Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN: 9781305654174

Author: Gary A. Porter, Curtis L. Norton

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 4, Problem 4.35MCE

Revenue Recognition, Cash and Accrual Bases

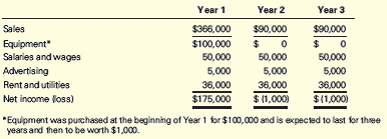

Hathaway Health Club sold three-year memberships at a reduced rate during its opening promotion. It sold 1,000 three-year nonrefundable memberships for $366 each. The club expects to sell 100 additional three-year memberships for $900 each over each of the next two years. Membership fees are paid when clients sign up. The club’s bookkeeper has prepared the following income statement for the first year of business and

Cash-basis income statements:

Required

- Convert the income statements for each of the three years to the accrual basis.

- Describe how the revenue recognition principle applies. Do you believe that the cash-basis or the accrual-basis income statements are more useful to management? to investors? Why?

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

expert of general accounting answer

Need help this question

Financial accounting

Chapter 4 Solutions

Financial Accounting: The Impact on Decision Makers

Ch. 4 - Read each definition below and write the number of...Ch. 4 - Prob. 4.1ECh. 4 - Comparing the Income Statement and the Statement...Ch. 4 - Prob. 4.3ECh. 4 - Accruals and Deferrals For the following...Ch. 4 - Office Supplies Somerville Corp. purchases office...Ch. 4 - Prepaid Rent—Quarterly Adjustments On September...Ch. 4 - Prob. 4.7ECh. 4 - Depreciation On July 1, 2016, Dexter Corp. buys a...Ch. 4 - Working Backward: Depreciation Polk Corp....

Ch. 4 - Prob. 4.10ECh. 4 - Subscriptions Horse Country Living publishes a...Ch. 4 - Customer Deposits Wolfe $ Wolfe collected $9,000...Ch. 4 - Concert Tickets Sold in Advance Rock N Roll...Ch. 4 - Prob. 4.14ECh. 4 - Wages Payable Denton Corporation employs 50...Ch. 4 - Prob. 4.16ECh. 4 - Prob. 4.17ECh. 4 - Interest Payable—Quarterly Adjustments Glendive...Ch. 4 - Prob. 4.19ECh. 4 - Interest Receivable On June 1, 2016, MicroTel...Ch. 4 - Rent Receivable Hudson Corp. has extra space in...Ch. 4 - Working Backward: Rent Receivable Randys Rentals...Ch. 4 - The Effect of Ignoring Adjusting Entries on Net...Ch. 4 - The Effect of Adjusting Entries on the Accounting...Ch. 4 - Reconstruction of Adjusting Entries from...Ch. 4 - The Accounting Cycle The steps in the accounting...Ch. 4 - Trial Balance The following account titles,...Ch. 4 - Prob. 4.28ECh. 4 - Preparation of a Statement of Retained Earnings...Ch. 4 - Reconstruction of Closing Entries The following T...Ch. 4 - Closing Entries for Nordstrom The following...Ch. 4 - Prob. 4.32ECh. 4 - Prob. 4.33ECh. 4 - Prob. 4.34ECh. 4 - Revenue Recognition, Cash and Accrual Bases...Ch. 4 - Depreciation Expense During 2016, Carter Company...Ch. 4 - Prob. 4.37MCECh. 4 - Adjusting Entries Kretz Corporation prepares...Ch. 4 - Prob. 4.2PCh. 4 - Prob. 4.3PCh. 4 - Recurring and Adjusting Entries Following are...Ch. 4 - Prob. 4.5PCh. 4 - Prob. 4.6PCh. 4 - Prob. 4.7PCh. 4 - Prob. 4.8PCh. 4 - Prob. 4.9PCh. 4 - Prob. 4.10PCh. 4 - Prob. 4.1IPCh. 4 - Prob. 4.2APCh. 4 - Prob. 4.3APCh. 4 - Prob. 4.7APCh. 4 - Prob. 4.9APCh. 4 - Prob. 4.10APCh. 4 - Prob. 4.11MCPCh. 4 - Prob. 4.12MCPCh. 4 - Prob. 4.13MCPCh. 4 - Prob. 4.11AMCPCh. 4 - Prob. 4.12AMCPCh. 4 - Prob. 4.13AMCPCh. 4 - Prob. 4.1APCh. 4 - Prob. 4.4APCh. 4 - Prob. 4.5APCh. 4 - Prob. 4.6APCh. 4 - Prob. 4.8APCh. 4 - Prob. 4.1DCCh. 4 - Prob. 4.2DCCh. 4 - Prob. 4.3DCCh. 4 - Prob. 4.4DCCh. 4 - Depreciation Jensen Inc., a graphic arts studio,...Ch. 4 - Prob. 4.6DCCh. 4 - Prob. 4.7DC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Given the solution and accounting questionarrow_forwardThe following data were selected from the records of Fluwars Company for the year ended December 31, current year: Balances at January 1, current year: Accounts receivable (various customers) $ 111,500Allowance for doubtful accounts 11,200 The company sold merchandise for cash and on open account with credit terms 1/10, n/30, without a right of return. The following transactions occurred during the current year: Sold merchandise for cash, $252,000.Sold merchandise to Abbey Corp; invoice amount, $36,000.Sold merchandise to Brown Company; invoice amount, $47,600.Abbey paid the invoice in (b) within the discount period.Sold merchandise to Cavendish Inc.; invoice amount, $50,000.Collected $113,100 cash from customers for credit sales made during the year, all within the discount periods.Brown paid its account in full within the discount period.Sold merchandise to Decca Corporation; invoice amount, $42,400.Cavendish paid its account in full after the discount…arrow_forwardGiven solution general accountingarrow_forward

- answer plzarrow_forwardThe following data were selected from the records of Fluwars Company for the year ended December 31, current year: Balances at January 1, current year: Accounts receivable (various customers) $ 111,500 Allowance for doubtful accounts 11,200 The company sold merchandise for cash and on open account with credit terms 1/10, n/30, without a right of return. The following transactions occurred during the current year: Sold merchandise for cash, $252,000. Sold merchandise to Abbey Corp; invoice amount, $36,000. Sold merchandise to Brown Company; invoice amount, $47,600. Abbey paid the invoice in (b) within the discount period. Sold merchandise to Cavendish Inc.; invoice amount, $50,000. Collected $113,100 cash from customers for credit sales made during the year, all within the discount periods. Brown paid its account in full within the discount period. Sold merchandise to Decca Corporation; invoice amount, $42,400. Cavendish paid its account in full after the…arrow_forwardNonearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License