Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

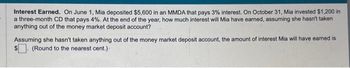

Transcribed Image Text:Interest Earned. On June 1, Mia deposited $5,600 in an MMDA that pays 3% interest. On October 31, Mia invested $1,200 in

a three-month CD that pays 4%. At the end of the year, how much interest will Mia have earned, assuming she hasn't taken

anything out of the money market deposit account?

Assuming she hasn't taken anything out of the money market deposit account, the amount of interest Mia will have earned is

(Round to the nearest cent.).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Kwaku Addo earns $4200 per month take-home pay and has the funds directly deposited in his checking account. He spends only about $3500 per month, and the excess funds have been building up in his account for about one year. (a) What other types of accounts are available to Kwaku? (b) How might he manage his accounts to earn as much interest as possible and keep his money safe? (c) How might he use electronic money management to accomplish these tasks?arrow_forwardAnn's grandmother put some money in an account for her on the day she was born. She is now 18 years old and is allowed to withdraw the money for the first time. The account currently has Ksh400,000 in it and pays an 8% per annum interest rate. i. Calculate how much money would be in the account if she left the money there until her 70th birthday.arrow_forwardSandy just received her annual bank statement. Exactly one year ago, she deposited $10,000 in a savings account. Today, her balance is $10,509.45. Sandy's savings account interest is compounded quarterly. Using simple interest as a guideline, Sandy received an annualized interest rate of_percent. a. 5, b. 5.5, c. 6, d. 6.5arrow_forward

- Dave borrowed $730 on January 1, 2019. The bank charged him a $4.00 service charge and interest was $54.40. If Dave paid the $730 in 12 equal monthly payments, what was the APR? (Enter your answer as a percent rounded to 1 decimal place.) Annual percentage rate %arrow_forwardAshley took out a student loan for $12,544. The loan had annual interest of 6.9%. She graduated five years after getting the loan and began repaying the loan upon graduation. Ashley will make monthly payments for two years after graduation. During the five years she was in school not making payments the loan occurred simple interest. What was her subsidize loan monthly payment an unsubsidized loan monthly payment?arrow_forwardKia deposited $1,300, at the BEGINNING of each year for 26 years in a credit union account. If the account paid 8% interest, compounded annually, use the appropriate formula to find the future value of her account. $95,037.72$103,940.74 $112,256.00$113,556.00arrow_forward

- Jamie earned $14 in interest on her savings account last year. She has decided to leave the $14 in her account so that she can earn interest on the $14 this year The interest earned on last year's interest earnings is called: Multiple Choice simple interest. complex interest. accrued interest interest on interest. discounted interestarrow_forwardFinancial contracts involving investments, mortgages, loans, and so on are based on either a fixed or a variable interest rate. Assume that fixed interest rates are used throughout this question. Zoe deposited $900 in a savings account at her bank. Her account will earn an annual simple interest rate of 7%. If she makes no additional deposits or withdrawals, how much money will she have in her account in 13 years? O $967.41 $2,168.86 O $163.00 O $1,719.00 Now, assume that Zoe's savings institution modifies the terms of her account and agrees to pay 7% in compound interest on her $900 balance. All other things being equal, how much money will Zoe have in her account in 13 years? O $1,719.00 O $963.00 O $2,168.86 O $151.82arrow_forwardYour grandfather put some money in an account for you on the day you were born. You are now 18 years old and are allowed to withdraw the money for the first time. The account currently has $2,407 in it and pays an 5% interest rate. a. How much money would be in the account if you left the money there until your 20th birthday? b. What if you left the money until your 65th birthday? c. How much money did your grandfather originally put in the account? ... a. How much money would be in the account if you left the money there until your 20th birthday? If you left the money there until your 20th birthday, the amount in the account would be $ (Round to the nearest cent.)arrow_forward

- A man borrows a money from a bank but he only received 91% of the amount requested. He signs a promissory note that he would pay P68,924 at the end of 7 years. How much money is requested from the bank if the simple interest rate is 12. 987%?arrow_forwardSebastian is going to deposit $790 in an account that earns 6.8% interest compounded annually. His wife Yolanda will deposit $815 in an account that earns 7.2% simple interest each year. They deposit the money on the same day and make no additional deposits or withdrawals for the accounts. Which statement is true concerning Sebastian’s and Yolanda’s account balances after 3 years? Yolanda’s account will have about $28.67 less than Sebastian’s account. Yolanda’s account will have about $9.78 less than Sebastian’s account. Sebastian’s account will have about $28.67 less than Yolanda’s account. Sebastian’s account will have about $9.78 less than Yolanda’s account.arrow_forwardImelda opens a savings account with $12,000, which pays an annual interest rate of 7.8%. If she reinvests the generated interest every month and also deposits $2,300 each month, how much will be in the account after 2 years? The interest is reinvested on the same day as the $2,300 deposit. Otions: 69177.89 71052.15 73548.61 70524.79arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education