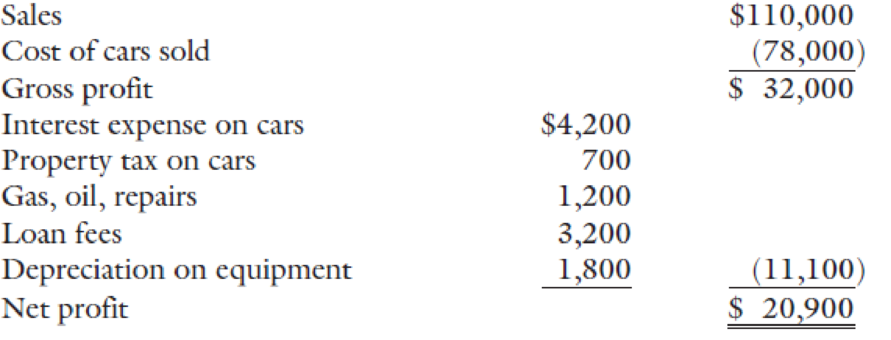

Ray, 83, is a used car dealer. He lives in a rural community and operates the business out of his home. One room in his 6-room house is used exclusively for his business office. He parks the cars in his front yard, and when customers come along, they sit on the front porch and negotiate a sale price. The income statement for Ray’s auto business is as follows:

If Ray’s home were rental property, the annual depreciation would be $2,900. The utilities and upkeep on the home cost Ray $6,400 for the year. Ray’s mortgage interest for the year is $2,400. When asked about the loan fees, Ray bitterly responds that Jim, the bank loan officer, charges him 10 percent of his gross profit on cars financed through the bank. Ray says, “The money is under the table, and if I don’t shell out the cash, Jim won’t loan the money to my customers to buy my cars. Everybody goes to Jim—he’s got the cash.”

Write a letter to Ray explaining the proper treatment of this information on his tax return.

Want to see the full answer?

Check out a sample textbook solution

Chapter 5 Solutions

Concepts in Federal Taxation 2019 (with Intuit ProConnect Tax Online 2017 and RIA Checkpoint 1 term (6 months) Printed Access Card)

- Wade paid 7,000 for an automobile that needed substantial repairs. He worked nights and weekends to restore the car and spent 2,400 on parts for it. He knows that he can sell the car for 13,000, but he is very wealthy and does not need the money. On the other hand, his daughter, who has very little income, needs money to make the down payment on a house. a. Would it matter, after taxes, whether Wade sells the car and gives the money to his daughter or whether he gives the car to his daughter and she sells it for 13,000? Explain. b. Assume that Wade gave the car to his daughter after he had arranged for another person to buy it from his daughter. The daughter then transferred the car to the buyer and received 13,000. Who is taxed on the gain?arrow_forwardBlaine is a practicing dentist. He operates his business from the basement of his house, with a separate entrance and facilities. Blaine uses the simplified method every year to calculate his business-use-of-home deduction. How will he calculate his depreciation for recapture when he sells the house? He will divide the basement square footage by the total square footage, multiply that percentage by the fair market value, and use the depreciation tables to calculate allowable depreciation to be recaptured. He will take the total fair market value of the home and use the depreciation tables to calculate allowable depreciation to be recaptured. Blaine has no depreciation to recapture. He uses the simplified method every year which means his depreciation is considered to be zero. Blaine will use Form 4797 to calculate the allowable depreciation amount and recapture that amount. Carrow_forwardSergio operates a sole proprietorship. He has a home office that functions as his principal place of business. He uses the home office regularly and exclusively for his business. The home office is 150 sq. ft. Which of the following are accurate? Select all that apply. a. Sergio can deduct $750/year under the safe harbor method b. Sergio can deduct a portion of his utility bills if he uses the actual cost method c. Sergio can depreciate a portion of his home if he uses the actual cost method d. As of 2018, Sergio is no longer entitled to a home office deduction because of recent changes to the tax laws e. If Sergio uses the safe harbor method, he can deduct a portion of his mortgage payments each yeararrow_forward

- Glen Campbell owns a small office building adjacent to an airport. He acquired the property 10 years ago at a total cost of $608,000—that is, $70,000 for the land and $538,000 for the building. He has just received an offer from a realty company that wants to purchase the property; however, the property has been a good source of income over the years, and so Campbell is unsure whether he should keep it or sell it. His alternatives are as follows: a. Keep the property. Campbell's accountant has kept careful records of the income realized from the property over the past 10 years. These records indicate the following annual revenues and expenses: Campbell makes a $13,450 mortgage payment each year on the property. The mortgage will be paid off in eight more years. He has been depreciating the building by the straight-line method, assuming a salvage value of $80,700 for the building, which he still thinks is an appropriate figure. He feels sure that the building can be rented for another…arrow_forwardBriana owns a second home that he rents to others. During the year, she used the second home for 50 days for personal use and for 100 days for rental use. She collected $20,000 of rental receipts during the year. Based on the number of rental and personal days, she allocated $7,000 of interest expense and property taxes, $10,000 of other expenses, and $4,000 of depreciation expense to the rental use. What is her net rental income this year?arrow_forwardSid Slaw purchased a car three years ago that he used for both private and business purposes (he is a freelance journalist). Sid bought the vehicle for $40,000 and made an initial input tax claim of $4,173.91 out of the $5,218 GST paid. After a year, Sid realised he had overestimated his business use proportion and made an output tax adjustment of $2,086.95. Sid has just sold the car for $12,000. Calculate the net amount of GST Sid should return to the IRD upon sale of the car?arrow_forward

- Meg O'Brien received a gift of some small-scale jewelry manufacturing equipment that her father had used for personal purposes for many years. Her father originally purchased the equipment for $1,640. Because the equipment is out of production and no longer available, the property is currently worth $5,750. Meg has decided to begin a new jewelry manufacturing trade or business. What is her depreciable basis for depreciating the equipment?arrow_forwardPhilip, a self-employed salesman, uses his Chevy to travel to potential buyers from his office. During 2020, he drove the car 5,000 miles for business, 3,000 commute miles and 12,000 personal miles. He paid $10,000 two years ago for the car which can be depreciated over 5 years. He has never depreciated the car using any other method than the straight-line method. In the past he has always used the standard mileage rate for car expenses. If his total gasoline and maintenance costs for the car (business and personal) were $2,000, how much may Philip deduct using the standard mileage rate for 2020? How much may he deduct using the actual cost method.arrow_forwardHelp Alisha, who is single, owns a sole proprietorship In which she works as a management consultant. She maintains an office in her home where she meets with clients, prepares bills, and performs other work-related tasks. She purchased the home at the beginning of year 1 for $400,000. Since she purchased the home and moved into it, she has been able to deduct $10,000 of depreciation expenses to offset her consulting income. At the end of year 3, Alisha sold the home for $500,000. What is the amount of taxes Alisha will be required to pay on the gain from the sale of the home? Alisha's ordinary marginal tax rate is 32 percent. (Ignore the net investment income tax.) Taxes to be paid LEGO 灣券 E of 15 Next > 目arrow_forward

- In the current year, Sandra rented her vacation home for 75 days, used it for personal use for 22 days, and left it vacant for the remainder of the year. Her income and expenses before allocation are as follows: Rental income 11,400 Real estate taxes 1,200 Utilities 1,350 Mortgage interest 3,200 Depreciation 6,000 Repairs and maintenance 810 equired: What is Sandra’s net income or loss from the rental of her vacation home? Use the Tax Court method. Note: Round your intermediate computations to 5 decimal places and final answers to nearest whole dollar value.arrow_forwardThis year, Amy purchased $4,200 of equipment for use in her business. However, the machine was damaged in a traffic accident while Amy was transporting the equipment to her business. Note that because Amy did not place the equipment into service during the year, she does not claim any depreciation or cost recovery expense for the equipment. a. After the accident, Amy had the choice of repairing the equipment for $2,690 or selling the equipment to a junk shop for $475. Amy sold the equipment. What amount can Amy deduct for the loss of the equipment? Deductible amountarrow_forwardRichard operates a small automobile parts store that specializes in providing parts for older vehicles. His company is called “Re-Store Auto Parts” and he is the sole operator. When he started the company, he put $30,000 of his own money into the company. Richard also purchased 5 vehicles for $3,000 each that were not running, so he could take parts out of them to sell. The rest of the money went into renting space to keep the parts and all other business operations. Richard needs to ensure that these financial transactions are recorded properly, therefore he provides this information to his accountant. a) Based on Richard’s situation, state and define the term we would use to describe his investment into his company b) Define each and explain the difference between a balance sheet and a financial statement as it applies to Richard’s company c) Analyze three parts of the balance sheet and apply it to Richard’s companyarrow_forward

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT