Grundvig Manufacturing produces several types of bolts used in aircraft. The bolts are produced in batches and grouped into three product families. Because the product families are used in different kinds of aircraft, customers also can be grouped into three categories, corresponding to the product family that they purchase. The number of units sold to each customer class is the same. The selling prices for the three product families range from $0.50 to $0.80 per unit. Historically, the costs of order entry, processing, and handling were expensed and not traced to individual customer groups. These costs are not trivial and totaled $9,000,000 for the most recent year. Recently, the company started emphasizing a cost reduction strategy with an emphasis on creating a competitive advantage.

Upon investigation, management discovered that order-filling costs were driven by the number of customer orders processed with the following cost behavior:

Step-fixed cost component: $50,000 per step (2,000 orders define a step)*

Variable cost component: $20 per order

*Grundvig currently has sufficient steps to process 200,000 orders.

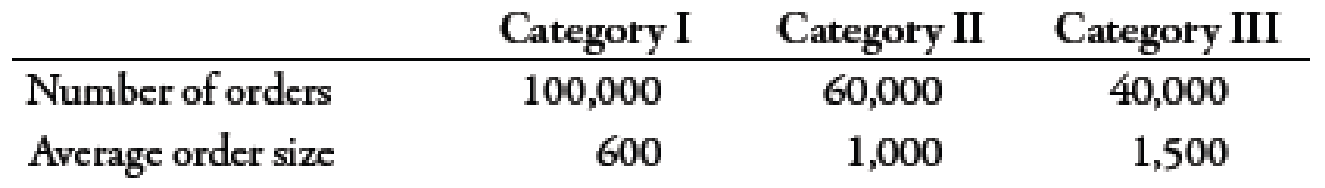

The expected customer orders for the year total 200,000. The expected usage of the order-filling activity and the average size of an order by customer category follow:

As a result of cost behavior analysis, the marketing manager recommended the imposition of a charge per customer order. The charge was implemented by adding the cost per order to the price of each order (computed by using the projected ordering costs and expected orders). This ordering cost was then reduced as the size of the order increased and was eliminated as the order size reached 2,000 units. Within a short period of communicating this new price information to customers, the average order size for all three product families increased to 2,000 units.

Required:

- 1. CONCEPTUAL CONNECTION Grundvig traditionally has expensed order-filling costs. What is the most likely reason for this practice?

- 2. Calculate the cost per order for each customer category. (Note: Round to two decimal places.)

- 3. CONCEPTUAL CONNECTION Calculate the reduction in order-filling costs produced by the change in pricing strategy (assuming that resource spending is reduced as much as possible and that the total units sold remain unchanged). Explain how exploiting customer activity information produced this cost reduction. Would any other internal activities benefit from this pricing strategy?

Trending nowThis is a popular solution!

Chapter 5 Solutions

Managerial Accounting: The Cornerstone of Business Decision-Making

- Moss Manufacturing produces several types of bolts. The products are produced in batches according to customer order. Although there are a variety of bolts, they can be grouped into three product families. The number of units sold is the same for each family. The selling prices for the three families range from 0.50 to 0.80 per unit. Because the product families are used in different kinds of products, customers also can be grouped into three categories, corresponding to the product family they purchase. Historically, the costs of order entry, processing, and handling were expensed and not traced to individual products. These costs are not trivial and totaled 6,300,000 for the most recent year. Furthermore, these costs had been increasing over time. Recently, the company had begun to emphasize a cost reduction strategy; however, any cost reduction decisions had to contribute to the creation of a competitive advantage. Because of the magnitude and growth of order-filling costs, management decided to explore the causes of these costs. They discovered that order-filling costs were driven by the number of customer orders processed. Further investigation revealed the following cost behavior: Step-fixed cost component: 70,000 per step; 2,000 orders define a step Variable cost component: 28 per order Moss currently has sufficient steps to process 100,000 orders. The expected customer orders for the year total 140,000. The expected usage of the order-filling activity and the average size of an order by product family are as follows: As a result of the cost behavior analysis, the marketing manager recommended the imposition of a charge per customer order. The president of the company concurred. The charge was implemented by adding the cost per order to the price of each order (computed using the projected ordering costs and expected orders). This ordering cost was then reduced as the size of the order increased and eliminated as the order size reached 2,000 units. (The marketing manager indicated that any penalties imposed for orders greater than this size would lose sales from some of the smaller customers.) Within a short period of communicating this new price information to customers, the average order size for all three product families increased to 2,000 units. Required: 1. Moss traditionally has expensed order-filling costs (following GAAP guidelines). Under this approach, how much cost is assigned to customers? Do you agree with this practice? Explain. 2. Consider the following claim: by expensing the order-filling costs, all products were undercosted; furthermore, products ordered in small batches are significantly undercosted. Explain, with supporting computations where possible. Explain how this analysis also reveals the costs of various customer categories. 3. Calculate the reduction in order-filling costs produced by the change in pricing strategy. (Assume that resource spending is reduced as much as possible and that the total units sold remain unchanged.) Explain how exploiting customer linkages produced this cost reduction. Moss also noticed that other activity costs, such as those for setups, scheduling, and materials handling costs, were reduced significantly as a result of this new policy. Explain this outcome, and discuss its implications. 4. Suppose that one of the customers complains about the new pricing policy. This buyer is a lean, JIT firm that relies on small, frequent orders. In fact, this customer accounted for 30 percent of the Family A orders. How should Moss deal with this customer? 5. One of Mosss goals is to reduce costs so that a competitive advantage might be created. Describe how the management of Moss might use this outcome to help create a competitive advantage.arrow_forwardGigabyte, Inc. manufactures three products for the computer industry: Gismos (product G): annual sales, 8,000 units Thingamajigs (product T): annual sales, 15,000 units Whatchamacallits (product W): annual sales, 4,000 units The company uses a traditional, volume-based product-costing system with manufacturing over-head applied on the basis of direct-labor dollars. The product costs have been computed as follows: Product G Product T Product W Raw material ..........................$ 35.00 $52.50 $17.50 Direct labor 16(.8 hr.at $20) 12(.6 hr at $20) 8(.4 hr at $20) Manufacturing overhead* ......140.00 105.00 70.00 Total product cost ..................$191.00 $169.50 $95.50 *Calculation of predetermined overhead rate: Manufacturing overhead budget: Machine setup...................................................................................$…arrow_forwardThe KMP Metal Machining Company produces widgets according to customer order. The company has determined that widgets can be produced on three different machine tools: M1, M2, or M3. An analysis of widget production cost reveals the following data: Solve, a. Using a graphical approach, determine the most economical machine tool to use for all order sizes between 1 and 200 units. In other words, determine the subranges within the overall range of 1 to 200 for which each machine tool is preferred. b. Using an algebraic approach, determine the most economical machine tool to use for all order sizes between 1 and 200 units. c. For an order of size 75, which machine tool should be used to produce the order, and what is the total production cost? d. For an order of size 160, assume that the preferred (most economical) machine is unavailable. What penalty (expressed in dollars of additional production cost) must be paid if the second most economical machine is used? The third?arrow_forward

- Atlanta Systems produces two different products, Product A, which sells for $650 per unit, and Product B, which sells for $1,200 per unit, using three different activities: Design, which uses Engineering Hours as an activity driver; Machining, which uses machine hours as an activity driver; and Inspection, which uses number of batches as an activity driver. The cost of each activity and usage of the activity drivers are as follows: Usage by Product A Usage by Cost Product B Design (Engineering Hours) Machining (Machine Hours) Inspection (Batches) $ 230,000 $2,600,000 $ 240,000 116 134 2,320 2,680 34 46 Atlanta manufactures 12,500 units of Product A and 10,172 units of Product B per month. Each unit of Product A uses $100 of direct materials and $45 of direct labor, while each unit of Product B uses $140 of direct materials and $75 of direct labor. Required: a. Calculate the activity rate for design. Rate for Design per hour b. Calculate the activity rate for machining. Rate for…arrow_forwardSebastian Company manufactures and sells sportswear products. Sebastian uses activity-based costing to determine the cost of the customer return processing and shipping activities. The customer return processing activity has an activity rate of $60 per return, and the shipping activity has an activity rate of $20 per shipment. Sebastian shipped 4,000 units of Product 1 in 800 shipments (some shipments are more than one unit). There were 90 returns. What is the per-unit customer cost for the combined shipping and return activities of Product 1? a.$1.38 per unit b.$80 per unit c.$5.35 per unit d.$359.55 per unitarrow_forwardAtlanta Systems produces two different products, Product A, which sells for $650 per unit, and Product B, which sells for $1,200 per unit, using three different activities: Design, which uses Engineering Hours as an activity driver; Machining, which uses machine hours as an activity driver; and Inspection, which uses number of batches as an activity driver. The cost of each activity and usage of the activity drivers are as follows: Usage by Product A Usage by Product B Design (Engineering Hours) Machining (Machine Hours) Inspection (Batches) Cost $ 230,000 $2,600,000 $ 240,000 116 134 2,320 2,680 34 46 Atlanta manufactures 12,500 units of Product A and 10,172 units of Product B per month. Each unit of Product A uses $100 of direct materials and $45 of direct labor, while each unit of Product B uses $140 of direct materials and $75 of direct labor. Required: a. Calculate the activity rate for design. Rate for Design per hour b. Calculate the activity rate for machining. Rate for…arrow_forward

- Walnut Systems produces two different products, Product A, which sells for $127 per unit, and Product B, which sells for $209 per unit, using three different activities: Design, which uses Engineering Hours as an activity driver; Machining, which uses machine hours as an activity driver; and Inspection, which uses number of batches as an activity driver. The cost of each activity and usage of the activity drivers are as follows: Cost Usage by Product A Usage by Product B Design (Engineering Hours) $ 158,080 216 304 Machining (Machine Hours) $ 542,720 1,150 3,090 Inspection (Batches) $ 25,480 36 16 Walnut manufactures 10,900 units of Product A and 6,600 units of Product B per month. Each unit of Product A uses $40 of direct materials and $18 of direct labor, while each unit of Product B uses $74 of direct materials and $26 of direct labor. Required: a. Calculate the activity rate for design.b. Calculate the activity rate for machining.c.…arrow_forwardWalnut Systems produces two different products, Product A, which sells for $127 per unit, and Product B, which sells for $209 per unit, using three different activities: Design, which uses Engineering Hours as an activity driver; Machining, which uses machine hours as an activity driver; and Inspection, which uses number of batches as an activity driver. The cost of each activity and usage of the activity drivers are as follows: Cost Usage by Product A Usage by Product B Design (Engineering Hours) $ 158,080 216 304 Machining (Machine Hours) $ 542,720 1,150 3,090 Inspection (Batches) $ 25,480 36 16 Walnut manufactures 10,900 units of Product A and 6,600 units of Product B per month. Each unit of Product A uses $40 of direct materials and $18 of direct labor, while each unit of Product B uses $74 of direct materials and $26 of direct labor. Required: a. Calculate the activity rate for design. (304)b. Calculate the activity rate for machining.…arrow_forwardGood Scent, Inc., produces two colognes: Rose and Violet. Of the two, Rose is more popular. Data concerning the two products follow: Rose Violet Expected sales (in cases) Selling price per case Direct labor hours Machine hours Receiving orders Packing orders Material cost per case Direct labor cost per case $9 The company uses a conventional costing system and assigns overhead costs to products using direct labor hours. Annual overhead costs follow. They are classified as fixed or variable with respect to direct labor hours. Fixed Direct labor benefits Machine costs Receiving department Packing department Total costs * All depreciation 55,000 11,000 $101 36,650 5,550 10,350 3,200 $ 50 - 97 $49 $82 27 53 Variable $215,220 218,500* 291,180 241,000 126,000 $585,500 $506,400 $42 $6 Required: 1. Using the conventional approach, compute the number of cases of Rose and the number of cases of Violet that must be sold for the company to break even. In your computations, round variable unit cost…arrow_forward

- Patz Company produces two types of machine parts: Part A and Part B, with unit contribution margins of 300 and 600, respectively. Assume initially that Patz can sell all that is produced of either component. Part A requires two hours of assembly, and B requires five hours of assembly. The firm has 300 assembly hours per week. Required: 1. Express the objective of maximizing the total contribution margin subject to the assembly-hour constraint. 2. Identify the optimal amount that should be produced of each machine part and the total contribution margin associated with this mix. 3. What if market conditions are such that Patz can sell at most 75 units of Part A and 60 units of Part B? Express the objective function with its associated constraints for this case and identify the optimal mix and its associated total contribution margin.arrow_forwardEvans, Inc., has a unit-based costing system. Evanss Miami plant produces 10 different electronic products. The demand for each product is about the same. Although they differ in complexity, each product uses about the same labor time and materials. The plant has used direct labor hours for years to assign overhead to products. To help design engineers understand the assumed cost relationships, the Cost Accounting Department developed the following cost equation. (The equation describes the relationship between total manufacturing costs and direct labor hours; the equation is supported by a coefficient of determination of 60 percent.) Y=5,000,000+30X,whereX=directlaborhours The variable rate of 30 is broken down as follows: Because of competitive pressures, product engineering was given the charge to redesign products to reduce the total cost of manufacturing. Using the above cost relationships, product engineering adopted the strategy of redesigning to reduce direct labor content. As each design was completed, an engineering change order was cut, triggering a series of events such as design approval, vendor selection, bill of materials update, redrawing of schematic, test runs, changes in setup procedures, development of new inspection procedures, and so on. After one year of design changes, the normal volume of direct labor was reduced from 250,000 hours to 200,000 hours, with the same number of products being produced. Although each product differs in its labor content, the redesign efforts reduced the labor content for all products. On average, the labor content per unit of product dropped from 1.25 hours per unit to one hour per unit. Fixed overhead, however, increased from 5,000,000 to 6,600,000 per year. Suppose that a consultant was hired to explain the increase in fixed overhead costs. The consultants study revealed that the 30 per hour rate captured the unit-level variable costs; however, the cost behavior of other activities was quite different. For example, setting up equipment is a step-fixed cost, where each step is 2,000 setup hours, costing 90,000. The study also revealed that the cost of receiving goods is a function of the number of different components. This activity has a variable cost of 2,000 per component type and a fixed cost that follows a step-cost pattern. The step is defined by 20 components with a cost of 50,000 per step. Assume also that the consultant indicated that the design adopted by the engineers increased the demand for setups from 20,000 setup hours to 40,000 setup hours and the number of different components from 100 to 250. The demand for other non-unit-level activities remained unchanged. The consultant also recommended that management take a look at a rejected design for its products. This rejected design increased direct labor content from 250,000 hours to 260,000 hours, decreased the demand for setups from 20,000 hours to 10,000 hours, and decreased the demand for purchasing from 100 component types to 75 component types, while the demand for all other activities remained unchanged. Required: 1. Using normal volume, compute the manufacturing cost per labor hour before the year of design changes. What is the cost per unit of an average product? 2. Using normal volume after the one year of design changes, compute the manufacturing cost per hour. What is the cost per unit of an average product? 3. Before considering the consultants study, what do you think is the most likely explanation for the failure of the design changes to reduce manufacturing costs? Now use the information from the consultants study to explain the increase in the average cost per unit of product. What changes would you suggest to improve Evanss efforts to reduce costs? 4. Explain why the consultant recommended a second look at a rejected design. Provide computational support. What does this tell you about the strategic importance of cost management?arrow_forwardGalaxy Sports Inc. manufactures and sells two styles of All Terrain Vehicles (ATVs), the Conquistador and Hurricane, from a single manufacturing facility. The manufacturing facility operates at 100% of capacity. The following per-unit information is available for the two products: In addition, the following sales unit volume information for the period is as follows: a. Prepare a contribution margin by product report. Compute the contribution margin ratio for each. b. What advice would you give to the management of Galaxy Sports Inc. regarding the profitability of the two products?arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub