Individual Income Taxes

43rd Edition

ISBN: 9780357109731

Author: Hoffman

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 4, Problem 25CE

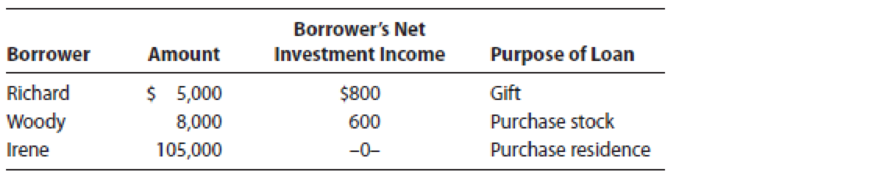

LO.4 Elizabeth made the following interest-free loans during the year. Assume that tax avoidance is not a principal purpose of any of the loans. Assume that the relevant Federal rate is 5% and that the loans were outstanding for the last six months of the year.

What are the effects of the imputed interest rules on these transactions? Compute Elizabeth’s gross income from each loan:

- a. Richard

- b. Woody

- c. Irene

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Elizabeth makes the following interest-free loans during the year. Assume that tax avoidance is not a principal purpose of any of the loans.

The relevant Federal rate is 5% and that the loans were outstanding for the last six months of the year.

Borrower's Net

Borrower Amount

Investment Income Purpose of Loan

Richard

$5,000

$800

Gift

Woody

$8,000

$600

Stock purchase

Irene

$105,000

$0

Purchase principal residence

By how much do each of these loans increase Elizabeth's gross income?

If an amount is zero, enter "0".

a. Richard is not

subject to the imputed interest rules because the $10,000 gift loan exception does

apply. Elizabeth's

gross income from the loan is $

0

b. The $10,000 exception does not

income producing

apply to the loan to Woody because the proceeds were used to purchase

assets. Although the $100,000 exception applies

to this loan, the amount of imputed interest is

1,000 X.Incorrect

is $

0 ✓.

c. None of the exceptions apply

gross income from the loan is $

to the loan to…

Judy Martinez, owner of Judy's Fashions,received a $12,000 tax refund. She depositedthe money in Chase Bank. The terms of theagreement are that she must leave the moneyon deposit for three years and the bank will payher 1 percent interest. Her account is aa. line of credit.b. certificate of deposit.c. checking account.d. commercial paper agreement.e. savings account.

Assume that Louisa carried an average balance of $1,000 from her credit card purchases over the past year. The A.P.R. on her credit card for the past year was 19.99%. Approximately how much interest would Louisa have paid over the course of the year?

She would have paid interest charges of $2,000.

She would have paid interest charges of $20.

The credit card company would have paid Louisa $20.

She would have paid interest charges of $200.

Chapter 4 Solutions

Individual Income Taxes

Ch. 4 - According to the Supreme Court, would it be good...Ch. 4 - Prob. 2DQCh. 4 - Prob. 3DQCh. 4 - Ben lost his job when his employer moved its...Ch. 4 - Howard buys wrecked cars and stores them on his...Ch. 4 - On December 29, 2019, an employee received a 5,000...Ch. 4 - Prob. 7DQCh. 4 - A Series EE U.S. government savings bond accrues...Ch. 4 - The taxpayer performs services with payment due...Ch. 4 - Wade paid 7,000 for an automobile that needed...

Ch. 4 - Prob. 11DQCh. 4 - Prob. 12DQCh. 4 - A divorce agreement entered into in 2017 requires...Ch. 4 - Prob. 14DQCh. 4 - Patrick and Eva are planning to divorce in 2019....Ch. 4 - Prob. 16DQCh. 4 - Prob. 17DQCh. 4 - Prob. 18DQCh. 4 - Prob. 19DQCh. 4 - Prob. 20DQCh. 4 - On January 1, 2019, Kunto, a cash basis taxpayer,...Ch. 4 - Bigham Corporation, an accrual basis calendar year...Ch. 4 - LO.3 Simba and Zola are married but file separate...Ch. 4 - Casper and Cecile divorced in 2018. As part of the...Ch. 4 - LO.4 Elizabeth made the following interest-free...Ch. 4 - Prob. 26CECh. 4 - Prob. 27CECh. 4 - Prob. 28PCh. 4 - Prob. 29PCh. 4 - Determine the taxpayers gross income for tax...Ch. 4 - Prob. 31PCh. 4 - Prob. 32PCh. 4 - Prob. 33PCh. 4 - Your client is a partnership, ARP Associates,...Ch. 4 - Trip Garage, Inc. (459 Ellis Avenue, Harrisburg,...Ch. 4 - Prob. 36PCh. 4 - Marlene, a cash basis taxpayer, invests in Series...Ch. 4 - Drake Appliance Company, an accrual basis...Ch. 4 - Freda is a cash basis taxpayer. In 2019, she...Ch. 4 - Prob. 40PCh. 4 - Prob. 41PCh. 4 - Troy, a cash basis taxpayer, is employed by Eagle...Ch. 4 - Prob. 43PCh. 4 - Prob. 44PCh. 4 - Prob. 45PCh. 4 - Nell and Kirby are in the process of negotiating...Ch. 4 - Alicia and Rafel are in the process of negotiating...Ch. 4 - Prob. 48PCh. 4 - Prob. 49PCh. 4 - Prob. 50PCh. 4 - Prob. 51PCh. 4 - Prob. 52PCh. 4 - For each of the following, determine the amount...Ch. 4 - Prob. 54PCh. 4 - Prob. 55PCh. 4 - Linda and Don are married and file a joint return....Ch. 4 - Charles E. Bennett, age 64, will retire next year...Ch. 4 - Donna does not think she has an income tax problem...Ch. 4 - Prob. 1RPCh. 4 - Prob. 2RPCh. 4 - Prob. 3RPCh. 4 - Prob. 1CPACh. 4 - Fred and Wilma were divorced in year 1 (before...Ch. 4 - Bill and Jane Jones were divorced on January 1,...Ch. 4 - Jake pays the following amounts to his former...Ch. 4 - Mary purchased an annuity that pays her 500 per...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 3.arrow_forwardDina loans $24,000 to her daughter Erin and does not charge any interest. Erin has investment income of $1,400 and investment expenses of $300. Assume that the applicable federal rate is 5%. How much interest must be imputed on the loan? 1. $1,000. 2. $1,100. 3. $1,200. 4. $1,400. Ⓒ$1,100. $1,200. $1,400. $1,000.arrow_forwardJoy had a tax refund of 733.43 due. She was able to get her tax refund immediately by paying a finance charge of 43.08 What simple interest rate is Joy paying for this loan assuming the following are true? Assume 360 days in a year. a) The tax refund check would be available in 5 days. b) The tax refund check would be available in 10 days. c) The tax refund check would be available in 20 days.arrow_forward

- 2. Simple versus compound interest Financial contracts involving investments, mortgages, loans, and so on are based on either a fixed or a variable interest rate. Assume that fixed interest rates are used throughout this question. Heather deposited $1,700 at her local credit union in a savings account at the rate of 9.8% paid as simple interest. She will earn interest once a year for the next 13 years. If she were to make no additional deposits or withdrawals, how much money would the credit union owe Heather in 13 years? O $3,865.80 O $5,731.65 O $1,882.93 O $266.60 Now, assume that Heather's credit union pays a compound interest rate of 9.8% compounded annually. All other things being equal, how much will Heather have in her account after 13 years? O $5,731.65 O $561.70 $1,866.60 O $3,865.80arrow_forwardA woman borrows $3000 at %9 compounded monthly, which is to be amortized over 3 years in equal monthly payments. For tax purposes, she needs to know the amount of interest paid during each year of the loan. Find the interest paid during the first year, the second year, and the third year of the loan. (Hint: Find the unpaid balance after 12 payments and after 24 payments. Also see example in your notes.)arrow_forwardam. 111.arrow_forward

- Dorothie paid the following amounts during the current year: Interest on her home mortgage (pre-12/16/17) $9,250 Service charges on her checking account 48 Credit card interest 168 Auto loan interest 675 Interest from a home equity line of credit (HELOC) 2,300 Interest from a loan used to purchase stock 1,600 Credit investigation fee for loan 75 Dorothie's residence has a fair market value of $250,000. The mortgage is secured by the home at the time of purchase and has a balance of $180,000. Dorothie used the same home to secure her HELOC with a balance of $50,000. Dorothie used the proceeds of her HELOC to pay for college and to buy a new car. Dorothie has $1,000 of net investment income. Compute Dorothie's interest deduction in the following scenarios: a. Calculate Dorothie's interest deduction (on Schedule A) for 2021. b. Same as part a, and Dorothie used the HELOC proceeds to add a new bedroom to her home. c. Same as part a, but Dorothie's home is valued at $1,200,000 and her…arrow_forward[The following information applies to the questions displayed below.] Javier and Anita Sanchez purchased a home on January 1 of year 1 for $1,000,000 by paying $200,000 down and borrowing the remaining $800,000 with a 6 percent loan secured by the home. The Sanchezes made interest-only payments on the loan in years 1 and 2. (Leave no answer blank. Enter zero if applicable.) b. Assuming year 1 is 2021, how much interest would the Sanchezes deduct in year 2? Maximum deductible interest expensearrow_forwardVisnoarrow_forward

- Interest Earned. On June 1, Mia deposited $5,600 in an MMDA that pays 3% interest. On October 31, Mia invested $1,200 in a three-month CD that pays 4%. At the end of the year, how much interest will Mia have earned, assuming she hasn't taken anything out of the money market deposit account? Assuming she hasn't taken anything out of the money market deposit account, the amount of interest Mia will have earned is (Round to the nearest cent.).arrow_forwardSalma borrowed $600from a bank for 2 years and was charged simple interest. The total interest that she paid on the loan was $84. As a percentage, what was the annual interest rate of her loan?arrow_forwardDebbie McAdams paid 9% interest on a $16,500 loan balance. Jan Burke paid $6,450 interest on a $107,500 loan. Based on 1 year: a. What was the amount of interest paid by Debbie? Interest paid by Debbie b. What was the interest rate paid by Jan? Note: Round your answer to the nearest tenth percent. Interest rate paid by Jan c. Debbie and Jan are both in the 28% tax bracket. Since the interest is deductible, how much would Debbie and Jan each save in taxes? Note: Round your answers to the nearest cent. Save in taxes % Debbie Janarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT

How to (Legally) Never Pay Taxes Again; Author: Next Level Life;https://www.youtube.com/watch?v=q63F1pBrUHA;License: Standard Youtube License