Fundamental Accounting Principles

24th Edition

ISBN: 9781259916960

Author: Wild, John J., Shaw, Ken W.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 4, Problem 7E

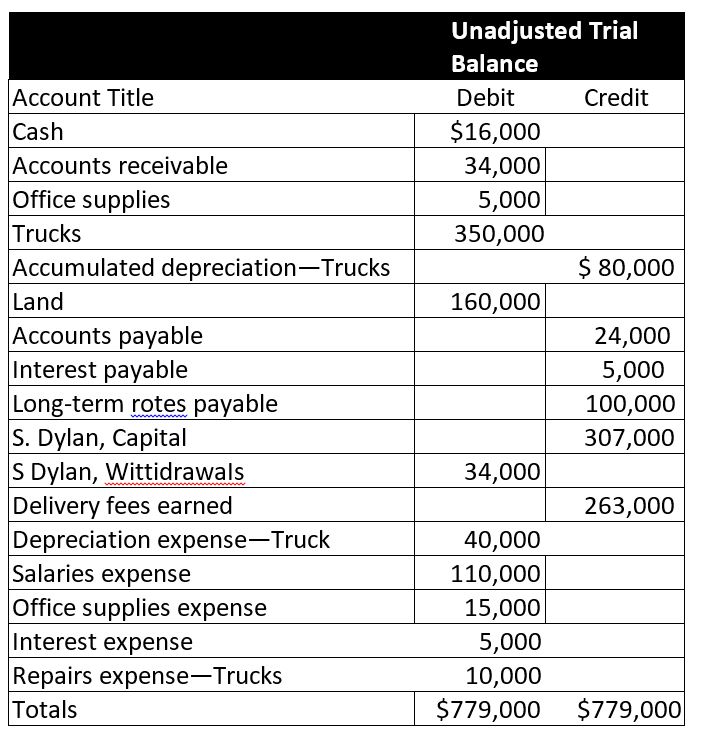

Exercise 4-7 Preparing a work sheet and recording closing entries P1 P2

The following unadjusted

- Use the following information about the company's adjustments to complete a 10-cotumn work sheet.

a. Unrecorded

b. The total amount of accrued interest expense at year-end is $6,000.

C. The cost of unused office supplies still available at year-end is $2,000.

Dylan. Capital account balance was $307,000 on December 31 of the prior year.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Do fast answer of this accounting questions

Hi expert please give me answer general accounting question

General accounting question

Chapter 4 Solutions

Fundamental Accounting Principles

Ch. 4 - Prob. 1DQCh. 4 - That accounts are affected by closing entries?...Ch. 4 - Prob. 3DQCh. 4 - What is the purpose of the Income Summary account?Ch. 4 - Prob. 5DQCh. 4 - Prob. 6DQCh. 4 - Why are the debit and credit entries in the...Ch. 4 - Prob. 8DQCh. 4 - Prob. 9DQCh. 4 - How is unearned revenue classified on the balance...

Ch. 4 - Prob. 11DQCh. 4 - Prob. 12DQCh. 4 - Prob. 13DQCh. 4 - Prob. 14DQCh. 4 - Prob. 15DQCh. 4 - Prob. 16DQCh. 4 - Prob. 17DQCh. 4 - Prob. 1QSCh. 4 - Preparing a work sheet P1 In the blank space...Ch. 4 - Computing ending capital balance using work sheet...Ch. 4 - Preparing a partial work sheet P1 The ledger of...Ch. 4 - Explaining temporary and permanent accounts Choose...Ch. 4 - Preparing closing entries from the ledger P2 The...Ch. 4 - Identifying post-closing accounts P3 Identify...Ch. 4 - Identifying the accounting cycle C2 List the...Ch. 4 - Classifying balance sheet items C3 The following...Ch. 4 - Preparing financial statements C2 Use the...Ch. 4 - Preparing a classified balance sheet C3 Use the...Ch. 4 - Identifying current accounts and computing the...Ch. 4 - Prob. 13QSCh. 4 - Exercise 4-1 Extending adjusted account balances...Ch. 4 - Exercise 4-2 Extending accounts in a work sheet Pl...Ch. 4 - Exercise 4-3 Preparing adjusting entries from a...Ch. 4 - Exercise 4-4 Preparing unadjusted and adjusted...Ch. 4 - Exercise 4-5 Determining effects of closing...Ch. 4 - Exercise 4-6 Completing the income statement...Ch. 4 - Exercise 4-7 Preparing a work sheet and recording...Ch. 4 - Exercise 4-8

Preparing and posting closing...Ch. 4 - Exercise 4-9 Preparing closing entries and a...Ch. 4 - Exercise 4-10 Preparing closing entries and a...Ch. 4 - Prob. 11ECh. 4 - Exercise 4-12 Preparing a classified balance sheet...Ch. 4 - Exercise 4-13 Computing the current ratio A1 Use...Ch. 4 - Exercise 4-14 Preparing closing entries P2...Ch. 4 - Exercise 4-15 Computing and analysing the current...Ch. 4 - Exercise 4.16A Preparing reversing entries P4 Hawk...Ch. 4 - Exercise 4-17APreparing reversing entries P4 The...Ch. 4 - Problem 4-1A Applying the accounting cycle C2 P2...Ch. 4 - Problem 4-2A Preparing a work sheet, adjusting and...Ch. 4 - Problem 4-3A Determining balance sheet...Ch. 4 - Problem 4-4A Preparing closing entries, financial...Ch. 4 - Problem 4-5A Preparing trial balances, closing...Ch. 4 - Problem 4-6AA Preparing adjusting, reversing, and...Ch. 4 - Problem 4-1B Applying the accounting cycle C2 P2...Ch. 4 - Prob. 2BPSBCh. 4 - Problem 4-3B Determining balance sheet...Ch. 4 - Prob. 4BPSBCh. 4 - Problem 4-5B Preparing trial balances, closing...Ch. 4 - Problem 4-6BAPreparing adjusting, reversing, and...Ch. 4 - The December 31. 2019= adjusted trial balance of...Ch. 4 - Transactions from the Fast Forward illustration in...Ch. 4 - Prob. 2GLPCh. 4 - Prob. 3GLPCh. 4 - Based on Problem 4-6ACh. 4 - Prob. 5GLPCh. 4 - Refer to Apple' s financial statements in Appendix...Ch. 4 - Prob. 2AACh. 4 - Prob. 3AACh. 4 - Prob. 1BTNCh. 4 - Prob. 2BTNCh. 4 - Prob. 3BTNCh. 4 - The unadjusted trial balance and information for...Ch. 4 - Prob. 5BTNCh. 4 - Prob. 6BTN

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Can you help me with accounting questionsarrow_forwardAcorn Construction (calendar-year-end C corporation) has had rapid expansion during the last half of the current year due to the housing market's recovery. The company has record income and would like to maximize its cost recovery deduction for the current year. (Use MACRS Table 1, Table 2, Table 3, Table 4, and Table 5.) Note: Round your answer to the nearest whole dollar amount. Acorn provided you with the following information: Asset Placed in Service Basis New equipment and tools August 20 $ 3,800,000 Used light-duty trucks October 17 2,000,000 Used machinery November 6 1,525,000 Total $ 7,325,000 The used assets had been contributed to the business by its owner in a tax-deferred transaction two years ago. a. What is Acorn's maximum cost recovery deduction in the current year?arrow_forwardGeneral accountingarrow_forward

- Multiple Choice 2-32 Educational Incentives (LO 2.14) Wendy is a single taxpayer and pays tuition of $7,800 in 2021. Her 2021 AGI is $66,000. What is the amount of Wendy's tuition deduction? X a. $2,000 O b. $0 O c. $3,733.33 O d. $4,000 O e. $7,800arrow_forwardMultiple Choice 2-32 Educational Incentives (LO 2.14) Wendy is a single taxpayer and pays tuition of $7,800 in 2021. Her 2021 AGI is $66,000. What is the amount of Wendy's tuition deduction? X a. $2,000 O b. $0 O c. $3,733.33 O d. $4,000 O e. $7,800arrow_forwardNonearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

College Accounting, Chapters 1-27 (New in Account...

Accounting

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY