FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

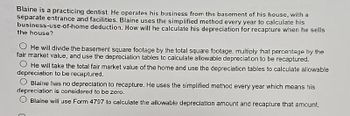

Transcribed Image Text:Blaine is a practicing dentist. He operates his business from the basement of his house, with a

separate entrance and facilities. Blaine uses the simplified method every year to calculate his

business-use-of-home deduction. How will he calculate his depreciation for recapture when he sells

the house?

He will divide the basement square footage by the total square footage, multiply that percentage by the

fair market value, and use the depreciation tables to calculate allowable depreciation to be recaptured.

He will take the total fair market value of the home and use the depreciation tables to calculate allowable

depreciation to be recaptured.

Blaine has no depreciation to recapture. He uses the simplified method every year which means his

depreciation is considered to be zero.

Blaine will use Form 4797 to calculate the allowable depreciation amount and recapture that amount.

C

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Brian acquired a rental house in 2003 for a cost of $80,000. Straight-line depreciation on the property of $26,000 has been claimed by Brian. In January 2019, he sells the property for $120,000, receiving $20,000 cash on March 1 and the buyer's note for $100,000 at 10 percent interest. The note is payable at $10,000 per year for 10 years, with the first payment to be received 1 year after the date of sale. Calculate his taxable gain under the installment method for the year of sale of the rental house. In your computations, round any division to two decimal places. Gain reportable in 2019 is $.arrow_forwardLina purchased a new car for use in her business during 2021. The auto was the only business asset she purchased during the year, and her business was extremely profitable. Calculate her maximum depreciation deductions (including §179 expense unless stated otherwise) for the automobile in 2021 and 2022 (Lina doesn’t want to take bonus depreciation for 2021 or 2022) in the following alternative scenarios (assuming half-year convention for all): (Use MACRS Table 1, Table 2, and Exhibit 10-10.) The vehicle cost $30,800, and business use is 100 percent (ignore §179 expense).arrow_forwardDuring 2021, William purchases the following capital assets for use in his catering business: New passenger automobile (September 30). $64,000 Baking equipment (June 30) 10,000 Assume that William decides to use the election to expense on the baking equipment (and has adequate taxable income to cover the deduction) but not on the automobile (which has a 5-year recovery period), and he also uses the MACRS accelerated method to calculate depreciation but elects out of bonus depreciation. Calculate William's maximum depreciation deduction for 2021, assuming he uses the automobile 100 percent in his business.arrow_forward

- Surendra's personal residence originally cost $340,000 (ignoring the value of the land). After living in the house for five years, he converts it to rental property. At the date of conversion, the fair market value of the house is $320,000. a. Surendra's basis for loss for the rental property is s 32,000 b. Surendra's basis for depreciation for the rental property is $ c. Surendra's basis for gain for the rental property is $ d. Could Surendra have obtained better tax results if he had sold his personal residence for $320,000 and then purchased another house for $320,000 to hold as rental property? No, because his basis in his personal residence would become his basis in the rental property. e. Complete the letter below regarding an e-mail to your instructor. TO: Instructor 320,000 340,000 FROM: Student DATE: January 6, 2022 The purpose of this e-mail is to address the tax issues associated with Surendra's conversion of his principal residence into a rental property. I am basing my…arrow_forwardy applies to the questions displayed below. Lina purchased a new car for use in her business during 2021. The auto was the only business asset she purchased during the year, and her business was extremely profitable. Calculate her maximum depreciation deductions (including $179 expense unless stated otherwise) for the automobile in 2021 and 2022 (Lina doesn't want to take bonus depreciation for 2021 or 2022) in the following alternative scenarios (assuming half-year convention for all): (Use MACRS Table 1. Table 2. and Exhibit 10-10.) Problem 10-67 Part c (Algo) c. The vehicle cost $80,100, and she used it 80 percent for business. Year Depreciation deduction 2021 2022 Lina purchased a new car for use in her business during 2021. The auto was the only business asset she purchased during the year, and her business was extremely profitable. Calculate her maximum depreciation deductions (including $179 expense unless stated otherwise) for the automobile in 2021 and 2022 (Lina doesn't want…arrow_forwardDuring 2023, Khan purchases the following capital assets for use in his catering business: Line Item Description Amount New passenger automobile (September 30) $66,000 Baking equipment (June 30) 10,000 Assume that Khan decides to use the election to expense on the baking equipment (and has adequate taxable income to cover the deduction) but not on the automobile, and he also uses the MACRS accelerated method to calculate depreciation but elects out of bonus depreciation. Click here to access the depreciation table and click here to access the annual automobile depreciation limitations. Calculate Khan's maximum depreciation deduction for 2023, assuming he uses the automobile 100 percent in his business.arrow_forward

- Mr. DEE has owned a modest triplex for a number of years, and all three units have been rented during that time. CCA has been deducted from his income from this property in each year. Mr. DEE has moved into one of the three units during the current year. Because MR DEE will only be renting two of the homes, he will report lower rental revenue. He hasn't sold anything, therefore he won't be reporting any capital gains or losses this year. Is this accurate?arrow_forward. Lina purchased a new car for use in her business during 2021. The auto was the only business asset she purchased during the year, and her business was extremely profitable. Calculate her maximum depreciation deductions (including §179 expense unless stated otherwise) for the automobile in 2021 and 2022 (Lina doesn't want to take bonus depreciation for 2021 or 2022) in the following alternative scenarios (assuming half-year convention for all ): a) The vehicle cost $35,000, and business use is 100 percent (ignore §179 expense). b) The vehicle cost $80,000, and business use is 100 percent. c) The vehicle cost $80,000, and she used it 80 percent for business. d) The vehicle cost $80,000, and she used it 80 percent for business. She sold it on March 1 of year 2. e) The vehicle cost $80,000, and she used it 20 percent for business. f) The vehicle cost $80,000 and is an SUV that weighs 6, 500 pounds. Business use was 100 percent.arrow_forwardLuis sold a rental house he had owned for several years. He claimed $24,787 in depreciation over the years. He claimed the allowable depreciation each year except the first year he owned the house, when he could have claimed $1,342 but failed to do so. Luis must adjust his basis in the house by the amount of depreciation allowed or allowable. What is this amount? $1,342 $23,445 $24,787 $26,129arrow_forward

- Sarah operates a printing business in Sydney. On 1 July 2018 she bought a new printing press for $200,000. The press was used 100% for business purposes and has an Effective Life of 8 years. Sarah opted to use the PCM to calculate depreciation. On 5 July 2020, Sarah sold the printing press. Required: Calculate the Balancing Adjustment and discuss the tax consequences if Sarah sold the press for: (a) $200,000 (b) $149,657.53 (c) $100,000arrow_forwardTerry purchased a machine for $15,000; the seller is holding the note. Terry paid $2,500 for the required wiring and installation. Terry has deducted depreciation on the machine for 3 years totaling $4,500. Terry owes $5,000 to the Seller. What is Terry’s adjusted basis in the machine? Group of answer choicesarrow_forwardIn the current year, Sandra rented her vacation home for 75 days, used it for personal use for 22 days, and left it vacant for the remainder of the year. Her income and expenses before allocation are as follows: Rental income Real estate taxes Utilities Mortgage interest Depreciation Repairs and maintenance Required: What is Sandra's net income or loss from the rental of her vacation home? Use the Tax Court method. Note: Round your intermediate computations to 5 decimal places and final answers to nearest whole dollar value. Rental income Real estate taxes Utilities Mortgage interest Repairs and maintenance Depreciation Net rental income 15,900 2,700 2,475 4,700 7,600 1,260 Schedule E Schedule Aarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education