College Accounting (Book Only): A Career Approach

12th Edition

ISBN: 9781305084087

Author: Cathy J. Scott

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

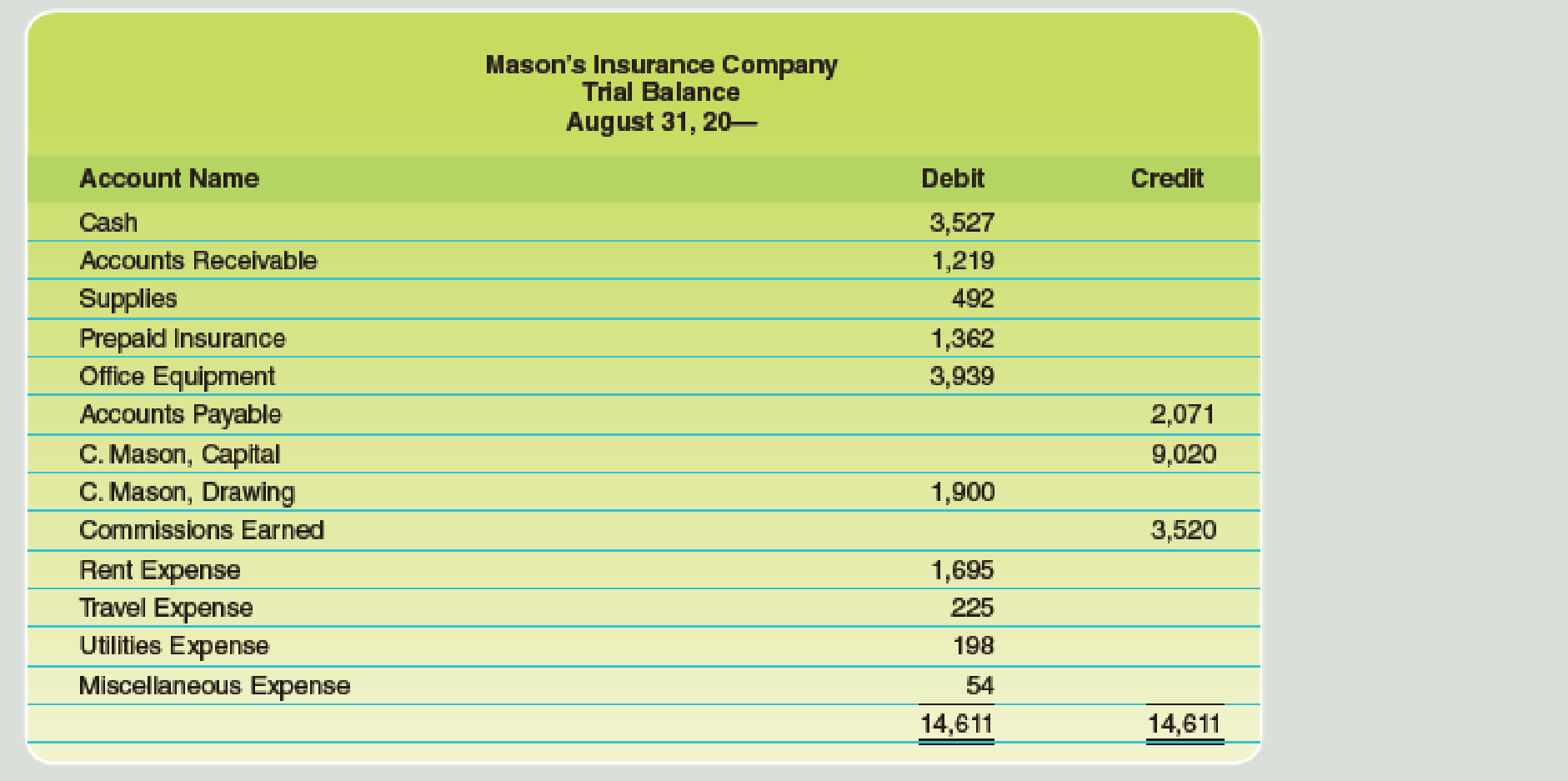

Chapter 4, Problem 1PB

The

Required

- 1. Record amounts in the Trial Balance columns of the work sheet.

- 2. Complete the work sheet by making the following adjustments and lettering each adjustment:

- a. Expired or used-up insurance, $260.

- b. Depreciation expense on office equipment, $900.

- c. Supplies used, $200.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Prepare a worksheet for Brown’s Plumbing and Heating.

Write the heading for the worksheet for the fiscal period ending December 31, 20xx.

Record the trial balance using the accounts and their balances from the Ledger tab. Some are done for you.

Calculate and record the Supplies adjustment. There is $5,600.00 in supplies on hand at the end of the fiscal year.

Calculate and record the Insurance adjustment. There is $900.00 of insurance coverage left at the end of the fiscal year.

Prove the Adjustments columns.

Extend all balance sheet account balances.

Extend all income statement account balances.

Calculate and record the net income or loss.

Total and rule the Income Statement and Balance Sheet columns.

Hankik Enterprises

Worksheet

For the Year Ended July 31, 2015

Adjusted Trial

Trial Balance

Adjustments

Description

Balance

Debit

Debit

Credit

Credit

Debit

Credit

Cash

36

Prepaid Insurance

12

Fees Receivable

56

Supplies

12

Equipment

60

Accum. Depreciation

12

Uncarned Revenue

20

Accounts Payable

32

Wages Payable

Ramon Hikik, Capital

84

Ramon Hikik,

4

Drawing

Service Revenue

80

Advertising Expense

28

Wage Expense

20

Insurance Expense

Supplies Expense

Depreciation Expense

228

Totals

228

A partial work sheet for Marge's Place is shown below.

Prepare the following adjustments on this work sheet for the month ended June 30, 20--.

Expired or used-up insurance, $450.

Depreciation expense on equipment, $750 (Remember to credit the Accumulated Depreciation account for equipment, not Equipment).

Wages accrued or earned since the last payday, $380 (owed and to be paid on the next payday).

Supplies used, $110.

If no amount is required, enter 0.

Marge's Place

Work Sheet

For Month Ended June 30, 20--

TRIAL BALANCE

ADJUSTMENTS

ACCOUNT NAME

DEBIT

CREDIT

DEBIT

CREDIT

1

Cash

4,370

fill in the blank 1

fill in the blank 2

1

2

Supplies

250

fill in the blank 3

fill in the blank 4

2

3

Prepaid Insurance

1,800

fill in the blank 5

fill in the blank 6

3

4

Equipment

4,880

fill in the blank 7

fill in the blank 8

4

5

Accumulated Depreciation, Equipment

1,350

fill in the blank 9

fill in the blank 10

5

6

Accounts Payable…

Chapter 4 Solutions

College Accounting (Book Only): A Career Approach

Ch. 4 - The __________ represents the sequence of steps in...Ch. 4 - The __________ is a working paper used by...Ch. 4 - On the work sheet, assets are recorded in which of...Ch. 4 - Rainy Day Services had 430 of supplies reported on...Ch. 4 - On the work sheet, Accumulated Depreciation,...Ch. 4 - The __________ requires that expenses be matched...Ch. 4 - Accumulated Depreciation, Equipment is reported a....Ch. 4 - What is the purpose of a work sheet?Ch. 4 - What is the purpose of adjusting entries?Ch. 4 - Prob. 3DQ

Ch. 4 - Prob. 4DQCh. 4 - Prob. 5DQCh. 4 - Define depreciation as it relates to a van you...Ch. 4 - Prob. 7DQCh. 4 - Why is it necessary to journalize and post...Ch. 4 - 1. List the following classifications of accounts...Ch. 4 - Classify each of the accounts listed below as...Ch. 4 - Place a check mark next to any account(s)...Ch. 4 - A partial work sheet for Marges Place is shown...Ch. 4 - Complete the work sheet for Ramey Company, dated...Ch. 4 - Journalize the adjusting entries from the partial...Ch. 4 - Journalize the adjustments for Newkirk Company as...Ch. 4 - Journalize the following adjusting entries that...Ch. 4 - Determine on which financial statement each...Ch. 4 - Prob. 1PACh. 4 - The trial balance of Clayton Cleaners for the...Ch. 4 - The trial balance for Game Time on July 31 is as...Ch. 4 - The trial balance for Benner Hair Salon on March...Ch. 4 - The trial balance for Masons Insurance Agency as...Ch. 4 - The trial balance of The New Decors for the month...Ch. 4 - The trial balance for Harris Pitch and Putt on...Ch. 4 - The trial balance for Wilson Financial Services on...Ch. 4 - Prob. 1ACh. 4 - You are the bookkeeper for a small but thriving...Ch. 4 - Prob. 3ACh. 4 - Your client is preparing financial statements to...Ch. 4 - Prob. 1CP

Additional Business Textbook Solutions

Find more solutions based on key concepts

What are assets limited as to use and how do they differ from restricted assets?

Accounting For Governmental & Nonprofit Entities

(a) Standard costs are the expected total cost of completing a job. Is this correct? Explain, (b) A standard im...

Managerial Accounting: Tools for Business Decision Making

Based on your answers to the above questions, should Lockwood invest in the machinery?

Horngren's Financial & Managerial Accounting, The Managerial Chapters (6th Edition)

This year, Prewer Inc. received a 160,000 dividend on its investment consisting of 16 percent of the outstandin...

PRINCIPLES OF TAXATION F/BUS.+INVEST.

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The trial balance for Harris Pitch and Putt on June 30 is as follows: Data for month-end adjustments are as follows: a. Expired or used-up insurance, 380. b. Depreciation expense on equipment, 1,950. c. Depreciation expense on repair equipment, 1,650. d. Wages accrued or earned since the last payday, 585 (owed and to be paid on the next payday). e. Supplies remaining at end of month, 120. Required 1. Complete a work sheet for the month. (Skip this step if using CLGL.) 2. Journalize the adjusting entries. 3. If using CLGL, prepare an adjusted trial balance. 4. Prepare an income statement, a statement of owners equity, and a balance sheet. Assume that no additional investments were made during June. If you are using CLGL, use the year 2020 when recording transactions.arrow_forwardA partial work sheet for Marges Place is shown below. Prepare the following adjustments on this work sheet for the month ended June 30, 20. a. Expired or used-up insurance, 450. b. Depreciation expense on equipment, 750. c. Wages accrued or earned since the last payday, 380 (owed and to be paid on the next payday). d. Supplies used, 110.arrow_forwardThe trial balance of The New Decors for the month ended September 30 is as follows: Data for the adjustments are as follows: a. Expired or used-up insurance, 425. b. Depreciation expense on equipment, 2,750. c. Wages accrued or earned since the last payday, 475 (owed and to be paid on the next payday). d. Supplies remaining at end of month, 215. Required 1. Complete a work sheet. (Skip this step if using GL.) 2. Journalize the adjusting entries. If you are using CLGL, use the year 2020 when recording transactions.arrow_forward

- The trial balance of Clayton Cleaners for the month ended September 30 is as follows: Data for the adjustments are as follows: a. Expired or used-up insurance, 800. b. Depreciation expense on equipment, 2,700. c. Wages accrued or earned since the last payday, 585 (owed and to be paid on the next payday). d. Supplies remaining at the end of month, 230. Required 1. Complete a work sheet. (Skip this step if using CLGL.) 2. Journalize the adjusting entries. If you are using CLGL, use the year 2020 when recording transactions.arrow_forwardA partial work sheet for Marge's Place is shown below. Prepare the following adjustments on this work sheet for the month ended June 30, 20--. Expired or used-up insurance, $570. Depreciation expense on equipment, $720 (Remember to credit the Accumulated Depreciation account for equipment, not Equipment). Wages accrued or earned since the last payday, $1,410 (owed and to be paid on the next payday). Supplies used, $110. If no amount is required, enter 0. Marge's Place Work Sheet For Month Ended June 30, 20-- TRIAL BALANCE ADJUSTMENTS ACCOUNT NAME DEBIT CREDIT DEBIT CREDIT 1 Cash 4,577 1 2 Supplies 250 2 3 Prepaid Insurance 1,800 3 4 Equipment 4,880 4 5 Accumulated Depreciation, Equipment 1,350 5 6 Accounts Payable 2,539 6 7 M. Benson, Capital 4,751 7 8 M. Benson, Drawing 2,000 8 9 Income from Services 6,937 9 10 Rent Expense 1,086 10 11 Supplies Expense…arrow_forwardThe trial balance for Wilson Financial Services on January 31 is as follows: Data for month-end adjustments are as follows: a. Expired or used-up insurance, 750. b. Depreciation expense on equipment, 300. c. Wages accrued or earned since the last payday, 1,055 (owed and to be paid on the next payday). d. Supplies used, 535. Required 1. Complete a work sheet for the month. (Skip this step if using CLGL.) 2. Journalize the adjusting entries. 3. If using CLGL, prepare an adjusted trial balance. 4. Prepare an income statement, a statement of owners equity, and a balance sheet. Assume that no additional investments were made during January.arrow_forward

- Prepare adjusting journal entries, as needed, considering the account balances excerpted from the unadjusted trial balance and the adjustment data. A. amount due for employee salaries, $4,800 B. actual count of supplies inventory, $ 2,300 C. depreciation on equipment, $3,000arrow_forwardThe following accounts appear in the ledger of Celso and Company as of June 30, the end of this fiscal year. The data needed for the adjustments on June 30 are as follows: ab.Merchandise inventory, June 30, 54,600. c.Insurance expired for the year, 475. d.Depreciation for the year, 4,380. e.Accrued wages on June 30, 1,492. f.Supplies on hand at the end of the year, 100. Required 1. Prepare a work sheet for the fiscal year ended June 30. Ignore this step if using CLGL. 2. Prepare an income statement. 3. Prepare a statement of owners equity. No additional investments were made during the year. 4. Prepare a balance sheet. 5. Journalize the adjusting entries. 6. Journalize the closing entries. 7. Journalize the reversing entry as of July 1, for the wages that were accrued in the June adjusting entry. Check Figure Net income, 14,066arrow_forwardThe account balances of Bryan Company as of June 30, the end of the current fiscal year, are as follows: Required 1. Data for the adjustments are as follows: a. Expired or used up insurance, 495 b. Depreciation expense on equipment, 670. c. Depreciation expense on the van, 1,190. d. Salary accrued (earned) since the last payday, 540 (owed and to be paid on the next payday). e. Supplies used during the period, 97. Your instructor may want you to use a work sheet for these adjustments. 2. Journalize the adjusting entries. 3. Prepare an income statement. 4. Prepare a statement of owners equity. Assume that there was an additional investment of 2,000 on June 10. 5. Prepare a balance sheet. 6. Journalize the closing entries using the four steps in the correct sequence. Check Figure Net Income, 13,627arrow_forward

- Complete the work sheet for Ramey Company, dated December 31, 20, through the adjusted trial balance using the following adjustment information: a. Expired or used-up insurance, 460. b. Depreciation expense on equipment, 870. (Remember to credit the Accumulated Depreciation account for equipment, not Equipment.) c. Wages accrued or earned since the last payday, 120 (owed and to be paid on the next payday). d. Supplies remaining, 80.arrow_forwardPrepare adjusting journal entries, as needed, considering the account balances excerpted from the unadjusted trial balance and the adjustment data. A. supplies actual count at year end, $6,500 B. remaining unexpired insurance, $6,000 C. remaining unearned service revenue, $1,200 D. salaries owed to employees, $2,400 E. depreciation on property plant and equipment, $18,000arrow_forwardThe trial balance for Benner Hair Salon on March 31 is as follows: Data for month-end adjustments are as follows: a. Expired or used-up insurance, 300. b. Depreciation expense on equipment, 500. c. Wages accrued or earned since the last payday, 235 (owed and to be paid on the next payday). d. Supplies remaining at the end of the month, 65. Required 1. Complete a work sheet for the month. (Skip this step if using CLGL.) 2. Journalize the adjusting entries. 3. Prepare an income statement, a statement of owners equity, and a balance sheet. Assume that no additional investments were made during March.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax CollegeCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax CollegeCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY