FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

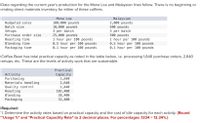

Transcribed Image Text:Data regarding the current year's production for the Mona Loa and Malaysian lines follow. There is no beginning or

ending direct materials inventory for either of these coffees.

Malaysian

2,000 pounds

500 pounds

Mona Loa

100,000 pounds

10,000 pounds

per batch

25,000 pounds

1 hour per 100 pounds

0.5 hour per 100 pounds

0.1 hour per 100 pounds

Budgeted sales

Batch size

3 per batch

500 pounds

1 hour per 100 pounds

0.5 hour per 100 pounds

0.1 hour per 100 pounds

Setups

Purchase order size

Roasting time

Blending time

Packaging time

the table below, i.e. processing 1,640 purchase orders, 2,640

has total practical capacity as notec

setups, etc. These are the levels of activity work that are sustainable.

Co

Ве

Practical

Сaраcity

1,640

2,640

1,440

102,400

38,400

32,400

Activity

Purchasing

Materials handling

Quality control

Roasting

Blending

Packaging

Required:

1. Determine the activity rates based on practical capacity and the cost of idle capacity for each activity. (Round

"Usage %" and "Practical Capactity Rate" to 2 decimal places. For percentages .1234 = 12.34%.)

%3D

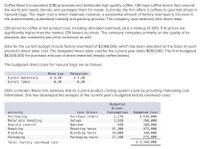

Transcribed Image Text:Coffee Bean Incorporated (CBI) processes and distributes high-quality coffee. CBI buys coffee beans from around

the world and roasts, blends, and packages them for resale. Currently, the firm offers 2 coffees to gourmet shops in

1-pound bags. The major cost is direct materials; however, a substantial amount of factory overhead is incurred in

the predominantly automated roasting and packing process. The company uses relatively little direct labor.

CBI prices its coffee at full product cost, including allocated overhead, plus a markup of 30%. If its prices are

significantly higher than the market, CBI lowers its prices. The company competes primarily on the quality of its

products, but customers are price conscious as well.

Data for the current budget include factory overhead of $3,168,000, which has been allocated on the basis of each

product's direct labor cost. The budgeted direct labor cost for the current year totals $600,000. The firm budgeted

$6,000,000 for purchase and use of direct materials (mostly coffee beans).

The budgeted direct costs for 1-pound bags are as follows:

Malaysian

$ 3.20

Mona Loa

Direct materials

$ 4.20

Direct labor

0.30

0.30

CBI's controller, Mona Clin, believes that its current product costing system could be providing misleading cost

information. She has developed this analysis of the current year's budgeted factory overhead costs:

Budgeted

Driver

Budgeted Cost

$ 639,000

768,000

168,000

973,000

348,000

Activity

Purchasing

Materials handling

Consumption

1,278

1,920

Cost Driver

Purchase orders

Setups

Quality control

Roasting

Blending

Batches

840

Roasting hours

Blending hours

Packaging hours

97,300

34,800

272,000

$ 3,168,000

Packaging

27,200

Total factory overhead cost

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Ponderosa, Inc., produces wiring harness assemblies used in the production of semi-trailer trucks. The wiring harness assemblies are sold to various truck manufacturers around the world. Projected sales in units for the coming five months are given below. January 10,000 February 10,500 March 13,900 April 16,000 May 18,500 The following data pertain to production policies and manufacturing specifications followed by Ponderosa: Finished goods inventory on January 1 is 900 units. The desired ending inventory for each month is 20 percent of the next month’s sales. The data on materials used are as follows: Direct Material Per-Unit Usage Unit Cost Part #K298 2 $4 Part #C30 3 7 Inventory policy dictates that sufficient materials be on hand at the beginning of the month to satisfy 30 percent of the next month’s production needs. This is exactly the amount of material on hand on January 1. The direct labor used per unit of…arrow_forwardAllison Manufacturing produces a subassembly used in the production of jet aircraft engines. The assembly is sold to engine manufacturers and aircraft maintenance facilities. Projected sales in units for the coming 5 months follow: January 40,000 February 50,000 March 60,000 April 60,000 May 62,000 The following data pertain to production policies and manufacturing specifications followed by Allison Manufacturing: Finished goods inventory on January 1 is 32,000 units, each costing $166.06. The desired ending inventory for each month is 80% of the next month's sales. The data on materials used are as follows: Direct Material Per-Unit Usage DM Unit Cost ($) Metal 10 lbs. 8 Components 6 5 Inventory policy dictates that sufficient materials be on hand at the end of the month to produce 50% of the next month's production needs. This is exactly the amount of material on hand on December 31 of the prior year. The direct labor used per unit of…arrow_forward45. According to the GAM for NGAs, disbursements for salaries and wages shall be supported by: Disbursement vouchers Payroll Petty cash vouchers Official receiptsarrow_forward

- Fact Pattern: Atlas Foods produces the following three supplemental food products simultaneously through a refining process costing $93,000. The joint products, Alfa and Betters, have a final selling price of $4 per pound and $10 per pound, respectively, after additional processing costs of $2 per pound of each product are incurred after the split-off point. Morefeed, a by- product, is sold at the split-off point for $3 per pound. O A. $60,000 $31,000 $3,000 $30,000 O B. C. Alfa D. Betters Assuming Atlas Foods inventories Morefeed, the by-product, the joint cost to be allocated to Alfa using the net realizable value method is 10,000 pounds of Alfa, a popular but relatively rare grain supplement having a caloric value of 4,400 calories per pound 5,000 pounds of Betters, a flavoring material high in carbohydrates with a caloric value of 11,200 calories per pound Morefeed 1,000 pounds of Morefeed, used as a cattle feed supplement with a caloric value of 1,000 calories per poundarrow_forwardPlease do not give solution in image format thankuarrow_forwardPearl Products Limited of Shenzhen, China, manufactures and distributes toys throughout Southeast Asia. Three cubic centimeters (cc) of solvent H300 are required to manufacture each unit of Supermix, one of the company's products. The company is planning its raw materials needs for the third quarter, the quarter in which peak sales of Supermix occur. To keep production and sales moving smoothly, the company has the following inventory requirements: a. The finished goods inventory on hand at the end of each month must equal 2,000 units of Supermix plus 25% of the next month's sales. The finished goods inventory on June 30 is budgeted to be 20,250 units. b. The raw materials inventory on hand at the end of each month must equal one-half of the following month's production needs for raw materials. The raw materials inventory on June 30 is budgeted to be 111,375 cc of solvent H300. c. The company maintains no work in process inventories. A monthly sales budget for Supermix for the third…arrow_forward

- Direct Materials Purchases Budget Soda Company is the largest bottler in Western Europe. The company purchases Brand 1 and Brand 2 concentrate from The Soda Company, dilutes and mixes the concentrate with carbonated water, and then fills the blended beverage into cans or plastic two-liter bottles. Assume that the estimated production for Brand 1 and Brand 2 two-liter bottles at the Wakefield, UK, bottling plant are as follows for the month of May: Brand 1 67,000 two-liter bottles Brand 2 51,000 two-liter bottles In addition, assume that the concentrate costs $70 per pound for both Brand 1 and Brand 2 and is used at a rate of 0.1 pound per 100 liters of carbonated water in blending Brand 1 and 0.15 pound per 100 liters of carbonated water in blending Brand 2. Assume that two liters of carbonated water are used for each two-liter bottle of finished product. Assume further that two-liter bottles cost $0.075 per bottle and carbonated water costs $0.055 per liter. Prepare a direct…arrow_forward2. Lens Junction has required production of 15,400 units in January and 18,100 in February. Each lens consists of 2 pounds of silicon costing $2.50 per pound and 3 ounces of solution costing $3 per ounce. Desired inventory levels are: Jan. Feb. Mar. Beginning Inventory: Finished Goods (units) 4,500 4,900 5,000 DM - Silicon (pounds) 8,500 9,100 9,200 DM - Solution (ounces) 11,200 12,000 13,000 PLEASE NOTE: Units are rounded to whole numbers with commas as needed (i.e. 1,234) - no labels. All dollar amounts are rounded to whole dollars and shown with "$" and commas as needed (i.e. $12,345), except for any "per" amounts (units, pounds, ounces, or dollars), which are rounded to two decimal places and shown with "$" and commas as needed (i.e. $1,234.56) - no labels. Cost per Pound Desired Ending Inventory DM per Unit Ounces Needed for Production Required DM Ounces Pounds Needed for Production Units to be Produced Total Cost of DM Purchase Required DM Pounds…arrow_forwardDo not give answer in imagearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education