Concept explainers

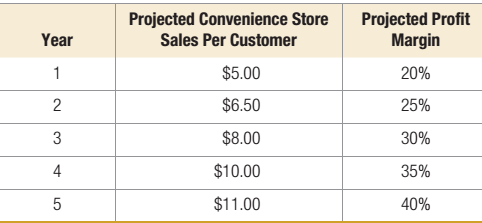

Darren Mack owns the Gas n’ Go convenience store and gas station. After hearing a marketing lecture, he realizes that it might be possible to draw more customers to his high-margin convenience store by selling his gasoline at a lower price. However, the Gas n’ Go is unable to qualify for volume discounts on its gasoline purchases, and therefore cannot sell gasoline for profit if the price is lowered. Each new pump will cost $95,000 to install, but will increase customer traffic in the store by 1,000 customers per year. Also, because the Gas n’ Go would be selling its gasoline at no profit, Darren plans on increasing the profit margin on convenience store items incrementally over the next 5 years. Assume a discount rate of 8 percent. The projected convenience store sales per customer and the projected profit margin for the next 5 years are as follows:

- What is the

NPV of the next 5 years of cash flows if Darren had four new pumps installed? - If Darren required a payback period of 4 years, should he go ahead with the installation of the new pumps?

Want to see the full answer?

Check out a sample textbook solution

Chapter 4 Solutions

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

Additional Business Textbook Solutions

Principles Of Operations Management

Operations Management

Operations and Supply Chain Management 9th edition

OPERATIONS MANAGEMENT IN THE SUPPLY CHAIN: DECISIONS & CASES (Mcgraw-hill Series Operations and Decision Sciences)

Operations Management, Binder Ready Version: An Integrated Approach

Loose-leaf for Operations Management (The Mcgraw-hill Series in Operations and Decision Sciences)

- Scenario 3 Ben Gibson, the purchasing manager at Coastal Products, was reviewing purchasing expenditures for packaging materials with Jeff Joyner. Ben was particularly disturbed about the amount spent on corrugated boxes purchased from Southeastern Corrugated. Ben said, I dont like the salesman from that company. He comes around here acting like he owns the place. He loves to tell us about his fancy car, house, and vacations. It seems to me he must be making too much money off of us! Jeff responded that he heard Southeastern Corrugated was going to ask for a price increase to cover the rising costs of raw material paper stock. Jeff further stated that Southeastern would probably ask for more than what was justified simply from rising paper stock costs. After the meeting, Ben decided he had heard enough. After all, he prided himself on being a results-oriented manager. There was no way he was going to allow that salesman to keep taking advantage of Coastal Products. Ben called Jeff and told him it was time to rebid the corrugated contract before Southeastern came in with a price increase request. Who did Jeff know that might be interested in the business? Jeff replied he had several companies in mind to include in the bidding process. These companies would surely come in at a lower price, partly because they used lower-grade boxes that would probably work well enough in Coastal Products process. Jeff also explained that these suppliers were not serious contenders for the business. Their purpose was to create competition with the bids. Ben told Jeff to make sure that Southeastern was well aware that these new suppliers were bidding on the contract. He also said to make sure the suppliers knew that price was going to be the determining factor in this quote, because he considered corrugated boxes to be a standard industry item. Is Ben Gibson acting legally? Is he acting ethically? Why or why not?arrow_forwardScenario 3 Ben Gibson, the purchasing manager at Coastal Products, was reviewing purchasing expenditures for packaging materials with Jeff Joyner. Ben was particularly disturbed about the amount spent on corrugated boxes purchased from Southeastern Corrugated. Ben said, I dont like the salesman from that company. He comes around here acting like he owns the place. He loves to tell us about his fancy car, house, and vacations. It seems to me he must be making too much money off of us! Jeff responded that he heard Southeastern Corrugated was going to ask for a price increase to cover the rising costs of raw material paper stock. Jeff further stated that Southeastern would probably ask for more than what was justified simply from rising paper stock costs. After the meeting, Ben decided he had heard enough. After all, he prided himself on being a results-oriented manager. There was no way he was going to allow that salesman to keep taking advantage of Coastal Products. Ben called Jeff and told him it was time to rebid the corrugated contract before Southeastern came in with a price increase request. Who did Jeff know that might be interested in the business? Jeff replied he had several companies in mind to include in the bidding process. These companies would surely come in at a lower price, partly because they used lower-grade boxes that would probably work well enough in Coastal Products process. Jeff also explained that these suppliers were not serious contenders for the business. Their purpose was to create competition with the bids. Ben told Jeff to make sure that Southeastern was well aware that these new suppliers were bidding on the contract. He also said to make sure the suppliers knew that price was going to be the determining factor in this quote, because he considered corrugated boxes to be a standard industry item. As the Marketing Manager for Southeastern Corrugated, what would you do upon receiving the request for quotation from Coastal Products?arrow_forwardAssume the demand for a companys drug Wozac during the current year is 50,000, and assume demand will grow at 5% a year. If the company builds a plant that can produce x units of Wozac per year, it will cost 16x. Each unit of Wozac is sold for 3. Each unit of Wozac produced incurs a variable production cost of 0.20. It costs 0.40 per year to operate a unit of capacity. Determine how large a Wozac plant the company should build to maximize its expected profit over the next 10 years.arrow_forward

- The Tinkan Company produces one-pound cans for the Canadian salmon industry. Each year the salmon spawn during a 24-hour period and must be canned immediately. Tinkan has the following agreement with the salmon industry. The company can deliver as many cans as it chooses. Then the salmon are caught. For each can by which Tinkan falls short of the salmon industrys needs, the company pays the industry a 2 penalty. Cans cost Tinkan 1 to produce and are sold by Tinkan for 2 per can. If any cans are left over, they are returned to Tinkan and the company reimburses the industry 2 for each extra can. These extra cans are put in storage for next year. Each year a can is held in storage, a carrying cost equal to 20% of the cans production cost is incurred. It is well known that the number of salmon harvested during a year is strongly related to the number of salmon harvested the previous year. In fact, using past data, Tinkan estimates that the harvest size in year t, Ht (measured in the number of cans required), is related to the harvest size in the previous year, Ht1, by the equation Ht = Ht1et where et is normally distributed with mean 1.02 and standard deviation 0.10. Tinkan plans to use the following production strategy. For some value of x, it produces enough cans at the beginning of year t to bring its inventory up to x+Ht, where Ht is the predicted harvest size in year t. Then it delivers these cans to the salmon industry. For example, if it uses x = 100,000, the predicted harvest size is 500,000 cans, and 80,000 cans are already in inventory, then Tinkan produces and delivers 520,000 cans. Given that the harvest size for the previous year was 550,000 cans, use simulation to help Tinkan develop a production strategy that maximizes its expected profit over the next 20 years. Assume that the company begins year 1 with an initial inventory of 300,000 cans.arrow_forwardThe world's oceans contain on average of 0.9 oz of Au /ton of ocean water. There were 2 proposed novel process in mineral extraction to recover the Au and they were compared using Engineering Economic Analysis. Process X costs $600/ton of ocean water processed and a recovery of 90%, while Process Z costs $450/ton and a recovery of 60%. Both processes will need the same amount of capital investment and equal ounces of Au extracted daily. If the Au today is $2,200/oz, which process is more feasible considering the fact that the world's ocean can be inexhaustible? This problem requires the analysis to be on the basis of profit per ounce of Au extracted.arrow_forwardThe Robot Company franchises combination gas and car wash stations throughout the United States. Robot gives a free car wash for a gasoline fill-up is about the same as far a wash alone, charges $0.50. Past expericnce shows that the number of customers that have car washes following fill-ups is about the same as for a wash alone. The average profit on a gasoline fill-up is about $0.70, and the cost of the car wash to Robot is $0.10 Robot stays open 14 hours per day. Robot has three power units and drive assemblies, and a franchisee must select the unit prefered Unit I can wash cans at the rate of one every five minutes and is leased for $12 per day. Unit I, a larger unit, can wash cars at the rate of one every four minutes but costs $16 per day. Unit II, the largest, costs $22 per day and can wash a car in three minutes. The franchisee estimates that customers will not wait in line more than five minutes for a car wash. A longer time will cause Robot to lose the gasoline sales as well…arrow_forward

- Taylor Smith owns a small clothing company, Cuteness for You, that offers an online subscription and personal shopping service targeted at busy families with children aged newborn to five years old. Currently, Taylor has one level of subscription service, the standard service. For $100 a month, the standard service provides its customers a monthly delivery of 10 clothing items carefully chosen to match the child's size, gender, and emerging style. The online clothing subscription market is fairly new but is growing rapidly and thus Taylor is considering extending the product line to increase its market share and profits. Taylor is debating whether to add a premium subscription service featuring profitable high-markup items for $125 per month, a basic subscription service that contains lower-markup popular items priced at $75 per month, or possibly both. Taylor knows that the new product lines provide an opportunity to attract more customers and possibly increase revenues and profit,…arrow_forwardTaylor Smith owns a small clothing company, Cuteness for You, that offers an online subscription and personal shopping service targeted at busy families with children aged newborn to five years old. Currently, Taylor has one level of subscription service, the standard service. For $100 a month, the standard service provides its customers a monthly delivery of 10 clothing items carefully chosen to match the child's size, gender, and emerging style. The online clothing subscription market is fairly new but is growing rapidly and thus Taylor is considering extending the product line to increase its market share and profits. Taylor is debating whether to add a premium subscription service featuring profitable high-markup items for $125 per month, a basic subscription service that contains lower-markup popular items priced at $75 per month, or possibly both. Taylor knows that the new product lines provide an opportunity to attract more customers and possibly increase revenues and profit,…arrow_forwardTaylor Smith owns a small clothing company, Cuteness for You, that offers an online subscription and personal shopping service targeted at busy families with children aged newborn to five years old. Currently, Taylor has one level of subscription service, the standard service. For $100 a month, the standard service provides its customers a monthly delivery of 10 clothing items carefully chosen to match the child's size, gender, and emerging style. The online clothing subscription market is fairly new but is growing rapidly and thus Taylor is considering extending the product line to increase its market share and profits. Taylor is debating whether to add a premium subscription service featuring profitable high-markup items for $125 per month, a basic subscription service that contains lower-markup popular items priced at $75 per month, or possibly both. Taylor knows that the new product lines provide an opportunity to attract more customers and possibly increase revenues and profit,…arrow_forward

- Thinking tools service assembles customized personal computers from generic parts. Formed and operated by part-time Svci students paulette cruz and maureen luis, the company has had steady growth since it started. The company assembles computers mostly at night, using part time students. Paulette and Maureen purchase generic computer parts in volume at a discount from a variety of sources whenever they see a good deal. Thus, they need a good forecast of demand for their computers so that they will know how many parts to purchase and stock. They have compiled demand data for the last 12 months as reported below A. Use exponential smoothing with smoothing parameter a=0.2 to compute the demand forecast for january (period 13) B. Use exponential smoothing with smoothing parameter a=0.5 to compute the demand forecast for january (period 13). C. Paulette believes that there is an upward trend in the demand, the initial forecast is 37 and the trend over this period is 0 units. Use…arrow_forwardAssume Sandra's forecasted ADR for the night is $1600.99. What would be her estimated total room revenue for this day? ADR = Total room revenue / Number of rooms soldarrow_forwardTaylor Smith owns a small clothing company, Cuteness for You, that offers an online subscription and personal shopping service targeted at busy families with children aged newborn to five years old. Currently, Taylor has one level of subscription service, the standard service. For $100 a month, the standard service provides its customers a monthly delivery of 10 clothing items carefully chosen to match the child's size, gender, and emerging style. The online clothing subscription market is fairly new but is growing rapidly and thus Taylor is considering extending the product line to increase its market share and profits. Taylor is debating whether to add a premium subscription service featuring profitable high-markup items for $125 per month, a basic subscription service that contains lower-markup popular items priced at $75 per month, or possibly both. Taylor knows that the new product lines provide an opportunity to attract more customers and possibly increase revenues and profit,…arrow_forward

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage, Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning