College Accounting (Book Only): A Career Approach

13th Edition

ISBN: 9781337280570

Author: Scott, Cathy J.

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

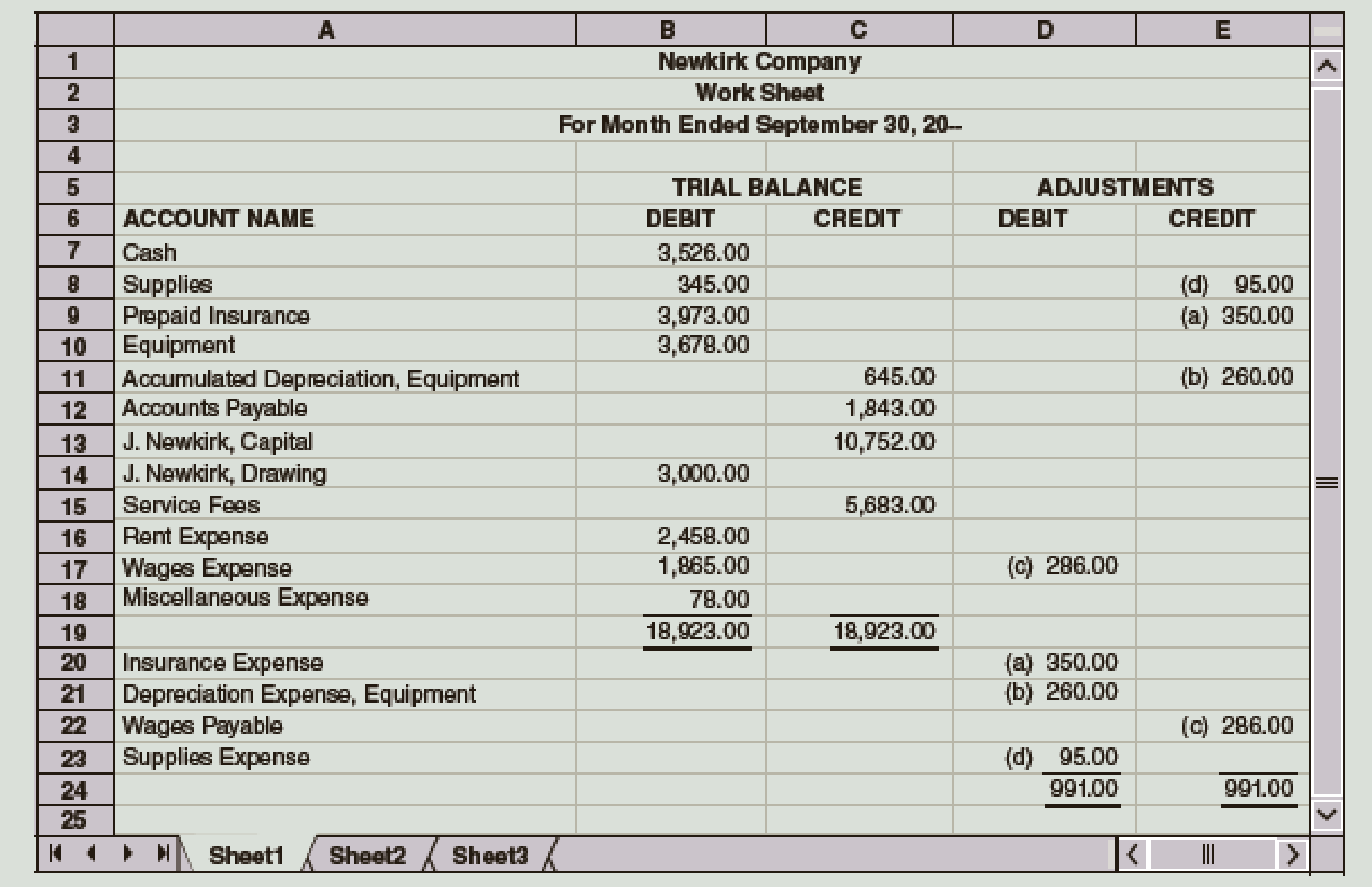

Chapter 4, Problem 7E

Journalize the

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Subject general accounting

Department during the month?

None

Chapter 4 Solutions

College Accounting (Book Only): A Career Approach

Ch. 4 - The __________ represents the sequence of steps in...Ch. 4 - The __________ is a working paper used by...Ch. 4 - On the work sheet, assets are recorded in which of...Ch. 4 - Rainy Day Services had 430 of supplies reported on...Ch. 4 - On the work sheet, Accumulated Depreciation,...Ch. 4 - The __________ requires that expenses be matched...Ch. 4 - Accumulated Depreciation, Equipment is reported a....Ch. 4 - What is the purpose of a work sheet?Ch. 4 - What is the purpose of adjusting entries?Ch. 4 - Prob. 3DQ

Ch. 4 - Prob. 4DQCh. 4 - Prob. 5DQCh. 4 - Define depreciation as it relates to a van you...Ch. 4 - Prob. 7DQCh. 4 - Why is it necessary to journalize and post...Ch. 4 - 1. List the following classifications of accounts...Ch. 4 - Classify each of the accounts listed below as...Ch. 4 - Place a check mark next to any account(s)...Ch. 4 - A partial work sheet for Marges Place is shown...Ch. 4 - Complete the work sheet for Ramey Company, dated...Ch. 4 - Journalize the adjusting entries from the partial...Ch. 4 - Journalize the adjusting entries from the partial...Ch. 4 - Journalize the following adjusting entries that...Ch. 4 - Determine on which financial statement each...Ch. 4 - Prob. 1PACh. 4 - The trial balance of Clayton Cleaners for the...Ch. 4 - The trial balance for Game Time on July 31 is as...Ch. 4 - The trial balance for Benner Hair Salon on March...Ch. 4 - The trial balance for Masons Insurance Agency as...Ch. 4 - The trial balance of The New Decors for the month...Ch. 4 - The trial balance for Harris Pitch and Putt on...Ch. 4 - The trial balance for Wilson Financial Services on...Ch. 4 - Prob. 1ACh. 4 - You are the bookkeeper for a small but thriving...Ch. 4 - Prob. 3ACh. 4 - Your client is preparing financial statements to...Ch. 4 - Prob. 1CP

Additional Business Textbook Solutions

Find more solutions based on key concepts

How is activity-based costing useful for pricing decisions?

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Assume the United States is an importer of televisions and there are no trade restrictions. US consumers buy 1 ...

Principles of Microeconomics (MindTap Course List)

1-1. Define marketing and outline the steps in the marketing process. (AASCB: Communication)

Marketing: An Introduction (13th Edition)

Fundamental and Enhancing Characteristics. Identify whether the following items are fundamental characteristics...

Intermediate Accounting (2nd Edition)

E6-14 Using accounting vocabulary

Learning Objective 1, 2

Match the accounting terms with the corresponding d...

Horngren's Accounting (12th Edition)

Mary Williams, owner of Williams Products, is evaluating whether to introduce a new product line. After thinkin...

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- What is the amount of the net fixed assets?arrow_forward9 A B C D E 4 Ramsey Miller Style, Inc. manufactures a product which requires 15 pounds of direct materials at a cost of $8 5 per pound and 5.0 direct labor hours at a rate of $17 per hour. Variable overhead is budgeted at a rate of $3 per direct labor hour. Budgeted fixed overhead is $433,000 per month. The company's policy is to end each month with direct materials inventory equal to 45% of the next month's direct materials requirement, and finished 7 goods inventory equal to 60% of next month's sales. August sales were 13,400 units, and marketing expects 8 sales to increase by 500 units in each of the upcoming three months. At the end of August, the company had 9 95,850 pounds of direct materials in inventory, and 8,340 units in finished goods inventory. 10 11 August sales 12 Expected increase in monthly sales 13 Desired ending finished goods (units) 14 Selling price per unit 15 Direct materials per unit 16 Direct materials cost 17 Direct labor hours (DLHS) per unit 18 Direct labor…arrow_forwardSherrod, Incorporated, reported pretax accounting income of $84 million for 2024. The following information relates to differences between pretax accounting income and taxable income: a. Income from installment sales of properties included in pretax accounting income in 2024 exceeded that reported for tax purposes by $3 million. The installment receivable account at year-end 2024 had a balance of $4 million (representing portions of 2023 and 2024 installment sales), expected to be collected equally in 2025 and 2026. b. Sherrod was assessed a penalty of $4 million by the Environmental Protection Agency for violation of a federal law in 2024. The fine is to be paid in equal amounts in 2024 and 2025. c. Sherrod rents its operating facilities but owns one asset acquired in 2023 at a cost of $88 million. Depreciation is reported by the straight-line method, assuming a four-year useful life. On the tax return, deductions for depreciation will be more than straight- line depreciation the…arrow_forward

- Direct materials price variancearrow_forward$ 36,000 204,000 The Drysdale, Koufax, and Marichal partnership has the following balance sheet immediately prior to liquidation: Cash Noncash assets Liabilities Drysdale, loan $ 50,000 10,000 Total assets $ 240,000 Drysdale, capital (50%) Koufax, capital (30%) Marichal, capital (20%) Total liabilities and capital 70,000 60,000 50,000 $ 240,000 Required: a-1. Determine the maximum loss that can be absorbed in Step 1. Then, assuming that this loss has been incurred, determine the next maximum loss that can be absorbed in Step 2. a-2. Liquidation expenses are estimated to be $15,000. Prepare a predistribution schedule to guide the distribution of cash. b. Assume that assets costing $74,000 are sold for $60,000. How is the available cash to be divided? Complete this question by entering your answers in the tabs below.arrow_forwardCalculate GP ratio round answers to decimal placearrow_forward

- What is the gross profit percentage for this periodarrow_forwardThe company's gross margin percentage is ?arrow_forwardProblem 19-13 (Algo) Shoney Video Concepts produces a line of video streaming servers that are linked to personal computers for storing movies. These devices have very fast access and large storage capacity. Shoney is trying to determine a production plan for the next 12 months. The main criterion for this plan is that the employment level is to be held constant over the period. Shoney is continuing in its R&D efforts to develop new applications and prefers not to cause any adverse feelings with the local workforce. For the same reason, all employees should put in full workweeks, even if that is not the lowest-cost alternative. The forecast for the next 12 months is MONTH FORECAST DEMAND January February March April 530 730 830 530 May June 330 230 July 130 August 130 September 230 October 630 730 800 November December Manufacturing cost is $210 per server, equally divided between materials and labor. Inventory storage cost is $4 per unit per month and is assigned based on the ending…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY