FUND.ACCT.PRIN.

25th Edition

ISBN: 9781260247985

Author: Wild

Publisher: RENT MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 4, Problem 9E

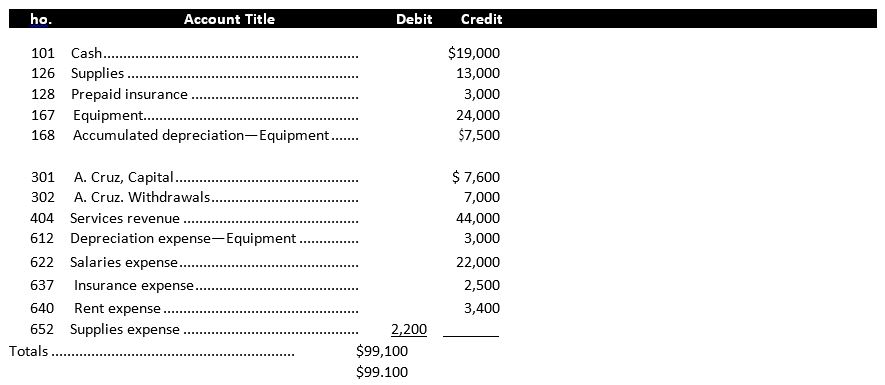

Exercise 4-9 Preparing closing entries and a post-closing

The following adjusted trial balance contains the accounts and year-end balances of Cruz Company as of December 31. (1) Prepare the December 31 closing entries for Cruz Company. Assume the account number for Income Summary is 901. (2) Prepare the December 31 post-closing trial balance for Cruz Company. Note: The A. Cruz. Capital account balance was $47.600 on December 31 of the prior year.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Follow-up for Q1 Submission

The schedule of accounts receivable by age, shown below, was prepared for the Lucero Company at the end of the firm's fiscal year

on December 31, 20X1:

LUCERO COMPANY

Schedule of Accounts Receivable by Age

December 31, 20X1

Past Due-Days

31-60

Account

1-30

Balance

660.00 $

Current

Over 60

Adson, Paul

Allen, Alfred

Ash, John

$

620.00

326.00

350.00

106.00

351.00

78.00

47,009.00

660.00

$ 510.00 $ 110.00

$ 326.00

Вае, John

Barker, Kelsie

Bentley, Maggie

Blair, Herman

(All other accts.)

350.00

75.00

125.00

31.00

155.00

71.00

55.00

23.00

38,790 5,304.00 1,764.00 1,151.00

Totals

$49,500.00 $40,000.00 $6,000.00 $2,000.00 $1,500.00

2. As of December 31, 20X1, there is a credit balance of $118 in Allowance for Doubtful Accounts. Compute the amount of the

adjustment for uncollectible accounts expense that must be made as part of the adjusting entries.

3. Prepare a journal entry to record the adjustment for the estimated losses. Use Uncollectible Accounts Expense and…

Week 7 Discussion question

Accounting for Assets: Receivables

Johnson company’s financial year ended on December 31, 2010. All the transactions related to the company’s uncollectible accounts are can be found below:

January 15

Wrote of $440 account of Miller Company as uncollectible

April 2nd

Re-establish the account of Louisa Teller and record the collection of $1,050 as payment in full for her account which had been written off earlier

July 31

Received 40% of the $700 balance owed by William John and wrote off the remainder as uncollectible

August 15

Wrote off as uncollectible the accounts of Sherwin Company, $1,700 and V. Vasell $2,200

September 26

Received 25% of the $1,140 owed by Grant Company and wrote off the remainder as uncollectible

October 16

Received $741 from M. Fuller in full payment of his account which had been written off earlier as uncollectible

December 31

Estimated uncollectible…

A dog training business began on December 1. The following transactions occurred during its first month.

December 1 Receives $21,000 cash as an owner investment in exchange for common stock.

December 2 Pays $6,120 cash for equipment.

December 3 Pays $3,660 cash (insurance premium) for a 12-month insurance policy. Coverage began on December 1.

December 4 Pays $1,020 cash for December rent expense.

December 7 Provides all-day training services for a large group and immediately collects $1,150 cash.

December 8 Pays $205 cash in wages for part-time help.

December 9 Provides training services for $2,420 and rents training equipment for $610. The customer is billed $3,030

for these services.

December 19 Receives $3,030 cash from the customer billed on Dec. 9.

December 20 Purchases $2,010 of supplies on credit from a supplier.

December 23 Receives $1,620 cash in advance of providing a 4-week training service to a customer.

December 29 Pays $1,305 cash as a partial payment toward the accounts…

Chapter 4 Solutions

FUND.ACCT.PRIN.

Ch. 4 - Prob. 1QSCh. 4 - Prob. 2QSCh. 4 - Computing ending capital balance using work sheet...Ch. 4 - Preparing a partial work sheet P1 The ledger of...Ch. 4 - Explaining temporary and permanent accounts Choose...Ch. 4 - Preparing closing entries from the ledger P2 The...Ch. 4 - Prob. 7QSCh. 4 - Prob. 8QSCh. 4 - Prob. 9QSCh. 4 - Prob. 10QS

Ch. 4 - Prob. 11QSCh. 4 - Prob. 12QSCh. 4 - Prob. 13QSCh. 4 - Prob. 14QSCh. 4 - Prob. 15QSCh. 4 - Prob. 16QSCh. 4 - Prob. 17QSCh. 4 - Prob. 18QSCh. 4 - Prob. 19QSCh. 4 - Prob. 20QSCh. 4 - Exercise 4-1 Extending adjusted account balances...Ch. 4 - Exercise 4-2 Extending accounts in a work sheet Pl...Ch. 4 - Exercise 4-3 Preparing adjusting entries from a...Ch. 4 - Exercise 4-4 Preparing unadjusted and adjusted...Ch. 4 - Exercise 4-5 Determining effects of closing...Ch. 4 - Exercise 4-6 Completing the income statement...Ch. 4 - Exercise 4-7 Preparing a work sheet and recording...Ch. 4 - Exercise 4-8

Preparing and posting closing...Ch. 4 - Exercise 4-9 Preparing closing entries and a...Ch. 4 - Exercise 4-10 Preparing closing entries and a...Ch. 4 - Prob. 11ECh. 4 - Exercise 4-12 Preparing a classified balance sheet...Ch. 4 - Exercise 4-13 Computing the current ratio A1 Use...Ch. 4 - Exercise 4-14 Preparing closing entries P2...Ch. 4 - Exercise 4-15 Computing and analysing the current...Ch. 4 - Exercise 4.16A Preparing reversing entries P4 Hawk...Ch. 4 - Exercise 4-17APreparing reversing entries P4 The...Ch. 4 - Problem 4-1A Applying the accounting cycle C2 P2...Ch. 4 - Problem 4-2A Preparing a work sheet, adjusting and...Ch. 4 - Problem 4-3A Determining balance sheet...Ch. 4 - Problem 4-4A Preparing closing entries, financial...Ch. 4 - Problem 4-5A Preparing trial balances, closing...Ch. 4 - Problem 4-6AA Preparing adjusting, reversing, and...Ch. 4 - Problem 4-1B Applying the accounting cycle C2 P2...Ch. 4 - Prob. 2PSBCh. 4 - Problem 4-3B Determining balance sheet...Ch. 4 - Prob. 4PSBCh. 4 - Problem 4-5B Preparing trial balances, closing...Ch. 4 - Problem 4-6BAPreparing adjusting, reversing, and...Ch. 4 - The December 31. 2019= adjusted trial balance of...Ch. 4 - Transactions from the Fast Forward illustration in...Ch. 4 - Prob. 2GLPCh. 4 - Prob. 3GLPCh. 4 - Based on Problem 4-6ACh. 4 - Prob. 5GLPCh. 4 - Refer to Apple' s financial statements in Appendix...Ch. 4 - Prob. 2AACh. 4 - Prob. 3AACh. 4 - Prob. 1DQCh. 4 - That accounts are affected by closing entries?...Ch. 4 - Prob. 3DQCh. 4 - What is the purpose of the Income Summary account?Ch. 4 - Prob. 5DQCh. 4 - Prob. 6DQCh. 4 - Why are the debit and credit entries in the...Ch. 4 - Prob. 8DQCh. 4 - Prob. 9DQCh. 4 - How is unearned revenue classified on the balance...Ch. 4 - Prob. 11DQCh. 4 - Prob. 12DQCh. 4 - Prob. 13DQCh. 4 - Prob. 1BTNCh. 4 - Prob. 2BTNCh. 4 - Prob. 3BTNCh. 4 - The unadjusted trial balance and information for...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- UNCOLLECTIBLE ACCOUNTSALLOWANCE METHOD Lewis Warehouse used the allowance method to record the following transactions, adjusting entries, and closing entries during the year ended December 31, 20--: Selected accounts and beginning balances on January 1, 20--, are as follows: REQUIRED 1. Open the three selected general ledger accounts. 2. Enter the transactions and the adjusting and closing entries in a general journal (page 6). After each entry, post to the appropriate selected accounts. 3. Determine the net realizable value as of December 31, 20--.arrow_forwardQuestion Content Area On October 1, Black Company receives a 4% interest-bearing note from Reese Company to settle a $17,400 account receivable. The note is due in six months. At December 31, Black should record interest revenue of a. $174 b. $181 c. $171 d. $184arrow_forwardWrite the third closing entry to transfer the net income or net loss to the P. Hernandez, Capital account, assuming the following: a. A net income of 3,842 during the first quarter (Jan.Mar.) b. A net loss of 1,781 during the second quarter (Apr.Jun.)arrow_forward

- UNCOLLECTIBLE ACCOUNTSALLOWANCE METHOD Pyle Nurseries used the allowance method to record the following transactions, adjusting entries, and closing entries during the year ended December 31, 20--. REQUIRED 1. Open the three selected general ledger accounts. 2. Enter the transactions and the adjusting and closing entries in a general journal (page 6). After each entry, post to the appropriate selected accounts. 3. Determine the net realizable value as of December 31.arrow_forwardAppendix 1 Adjusting entry for gross method The following data were extracted from the accounting records of Sacajawea Mercantile Co. for the year ended June 30, 20Y4: a. Journalize the June 30, 20Y4, adjusting entry for estimated sales discounts. b. How would sales and accounts receivable be reported on the financial statements for the year ending June 30, 20Y4?arrow_forwardPayroll accounts and year-end entries The following accounts, with the balances indicated, appear in the ledger of Garcon Co. on December 1 of the current year: The following transactions relating to payroll, payroll deductions, and payroll taxes Occurred during December: Dec. 2. Issued Check No. 410 for 3,400 to Jay Bank to invest in a retirement savings account for employees. 2. Issued Check No. 411 to Jay Bank for 27,046, in payment of 9,273 of social security tax, 2,318 of Medicare tax, and 15,455 of employees federal income tax due. 13. Journalized the entry to record the biweekly payroll. A summary of the payroll record follows: Dec. 13. Issued Check No. 420 in payment of the net amount of the biweekly payroll to fund the payroll bank account. 13. Journalized the entry to record payroll taxes on employees earnings of December13: social security tax, 4,632; Medicare tax, 1,158; state unemployment tax, 350; federal unemployment tax, 125. 16. Issued Check No. 424 to Jay Bank for 27,020, in payment of 9,264 of social security tax, 2,316 of Medicare tax, and 15,440 of employees federal income tax due. 19. Issued Check No. 429 to Sims-Walker Insurance Company for 31,500, in payment of the semiannual premium on the group medical insurance policy. 27. Journalized the entry to record the biweekly payroll. A summary of the payroll record follows: 27. Issued Check No. 541 in payment of the net amount of the biweekly payroll to fund the payroll bank account. 27. Journalized the entry to record payroll taxes on employees earnings of December27: social security tax, 4,668; Medicare tax, 1,167; state unemployment tax, 225; federal unemployment tax, 75. 27. Issued Check No. 543 for 20,884 to State Department of Revenue in payment of employees state income tax due on December 31. 31. Issued Check No. 545 to Jay Bank for 3,400 to invest in a retirement savings account for employees. 31. Paid 45,000 to the employee pension plan. The annual pension cost is 60,000. (Record both the payment and unfunded pension liability.) Instructions 1. Journalize the transactions. 2. Journalize the following adjusting entries on December 31: a. Salaries accrued: operations salaries, 8,560; officers salaries, 5,600; office salaries,1,400. The payroll taxes are immaterial and are not accrued. b. Vacation pay, 15,000.arrow_forward

- Reconstruction of Closing Entries The following T accounts summarize entries made to selected general ledger accounts of Cooper $ Company. Certain entries, dated December 31, are closing entries. Prepare the closing entries that were made on December 31.arrow_forwardREVERSING ENTRIES Prepare reversing journal entries for Hendrix Company on January 1, 20-2. The following year-end adjustments were made:arrow_forwardClosing Entries for Nordstrom The following accounts appear on Nordstroms 2013 financial statements as reported in its Form 10-K for the fiscal year ended February 1, 2014. The accounts are listed in alphabetical order, and the balance in each account is the normal balance for that account. All amounts are in millions of dollars. Prepare closing entries for Nordstrom for 2013.arrow_forward

- Instruction Chart of Accounts General Journal Instruction Record the following transactions for the Scott Company: Transactions: Nov. Received a $6,500, 90-day, 6% note from Tim's Co. in payment of the account. 4 Dec. 31 Accrued interest on the Tim's Co. note. Feb. Received the amount due from Tim's Co. on the note. Required: Journalize the above transactions. Refer to the Chart of Accounts for exact wording of account titles. Round your answers to two decimal places. Assume a 360-day year when calculating interest. Previous Nex 2.arrow_forwardPROBLEM December 31 balances for selected accounts of the Carley Company are presented below: Accounts receivables $500 Sales 2,000 Interest revenue 600 Dividends distributed 300 Allowance for doubtful 100 accounts Salaries expense 800 Depreciation expense 400 Unearned rent 200 Required: Prepare whatever closing entries are appropriate for the accounts above.arrow_forwardSelected accounts and related amounts for Druid Hills Co. for the fiscal year ended May 31, 20Y8, are presented in Problem 6-5A. Adjunt problem 6-5A Instructions 1. Prepare a single-step income statement in the format shown in Exhibit 12. 2. Prepare closing entries as of May 31, 20Y8.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY