Foundations Of Finance

10th Edition

ISBN: 9780134897264

Author: KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher: Pearson,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 6, Problem 1SP

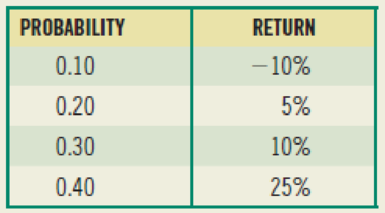

(Expected return and risk) Universal Corporation is planning to invest in a security that has several possible

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Using the data generated in the attached picture:

Plot the Security Market Line (SML)

Superimpose the CAPM’s required return on the SML

Indicate which investments will plot on, above and below the SML?

If an investment’s expected return (mean return) does not plot on the SML, what does it show? Identify undervalued/overvalued investments from the graph.

What is the equation for the Security Market Line? Define each term. If an asset has a beta of 2.0, what type of return should it realize compared to the market portfolio?

Based on the following probability distribution, what is the security's expected

return?

State

Probability

1

0.2

-5.0%

2

0.3

10.0

3

0.5

30.0

What is the expected return of the following investment?

Probability

Payoff

Chapter 6 Solutions

Foundations Of Finance

Ch. 6 - a. What is meant by the investors required rate of...Ch. 6 - Prob. 2RQCh. 6 - What is a beta? How is it used to calculate r, the...Ch. 6 - Prob. 4RQCh. 6 - Prob. 5RQCh. 6 - Prob. 6RQCh. 6 - Prob. 7RQCh. 6 - What effect will diversifying your portfolio have...Ch. 6 - (Expected return and risk) Universal Corporation...Ch. 6 - (Average expected return and risk) Given the...

Ch. 6 - (Expected rate of return and risk) Carter, Inc. is...Ch. 6 - (Expected rate of return and risk) Summerville,...Ch. 6 - Prob. 5SPCh. 6 - Prob. 9SPCh. 6 - Prob. 10SPCh. 6 - Prob. 11SPCh. 6 - Prob. 12SPCh. 6 - Prob. 14SPCh. 6 - (Capital asset pricing model) Using the CAPM,...Ch. 6 - Prob. 16SPCh. 6 - Prob. 17SPCh. 6 - a. Compute an appropriate rate of return for Intel...Ch. 6 - (Estimating beta) From the graph in the right...Ch. 6 - Prob. 20SPCh. 6 - Prob. 21SPCh. 6 - (Capital asset pricing model) The expected return...Ch. 6 - (Portfolio beta and security market line) You own...Ch. 6 - (Portfolio beta) Assume you have the following...Ch. 6 - Prob. 1MCCh. 6 - Prob. 2MCCh. 6 - Prob. 3MCCh. 6 - Prob. 4MCCh. 6 - Prob. 5MCCh. 6 - Prob. 6MCCh. 6 - Prob. 7MCCh. 6 - Prob. 8MCCh. 6 - Prob. 9MCCh. 6 - Prob. 10MCCh. 6 - Prob. 11MC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Which one of the following is the formula that explains the relationship between the expected returnon a security and the level of that security's systematic risk?Select one:a. Time value of money equationb. Unsystematic risk equationc. Expected risk formulad. Market performance equatione. Capital asset pricing modelarrow_forwardSupposing the return from an investment has the following probability distribution Return Probability R (%) 8 0.2 10 0.2 12 0.5 14 0.1 Required: What is the expected return of the investment? What is the risk as measured by the standard deviation of expected returns?arrow_forwardUsing the data generated in the previous question (Question 1); a) Plot the Security Market Line (SML) b) Superimpose the CAPM’s required return on the SML c) Indicate which investments will plot on, above and below the SML? d) If an investment’s expected return (mean return) does not plot on the SML, what does it show? Identify undervalued/overvalued investments from the grapharrow_forward

- Exploring Finance: Security Market Line. Security Market Line Conceptual Overview: Explore the determinants of the security market line. The Security Market Line defines the required rate of return for a security to be worth buying or holding. The line, depicted in blue in the graph, is the sum of the risk-free return (rf in the slider) and a risk premium determined by the market-risk premium (RPM) multiplied by the security's beta coefficient for risk. Drag the rf slider below the graph to change the amount of the risk-free return. These changes reflect changes in inflation. Drag the RPM slider below the graph to change the relationship between a security's beta coefficient and the amount of the market risk premium. Drag left or right on the graph to move the cursor line to evaluate securities with different beta coefficients. r = r_{RF} + RP_M * beta = 6\% + 5\% * 1 = 6\% + 5.00\% = 11.00\%r=rRF+RPM∗beta=6%+5%∗1=6%+5.00%=11.00% 1. For a risk-free return rate of 5%, a…arrow_forwardWhich of the following statements about the Security Market Line are correct? I. The intercept point is the market rate of return. II. The slope of the line is beta. III. An investor should accept any return located above the SML line. IV. A beta of 0.0 indicates the risk-free rate of returnarrow_forwardWhich is least likely correct about security valuation?a. The calculated or determined value considers the stream of future cash flows.b. The calculated or determined value equals the market price.c. The calculated or determined value considers the risks involved and the opportunity cost.d. The calculated or determined value allows the investors to evaluate whether a security isovervalued or undervalued.e. All of the abovearrow_forward

- Using the data generated in the graph, show what the information looks like in a spreadsheet. a) Plot the Security Market Line (SML) b) Superimpose the CAPM’s required return on the SML c) Indicate which investments will plot on, above, and below the SML? d) If an investment’s expected return (mean return) does not plot on the SML, what does it show? Identify undervalued/overvalued investments from the graph.arrow_forwardThe expected rate of return of an investment ________. a. equals one of the possible rates of return for that investment b. equals the required rate of return for the investment c. is the mean value of the probability distribution of possible returns d. is the median value of the probability distribution of possible returns e. is the mode value of the probability distribution of possible returnsarrow_forwardWrite out the equation for the Capital Market Line (CML), and draw it on the graph. Interpret the plotted CML. Now add a set of indifference curves and illustrate how an investors optimal portfolio is some combination of the risky portfolio and the risk-free asset. What is the composition of the risky portfolio?arrow_forward

- Fill the parts in the above table that are shaded in yellow. You will notice that there are nineline items. Using the data generated in the previous question (Question 1);a) Plot the Security Market Line (SML) b) Superimpose the CAPM’s required return on the SML c) Indicate which investments will plot on, above and below the SML?d) If an investment’s expected return (mean return) does not plot on the SML, what doesit show? Identify undervalued/overvalued investments from the graph Please answer A, B, C & Darrow_forwardCalculate the expected return from the following security using the CAPM Capital Asset Pricing Model: Standard Deviation of Security = 0.18 Standard Deviation of Market Portfolio = 0.10 Expected Return on Market Portfolio = 0.09 Correlation between possible Returns for the Security and the Market Portfolio = 0.70. Expected Risk Free Rate = 0.03arrow_forwardJerome J. Jerome is considering investing in a security that has the following distribution of possible one-year returns: Probability of occurrence 0.10 0.20 0.30 0.30 0.10 Possible return −0.10 0.00 0.10 0.20 0.30 a. What is the expected return and standard deviation associated with the investment?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Portfolio Management; Author: DevTechFinance;https://www.youtube.com/watch?v=Qmw15cG2Mv4;License: Standard YouTube License, CC-BY