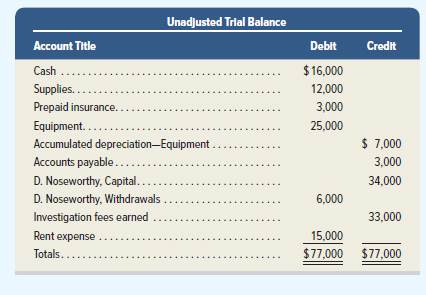

The unadjusted

Additional Year-End Information

1. Insurance that expired in the current period amounts to $2,200.

2. Equipment

3. Unused supplies total $5,000 at period-end.

4. Services in the amount of $800 have been provided but have not been billed or collected.

Responsibilities for Individual Team Members

1. Determine the accounts arid adjusted balances to be extended to the

determine total assets and total liabilities.

2. Determine the adjusted revenue account balance and prepare the entry to close this account.

3. Determine the adjusted account balances for expenses and prepare the entry to dose these accounts.

4. Prepare T-accounts for both D. Noseworthy, Capital (reflecting the unadjusted trial balance amount) and Income Summary. Prepare the third

and fourth closing entries. Ask teammates assigned to parts 2 and 3 for the postings for Income Summary. Obtain amounts to complete the

third closing entry and post both the third and fourth closing entries. Provide the team with the ending capital account balance.

5. The entire team should prove the accounting equation using post-closing balances.

Want to see the full answer?

Check out a sample textbook solution

Chapter 4 Solutions

Fundamental Accounting Principles

- Compute the company degree of operating leveragearrow_forwardNonearrow_forwardDenver Enterprises has fixed costs of $3,150,000. It has a unit selling price of $15.50, unit variable cost of $6.80, and a target net income of $850,000. Compute the required sales in units to achieve its target net income. Answerarrow_forward

Pkg Acc Infor Systems MS VISIO CDFinanceISBN:9781133935940Author:Ulric J. GelinasPublisher:CENGAGE L

Pkg Acc Infor Systems MS VISIO CDFinanceISBN:9781133935940Author:Ulric J. GelinasPublisher:CENGAGE L