Accounting For Governmental & Nonprofit Entities

18th Edition

ISBN: 9781259917059

Author: RECK, Jacqueline L., Lowensohn, Suzanne L., NEELY, Daniel G.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 6, Problem 15C

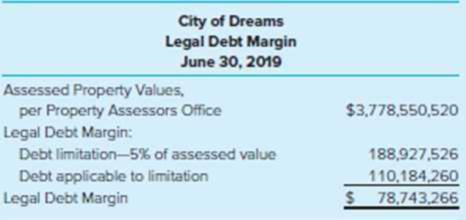

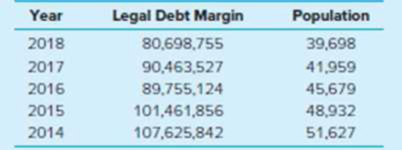

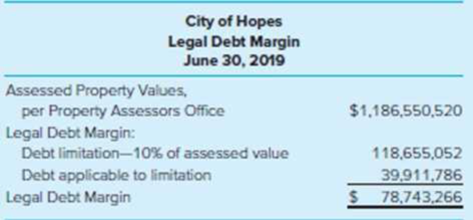

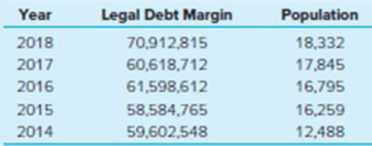

Evaluating Legal Debt Margins. (LO6-2) You’ll be moving to a nearby state after graduation and are focusing on two cities near your new job. After reading this chapter, you decide to look at the debt held by each of the governments. Disclosures of the legal debt margin for each city over the past few years are reproduced below.

Five-year trend information:

Five-year trend information:

Required

Compare the legal debt margin of the two cities. What are your observations regarding the debt position of the two governments?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

PERFORM THE EXERCISE IN EXCEL AND SHOW THE FORMULAS1.- Simple interest on a loan. A Financiera Popular recently opened in the city, to which Ms. Maru Villegas applied for a $253,700.00 unsecured loan, signing the promissory note on March 8 with maturity in 180 days. The stipulated interest rate is 11.5%. In order not to make a mistake, she takes into consideration the simple interest rate and a year of 360 days. What is the amount of interest calculated for Maru?

Note:In the image, this is the original exercise, it is in Spanish, but it is easy to understand.

Very important Note:It is necessary that you make a solution approach and then the result. Above all, to check the procedure and/or the formulas used, especially when you use excel.

TO CONSIDER THE YEAR AS 360 DAYS (WHICH IS COMMERCIAL)

You have just been hired as a loan officer at a national bank. Your first assignment is to calculate the amount of the periodic payment (in $) required to amortize (pay off) the following loan being considered by the bank (use Table 12-2). (Round your answer to the nearest cent.)

LoanPayment

PaymentPeriod

Term ofLoan (years)

NominalRate (%)

Present Value(Amount of Loan)

$

every year

12

6

$40,000

Your supervisor has tasked you with evaluating several loans related to a new expansion project. Using the PVIFA table (table 9.4 in the textbook), determine the annual payment on a $365,900, 7% business loan from a commercial bank that is to be amortized over a five-year period. Show your work. Does this payment seem reasonable? Explain.

Chapter 6 Solutions

Accounting For Governmental & Nonprofit Entities

Ch. 6 - Prob. 1QCh. 6 - What disclosures about long-term liabilities are...Ch. 6 - Prob. 3QCh. 6 - Prob. 4QCh. 6 - Although the most common type of general long-term...Ch. 6 - What is overlapping debt? Why would a citizen care...Ch. 6 - Prob. 7QCh. 6 - Prob. 8QCh. 6 - How are debt issuance costs accounted for at the...Ch. 6 - Under what circumstances might a government...

Ch. 6 - Prob. 11CCh. 6 - A citizens group in your state has placed an...Ch. 6 - A county government and a legally separate...Ch. 6 - Prob. 14CCh. 6 - Evaluating Legal Debt Margins. (LO6-2) Youll be...Ch. 6 - Prob. 17.1EPCh. 6 - Proceeds from bonds issued to construct a new city...Ch. 6 - The liability for long-term debt issued to finance...Ch. 6 - Which one of the following statements regarding...Ch. 6 - Prob. 17.5EPCh. 6 - On March 2, 2020, 20-year, 6 percent, general...Ch. 6 - Prob. 17.7EPCh. 6 - Prob. 17.8EPCh. 6 - The liability for special assessment bonds for...Ch. 6 - Total general long-term indebtedness subject to...Ch. 6 - Payment of general obligation bond interest would...Ch. 6 - Debt issuance costs a. Include legal and...Ch. 6 - If bonds are sold at a premium: a. The premium is...Ch. 6 - Prob. 17.14EPCh. 6 - Prob. 17.15EPCh. 6 - Prob. 18EPCh. 6 - Budgeted and Actual Debt Service Transactions....Ch. 6 - Lease Agreement. (LO6-5) McCormick County agreed...Ch. 6 - Legal Debt Margin and Direct and Overlapping Debt....Ch. 6 - Debt Service Fund Trial Balance. (LO6-5) Following...Ch. 6 - Prob. 23EPCh. 6 - Term Bond Debt Service Fund Transactions. (LO6-5)...Ch. 6 - Prob. 25EP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 1.- Simple interest on a loan. A Financiera Popular recently opened in the city, to which Ms. Maru Villegas applied for a $253,700.00 unsecured loan, signing the promissory note on March 8 with maturity in 180 days. The stipulated interest rate is 11.5%. In order not to make a mistake, she takes into consideration the simple interest rate and a year of 360 days. What is the amount of interest calculated for Maru? Note:In the image, this is the original exercise, it is in Spanish, but it is easy to understand. Very important Note:It is necessary that you make a solution approach and then the result. Above all, to check the procedure and/or the formulas used, especially when you use excel.arrow_forwardThe employee credit union at State University is planning the allocation of funds for the coming year. The credit union makes four types of loans to its members. In addition, the credit union invests in riskfree securities to stabilize income. The various revenueproducing investments together with annual rates of return are as follows: Type of Loan/Investment Annual Rate of Return (%) Automobile loans 8 Furniture loans 10 Other secured loans 11 Signature loans 12 Riskfree securities 9 The credit union will have $2,000,000 available for investment during the coming year. State laws and credit union policies impose the following restrictions on the composition of the loans and investments.•Riskfree securities may not exceed 30% of the total funds available for investment.•Signature loans may…arrow_forwardThe employee credit union at State University is planning the allocation of funds for the coming year. The credit union makes four types of loans to its members. In addition, the credit union invests in risk-free securities to stabilize income. The various revenue-producing investments, together with annual rates of return, are as follows. Type of Loan/Investment Automobile loans Furniture loans Other secured loans Signature loans Risk-free securities $ ● Automobile loans The credit union will have $2,400,000 available for investment during the ng year. State laws and credit union policies impose the following restrictions on the composition of the loans and investments. Furniture loans Other secured loans • Risk-free securities may not exceed 30% of the total funds available for investment. Signature loans may not exceed 10% of the funds invested in all loans (automobile, furniture, other secured, and signature loans). Signature loans Risk-free securities • Furniture loans plus other…arrow_forward

- Using the information provided please show all work and formulas in excel ! Suppose that you have two loan choices with monthly payments (a) What is the incremental borrowing cost of $30,000 for loan 1 over loan 2 if you hold the loan for the entire term and there are no origination costs for the two loans? (b) What is the incremental borrowing cost of $30,000 for loan 1 over loan 2 if you hold the loan for only 6 years (72 months) and there are no origination costs for the two loans?arrow_forwardYou Using the following data, build a debt snowball and show how long it would take to pay off the following debts if the were able to add an additional $150 per month to the debts they were paying off. You may use powerpay.org or the link to the financial calculators on the churches website - https://providentliving.churchofjesuschrist.org/self-reliance/finances/financial-calculator?lang=engLinks to an external site. Credit Card Debt: Balance: $800 Minimum Payment: $50 Interest Rate: 18% Medical Bill: Balance: $1,200 Minimum Payment: $70 Interest Rate: 5% Personal Loan: Balance: $2,500 Minimum Payment: $100 Interest Rate: 10% Car Loan: Balance: $5,000 Minimum Payment: $150 Interest Rate: 7% Student Loan: Balance: $10,000 Minimum Payment: $200 Interest Rate: 6% If they continue making the minimum payment how long will it take to pay the debt off? If they use the snowball method how long will it take to pay the debt off? If they use the snowball method and once the debt is paid off…arrow_forward7. Computing the cost of a discount interest loan The financial managers at Wallace Corporation are arranging the financing for working capital requirements for the upcoming year. Wallace's local bank offers a discount interest loan at a quoted (simple) interest rate of 8.00%. With a discount interest loan, interest is payable up front, and the actual amount received is less than the face amount of the loan. Suppose Wallace applies for a $300,000 loan with a nine-month term. Calculate the interest payment, the amount of cash received, the annual percentage rate (APR), and the effective annual rate (EAR) of this loan. Interest payment Amount of cash received Annual percentage rate (APR) Effective annual rate (EAR) What is the nine-month rate if the bank charges a $100 processing fee? O 5.78% O 6.03% O 8.51% Value O 6.42%arrow_forward

- You have just been hired as a loan officer at a national bank. Your first assignment is to calculate the amount of the periodic payment (in $) required to amortize (pay off) the following loan being considered by the bank (use Table 12-2). (Round your answer to the nearest cent.) LoanPayment PaymentPeriod Term ofLoan (years) NominalRate (%) Present Value(Amount of Loan) $ every month 1 3 4 6 $40,000arrow_forwardA borrower has two alternatives for a loan: (1) issue a $420,000, 30-day, 6% note or (2) issue a $420,000, 30-day note that the creditor discounts at 6%. Assume a 360-day year. This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions below. Calculate the amount of the interest expense for each option. Round your answer to the nearest dollar. $ fill in the blank 2 for each alternative. Determine the proceeds received by the borrower in each alternative. Round your answers to the nearest dollar. (1) $420,000, 30-day, 6% interest-bearing note: $ fill in the blank 3 (2) $420,000, 30-day note discounted at 6%: $ fill in the blank 4 Alternative 1 is more favorable to the borrower because the borrower receives more cash .arrow_forwardThe employee credit union at State University is planning the allocation of funds for the coming year. The credit union makes four types of loans to its members. In addition, the credit union invests in risk-free securities to stabilize income. The various revenue-producing investments together with annual rates of return are as follows. Type of Loan/Investment Automobile loans Furniture loans Other secured loans Signature loans Risk-free securities ● How should the $2,400,000 Automobile loans Furniture loans Other secured loans Signature loans Risk-free securities to LA The credit union will have $2,400,000 available for investment during the coming year. State laws and credit union policies impose the following restrictions on the composition of the loans and investments. LA Annual Rate of Return (%) • Risk-free securities may not exceed 30% of the total funds available for investment. Signature loans may not exceed 10% of the funds invested in all loans (automobile, furniture, other…arrow_forward

- This is a Debt Coverage Ratio or DCR question for part a and a CAP rate question for part b]. Wendy is going to purchase a commercial building and is working with a commercial lender at her local bank. The bank has some loan parameters that Wendy must follow. Understanding the rules will allow her to calculate her cash, income, and payment projections. The bank requires a 1.4 debt coverage ratio for her project. Wendy needs to calculate her net operating income or NOI first. The debt coverage ratio is based on this number. Then she will apply for a 20 year loan at 5% with annual payments. Information on the property includes: Gross rents- $780,000 Vacancy 5% Salaries $85,000 Other Fixed Expenses $125,000 Variable Expenses 20% of gross rents. NOI=_________________ Use the NOI and Debt Coverage requirement to calculate the answer. What is the largest annual payment the bank will allow? If Wendy had to buy the property at a 6% CAP (capitalization) rate, what is the asking price?arrow_forwardThe employee credit union at State University is planning the allocation of funds for the coming year. The credit union makes four types of loans to its members. In addition, the credit union invests in risk-free securities to stabilize income. The various revenue-producing investments together with annual rates of return are as follows: Type of Loan/Investment Annual Rate of Return (%) Automobile loans 8 Furniture loans 10 Other secured loans 11 Signature loans 12 Risk-free securities 9 The credit union will have $2 million available for investment during the coming year. State laws and credit union policies impose the following restrictions on the composition of the loans and investments: Risk-free securities may not exceed 30% of the total funds…arrow_forwardYou have just been hired as a loan officer at a national bank. Your first assignment is to calculate the amount of the periodic payment (in $) required to amortize (pay off) the following loan being considered by the bank (use Table 12-2). (Round your answer to the nearest cent.) LoanPayment PaymentPeriod Term ofLoan (years) NominalRate (%) Present Value(Amount of Loan) $ 2,582 every month 1 1 4 6 $30,000 loan payment wrong needs correctionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...

Statistics

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Cengage Learning

The Main Types of Mortgages (EXPLAINED); Author: Bankrate;https://www.youtube.com/watch?v=tp284BA6Zxg;License: Standard Youtube License