Term Bond Debt Service Fund Transactions. (LO6-5) On July 1, 2019, the first day of its 2020 fiscal year, the Town of Bear Creek issued at par $2,000,000 of 6 percent term bonds to renovate a historic wing of its main administrative building. The bonds mature in five years on July 1, 2024. Interest is payable semiannually on January 1 and July 1.

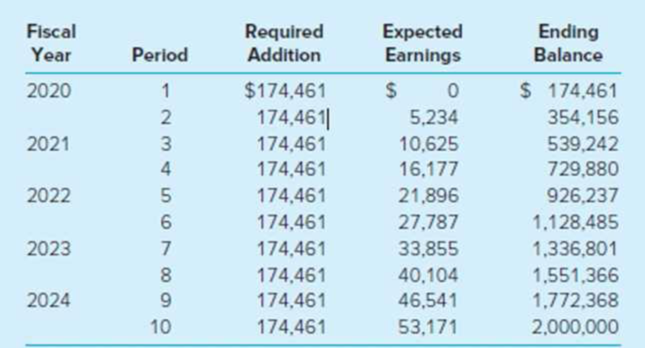

As illustrated in the table below, a sinking fund is to be established with equal semiannual additions made on June 30 and December 31. Cash for the sinking fund additions and the semiannual interest payments will be transferred from the General Fund shortly before the due dates. Investment earnings are added to the investment principal.

Required

Create a term bond debt service fund for the town and prepare

- a. On July 1, 2019, record the budget for the fiscal year ended June 30, 2020. Include all interfund transfers to be received from the General Fund during the year. An appropriation should be provided only for the interest payment due on January 1, 2020.

- b. On December 28, 2019, the General Fund transferred $234,461 to the debt service fund. The addition to the sinking fund was immediately invested in 6 percent certificates of deposit.

- c. On December 28, 2019, the city issued checks to bondholders for the interest payment due on January 1, 2020.

- d. On June 27, 2020, the General Fund transferred $234,461 to the debt service fund. The addition for the sinking fund was invested immediately in 6 percent certificates of deposit.

- e. Actual interest earned on sinking fund investments at year-end (June 30, 2020) was the same as the amount budgeted in the table. This interest adds to the sinking fund balance.

- f. All appropriate closing entries were made at June 30, 2020, for the debt service fund.

Want to see the full answer?

Check out a sample textbook solution

Chapter 6 Solutions

Accounting For Governmental & Nonprofit Entities

- The town of McHenry Has $10,000,000 in general obligation bonds outstanding and maintains a single debt service fund for all debt service transactions. On july 1, 2020, a current refunding took pace in which $10,000,000 in new general obligation bonds were issued. Record the transaction on the books of the debt service fund.arrow_forwardOn October 1, 2019, the City of Thomasville issued $5,000,000 in 4%, general obligation bonds at 101 for the purpose of constructing an addition to City Hall. The premium was transferred to a debt service fund. A total of $4,968,750 was used to construct the addition, which was completed prior to June 30, 2020. The remaining funds were transferred to the debt service fund. The bonds were dated October 1, 2019, and paid interest on April 1 and October 1. The first of 20 annual principal payments of $250,000 is due October 1, 2020. The fiscal year for Thomasville is July 1 - June 30.How would the construction costs be reported at year-end? As an expenditure of the capital projects fund and an expense in the government-wide Statement of Activities. As an expenditure of the capital projects fund only. As an expenditure of the capital projects fund and a capital asset in the government-wide Statement of Net Position. As a capital asset in the Statement of Net Position only.arrow_forwardOn March 2, 2018, Beloit City issued 10-year general obligation bonds at face amount, with interest payable on March 1 and September 1. The proceeds were to be used to finance the construction of a civic center over the period of April 1, 2018, to March 31, 2019. During the fiscal year ended June 30, 2018, no resources had been provided to the debt service fund for the payment of principal and interest.The liability for the general obligation bonds should be recorded in the a. general fund. b. capital projects fund. c. general long-term debt account group. d. debt service fund.arrow_forward

- A city keeps its books on a calendar-year basis. On April 1, 2019, the city sold $500,000 of 2% general obligation bonds, payable in semi-annual installments. The first installment, due October 31, 2019 covered interest of $5,000 and principal of $10,000. For the year ended December 31, 2019, how much should the Debt Service Fund report as expenditures? $15,000 $5,000 $15,000, plus an accrual for three months' interest $5,000, plus an accrual for three months' interest and principalarrow_forwardCraven City borrows $1,000,000 in bonds payable on January 1, 2022, and the bonds are scheduled to be repaid over 10 years, with the first payment scheduled for December 31, 2022. The bonds have a stated interest rate of 4%, and interest is payable annually with the first interest payment scheduled for December 31, 2022. Assuming the debt is repaid from a debt service fund (because the bond proceeds were used to benefit the governmental funds), what amount of expenditures would be recognized in the debt service fund for 2022? What amount of expense would be recognized if the bonds were repaid in an enterprise fund (because the bond proceeds were used to benefit the enterprise fund)? O $40,000 expenditures in the debt service fund; $40,000 expense in the enterprise fund O $140,000 expenditures in the debt service fund; $40,000 expense in the enterprise fund O $140,000 expenditures in the debt service fund; $140,000 expense in the enterprise fund $40,000 expenditures in the debt service…arrow_forwardCraven City borrows $2,000,000 in bonds payable on January 1, 2022, and the bonds are scheduled to be repaid over 10 years, with the first payment scheduled for December 31, 2022. The bonds have a stated interest rate of 5%, and interest is payable annually with the first interest payment scheduled for December 31, 2022. Assuming the debt is repaid from a debt service fund (because the bond proceeds were used to benefit the governmental funds), what amount of expenditures would be recognized in the debt service fund for 2022? What amount of expense would be recognized if the bonds were repaid in an enterprise fund (because the bond proceeds were used to benefit the enterprise fund)?arrow_forward

- On October 1, 2019, the City of Mizner issued $6,000,000 in 4%, general obligation bonds at 101 for the purpose of constructing an addition to City Hall. The premium was transferred to a debt service fund. A total of $5,968,750 was used to construct the addition, which was completed prior to June 30, 2020. The remaining funds were transferred to the debt service fund. The bonds were dated October 1, 2019, and paid interest on April 1 and October 1. The first of 20 annual principal payments of $300,000 is due October 1, 2020. The fiscal year for Mizner is July 1- June 30.In addition to a $6,000,000 liability in the government-wide Statement of Net Position, how would the bond sale be reported? Multiple Choice As a $6,000,000 other financing source in the capital projects fund, a $60,000 other financing source in the debt service fund, and as a $6,000,000 liability in the debt service fund. As a $6,060,000 other financing source in the capital projects fund, a $60,000…arrow_forward3.) The Village of Hawksbill issued $4,000,000 in 5 percent general obligation, tax-supported bonds on July 1, 2023, at a premium of 1.5 percent. A fiscal agent is not used. Resources for principal and interest payments are to come from the General Fund. Interest payment dates are December 31 and June 30. The first of 20 annual principal payments will be made on June 30, 2024. Hawksbill has a calendar fiscal year. A capital projects fund transferred the premium to the debt service fund. On December 31, 2023, funds in the amount of $100,000 were received from the General Fund, and the first interest payment was made. The books were closed for 2023. On June 30, 2024, funds in the amount of $240,000 were received from the General Fund, and the second interest payment ($100,000) was made along with the first principal payment ($200,000). On December 31, 2024, funds in the amount of $95,000 were received from the General Fund, and the third interest payment was made (also in the amount of…arrow_forwardConstruction and debt transactions can affect more than one fund. During 2021 Luling Township engaged in the following transactions related to modernizing the bridge over the Luling River. The township accounts for long-term construction projects in a capital projects fund.• On July 1 it issued 10-year, 4 percent bonds with a face value of $1 million. The bonds were sold for $1,016,510, an amount that provides an annual yield of 3.8 percent (semiannual rate of 1.9 percent). The city incurred $10,000 in issue costs.• On August 1, it was awarded a state reimbursement grant of $800,000. During the year it incurred allowable costs of $600,000. Of these it paid $500,000 in cash to various contractors. It received $450,000 from the state, expecting to receive, early in 2022, the $150,000 difference between allowable costs incurred and cash received. Moreover, it expects to receive the balance of the grant later in 2022. • It invested the bond proceeds in short-term federal securities. During…arrow_forward

- The Village of Hawksville issued $4,000,000 in 5 percent general obligations, tax supported bonds on July 1, 2019, at 102. A fiscal agent is not used.Resources for principal and interest payments are to come from the General Fun. Interest pyments dates are December 31 and June 30. The first of 20 annual principal payments is to be made June 30, 2020. Hawksbill has a calander fiscal year. 1. A capital projects fund transferred the premium ( in the amountof $40,000) to the debt service fund. 2. On December 31, 2019 funds in the amount of $100,000 were received from the General Fund and the first interest payment was made. 3. The books were closed for 2019. 4. On June30,2020 funds in the amount of $220,000 were received from the General Fund, and the second interest payment ($100,00) was madealong with the first pricipal payment ($200,000) 5. On December 31,2020 funds inthe amount of $95,000 were received from the General Fund and the third interest payment was made (also in the amount of…arrow_forwardThe Town of Mercy has $14,000,000 in general obligation bonds outstanding and maintains a single debt service fund for all debt service transactions. On July 1, 2024, a current refunding took place in which $14,000,000 in new general obligation bonds were issued. Required: Record the transaction on the books of the debt service fund. Note: If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.arrow_forwardThe Town of Presho had the following transactions related to the construction of a new courthouse. (a) 1/2/2020: 20 year 4% General Obligation Serial Bonds with a face value of $6,000,000 are issued at 101. Interest and principle payments are made on Jan. 1 and July 1 of each year. The premium was transferred into the Debt Service Fund. The General Fund will fully fund each payment as they become due. (b) 3/1/2020: Land is purchased for a new courthouse at a cost of $250,000. (c) 3/1/2020: A contract is signed for construction of the new courthouse in the amount of $5,400,000. (d) 6/15/2020: Cash ($210,000) sufficient to cover interest and principal payments for the year less the premium is transferred from the General Fund. (e) 7/1/2020: Interest ($120,000) and principal ($150,000) are paid on the courthouse fund serial bonds. (f) 12/1/2020: Receive an invoice for progress completed to date on the courthouse construction project in the amount of $4,700,000. (g) 12/27/2020: $117,000 is…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education