ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

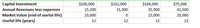

Four mutually exclusive alternatives are being evaluated, and their costs and revenues are itemized in the Table. If the MARR 15%per year and the analysis period is 12 years, use the PW method to determine PW1, PW2, PW3, PW4, and which one of those four is the best alternative ?

Transcribed Image Text:Capital Investment

Annual Revenues less expenses

$100,000

$152,000

$184,000

$75,000

15,200

31,900

35,900

41,500

Market Value (end of useful life)

10,000

15,000

20,000

Useful life (years)

12

12

12

12

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 6 steps

Knowledge Booster

Similar questions

- Three different plans were presented to the Ahbhalet Corporation for operating an identity-theft scanning system. Plan A involves renewable 1-year contracts with payments of $1.1 million at the beginning of each year. Plan B is a 2-year contract that requires four payments of $360,000 each, with the first one made now and the other three at 6-month intervals. Plan C is a 3-year contract that entails payment of $3.5 million now and the second payment of $0.5 million 2 years from now. Assuming that the company could renew any of the plans under the same payment conditions, determine which plan is best on the basis of a PW analysis at a MARR of 6% per year compounded semiannually. The present worth of plan A is $ The best plan on the basis of the present worth analysis is plan B the present worth of plan B is $ and the present worth of plan C is $arrow_forwardBiomet Implants is planning new online patient diagnostics for surgeons while they operate. The new system will cost $300,000 to install in an operating room, $5000 annually for maintenance, and have an expected life of 4 years. The revenue per system is estimated to be $80,000 in year 1 and to increase by $10,000 per year through year 4. Determine if the project is economically justified using PW analysis and an MARR of 10% per year. $-18,470 not justified $-18,475 not justified $-18,477 not justified $-18,479 not justified O No correct answerarrow_forwardABC Beverage, LLC, purchases its 355-ml cans in large bulk from Wald-China Can Corporation. The finish on the anodized aluminum surface is produced by mechanical finishing technologies called brushing or bead blasting. Engineers at Wald are switching to more efficient, faster, and cheaper machines to supply ABC. Use the estimates and MARR = 8% per year to select between the two alternatives. Brush Alternative Bead Blasting Alternative P $-400,000 $-400,000 n 6 years large Salvage Value $50,000 no value AOC Nonlabor $-60,000 in year 1, decreasing by $2500 annually starting in year 2 $-70,000 per yeararrow_forward

- A professional mechanics who specializes in truck engines paid $46,000 for equipment that will have a $4800 salvage value after 5 years. The costs with each usage amount to $60 per day. The income is $290 per day for his services, how many days per year must he be worked in order to break even at an interest rate of 7% per year?arrow_forwardAnswer please and take likearrow_forwardRequired information Spectra Scientific of Santa Clara, California, manufactures Q-switched solid-state industrial lasers for LED substrate scribing and silicon wafer dicing. The company got a $72 million loan, amortized over a 7-year period at 8% per year interest. NOTE: This is a multi-part question. Once an answer is submitted, you will be unable to return to this part. What is the amount of the unrecovered balance immediately before the payment is made at the end of year 1. (Enter your answer in dollars and not in millions.) The amount of the unrecovered balance is $ 63930787.10arrow_forward

- Two methods can be used to produce solar panels for electric power generation. Method 1 will have an initial cost of $800,000, an AOC of $150,000 per year, and $125,000 salvage value after its 3-year life. Method 2 will cost $910,000 with an AOC of $125,000 and a $230,000 salvage value after its 5-year life. Assume your boss asked you to determine which method is better, but she wants the analysis done over a three-year planning period. You estimate the salvage value of Method 2 will be 40% higher after three years than it is after five years. If the MARR is 14% per year, which method should the company select? Which method should the company select?arrow_forwardA bulk materials hauler purchased a used dump truck for %50,000. The operating cost was %5,000 per year, with average revenues of %7,500 per year. After 24 years, the truck was sold for %11,000. The rate of return was closest to; Your answer: 6.6% per year 2.6% per year 4.6% per year 7.6% per yeararrow_forwardA project has a first cost of $200,000 with annual costs of $50,000 and revenue of $90,000 per year.What is the payback period at (a) no-return, and (b) i = 7% per year?arrow_forward

- Three mutually exclusive electric-vehicle battery systems are being investigated by a large automobile manufacturer. Pertinent data are given below: Solve, a. Use the PW method to select the best battery system. The MARR is 15% per year, and the system chosen must provide service for 10 years. Assume repeatability. b. Confirm your recommendation in Part (a) using the IRR method.arrow_forwardSelect the best option using Rate of Return Analysis (incremental Rate of Return) \table[[MARR, 20%,,,], [Useful Life, 5 years,,,], [Brand, D1, D2, D3, D4]] \table[[\table[[Capital], [Investment]], $100,00, $140, 600, $148, 200, $122,000. Solve using excel spreadsheet. ف c 3. Select the best option using Rate of Return Analysis (incremental Rate of Return) MARR Useful Life Brand 20% 5 years D1 D2 D3 D4 Capital $100,00. $140,600 $148,200 $122,000 Investment Annual Expenses $29,000 $16,900 $14,800 $22,100 Salvage $10,000 $14,000 $25,600 $14,000arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education