ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

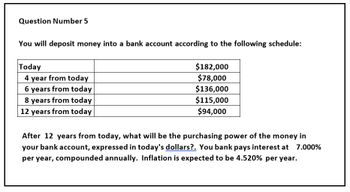

Transcribed Image Text:Question Number 5

You will deposit money into a bank account according to the following schedule:

Today

4 year from today

6 years from today

8 years from today

12 years from today

$182,000

$78,000

$136,000

$115,000

$94,000

After 12 years from today, what will be the purchasing power of the money in

your bank account, expressed in today's dollars?. You bank pays interest at 7.000%

per year, compounded annually. Inflation is expected to be 4.520% per year.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- 2 Answer 345678 ASM International, an Australian steel company, claims that a savings of 30% of the cost of stainless steel threaded bar can be achieved by replacing machined threads with precision 5 weld depositions. A U.S. manufacturer of rock bolts and grout-in fittings plans to purchase the equipment. A mechanical engineer with the company has prepared the following cash 6 flow estimates. Determine the expected nominal annual rate of return (nominal ANNUAL IRR). Draw CFD, and Enter the Answer in 'B2' Cell above. 10 11 Quarter 12 13 14 15 16 17 5 to 10 18 19 20 21 22 23 24 0 $ 1 $ 2 $ 3 $ 4 $ $ Cost 350,000.00 $ 25,000.00 $ 20,000.00 $ 15,000.00 $ 11,000.00 $ 2,000.00 $ Benefit 8,000.00 15,000.00 25,000.00 30,000.00 50,000.00arrow_forwardCalculate the Future worth, at year 7, of the following cash flow. Consider 6% annual interest rate, compounded semiannually. 0 2000 1 3000 Interest Tables 2 1000 3 1500 4 5 6 7 $2,000 2500 3000 ia = (1 + i)m − 1 where İa = effective annual interest rate i = rate for one compounding period m = number times interest is compounded per year i = (1 + r / m)m – 1 where i = effective interest rate for any time period r = nominal rate for same time period as i m = no. times interest is comp'd in period specified for iarrow_forward*Any help with this question would be appreciated, thanks!*arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education