Engineering Economy (17th Edition)

17th Edition

ISBN: 9780134870069

Author: William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 5, Problem 48P

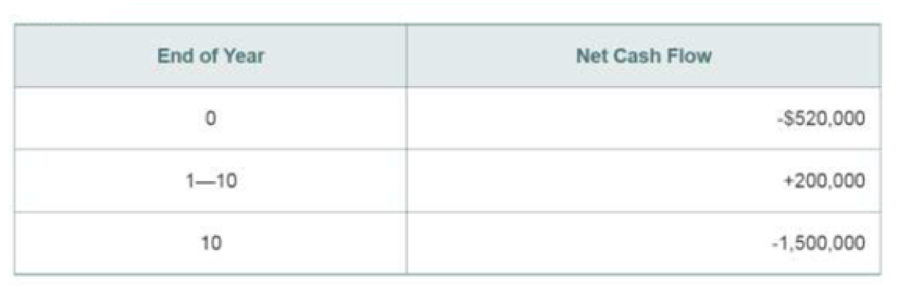

The prospective exploration for oil in the outer continental shelf by a small, independent drilling company has produced a rather curious pattern of cash flows, as follows:

The$1,500,000 expense at EOY 10 will be incurred by the company in dismantling the drilling rig

- a. Over the 10-year period, plot PW versus the interest rate (i) in an attempt to discover whether multiple

rates of return exist. (5.6) - b. Based on the projected net cash flows and results in Part (a), what would you recommend regarding the pursuit of this project? Customarily, the company expects to earn at least 20% per year on invested capital before taxes. Use the ERR method (∈ = 20%). (5.7)

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

A$ 100,000 machine replacement project

indicates that it can generate, after-tax cash

flows, $ 35,000 per year over its 10-year

useful life. At the end of this period, it could

be sold for $ 10,000. Considering a Minimum

Attractive Rate of Return (MARR) of 10% per

year, select the equation by notation of

factors that calculates your Net Present Value

-100000 + 35000 (P/A,10%,9) + 10000 (P/F,10%,10)

-100000 + 35000 (P/A,10%,9) + 45000 (P/F,10%,10)

100000 – 35000 (P/A,10%,9) – 45000 (P/F,10%,10)

-100000 + 35000 (P/F,10%,10) + 10000 (P/A,10%,10)

Commercial You are a corporate account officer with the Commercial & In-

dustrial Bank Corporation (CIBC). One of your major manufacturing clients, who are re- tooling one of their factories, just bought a piece of customized machinery to be delivered in six months’ time. The company’s treasurer intends to initially finance the purchase in the short-term loan market for six months and inquires about the possibilities of locking in the borrowing cost now. The amount is USD 10m and the loan would be disbursed in a six months from now to be repaid in exactly one year’s time from now. The current SOFR term structure is as follows:

Maturity (D)

SOFR Rate (%)

30

0.15%

90

0.24%

180

0.33%

360

0.55%

Use excel to calculate

Define and calculate the SOFR forward Why or why not is it a good predictor for future SOFR rates?

At expiration, e., six months after entering into the agreement, the 180D 20 SOFR stands at 0.90%. Who wins and who loses?…

Suppose I develop a new carbonated beverage that has Pomegranate, Orange, Watermelon, Strawberry, and Apple juice. I trademark the name POWSA (to rhyme with

YOWSA for an intended marketing campaign about how deliciously refreshing it is... POWSA!!). Then I perfect the tastiest ingredient mix with the essential acronym aligned

components... POWSA!!

I believe it is possible to get a $10 million annual SOM by selling 10 million cans at $1 each while the cost (at that scale of operation) will be sixty cents per can. However, I

need to invest $20 million in the marketing, so I need a VC or angel investor to buy an equity stake for $20 million. I pitch the idea of getting Sugar Ray Leonard to do the ads

for that "light-weight-sugar champion" POWSA Punch element of the marketing campaign. I claim the ad campaign with Sugar Ray would be effective with the $20 million

budget. Now suppose Warren Buffet agrees with all my numbers and also has a 10% opportunity cost of capital (he believes the $20…

Chapter 5 Solutions

Engineering Economy (17th Edition)

Ch. 5.A - Use the ERR method with = 8% per year to solve for...Ch. 5.A - Apply the ERR method with = 12% per year to the...Ch. 5.A - Are there multiple IRRs for the following...Ch. 5.A - Are there multiple IRRs for the following cash...Ch. 5 - Tennessee Tool Works (TTW) is considering...Ch. 5 - Prob. 2PCh. 5 - Prob. 3PCh. 5 - Prob. 4PCh. 5 - What is the capitalized worth of a project that...Ch. 5 - A large induced-draft fan is needed for an...

Ch. 5 - Prob. 7PCh. 5 - Prob. 8PCh. 5 - Prob. 9PCh. 5 - A corporate bond pays 5% of its face value once...Ch. 5 - Prob. 11PCh. 5 - Prob. 12PCh. 5 - Prob. 13PCh. 5 - The cash-flow diagram below has an internal rate...Ch. 5 - Prob. 15PCh. 5 - Prob. 16PCh. 5 - Prob. 17PCh. 5 - Prob. 18PCh. 5 - Prob. 19PCh. 5 - Your firm is thinking about investing 200,000in...Ch. 5 - Determine the FW of the following engineering...Ch. 5 - Prob. 22PCh. 5 - Fill in Table P5-23 below when P = 10,000, S = 2,...Ch. 5 - An asset has an initial capital investment of4...Ch. 5 - A simple, direct space heating system is currently...Ch. 5 - Prob. 26PCh. 5 - Prob. 27PCh. 5 - Prob. 28PCh. 5 - Prob. 29PCh. 5 - Its easier to make money when interest rates in...Ch. 5 - Prob. 31PCh. 5 - Prob. 32PCh. 5 - Stan Moneymaker has been informed of a major...Ch. 5 - The required investment cost of a new, large...Ch. 5 - Prob. 35PCh. 5 - A parking garage has a capital investment cost of...Ch. 5 - The city of Oak Ridge is considering the...Ch. 5 - Prob. 38PCh. 5 - Prob. 39PCh. 5 - Prob. 40PCh. 5 - Prob. 41PCh. 5 - Prob. 42PCh. 5 - Prob. 43PCh. 5 - To purchase a used automobile, you borrow 10,000...Ch. 5 - Your boss has just presented you with the summary...Ch. 5 - Experts agree that the IRR of a college education...Ch. 5 - A company has the opportunity to take over a...Ch. 5 - The prospective exploration for oil in the outer...Ch. 5 - Prob. 49PCh. 5 - An integrated, combined cycle power plant produces...Ch. 5 - A computer call center is going to replace all of...Ch. 5 - Prob. 52PCh. 5 - Prob. 53PCh. 5 - Prob. 54PCh. 5 - The upturned wingtips on jet aircraft reduce drag...Ch. 5 - Prob. 56PCh. 5 - Prob. 57PCh. 5 - Prob. 58PCh. 5 - In southern California a photovoltaic (PV) system...Ch. 5 - a. Calculate the IRR for each of the three...Ch. 5 - Prob. 61PCh. 5 - A hospital germ-fighting and floor cleaning robot,...Ch. 5 - Prob. 63PCh. 5 - Prob. 64SECh. 5 - Prob. 65SECh. 5 - Prob. 66SECh. 5 - A certain medical device will result in an...Ch. 5 - Refer to Problem 5-61. Develop a spreadsheet to...Ch. 5 - Prob. 69CSCh. 5 - Prob. 70CSCh. 5 - Suppose that the average utilization of the CVD...Ch. 5 - Prob. 72FECh. 5 - Prob. 73FECh. 5 - Prob. 74FECh. 5 - Prob. 75FECh. 5 - Prob. 76FECh. 5 - Prob. 77FECh. 5 - Prob. 78FECh. 5 - Prob. 79FECh. 5 - A new machine was bought for 9,000 with life of...Ch. 5 - Prob. 81FECh. 5 - Prob. 82FECh. 5 - Prob. 83FECh. 5 - Prob. 84FECh. 5 - Prob. 85FE

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 3) Find the rate of return (IRR-Ch16.3) on a project that will cost $100,000 today and $400,000 in 3 years from today, BUT will return $50,000 at the end of every year for 11 years (4)arrow_forwardYou have received the proposal to invest $1,000,000 in exchange for receiving income of $75,000 at the end of the first month that would decrease 0.3% each month starting from the 2nd month. Expenses are estimated at $25,000 at each end of the month, starting from the 1st month. Assume that the proposal will last 5 years and that the minimum acceptable rate of return (m) is 1.5% per month. What does the Present Value criterion recommend? Show your work. If flow patterns are found (uniform, arithmetic, exponential), use factors.arrow_forwardA firm reports that its IRR for each quarter is 1.09%. What is the equivalent annual effective rate of return for this firm expressed in percentage terms to 3 digits after the decimal point?arrow_forward

- Example: A new process for a manufacturing process will have a first cost of $55,000 with annual costs of $38,000. Extra income associated with the new process is expected to be $62,000 per year. What is the payback period at i= 12% per year? a) 2.29 b) 3.00 c) 6.00 d) 2.14 CITIarrow_forwardA company would like to invest on a project. The rate the company uses to justify their investments, i.e. the MARR is 25% per year (compounded yearly). Their estimations about the projects are as follows: Initial Cost: ($300,000)The Study Period: 15 yearsSalvage (Market) Value of the Project: 20% of the initial cost 1-) What is the capital recovery cost, CR? 2-) Operating costs in the first year are estimated to be ($7,500) and these operating costs are estimated to increase by 5% per year. Construct cash flow table and determine the minimum amount of annual revenue ($ per year?) that makes this investment an attractive option for the company? (i.e. what is Equivalent UNIFORM (Annual) Cost, EU(A)C?) 3-) Benefits in in the first year are estimated to be $30,000 and these benefits are estimated to increase by 13% per year. Construct cash flow table and determine the net present value/worth of the project, NPW. 4-) What is the simple payback period? 5-) Determine IRR of…arrow_forwardQuestion Number 5 You will deposit money into a bank account according to the following schedule: Today 4 year from today 6 years from today 8 years from today 12 years from today $182,000 $78,000 $136,000 $115,000 $94,000 After 12 years from today, what will be the purchasing power of the money in your bank account, expressed in today's dollars?. You bank pays interest at 7.000% per year, compounded annually. Inflation is expected to be 4.520% per year.arrow_forward

- Determine the IRR for this projectarrow_forwardan engineer knows that the supplier of their set-5100 laser surface metrology system used on one of their lines superseded their 5100 model with the 5105. the new model has a net cost of $420000. adding the new 5105 model to the production line would in decrease scrap rate estimated to save 630000 in the first year. the rate of return for on the set-5105 purchase is 13% MEMD IS 15% what is the opportunity costarrow_forwardQ4-a) A nuclear power company presently spending OMR 1200000 per year to dispose the spent fuel in to water. As an alternative, the company is building storage sheds in a society land with a utilization period of 20 years, to store the spent waste. The new facility will cost OMR 800000 to construct and OMR 150000 per year to operate. This company pays 10 % interest on its borrowed money. The company is willing to pay OMR 200000 per year rent to the land owner. Assume the befits associated in water and land disposal are OMR 50000 and OMR 80000 respectively. Analyze these two options based on Cost effectiveness analysis ķ Benefit cost analysis (i)arrow_forward

- SHOW COMPLETE SOLUTIONS. SHOW CASHFLOW DIAGAM. DO NOT USE EXCEL. UNIFORM ARITHMETIC GRADIENT A parcel of land in a downtown area, suitable for parking lot, can be leased for a period of 10 years. Initial development costs for clearing, paving and constructing a small office shed on the lot is estimated to be P150,000. If the net annual revenue for the first year is P22,000 and increases by 10% per year thereafter until the tenth year, and the improvements revert to the owner of the land at the end of 10 years, what is the rate of return on the investment?arrow_forwardFive years ago, Logocom made a $5 million investment in a new high-temperature material. The product was not well accepted after the first year on the market. However, when it was reintroduced 4 years later, It did sell well during the year. Major research funding to broaden the applications has cost $15 million in year 5. Determine the rate of return for these net cash flows (in $1.000 units). Year NCF, $1000 -5,000 4,500 4 21,500 -15,000 The rate of return is % per year.arrow_forwardDetermine the FW of the following engineering project when the MARR is 15% per year. Is the project acceptable? (5.4) *A negative market value means that there is a net cost to dispose of an asset. Investment cost Expected lifeMarket (salvage) value* Annual receiptsAnnual expenses $10,000 5 years -$1,000 $8,000 $4,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education

DATA GEMS: How to Access Income Data Tables and Reports From the CPS ASEC; Author: U.S. Census Bureau;https://www.youtube.com/watch?v=BWpVC-Clczw;License: Standard Youtube License