Accounting For Governmental & Nonprofit Entities

18th Edition

ISBN: 9781259917059

Author: RECK, Jacqueline L., Lowensohn, Suzanne L., NEELY, Daniel G.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 6, Problem 17.6EP

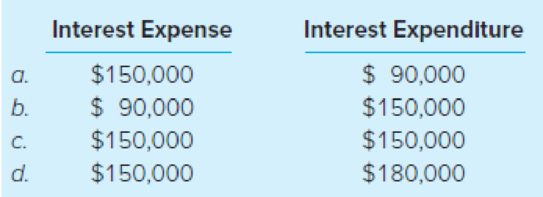

On March 2, 2020, 20-year, 6 percent, general obligation serial bonds were issued by Mossy County at the face amount of $3,000,000. Interest of 6 percent per year is due semiannually on March 1 and September 1. The first principal payment of $150,000 is due on March 1, 2021. The county’s fiscal year-end is December 31. What amounts are reported as interest expense in the government-wide financial statements and interest expenditure in the debt service fund for 2020?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

A city keeps its books on a calendar-year basis. On April 1, 2019, the city sold $500,000 of 2% general obligation bonds, payable in semi-annual installments. The first installment, due October 31, 2019 covered interest of $5,000 and principal of $10,000. For the year ended December 31, 2019, how much should the Debt Service Fund report as expenditures?

$15,000

$5,000

$15,000, plus an accrual for three months' interest

$5,000, plus an accrual for three months' interest and principal

Ont/2/ 2021, the County of Santa Teresa issued a 20-year-life serial bond with a principal of $8,000,000 and 5% annual interest. Interests are paid on

January 1 and July 1 with $400,000 in bonds being retired on each interest payment date. The debt service fund levies property taxes in the amount to

cover interest and principal payments.

Prepare entries for the Debt Service Fund for the following transactions.

1. Prepare the entries to record the budget for the debt service fund for Year 2021.

2. Prepare the entry to levy the property taxes.

3. Prepare the entry to pay the interest and principal on 7/1/2021.

On March 2, 2018, Beloit City issued 10-year general obligation bonds at face amount, with interest payable on March 1 and September 1. The proceeds were to be used to finance the construction of a civic center over the period of April 1, 2018, to March 31, 2019. During the fiscal year ended June 30, 2018, no resources had been provided to the debt service fund for the payment of principal and interest.Proceeds from the general obligation bonds should be recorded in the a. general fund. b. capital projects fund. c. general long-term debt account group. d. debt service fund.

Chapter 6 Solutions

Accounting For Governmental & Nonprofit Entities

Ch. 6 - Prob. 1QCh. 6 - What disclosures about long-term liabilities are...Ch. 6 - Prob. 3QCh. 6 - Prob. 4QCh. 6 - Although the most common type of general long-term...Ch. 6 - What is overlapping debt? Why would a citizen care...Ch. 6 - Prob. 7QCh. 6 - Prob. 8QCh. 6 - How are debt issuance costs accounted for at the...Ch. 6 - Under what circumstances might a government...

Ch. 6 - Prob. 11CCh. 6 - A citizens group in your state has placed an...Ch. 6 - A county government and a legally separate...Ch. 6 - Prob. 14CCh. 6 - Evaluating Legal Debt Margins. (LO6-2) Youll be...Ch. 6 - Prob. 17.1EPCh. 6 - Proceeds from bonds issued to construct a new city...Ch. 6 - The liability for long-term debt issued to finance...Ch. 6 - Which one of the following statements regarding...Ch. 6 - Prob. 17.5EPCh. 6 - On March 2, 2020, 20-year, 6 percent, general...Ch. 6 - Prob. 17.7EPCh. 6 - Prob. 17.8EPCh. 6 - The liability for special assessment bonds for...Ch. 6 - Total general long-term indebtedness subject to...Ch. 6 - Payment of general obligation bond interest would...Ch. 6 - Debt issuance costs a. Include legal and...Ch. 6 - If bonds are sold at a premium: a. The premium is...Ch. 6 - Prob. 17.14EPCh. 6 - Prob. 17.15EPCh. 6 - Prob. 18EPCh. 6 - Budgeted and Actual Debt Service Transactions....Ch. 6 - Lease Agreement. (LO6-5) McCormick County agreed...Ch. 6 - Legal Debt Margin and Direct and Overlapping Debt....Ch. 6 - Debt Service Fund Trial Balance. (LO6-5) Following...Ch. 6 - Prob. 23EPCh. 6 - Term Bond Debt Service Fund Transactions. (LO6-5)...Ch. 6 - Prob. 25EP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On October 31, 2020, the Village of Lexington issued $1,000,000 of 3% general obligation serial bonds. The bonds pay interest on April 30 and October 31. Starting on October 31, 2021, the first of 20 equal annual serial payments of $50,000 was made. For the year ended December 31, 2022, what is the amount that should be reported for “expenditures—matured interest” on the debt service fund’s statement of revenues, expenditures, and changes in fund balance? A. $27,750. B. $30,000. C. $27,000. D. $28,500.arrow_forwardOn March 2, 2022, 20-year, 3 percent, general obligation serial bonds were issued at the face amount of $3,000,000. Interest of 3 percent per annum is due semiannually on March 1 and September 1. The first payment of $150,000 for redemption of principal is due on March 1, 2023. Fiscal year-end occurs on December 31. What is the interest expenditure in the governmental funds for the fiscal year ending December 31, 2022?arrow_forwardOn March 2, 2022, 20-year, 3 percent, general obligation serial bonds were issued at the face amount of $3,000,000. Interest of 3 percent per annum is due semiannually on March 1 and September 1. The first payment of $150,000 for redemption of principal is due on March 1, 2023. Fiscal year-end occurs on December 31. What is the interest expense in the governmental activities accounts for the fiscal year ending December 31, 2022?arrow_forward

- On March 2, 2018, Finch City issued 10-year general obligation bonds at face amount, with interest payable on March 1 and September 1. The proceeds were to be used to finance the construction of a civic center over the period from April 1, 2018, to March 31, 2019.During the fiscal year ended June 30, 2018, no resources had been provided to the debt service fund for the payment of principal and interest. On June 30, 2018, in which statements should Finch report the construction in progress for the civic center? Capital Projects FundBalance Sheet Government-WideStatement of Net Position a. b. c. d. Yes Yes No No Yes No No Yesarrow_forwardBreneman City reported bonds payable of $5,500,000 in the governmental activities column of its statement of net position for fiscal year ended June 30, 2021. During fiscal year ended June 30, 2022, the City issued bonds payable totaling $1,000,000, and made principal payments on bonds payable totaling $220,000. Prepare the three journal entries required to adjust the governmental funds statements to the government-wide statements for fiscal year ended June 30, 2022.arrow_forwardOn March 2, 2018, Beloit City issued 10-year general obligation bonds at face amount, with interest payable on March 1 and September 1. The proceeds were to be used to finance the construction of a civic center over the period of April 1, 2018, to March 31, 2019. During the fiscal year ended June 30, 2018, no resources had been provided to the debt service fund for the payment of principal and interest.The liability for the general obligation bonds should be recorded in the a. general fund. b. capital projects fund. c. general long-term debt account group. d. debt service fund.arrow_forward

- The City of Dylan issues a 10-year bond payable of $1 million at face value on the first day of Year 1. Debt issuance costs of $10,000 are paid on that day. For government-wide financial statements, how is this debt issuance cost reported? $1,000 is recorded as an expense and $9,000 is recorded as an asset. $1,000 is recorded as an expense and $9,000 is recorded as a deferred outflow of resources. $10,000 is recorded as an expense. $10,000 is recorded as an asset.arrow_forwardThe City of Dylan issues a 10-year bond payable of $1 million at face value on the first day of Year 1. Debt issuance costs of $10,000 are paid on that day. For government-wide financial statements, how is this debt issuance cost reported? Choose the correct.a. $1,000 is recorded as an expense and $9,000 is recorded as an asset.b. $1,000 is recorded as an expense and $9,000 is recorded as a deferred outflow of resources.c. $10,000 is recorded as an expense.d. $10,000 is recorded as an asset.arrow_forwardOn October 31, 2020, the Village of Lexington issued $1,000,000 of 3% general obligation serial bonds. The bonds pay interest on April 30 and October 31. Starting on October 31, 2021, the first of 20 equal annual serial payments of $50,000 was made. At December 31, 2022, what is the amount of accrued but unmatured interest that is not reported by the debt service fund? A. $4,875. B. $5,000. C. $4,500. D. $4,750.arrow_forward

- During fiscal year 2019, a municipality issued the following debt instruments: Tax anticipation notes : $2,500,000 Utility bonds : 3,000,000 General obligation bonds : 8,000,000 How much of this debt should be reported in the fund financial statement?arrow_forwardThe City of Oriole issued 300 bonds at their face value of $2,000 each plus accrued interest on June 1, 2023. The term of the bonds was January 1, 2023, to January 1, 2029, with interest payable semi-annually each January 1 and July 1 at 6%. Oriole uses the effective interest method.Prepare the journal entry for the date of issuance. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List all debit entries before credit entries.) Account Titles and Explanation Debit Credit Bonds Payablearrow_forwardRaygun County had outstanding $35 million in Series 1998 general obligation bonds on June 30, 2018. The bonds were issued at an interest rate of 10 percent with interest payable on June 30 and December 31. In July 2018, interest rates declined substantially, and the county issued refunding bonds in the amount of $35 million at 5 percent. The proceeds of the refunding bonds were placed in escrow along with $2,800,000 held in the county’s debt service fund as a sinking fund for the 1998 debt. The proceeds of the refunding bonds and the sinking fund amount would be used in December 2018 (the call date) to purchase the 1998 debt at a 3 percent call premium, totaling $1,050,000, plus accrued interest of $1,750,000. The County had $250,000 of unamortized debt issue costs on the 1998 bonds, which it reported in its government-wide financial statements. This amount combined with the call premium resulted in a $3,050,000 “loss” on the refunding. (a) What journal entries should the county make…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education

IAS 10 Events After the Reporting Period; Author: Silvia of CPDbox;https://www.youtube.com/watch?v=ijYZlb1_ZyQ;License: Standard Youtube License