tutorials Point (India) Ltd.;https://www.youtube.com/watch?v=wOEkc3O_Q_Y;License: Standard YouTube License, CC-BY

Cost Volume Profit Analysis (CVP): calculating the Break Even Point; Author: Edspira;https://www.youtube.com/watch?v=Nw2IioaF6Lc;License: Standard Youtube License