Century 21 Accounting Multicolumn Journal

11th Edition

ISBN: 9781337679503

Author: Gilbertson

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

CORRECT ANSWER✅

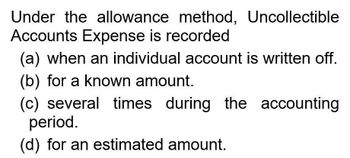

Transcribed Image Text:Under the allowance method, Uncollectible

Accounts Expense is recorded

(a) when an individual account is written off.

(b) for a known amount.

(c) several times during the accounting

period.

(d) for an estimated amount.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Final answerarrow_forwardQuestion: 1. Under the allowance method, Accounts recorded Uncollectible Expense is a. for an estimated amount. b. when an individual account is written off. c. for a known amount. d. several times during the accounting period.arrow_forwardThe collection of an account that had been previously written off under the allowance method of accounting for uncollectible Select one: a. will increase income in the period it is collected. b. does not affect income in the period it is collected. C. will decrease income in the period it is collected. d. requires a correcting entry for the period in which the account was written off.arrow_forward

- Using the allowance method, the entry to record a write-off of accounts receivable will include a. A debit to Bad Debt Expense.b. A debit to Allowance for Uncollectible Accounts. c. No entry because an allowance for uncollectible accounts was established in an earlier period. d. A debit to Service Revenue.arrow_forwardUsing the allowance method, the effect on the current year’s financial statements of writing off an account receivable generally is to a. Decrease total assets.b. Decrease net income.c. Both a. and b.d. Neither a. nor b.arrow_forwardUnder the allowance method of recognizing uncollectible accounts, the entry to write off an AR has no effect on net income. increases the allowance for uncollectible accounts. O increases AR. has no effect on the allowance for uncollectible accounts. O decreases net income.arrow_forward

- When the allowance method for recognizing uncollectible accounts receivable is used, the allowance account will have a positive balance at the end of the period if the write-offs during the period exceed the beginning balance the write-offs are equal to the balance of the account at the beginning of the period the write-offs during the period are less than the beginning balance the write-offs are equal to the difference between the beginning and the ending balance of the account.arrow_forwardThe entry to write off an account receivable under the allowance method willT ( A. increase total assets O B. increase net income C. reduce net income D. have no effect on net income)arrow_forwardWhen using the allowance method, what account is debited when writing off uncollectible accounts? How does this differ from the direct write-off method?arrow_forward

- Two methods of accounting for uncollectible accounts are the Question 40 options: allowance method and the accrual method. allowance method and the net realizable method. direct write-off method and the accrual method. direct write-off method and the allowance method.arrow_forwardWhen an account is written off under the allowance method, there should be a debit to Bad Debt Expense.arrow_forwardEach time an account is written off under the direct write-off method, Bad Debt Expense is debited.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,