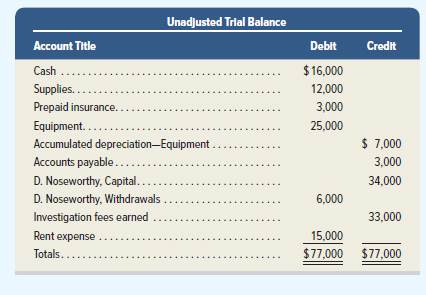

The unadjusted

Additional Year-End Information

1. Insurance that expired in the current period amounts to $2,200.

2. Equipment depreciation for the period is $4,000.

3. Unused supplies total $5,000 at period-end.

4. Services in the amount of $800 have been provided but have not been billed or collected.

Responsibilities for Individual Team Members

1. Determine the accounts arid adjusted balances to be extended to the Balance Sheet columns of the work sheet for Noseworthy. Also

determine total assets and total liabilities.

2. Determine the adjusted revenue account balance and prepare the entry to close this account.

3. Determine the adjusted account balances for expenses and prepare the entry to dose these accounts.

4. Prepare T-accounts for both D. Noseworthy, Capital (reflecting the unadjusted trial balance amount) and Income Summary. Prepare the third

and fourth closing entries. Ask teammates assigned to parts 2 and 3 for the postings for Income Summary. Obtain amounts to complete the

third closing entry and post both the third and fourth closing entries. Provide the team with the ending capital account balance.

5. The entire team should prove the accounting equation using post-closing balances.

Want to see the full answer?

Check out a sample textbook solution

Chapter 4 Solutions

FUND.ACCT.PRIN.

- Chapter 7 of the textbook presents some concerns regarding the current accounting standards for research and development expenditures. Instructions: For this discussion, you will be divided into two groups: Group B: You are assigned to Group B if you have a last name beginning with N-Z. Assume that you are the FASB member. Write a memo defending the current standards regarding research and development. For both groups, your memo should address the following questions: By requiring expensing of R&D, do you think companies will spend less on R&D? Why or why not? What are the possible implications for the competitiveness of U.S. companies? If a company makes a commitment to spend money for R&D, it must believe it has future benefits. Shouldn't these costs therefore be capitalized just like the purchase of any long-lived asset that you believe will have future benefits? Explain your answer. For your initial post, indicate in the subject line which group you are in (Group A…arrow_forwardJa'Niya, a recent college graduate has started working for Cline CPA Firm. Ja'Niya is currently taking part in her first audit, and is discussing the management letter with her supervisor, Jamie. Jamie has just explained why the CPA firm sends management letters to its audit clients, however Ja'Niya is still confused as to the purpose of the letter and asks Jamie to provide some examples of items that might be in the letter. Which of the following would represent examples of items that an auditor might apprise management of in a management letter? • Generally accepted auditing standards require drafting and transmittal of the management letter by the external auditors for all public and private clients. Once the management letter has been received by management, the auditors' requests written assurances from management confirming the effectiveness of internal controls in the noted areas. • The external auditing firm might use a management letter to communicate important matters and…arrow_forwardCreate a hypothetical ethics case then describe the guidance that applies to the issue. The simplest was to complete this assignment is to use any ethical dilemma that you may have encountered in professional practice or review the AICPA Code of Conduct or the IRS Circular 230 then inventing an ethical situation based on one of these sources. Also, you can use news stories, any disciplinary actions on state CPA websites. After you describe the situation in a case format, then search and locate the ethics guidance that addresses the issue. Use this format: 1. What inspired this case idea? 2. Describe the situation in case format 3. Outline the applicable guidance and how it should be applied to this issuearrow_forward

- Make a note of any responses entered on this page in the last few minutes, then try to re-connect. Once connection has been re-established, your responses should be saved and this message will disappear. 020114022 AAUP - JENIN) y courses / AUDITING AND ASSURANCE SERVICES Section1 Lecture (20202 020114022 AAUP JENIN) / 10 July Time left 0: Determine the type of evidence we can get from this audit procedure. Calculate the ratio of cost of goods sold to sales as a test of overall reasonableness of gross margin relative the preceding year. O a. Analytical procedure O b. Confirmation Oc. Physicals examination O d. Inspectionarrow_forwardDescribe who Elliott Ness was and how his team was able to capture evidence that led to the successful of Al "Scarface" Capone. Provide two websites that demonstrate forensic accounting in practice.arrow_forwardJimmy Bunting, the practitioner at Yanzhou Coal Mining and Minerals, performed the following tasks: he used analytical procedures and he had discussions with management. These activities were a basis for a conclusion on the financial information. What did Jimmy Bunting perform? a qualified report an unmodified opinion a review engagement O a compilation engagementarrow_forward

- Shining Glass is switching to a new accounting information system. To expedite the implementation, the managing director asked your consulting team to postpone establishing standards and controls until after the system is fully operational. What will be your response to the managing director’s request? Explain.arrow_forwardNazril is a new audit trainee at Faezi & Co. In assisting the audit seniors to undertake the audit work, the audit seniors always advise her to properly maintain all the working papers. From there on, whenever she does any audit work, she will make sure all information is properly documented and properly kept in a proper file. Clarify TWO (2) reasons why auditors need to properly maintain these files.arrow_forwardWhich of the following is true?a. Members of an audit engagement team cannot speak with audit client officers about matters outside the scope of the audit while the audit engagement is in progress.b. Audit team members who leave the public accounting firm for employment with auditclients can provide audit efficiencies (next year) because they are very familiar with thefirm’s audit plans.c. Audit team partners who leave the public accounting firm for employment with auditclients can retain variable annuity retirement accounts established in the person’s formerfirm retirement plan.d. The public accounting firm must discuss with the audit client’s board or its audit committee the independence implications of the client’s having hired the audit engagement teammanager as its financial vice president.arrow_forward

- Ryan is an audit manager in a reputed tax and audit firm. He is incharge of the firm's engagement's objectives, scope, action plans and audit recommendations. He has to release the final audit results for the financialyear along with the internal auditor's options/ results. Which approach will best help him to furnish the details? A) Using external source and process reports B) Using assignment and feedback charts C) Using visualization and interactive reports D) Using accounts payable and receivable reportsarrow_forwardYou are an audit graduate working for an audit firm. A client has said to you that you seem to be endlessly documenting matters and queries is this necessary as it is undoubtedly increasing the cost of the audit. REQUIRED Succinctly explain what your answer to the client should be.arrow_forwardor students doing a Project Study and students doing an internship, prepare a journal entry sharing your reflections on your experience in collecting the (primary) data you collected for your research. For students doing a Systematic Review prepare a journal entry sharing your reflections on your experience in collecting the (secondary) data you collected from your selected resources. You are to follow Gibb’s Reflective Cycle as your guide in laying out your reflection.arrow_forward